Sundry Photography/iStock Editorial via Getty Images

Beyond Meat (NASDAQ:BYND) is my favorite plant-based vegan stock in a fast-growing industry that will change the way we eat and treat animals.

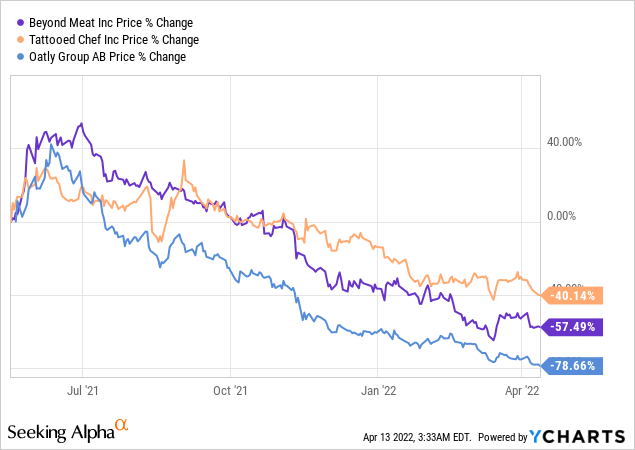

However, vegan stocks have been absolutely crushed over the last 52 weeks and many big names are down as much as 80%.

Rising inflation, higher bond yields, and massive overvaluations based on greed have caused these companies to fall off a cliff despite a bullish long-term outlook for the plant-based meat and milk industry.

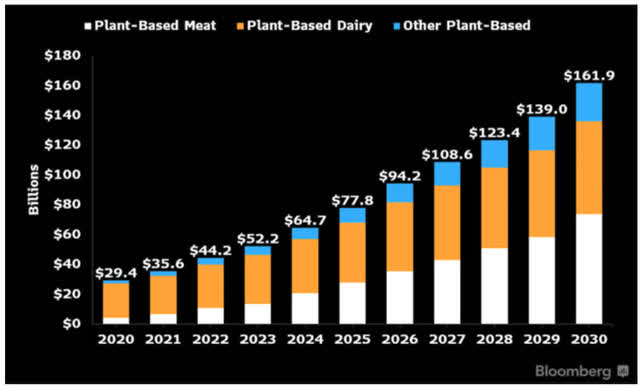

According to FoodBusinessNews.net, the plant-based food industry could grow 5x to $161 billion by 2030.

2030 Plant-Based Food Industry Growth (Foodbusinessnews.net)

As the global population grows larger, it’s becoming impossible to feed the entire planet using the old traditional animal-based food pyramid.

Plant-based meat and milk companies will disrupt the entire food industry by providing healthier alternatives to meat and dairy. According to Vox, plant-based foods are also better for the environment by consuming less water and producing lower Co2 emissions.

Out of the many choices given to investors, I choose Beyond Meat as a clear winner and will provide my insights on why I’m still bullish on BYND shares.

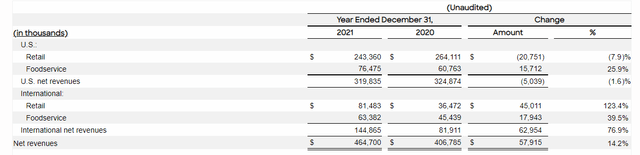

Beyond Meat Finished 2021 with Nearly Half a Billion in Revenue

In 2021, Beyond Meat reported annual revenue of $467 million (Up 14.7% YoY) with a net loss of $187 million (-$2.88 per share).

The good news is that Beyond Meat has a ton of new products in the pipeline along with several partnerships with big companies like McDonald’s (MCD) and PepsiCo (PEP).

Beyond Meat launched the McPlant burger nationwide in the UK and in limited locations in the United States. It seems that the McPlant performed much better in Europe while US sales have been underperforming.

Recently, the company launched a new retail product called Beyond Meat Jerky and expanded the distribution of its meatless chicken nuggets product.

In the Q4 2021 quarterly report, Beyond Meat CEO Ethan Brown talked a lot about how the company was dealing with declining US sales while revenue increased internationally YoY.

Beyond Meat Full Year 2021 Revenue Numbers (BeyondMeat.com)

The problem is that only 10% of Americans don’t eat meat while most are loyal to the traditional American diet. The good news is Beyond Meat will launch several products this year to convince more Americans to give them a try.

International sales remain strong, and I expect this trend to continue well into 2022.

Beyond Meat Remains the Top Dog of the Plant-Based Meat Industry

I’m still bullish on Beyond Meat to lead the plant-based alternative meat industry in the future.

