SergeyZavalnyuk

“The stock market is a device for transferring money from the impatient to the patient.” – Warren Buffet

Commodities

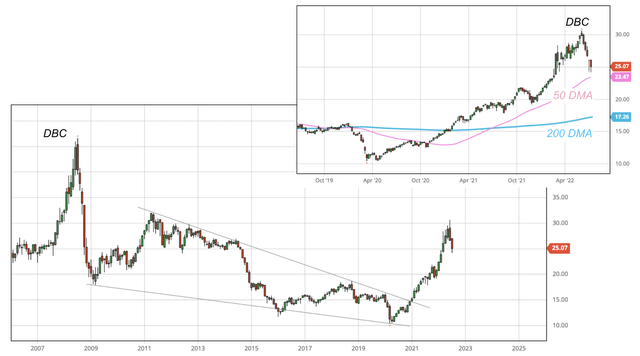

Commodity prices are plunging of late. Since early June, Invesco DB Commodity Index Tracking ETF (DBC) has lost ~18.2% and appears to be crashing toward the 50 DMA (Fig. 1). The market is said to be in fear of a recession due to interest rate hikes by the Fed and a possible collapse of the Chinese economy.

Fig. 1. Invesco DB Commodity Index Tracking ETF (DBC), shown with 50 DMA and 200 DMA (Laurentian Research, modified from Seeking Alpha and Barchart)

The volatility is certainly frustrating for those generalist investors who may have entered the commodity space over the last few months.

The following questions concerning the nature of the commodity selloff ensue:

- Is the selloff the beginning of a downward trip back to a commodity down-cycle only two years after a 12-year bear market? If that is the case, the spike from March 2020 to May 2022 will prove to be just a head-fake in the wake of the Covid-19 pandemic.

- Or is the pullback a necessary correction before the commodity prices resume their ascent? In that case, the selloff provides investors with a buy-the-dip opportunity while the commodity super-cycle rolls on.

Such questions can only be properly answered by looking at the supply-demand dynamic in the physical commodity market.

Take crude oil

Global demand for oil is still in the process of recovery from the Covid-19 crash, as I discussed in a recent article. There may be some early signs of fatigue in U.S. and European demand growth; however, the weakness in the developed world may well be offset by demand growth in emerging markets. According to the July 2022 issue of OPEC monthly oil market report, oil demand is forecast to grow by 3.4 MMbo/d in 2022 to an annual average of 100.3 MMbo/d, and by 2.7 MMbo/d in 2023 to an annual average of 103.0 MMbo/d, led by non-OECD countries.

- Recall the primary driver of oil demand growth is global population expansion. World population growth rates, albeit having been in a decline, still hover around 1.0% per year. Some 80 million people – equivalent to 8.9% of the combined population of the U.S., European Union and Japan – are added every year, mostly in the developing world.

The driving forces behind the commodity super-cycle, namely, the populist movement on a global scale and decarbonization in the rich countries, show no sign of abating. They are expected to remain alive and well for a decade if not longer.

In spite of the deep selloff in the oil futures market, a trader reportedly found no sellers willing to take his bid for a cargo of North Sea oil for late July 2022 loading at a premium of $5.35/bo over Brent. Clearly, the physical market tells a different story from what the financial market seems to be suggesting; we are facing an unprecedented tight oil supply.

Why are E&P companies not producing more oil? Well, as it turns out, they have little spare production capacity, thanks to sustained under-investment that began in late 2014 and continues to this day (due to government animosity and public opinions against hydrocarbons). Following Wall Street advices, U.S. oil companies are practicing capital discipline; even if they want to spend over their capital budget, they face challenges in supply chain constraints and skilled labor shortage. As a result, the inventory of drilled but uncompleted (or DUC) wells in the U.S. has shrunk to a dangerous level. Ahead of Joe Biden’s visit to Saudi Arabia, Aramco announced it would only increase its production capacity – currently at 12 MMbo/d with spare capacity at 1.4 MMbo/d – by 1 million b/d by 2027. Russia, the world’s number-three oil producer, is being purged from the energy supply chains of the West after its invasion of Ukraine. As western capital and oilfield services expertise exit the country, the future is bleak for Russian oil production.

It is evident the structural forces underpinning the oil bull market remain strong. Continued under-investment by the oil industry seems to indicate we are still in the early innings of an oil bull market.

Barring lithium, which received a lot of investment over the past few years, pretty much every other kind of metals is in a long-term supply-demand situation similar to that of crude oil: strong demand, tight supply.

