LoraClark/iStock via Getty Images

Dividend Stocks for a Recession

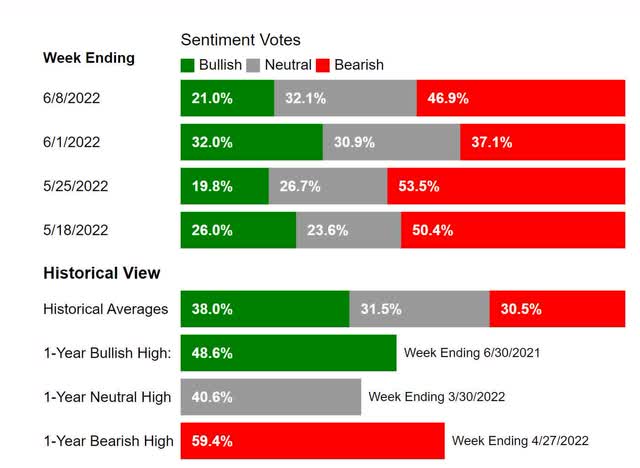

Bear down! Signs of recession are drawing nearer, as investors and analysts are concerned that taming inflation without a recession is near impossible. In a bear market, playing defense is sometimes the best offense, especially when extreme emotion is moving the markets. The market sentiment over the last few weeks compared to historical figures has jumped from bullish to bearish rapidly.

AAII Sentiment Survey Chart (AAII Sentiment Survey)

According to the above chart that reported AAII Member Survey figures, the bearish bullish indicators of the past note that low levels of optimism are typically followed by above-average market returns versus lower market returns followed by higher levels of pessimism. Investor sentiment is currently in extreme fear on the heels of uncertainty about monetary policy, inflation, and rising fuel, energy, and grocery prices. Passive income can help ease some of those concerns, with quality dividend stocks as options.

Focusing on companies with higher dividend yields is a great way to offset the historically high inflation people are experiencing. Not to mention, portfolios with tech stocks and crypto holdings are getting crushed, experiencing some of the worst sell-offs in history, over $1 trillion each. Given the unstable market conditions, dividend-paying stocks can potentially provide some relief for investors, and we have three dividend-paying stocks with great fundamentals.

3 Best Dividend Stocks to Buy In Preparing for a Recession

Inflation continues to be headline news, with no end in sight. While the Fed and investors are facing some headwinds, we encourage investors to protect their portfolios by seeking out companies that should stand the test of time, offering a long track record of dividend growth. As I recently wrote in Top 4 High-Yield Dividend Monsters:

“Not all dividend stocks are created equal. Given that yield is a payout relative to share price, which does not always mean the company is doing well when picking high-yield stocks, investors must dig deeper into a stock’s fundamentals.”

Consider our three stock picks below, which possess solid financials, higher dividend yields, and dividend growth to stand the test of time.

1. WEC Energy Group, Inc. (NYSE:WEC)

WEC Energy Group, Inc., through its subsidiaries, provides natural gas, electricity, and renewable energy. One of the largest utilities in the nation, WEC serves more than 4.6 million business and residential customers.

Possessing one of the highest dividend growth rates in the industry of 7.14%, we selected this stock because this investment is ideal for investors seeking a steady income stream. Conservative and retired investors tend to like utility companies as investments, given they offer stable income streams, attractive dividend yields, and reasonable growth.

WEC Growth & Profitability

WEC has solid growth and profitability metrics. Over the last five quarters, WEC has beaten both top-and bottom-line earnings, with the most recent EPS of $1.79 beating by $0.10 and revenue of $2.91B beating by $77.22M. The results prompted 13 analysts to give upward revisions within the last 90 days, and there have been zero down revisions.

WEC EPS (Seeking Alpha Premium)

Continued economic growth has contributed to the success and growth of WEC. The commitment to renewable energy and tailwinds from inflation and strategic planning and operations has helped boost the company’s growth and profits. As Xia Liu, WEC Energy Group CFO, states:

“Our utility operations, we grew our earnings by $0.15 compared to the first quarter of ’21. First, rate base growth contributed $0.13 to earnings. As we continued to execute on our ESG progress plan, we grew our utility rate base by over 7% last year…Residential natural gas sales were up 1.6% from the first quarter of ’21, and commercial and industrial natural gas sales were up 6.8%…Earnings at our Energy Infrastructure segment improved $0.06 in the first quarter of ’22 compared to the first quarter of ’21. Higher production tax credits, driven by strong wind production, added $0.03 in earnings.”

As the company has grown, so too has its share price. And while some consider it overpriced, we still believe this stock’s momentum has room to deliver upside and a steady income stream.

