grandriver/E+ via Getty Images

Daseke, Inc. (NASDAQ:DSKE) offers a diversified customer base, growing EBITDA, stable FCF margins, and beneficial 2022 outlook. The company is also storing fuel to diminish the effects of fuel costs, and drivers buy gasoline from truck stops, where the company has negotiated prices. In my view, the current undervaluation is not at all justified. In the last presentation, management claimed to be trading at 5.18x with peers trading at 7.7x. Besides, under my DCF models, future free cash flow would justify significant upside potential in DSKE’s stock price. In my view, the DSKE is a buy.

Daseke: Diversified List Of Customers From Different Sectors

Daseke is a transportation solutions specialist offering tractors and flatbed, warehousing services, and trailers to clients in the United States, Canada, and Mexico.

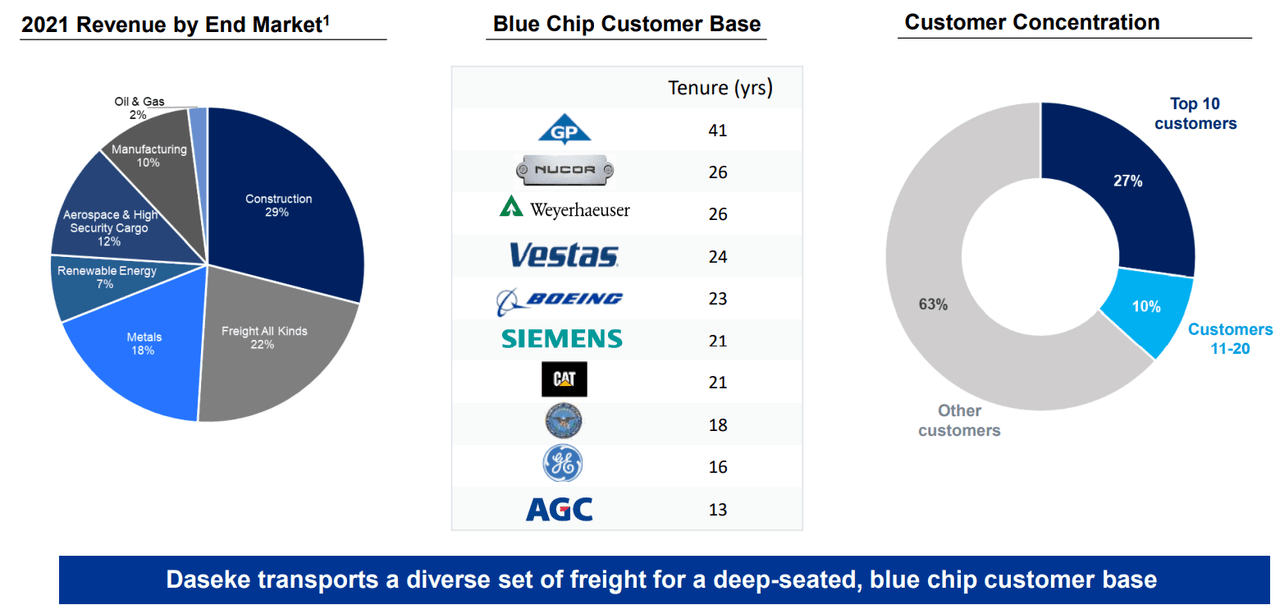

In my view, the most interesting feature about DSKE is the diversification of clients. The list of clients is large, and I don’t see a significant concentration of customers. Clients also work for very different industries including construction, metals, renewable energy, and manufacturing among others:

Investor Presentation

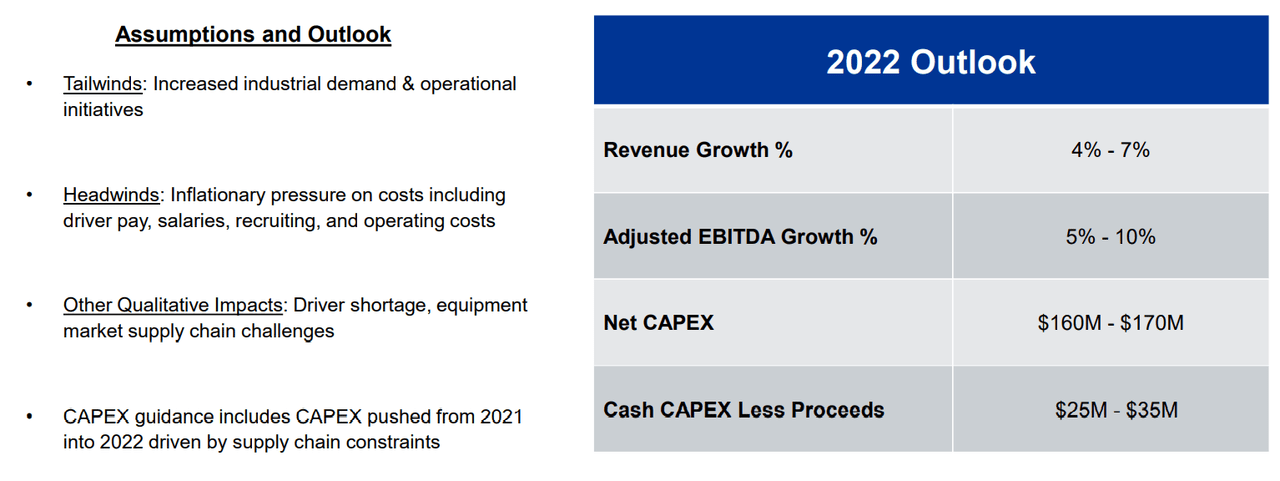

Besides, there are two aspects that have drawn my attention, the company’s beneficial outlook and the fact that management claims that DSKE is undervalued as compared to peers. Management believes that it will be able to report 4%-7% sales growth in 2022, adjusted EBITDA growth of 5%-10% thanks to increased industrial demand, and operational initiatives:

Investor Presentation

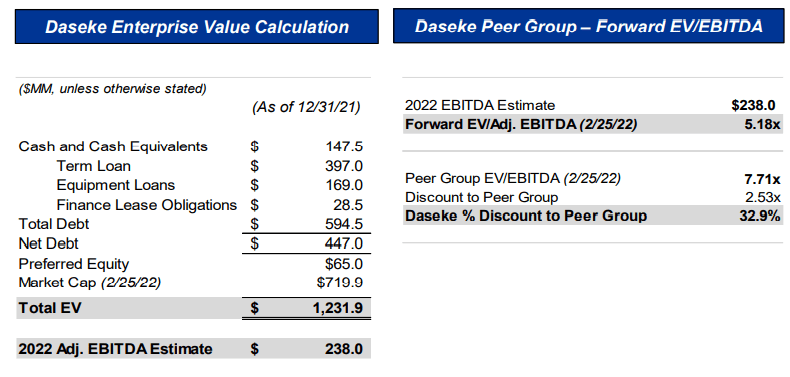

In the most recent presentation, management claimed that the peer group trades at 7.7x, which makes DSKE quite undervalued at 5.18x forward EBITDA. With cash of $147 million, net debt of $447 million, sales growth, and growing EBITDA margins, I don’t really see why the company trades at the current valuation. With this in mind, I decided to run a few DCF models:

Investor Presentation

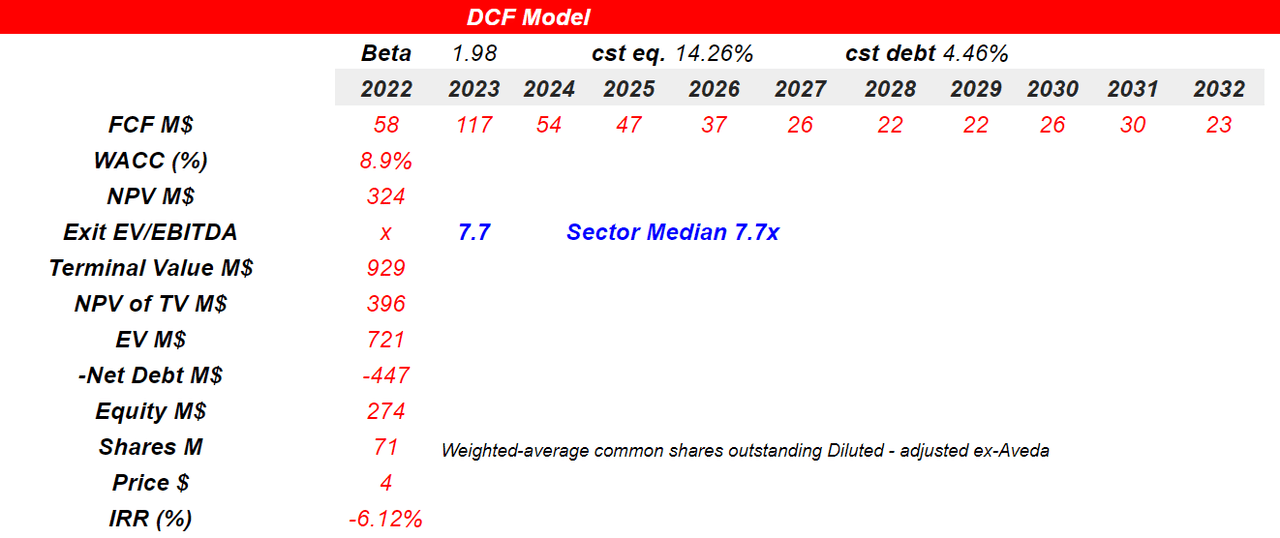

My DCF Model, Assuming Conservative Sales Growth Of 4% And EBITDA Margin Of 14%, Implies A Stock Price Of $19

In my view, if DSKE stores fuel in underground storage tanks, the company may not have to pay a lot for gasoline in the future. Besides, drivers reduce fuel costs by visiting truck stops, where the company has negotiated prices. I am not really inventing anything new that the company has not done in the past. In this regard, read the following words from the management:

The Company purchases its fuel through a network of retail truck stops with which it has negotiated volume purchasing discounts. The Company seeks to reduce its fuel costs by routing its drivers to truck stops with which the Company has negotiated volume purchase discounts when fuel prices at such stops are lower than the bulk rate paid for fuel at the Company’s terminals. The Company stores fuel in aboveground and underground storage tanks at some of its facilities. Source: 10-K

In my view, management will likely grow more than expected thanks to M&A activity. As a result, I expect an increase in the EBITDA margin thanks to operating synergies. In my opinion, a larger corporation will likely be able to negotiate with bankers, and receive more debt financing. With all this in mind, let’s point out that management established that acquisition is among the company’s strategic objectives:

As part of its business strategy, the Company has in the past and may in the future acquire strategic and complementary businesses. Source: 10-K

Acquiring businesses in the open-deck industry or other logistics sectors may also not be very difficult because the industry is quite fragmented. I am sure that there are many competitors out there for sale:

The open-deck industry is highly competitive and fragmented. The Company competes primarily with other flatbed carriers and to a lesser extent, logistics companies, as well as railroads. Source: 10-K

In the last annual report, DSKE reported that disposition of assets and businesses is also among the company’s business plans. If management sells business divisions reporting less EBITDA margin, the company’s financial ratios will likely increase. In addition, the company could obtain more cash to acquire more complementary business divisions operating in growing sectors:

As part of the Company’s business strategy, it evaluates the potential disposition of assets and businesses that may no longer help it meet its objectives. Source: 10-K

