Scott Olson

Introduction

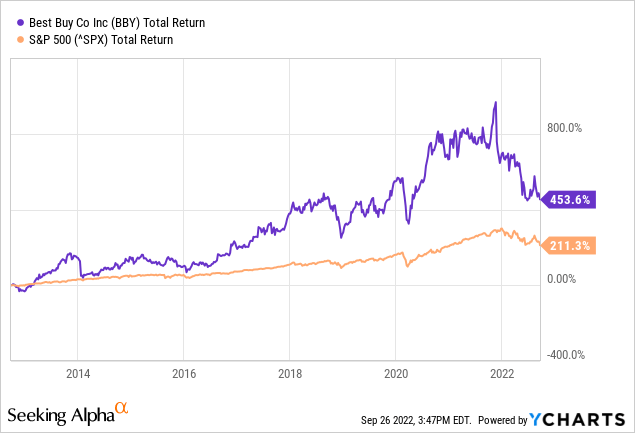

Best Buy (NYSE:BBY) has had strong total returns over the past 10 years. On average, the stock rose an average of 18.7% per year during this period, while the S&P 500 averaged 12% annually. The share has fallen sharply since the beginning of 2022 and therefore offers a great opportunity to take a closer look at the share.

BBY’s Quarterly Earnings Were Mixed

Recent quarterly results have been mixed, with comparable store sales falling 12%, but were above analyst expectations. The non-GAAP operating margin decreased from 6.9% to 4.1%. Declining comparable sales was mainly the result of declining demand in the consumer electronics industry. Best Buy has had known strong demand for their products during the coronavirus crisis for the past two years, but this strong demand has now abated. The declining operating margin is worrying, Best Buy described in their recent quarterly earnings report:

The lower gross profit rate was primarily due to: (1) lower services margin rates, including pressure associated with the Best Buy Totaltech membership offering; (2) lower product margin rates, including increased promotions; and (3) higher supply chain costs. These pressures were partially offset by higher profit-sharing revenue from the company’s private label and co-branded credit card arrangement.

Loop Capital Partners pointed out that Best Buy offers extremely competitive pricing compared to other retailers, the company has assigned a price target of $110. Even though Best Buy is one of the better retailers, I don’t think it’s a buying moment right now. Electronics companies such as HP saw their sales and free cash flow decline and are lowering their guidance for the upcoming years. When the consumer electronics retail market shows positive developments can Best Buy be an interesting buy.

Dividends And Share Repurchases

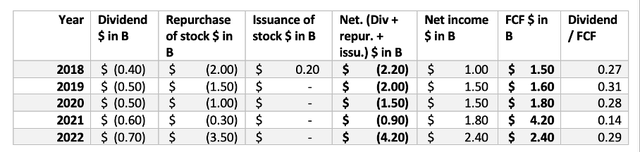

Best Buy pays a dividend of $3.52, which represents a high dividend yield of currently 5.1%. Management also repurchases Best Buy’s stock, reducing the total number of outstanding shares each year. The dividend per share then increases. In fiscal 2022, it repurchased $3.5 billion of its own shares, representing a high buyback yield of nearly 15%.

In the current year, Best Buy has repurchased a total of $2.2 billion in shares. However, this did not drive up the price. The share buyback program was put on hold in the past quarter.

Cash flow highlights (SEC and Authors’ Own Calculations)

Both dividend payments and share buybacks together are equal to or lower than the free cash flow of a year earlier. Their return to shareholders program is therefore sustainable for the long term. However, due to temporary headwinds and lower cash flow outlook, the share buyback program for the coming quarters will be less than before.

Valuation Metrics

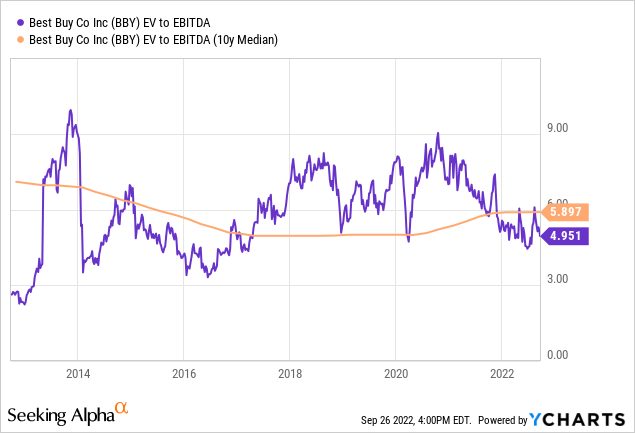

To map the valuation, I use the EV/EBITDA ratio because it includes both debt and cash on the balance sheet. This ratio shows that Best Buy is valued very cheaply with a ratio of 5. One should keep in mind that Best Buy’s profit margins are low, which justifies a low valuation. Best Buy is also undervalued by the 10-year median.

The low stock valuation doesn’t mean that Best Buy is a good buy. The company is experiencing temporary headwinds and I am waiting for positive developments to push the stock up before making a purchase.

Conclusion

Best Buy is a retailer that specializes in the sale of consumer electronics. Shares have grown strongly over the past 10 years but have declined since early 2022. This is because comparable store sales fell by 12% in the past quarter compared to last year. The strong demand from consumer electronics in the past two years has decreased. The company is also feeling price pressure due to lower services margin rates, and lower product margin rates, and higher supply chain costs. Best Buy has been paying a dividend for years and currently the dividend yield is 5.1%. In addition to paying dividends, it buys back its own shares. The company does this significantly because almost all their free cash flow is returned to shareholders. Stock valuation metrics look good, EV/EBITDA is only 5.0 and below the 10-year median. Although the stock is attractively valued, I have the stock on hold because the company is experiencing temporary headwinds, and management has put the share buyback program on hold. When these temporary headwinds are over, I will consider a position.

Be the first to comment