WEC Valuation & Momentum

WEC has a less than ideal D valuation but is strong on collective metrics and has excellent momentum. On quarterly price performance, the stock outperforms its sector peers, as showcased below, supporting its solid B rating.

WEC Momentum Grade (Seeking Alpha Premium)

Despite market volatility, the stock is up a modest +3% over one year, and the company has increased earnings guidance for 2022. Although the stock’s considered slightly overvalued, given the tailwinds to accompany this utility stock coupled with improved earnings for 2022, some prudence is necessary if adding or diving into a position at its current price, but we believe the stock is a strong buy, and its dividend track record reinforces the rating.

WEC Dividends

An almost dividend aristocrat, WEC has a 2.93% dividend yield and has managed to pay its shareholders a consistent dividend for 32 years, increasing the payment for 19 consecutive years. With stellar stats like this, it’s no wonder its dividend grades are strong.

WEC Dividend Consistency (Seeking Alpha Premium)

“The usual way that we judge a company’s ability to cover its dividend is by looking at its free cash flow. The free cash flow is the cash that is generated by the company’s ordinary operations and is left over after it pays all of its bills and makes all necessary capital expenditures…During the third quarter 2021, WEC Energy had an operating cash flow of $780.5 million. This is more than enough to cover the $213.7 million in dividends with money left over to partially fund the capital expenditures,” writes Power Hedge, Seeking Alpha Marketplace Author.

With its solid cash flow, and B+ dividend safety rating, we’re confident that this utility company will not only maintain its $0.7275 quarterly dividend in the foreseeable future, but our next stock pick is also attractive on dividend growth.

2. NRG Energy, Inc. (NYSE:NRG)

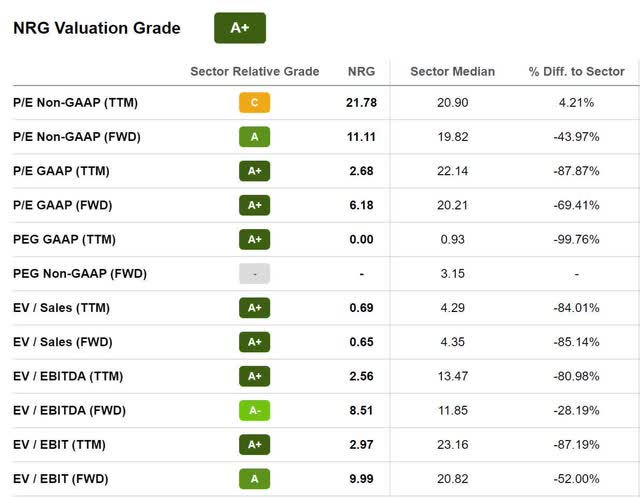

Top value stock and electric utility company NRG Energy Inc. delivers power to the people. Using natural gas, coal, oil, solar, nuclear, and battery storage to produce electricity throughout the U.S., its tremendous success and focus on sustainability landed it the Excellence in Environmental Initiatives SEAL Business Sustainability Awards in 2021. Utility companies are great inflation- and recession-resilient sectors because people do not want to go without heat and light; it’s necessary. At an extremely discounted price and bullish momentum, NRG is a strong buy.

NRG Valuation And Momentum

As a long-term pick, NRG is a great stock to capture now at a discount, particularly as rising costs are passed onto consumers, and the stock is upward trending. Possessing a P/E ratio (TTM) of 2.68x, 87.87% below its sector, and an a+ PEG ratio, NRG is severely undervalued.

NRG Valuation Grade (Seeking Alpha Premium)

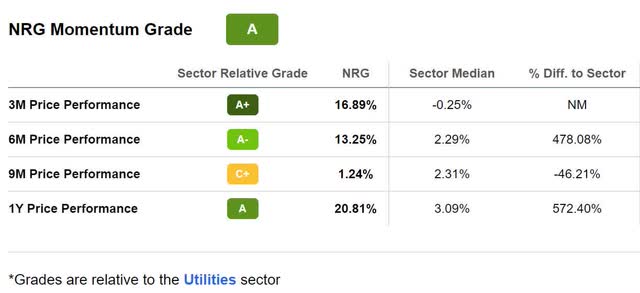

In addition to being discounted, NRG is up 9% over the last year. With continued upward momentum and an A Momentum Grade, NRG is outperforming its sector peers quarterly, as evidenced below.

NRG Momentum Grade (Seeking Alpha Premium)

I recently wrote an article highlighting NRG as a top utility stock to help offset the price of skyrocketing utility bills. Given little clarity on the impending Fed decision and what the FOMC meeting this week will unveil, the outlook seems that rates will continue rising, and NRG has the growth and profitability metrics for a solid pick.