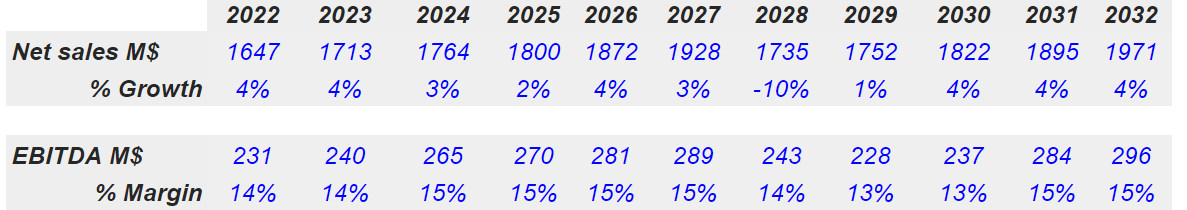

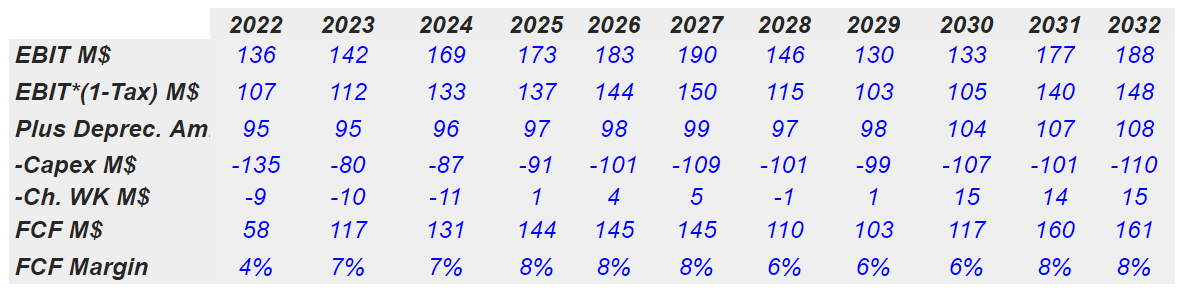

For the year 2022, the company expects to show sales growth between 4% and 7%. With this in mind, I assumed sales growth between 2% and 4% from 2022 to 2032. Also, with an EBITDA margin of approximately 14%, I obtained 2032 EBITDA of $296 million:

YC

Finally, assuming conservative D&A, changes in working capital, and effective tax of 22%, the free cash flow should grow from $58 million in 2022 to $161 million in 2032:

YC

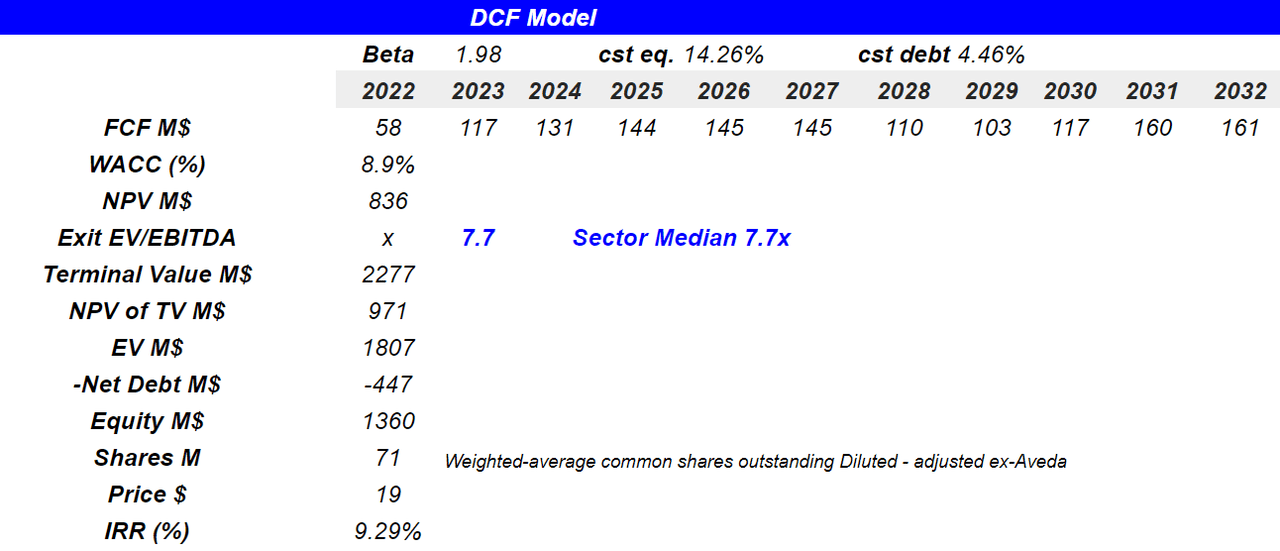

Summing the free cash flow from 2022 to 2032 with a WACC of 8.9%, the net present value stands at $836 million. If we also use the sector median EV/EBITDA of 7.7x, the terminal value discounted with the WACC stands at $971 million. Finally, the implied stock price would be $19:

YC

Downside Risks: Competition, Lack Of Many Long-Term Contracts, And Failed Acquisitions or Divestitures