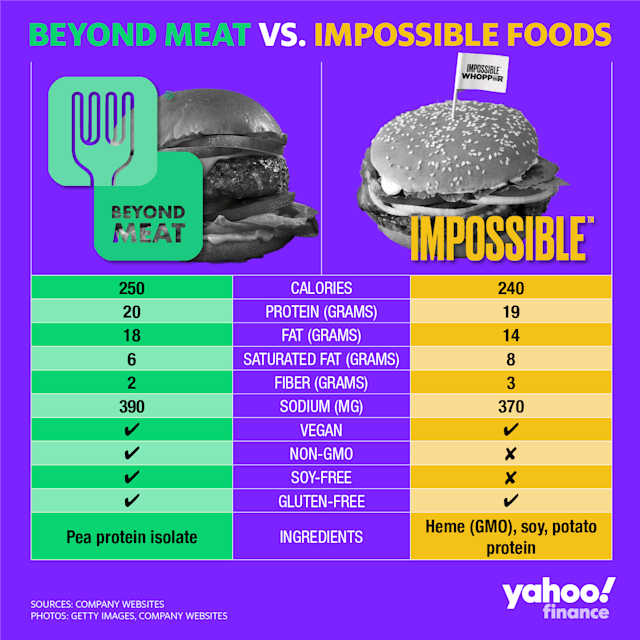

Beyond Meat’s products are generally more expensive and contain less saturated fat and more protein.

For example, Impossible Foods distributes its plant-based burger in partnership with Burger King, yet research shows that Beyond Meat is by far the healthier choice.

Beyond Meat vs Impossible Foods (Yahoo.com)

According to EverydayHealth, there are several health benefits to adopting a plant-based diet, including weight loss, increased mental clarity, and a more youthful appearance.

Meatless alternatives consume far less water and produce fewer Co2 emissions. More people will embrace a plant-based lifestyle once they experience the health benefits for themselves and Beyond Meat is the clear innovator in this new yet exciting industry.

Risk Factors

Competition from plant-based food companies is arguably the biggest risk factor at the moment.

Impossible Foods sells comparable products at cheaper prices and already signed a multi-year partnership with Burger King. However, the company founder recently stepped down as CEO due to a delayed IPO.

There are other plant-based food competitors such as Tattooed Chef (TTCF) and Very Good Food Company (VGFC) that could steal market share in the future. These companies can build loyal followings with their product offerings and persuade Beyond Meat consumers to make the switch in the future.

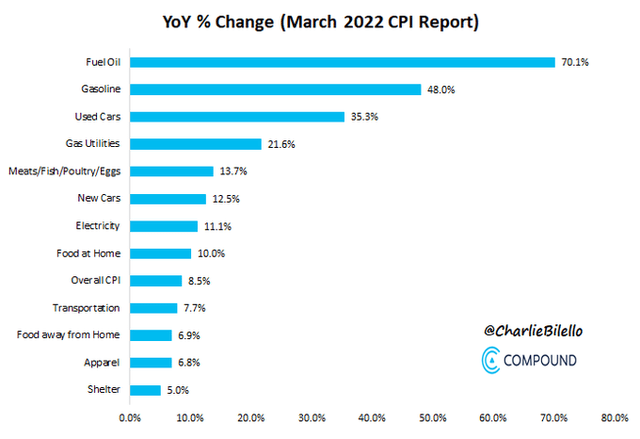

Pricing could also scare consumers away due to increased inflationary worries. March 2022 CPI data pegged inflation at 8.5%, while food price inflation was estimated at 10%.

March 2022 CPI Inflation Data (CompoundAdvisors.com)

A lot of consumers may reach for cheaper food products to protect themselves from inflationary pressures.

Another major risk factor is cash burn, while Beyond Meat invests heavily in R&D plus distribution. The company has yet to turn a profit and has an accumulated deficit over $500 million. In March 2021, Beyond Meat raised nearly $1 billion through a convertible note sale and these notes will mature on March 15th, 2027.

Beyond Meat continues to rack up bigger losses as the company aims for rapid revenue growth. The company has $733.3 million in cash but could slowly burn through its reserves over the next few years.

Lastly, short sellers continue to bet against the company and now Beyond Meat has a 39% short interest. In fact, Beyond Meat is one of the most shorted stocks on Wall Street.

As long as the shorts are crushing the stock, I wouldn’t be surprised to see Beyond Meat stock dip below $40 or even approach the $25 level.

There is more downside risk at these levels, so don’t assume BYND shares have bottomed already.

Conclusion

I believe Beyond Meat CEO Ethan Brown is a visionary that wants to change the way we treat animals around the world.

BYND stock is a bit risky now, and I understand why many investors are betting against this company due to its falling stock price. However, if you think long term, then this could be a great opportunity to average down or buy the dip.

With just under a $3 billion market cap, Beyond Meat is the future frontrunner and could be a 10x stock that gets talked about in the years to come.

Be the first to comment