Justin Sullivan

Dollar General Corporation (NYSE:DG), a discount retailer, provides various merchandise products in the Southern, Southwestern, Midwestern, and Eastern United States.

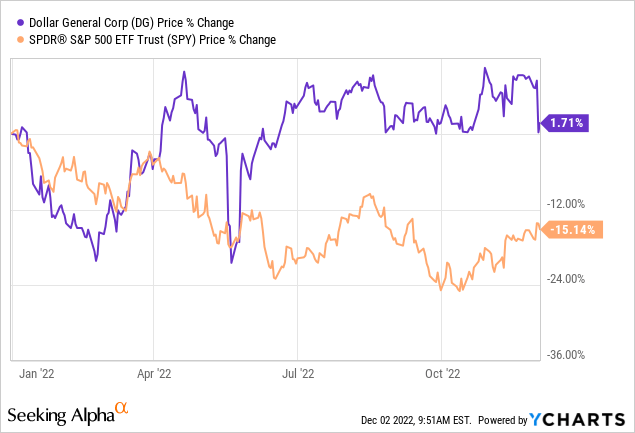

The company’s stock has been performing well in 2022, despite the challenging macroeconomic environment. Year-to-date, the Dollar General stock price has increased by about 2%, despite the significant selloff earlier this week.

The selloff earlier this week has been induced by the latest quarterly earnings release.

In our opinion, the earnings might have been interpreted too pessimistically and, therefore, we believe the selloff is not justified. Let us take a look now at three highlights from the earnings report, which we believe are showing Dollar General Corporation’s strength currently and in the near future.

1. Revenue growth

Despite the challenging macroeconomic environment, DG has achieved a more than 11% increase in net sales, reaching as much as $9.5 billion in the third quarter. New store openings and same-store sales growth have both positively contributed to the net sales growth, while store closures have had an offsetting impact.

While DG is rapidly expanding and opening a significant amount of new stores as a part of their strategy (new store openings in 2022 are now expected to be 1025), we place more emphasis on the same-store sales growth. Sales are likely to grow when more and more stores are opened, and, therefore, may not realistically reflect how the demand for DG’s products actually develops over time. Same-store sales growth could be a better metric in this case.

Same-store sales growth has reached 6.8% compared to the third quarter of 2021. This growth has been fueled by the increase in average transactions and the increase in customer traffic. We believe this proves that the demand for DG’s products is relatively inelastic, and people are willing to buy these products even at higher prices. In terms of product category, “consumables” have contributed the most to growth, partially offset by “apparel,” “seasonal,” and “home products.”

What do we expect going forward?

We expect the macroeconomic environment to remain challenging in the coming quarters. Consumer confidence is not likely to significantly improve in the first half of 2023. During times of low consumer confidence, the demand for more affordable products normally increases, and in our opinion, DG can benefit from this.

Further, many American retailers’ revenue has been hit this year due to the relative strength of the USD compared to other currencies. While we also expect the FX environment to remain unfavorable, DG is likely to be unaffected by this as their revenue is generated in the United States.

The firm’s outlook for 2022 also remains promising:

Same-store sales growth of approximately 6% – 7% for the fourth quarter of fiscal year 2022, which would result in growth toward the upper end of its previously expected range of 4.0% – 4.5% for fiscal year 2022 […]

2. Earnings growth

Not only revenue has increased compared to the prior year quarter, but also net income:

The Company reported net income of $526.2 million for the third quarter of 2022, an increase of 8.0% compared to $487.0 million in the third quarter of 2021. Diluted EPS increased 12.0% to $2.33 for the third quarter of 2022 compared to diluted EPS of $2.08 in the third quarter of 2021.

While many retailers and businesses have managed to achieve revenue growth in the previous quarters, not so many of them have been able to also increase their earnings, due to the substantial increase in costs. DG, however, has managed it.

Let us take a closer look at how different costs and expenses developed to understand how this achievement has been possible.

Gross margin has decreased by 27 bps. Considering the current level of inflation, we believe a decrease of only 27 bps can be considered as a good result. This contraction has been primarily driven by higher product costs and a greater proportion of sales coming from the consumables category, which generally has a lower gross profit margin. Increases in distribution costs, markdowns, inventory shrink and damages have also negatively impacted the margin.

Selling, general and administrative expenses (“SG&A”) have, on the other hand, decreased by 23 bps YoY. The primary factors that have positively impacted the SG&A expenses were: lower percentage of net sales in the current year period were retail labor, incentive compensation, hurricane-related disaster expenses, and occupancy costs.

As a result, operating profit has increased by 10.5% year-over-year, reaching $735.5 million

In our opinion, the firm has managed to control costs effectively, which is reflected in the EPS. We believe that effective cost control in the current market environment is key, therefore, we find the business attractive from this perspective.

Commitment to return value to shareholders

Last, but not least, we have to mention returns to shareholders, both in the form of dividend payments and share buybacks.

Dividends

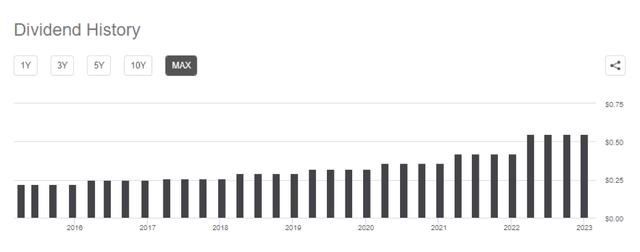

Dollar General Corporation has been paying dividends each year in the last 7 years and has managed to increase the payments each year in the last 5 years.

Dividend history (Seeking Alpha)

While the dividend history is not exceptionally long, we believe that these payments are safe and sustainable, especially when we consider the sales and earnings growth, which are expected to continue in the near future. Further, the firm has a dividend coverage ratio of 5.15, meaning that they can easily cover the upcoming payments.

For this reason, we believe that DG’s stock could be attractive for dividend and dividend growth investors, even if the yield is currently below 1%.

Share buybacks

In Q3, Dollar General Corporation bought back $546 million worth of its common stock. From their previous share buyback authorization, at the end of the quarter, $2.5 billion was still remaining. To put this amount into perspective, the firm’s current market cap is around $58 billion. At the current share price, it would account for slightly more than 4% of the shares outstanding.

Conclusion

Net sales growth, combined with earnings growth, is signaling that the demand for Dollar General Corporation’s products has remained strong, while the company has managed to control costs effectively.

As the macroeconomic environment is likely to remain challenging, including poor consumer confidence, customers are likely to shift to lower-cost alternatives. DG may benefit from this change.

The dividend payments and the share buyback programs signal that DG is committed to returning capital to their shareholders.

For these reasons, we believe that the sell-off is not justified, and we rate Dollar General Corporation’s stock as “buy.”

Be the first to comment