Management notes that DSKE has to deal with significant competition. Some open-deck carriers have more resources, better equipment, and less indebtedness than DSKE. If clients decide to work with DSKE’s competitors, the company may lose market share. As a result, investors would expect less future free cash flow, and the company’s valuation will likely decline:

The Company competes with many open-deck carriers of varying sizes, including some that may have greater access to equipment, a wider range of services, greater capital resources, less indebtedness or other competitive advantages and including smaller, regional service providers that cover specific shipping lanes with specific customers or that offer niche services. Source: 10-K

The company does not have long-term contracts with many customers. If they decide to stop receiving DSKE’s services, it will be easy for them to walk away. In that scenario, DSKE may suffer a significant decline in sales and FCF. The valuation of the company will likely decline:

A number of customers use the Company’s services on a shipment-by-shipment basis rather than under long-term contracts. These customers have no obligation to continue using the Company’s services and may stop using them at any time without penalty or with only limited penalties. Source: 10-K

It is also quite risky that DSKE works with a significant number of independent contractor owner-operators. If some of them decide to leave the company or altogether decide to initiate negotiations with DSKE, the company’s EBITDA margins may decline significantly:

Approximately 44% of the Company’s freight revenue was carried by independent contractor owner-operators in 2021. The Company’s reliance on independent contractor owner-operators creates numerous risks for the Company’s business. Source: 10-K

Shareholders may suffer significantly if DSKE announces certain synergies from acquisitions or other types of transactions. As a result, management may deliver lower EBITDA figures, and FCF expectations could decline. In the worst case scenario, failed transactions may be exposed by the media, which would lead to less demand for the stock:

In addition, it may experience greater dis-synergies than expected, and the impact of the divestiture on its business, results of operations and prospects may be larger than projected. Dispositions may also involve continued financial involvement in the divested business, such as through guarantees, indemnities or other financial obligations. Source: 10-K

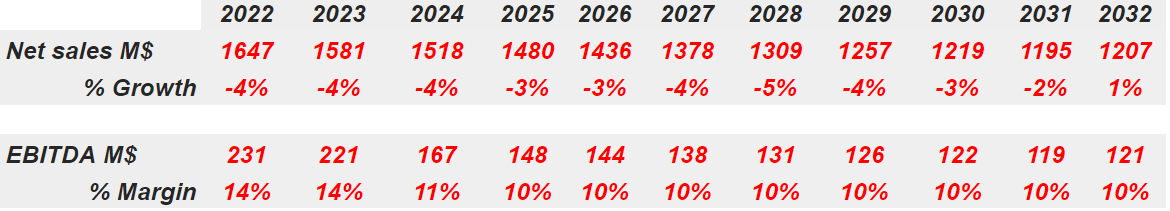

Under these traumatic assumptions, I included sales growth of -4% from 2022 to 2032, and an EBITDA margin close to 10% from 2025 to 2032. My results include 2032 EBITDA close to $120 million:

YC

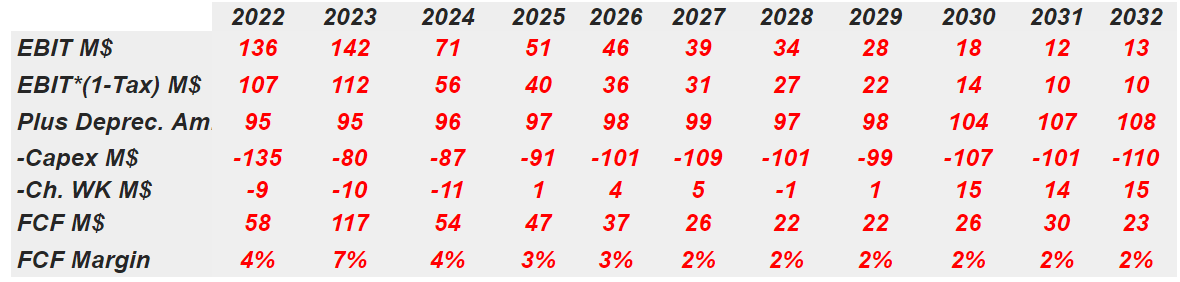

Also, with growing capital expenditures, conservative D&A, and effective tax ratio, the FCF margin should stand at 4%-2%. 2032 FCF would be equal to $23 million:

YC

With an exit multiple of 7.7x EBITDA and net debt of $447 million, the implied price would be equal to $4. In my view and with the figures obtained in the previous case scenario, the downside risk appears smaller than the upside potential:

YC

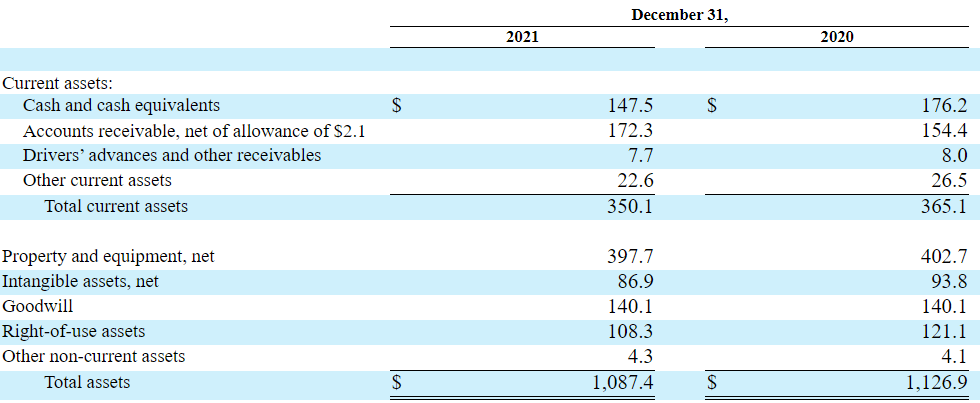

Balance Sheet Looks Healthy

As of December 31, 2021, the company reports $147 million in cash, an asset/liability ratio of 1.19x, and $397 million in property and equipment. I believe that most investment advisors out there will not be afraid of the company’s financial health:

10-K

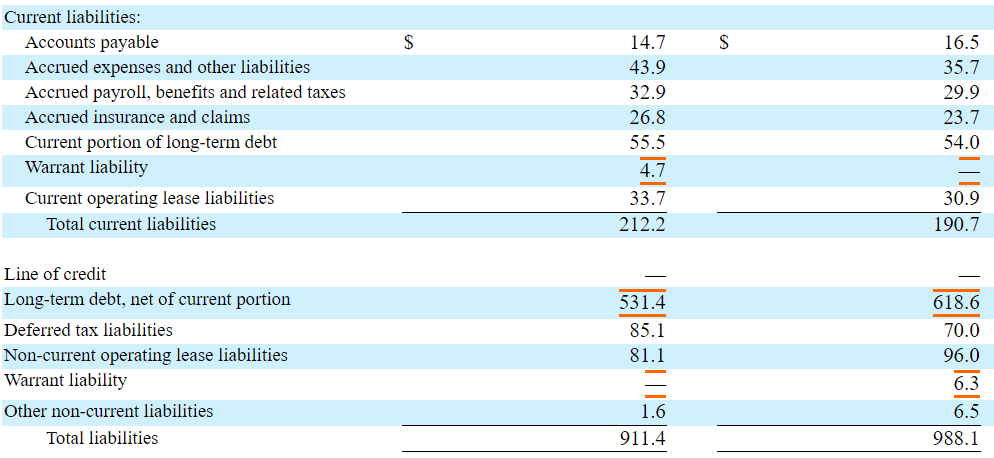

In the last annual report, the total amount of debt declined to $531 million. I assumed a 2025 EBITDA of $270 million, so I don’t believe that the total amount of debt is elevated. In my view, if management wants to acquire other competitors, bankers will likely offer more financing:

10-K

Conclusion

DSKE works for a significant number of customers from different industries. In addition, DSKE appears to be storing fuel in underground storage, so risks from increases in the oil price don’t seem that large. Drivers also obtain gasoline from truck stops, where management has negotiated decent fuel prices. With all this in mind and management giving a very beneficial 2022 outlook, the current stock price does not seem justified. DSKE is trading undervalued as compared to other peers. The sum of future free cash flow discounted with a conservative WACC implies significant upside potential. In my view, DSKE is a buy.

Be the first to comment