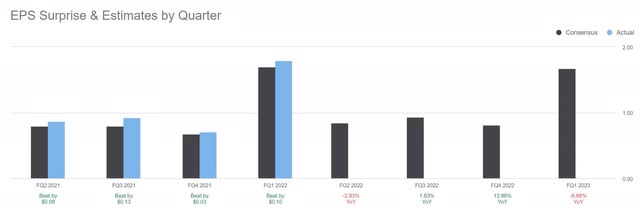

NRG Growth And Profitability

Seeking Alpha Contributor, The Black Sheep calls NRG the forgotten energy stock poised for growth. Utilities are cashing in as consumers are getting crushed by inflation and higher utility bills. As one of the largest independent power suppliers in the nation, NRG supplies energy and gas to more than 3.7 million residential and commercial customers. With a growth plan focused on acquiring Direct Energy, NRG captured an additional three million customers across North America in the first quarter of 2021. NRG also signed renewable Power Purchase Agreements (PPAs) to service geographically diverse areas in Texas, which should be paying off handsomely given the hot weather that prompted Texas to break its all-time record for power usage in June.

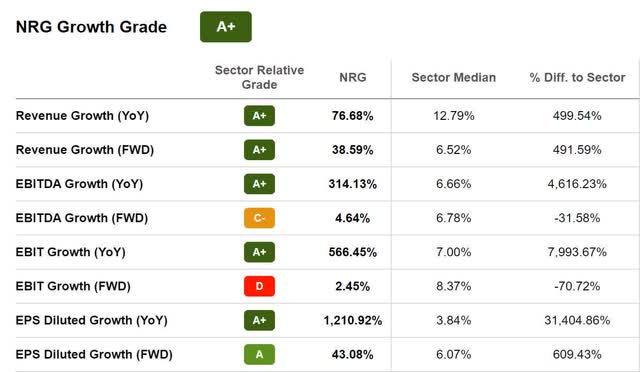

NRG Growth Grade (Seeking Alpha Premium)

Guidance remains strong for NRG, although Q1 2022 EPS of $0.22 was a miss by $0.41. Revenues topped $7.90B for the same period. With an A+ profitability grade and excellent cash from operations, shareholders should feel at ease with the company’s dividend scorecard and growth attractiveness.

NRG Dividends

On the heels of rising energy prices, NRG plans to execute a $1B share buyback program. Because dividends play an important factor for investors during periods of extreme market fluctuation, utilities like NRG can offer a steady income.

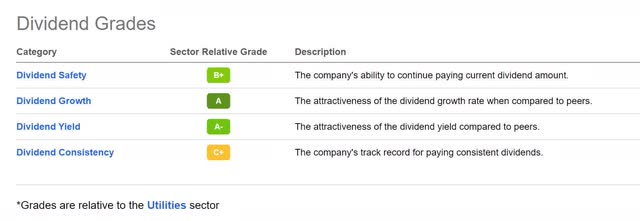

With a 3.18% dividend yield, nine consecutive years of dividend payments, and a B+ dividend safety grade, shareholders can feel confident that this stock is likely to continue its trajectory and consistency of paying out a dividend.

NRG Dividend Grades (Seeking Alpha Premium)

Capital gains are becoming harder to achieve in this risky market, and investors want to make money. Given dividend stocks’ lower perceived volatility while offering a payout in a bear market, recession, or rally, we believe the right sectors and industries will achieve the desired income stream. Our final pick is in the insurance industry.

2. American International Group, Inc. (NYSE:AIG)

-

Market Capitalization: $42.33B

-

Quant Rating: Strong Buy

-

Dividend Safety Grade: B+

-

Forward Dividend Yield: 2.40%

While all companies can be affected by adverse conditions, some are less likely. Insurance is one of those recession-resilient industries because, in good or bad times, the products they insure and services they provide are still in demand. With a wide range of insurance offerings, from general liability to property & casualty, to life insurance and more, you name it, American International Group (AIG) has it and is a stock that should continue to provide a steady stream of income.

I previously wrote about insurance stocks as hedges against inflation. Insurance holdings are the crux of Warren Buffett’s Berkshire Hathaway (BRK.A) because the industry is highly unlikely to become obsolete. As sales volumes for companies like AIG increase during periods of growth and inflation, that is a good time to consider them for portfolios.

