Ed Lallo/iStock via Getty Images

Introduction

My thesis is that Berkshire Hathaway Energy (“BHE”) (NYSE:BRK.A) (NYSE:BRK.B) will continue increasing the percentage of their overall electricity generation that comes from renewables.

Hydropower is a form of renewable power, but this article treats it separately, such that “renewable” in this context refers to green sources other than hydro such as wind and solar.

The Numbers

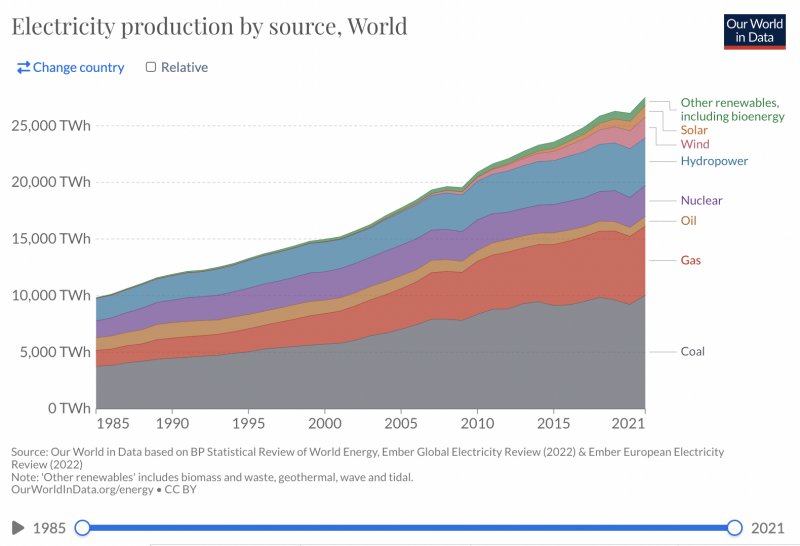

There is more agreement than ever that the world needs to limit the amount of electricity generation that comes from coal and natural gas. Here are the numbers from Our World in Data:

global electricity generation (Our World in Data)

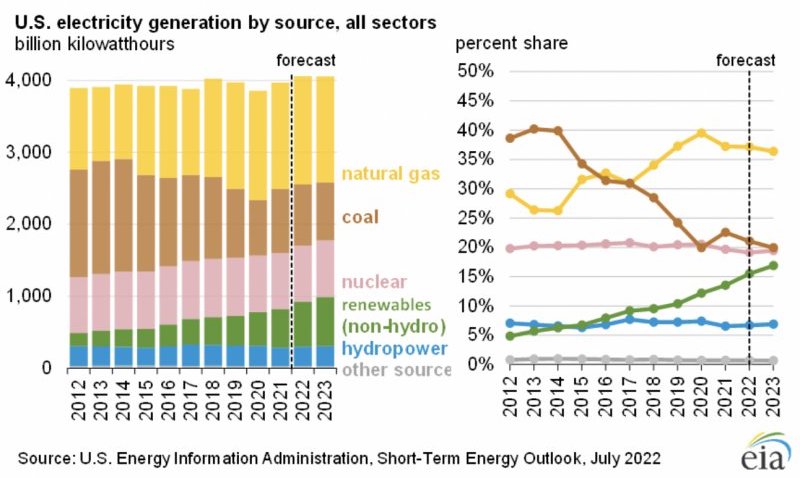

The U.S. is incentivizing companies like BHE to limit the use of coal and natural gas. These incentives are working, as the EIA shows that coal has declined as a percentage of U.S. electricity generation from about 40% in 2012 to a forecast close to 20% for 2023:

U.S. electricity generation (EIA)

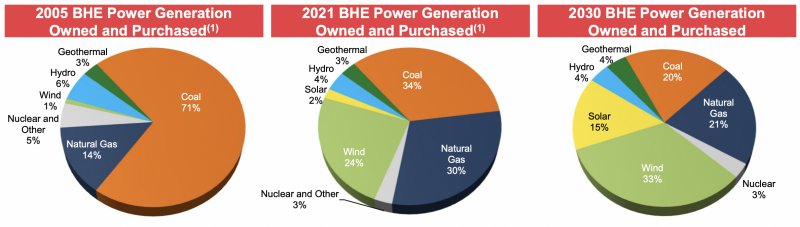

The BP (BP) Statistical Review of World Energy 2022 shows that 23.5% or of electricity in Europe was generated by renewables in 2021 [946.5 TWh out of 4,032.5 TWh]. Leading the way were the UK at 37.7% [116.9 TWh out of 309.9 Twh] and Germany at 37.2% [217.6 TWh out of 584.5 TWh]. BHE is on its way to more renewable generation like the UK and Germany. Combining wind, solar and geothermal, BHE has gone from 4% of their overall electricity generation coming from renewables in 2005 to 27% in 2021 per the BHE 2022 Fixed-Income Presentation:

BHE renewables (BHE 2022 Fixed-Income Presentation)

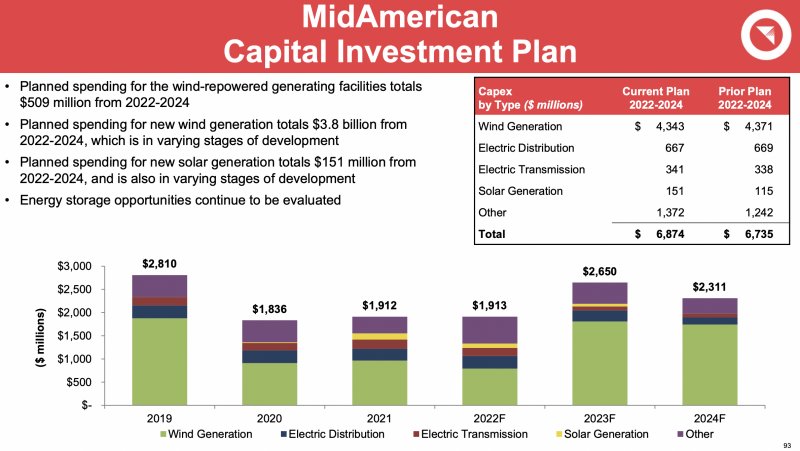

BHE is incentivized to continue investing in renewables, given tax credits and projects from data center companies. Projections show that 52% of BHE’s electricity generation will come from renewables in 2030, and I believe these numbers are realistic. Berkshire can be somewhat reticent with tax planning details, but they have said on a summary level that they are one of the few energy companies in the U.S. that has a full enough tax appetite to properly use incentives. BHE’s MidAmerican subsidiary is set to continue their fervid expansion on the wind side:

MidAmerican investments (BHE 2022 Fixed-Income Presentation)

The BHE 2022 Fixed-Income Presentation shows that MidAmerican had about 23,000 GWh of wind generation in 2021. This pencils out seeing as the 2021 annual 10-K shows MidAmerican wind capacity of 7,186 MWs which we multiply by 8,760 hours per year times 0.36 capacity times a MWh to GWh conversion factor of 0.001 to get a little under 23,000. The EIA shows that the U.S. as a whole had 380 TWh of wind generation in 2021, so I think it’s cool to know that this BHE subsidiary had about 23 TWh which is around 6% of the nation’s total.

BHE has a history of signing renewable agreements for data centers. In April 2014, BHE announced that MidAmerican had reached an agreement to supply wind-sourced energy for a Google (GOOG) (GOOGL) data center in Council Bluffs, Iowa. In January 2017, BHE revealed that their NV Energy subsidiary and Apple agreed on solar projects to support Apple’s data center in Reno. A May 2018 release from BHE describes a Utah data center for Meta (META) powered entirely by renewable sources. A January 2020 news post from DCD describes Google’s Nevada data center project with NV Energy, saying a solar farm is the power source.

Valuation

There are limits to BHE’s expansion. Wind and solar will continue to replace coal and natural gas, but hydro should remain in place. As such, I doubt BHE will get involved in hydro-heavy markets. 59.4% of Canada’s electricity [380.8 TWh/641 TWh] comes from hydro. South and Central America are also phenomenal in terms of hydro; these areas generate 48% or 660.1 TWh out of 1,364.8 TWh of their total electricity from this source. Brazil is the biggest contributor in the area, where hydro is responsible for 55.4% of their electricity [362.8 TWh/654.4 TWh]. China is the leader in raw hydro TWh at 1,300, but it is only 15.2% of their overall electricity generation of 8,534.3 TWh.

My valuation thoughts are still in sync with the views in my April article. It’s encouraging to ponder what the 2021 10-K says about cash flow from operations:

Net cash flows from operating activities for the years ended December 31, 2021 and 2020 were $8.7 billion and $6.2 billion, respectively. The increase was primarily due to $970 million of incremental net cash flows from operating activities at BHE GT&S, improved operating results and changes in working capital.

Disclaimer: Any material in this article should not be relied on as a formal investment recommendation. Never buy a stock without doing your own thorough research.

Be the first to comment