AIG Valuation & Momentum

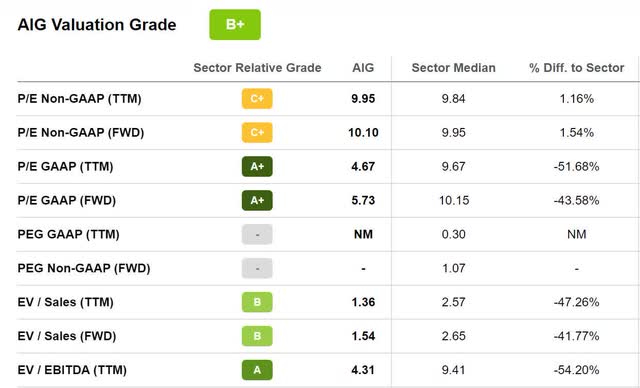

Trading at a discount, the company’s forward P/E is 5.73x, a -43.58% difference to the sector. Additionally, forward EV/Sales of 1.54x come at a more than 40% difference, showcasing that AIG is undervalued. With a B+ valuation grade and bullish momentum, this stock is a great pick to add to a portfolio.

AIG Valuation Grade (Seeking Alpha Premium)

With bullish momentum, the stock possesses an overall A- Momentum grade outperforming its sector peers quarterly. The stock has been on a longer-term upward trend, with hopes of continued propulsion.

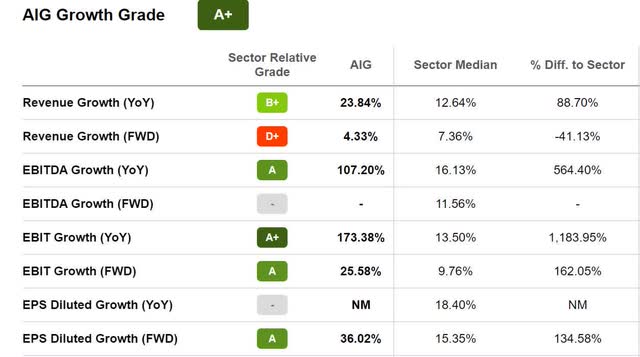

AIG Growth & Profitability

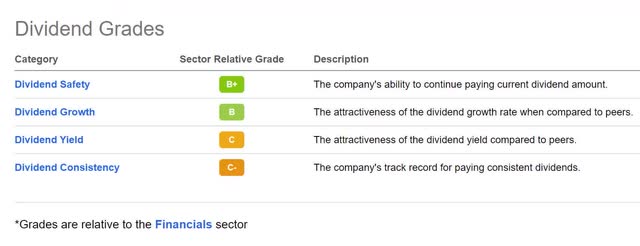

AIG has stellar growth and profitability metrics, with an A+ for growth and a solid A for profitability. After topping Q1 consensus earnings, the board increased AIG’s share repurchase to $6.5B and returned $1.7B to shareholders through $1.4B of stock buybacks and $265M of dividends. To paint a clearer picture, AIG offers very solid dividend safety and overall grades, as evidenced below.

AIG Dividend Grades (Seeking Alpha Premium)

In addition to its 2.40% forward dividend yield, $5.70B cash from operations, and year-over-year EBITDA growth of 107.20% appeals to investors. AIG’s increased its General Insurance net premiums by 2% compared to Q1 2021, a big win for the organization that continues to drive profitability.

AIG Growth Grade (Seeking Alpha Premium)

“General Insurance continues to generate top-line growth while driving sustainable underwriting improvement and expense discipline in both the combined ratio and the adjusted accident year combined ratio, which improved 590 and 290 basis points, respectively, year over year to 92.9% and 89.5%.” –AIG Chairman and CEO Peter Zaffino.

Q1 EPS of $1.30 beat by $0.,13 and revenue of $15.81B beat by $4.38B. The premiums for a number of their insurance lines increased. North American personal lines grew by 40%. Life Retirement increased during Q1 despite headwinds faced by inflation and capital markets. But those headwinds were offset by strong alternative investment income growth and premiums that saw a jump of 13% YoY. With such diversified offerings, AIG is a great option for a portfolio. Insurance companies are designed to deliver during adversity, and when markets are down, a dividend stock like AIG can serve as inflation and recession hedges. Consider AIG, WEC, and NRG as strong buys in sectors that should stand to benefit while remaining resilient during a recession.

Insurance and Utility Stocks Are a Great Defense for Inflation

Investors want safety when buying stocks, whether a rise or fall in the markets. Our three stock picks, WEC, NRG, and AIG, should be able to thrive in both environments and possess solid dividend yields and dividend safety ratings. Keep an eye out for dividend stocks with strong yields that do not sacrifice quality or growth. Each of our stocks should provide investors with a steady income stream in a market where investor sentiment is pessimistic.

Our investment research tools help to ensure you’re furnished with the best resources to make informed investment decisions. Check out our Top Dividend Stocks. Or maybe you want to evaluate your stocks using our tools to help ensure you stick with highly graded dividend stocks that stand to increase their income stream over time.

Be the first to comment