Given the long-term supply-demand outlook, I believe the recent commodity price plunge represents a great entry opportunity.

Below are two of my favorite commodity stock picks.

Halliburton

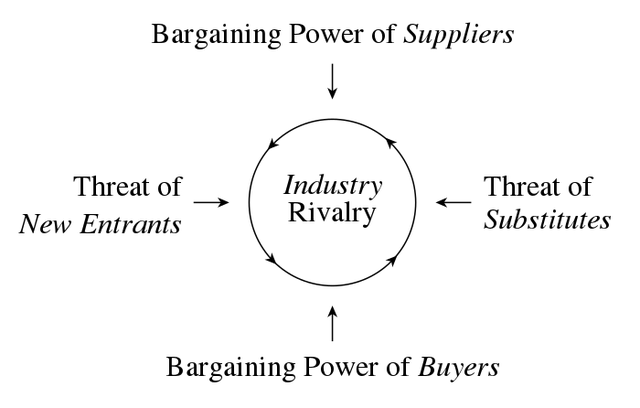

After a lengthy oil bear market and industry consolidation, the oilfield service space has become more concentrated. With essentially no new entrants, absence of the threat of substitutes, and less intense industry rivalry, oilfield service vendors today appear to command a strong pricing power over its customers – the E&P companies, which happen to be pulling in so much cash flow these days (Fig. 2). Such a pricing power manifests itself through rising OFS day rates as reported in recent quarters.

- I expect oilfield service companies to face challenges in material procurement and skilled labor hiring in the inflationary environment of today. However, the high costs OFS vendors have to pay to their suppliers can be easily passed down to the E&P operators.

Fig. 2. Michael Porter’s five forces in competition analysis (Porter)

In my experience, once the oil bull market is unfolding in earnest, investors are more likely to find better risk-reward profiles in OFS stocks than in E&P stocks. With nearly full equipment utilization and continually rising day rates, oilfield service vendors tend to pull in steadily growing revenue, yet without feeling the direct brunt of the increasing volatility of commodity prices.

Halliburton Company (HAL) is my favorite at this time among the big three oilfield service companies, the other two being Schlumberger (SLB) and Baker Hughes (BKR).

- Firstly, Halliburton has an outsized (>40% in terms of revenue contribution) exposure to onshore North America, where industry activities are dominated by short-cycle shale development. As the oil industry pivots towards short-cycle projects, Halliburton is better positioned to reap benefits. Indeed, the company reported faster top line growth in recent quarters.

- Halliburton share prices fell nearly 30% during the recent selloff. Currently, Halliburton is under-valued relative to its archrivals. Halliburton has a forward EV/EBITDA multiple of 8.7X, lower than that of Baker Hughes (9.3X) or Schlumberger (9.4X).

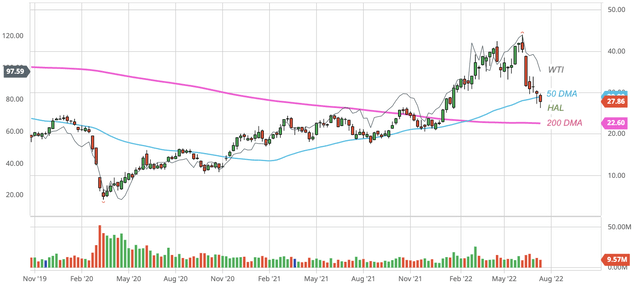

- Halliburton’s fracking fleet was booked out for 2Q and is expected to remain so for the foreseeable future. High equipment utilization and appreciating day rates can only lead to improved financial results. I expect Halliburton to report on July 19, 2022 excellent results for the second quarter. Interested investors may consider establishing a starter position in Halliburton ahead of the quarterly earnings report (Fig. 3).

Fig. 3. Stock chart of Halliburton (HAL), dividend back-adjusted, shown with 50 DMA, 200 DMA and WTI (Laurentian Research based on Seeking Alpha and Barchart)

Labrador Iron Ore Royalty Corp.

Royalty companies boast the most advantageous business model in the entire mining patch. A royalty company is in essence a special kind of financier that fund mining projects. For an upfront payment to the operator, the royalty firm acquires the perpetual right to a percentage of the mineral production or revenue generated from the mining project.

- Because royalty is paid off-the-top, free from any operating costs, and not dependent on whether the operator makes money or not, royalty companies are exposed to very limited operational and CapEx risk while realizing high margins.

- Royalty companies are also entitled to any new mineral resource discovered, delineated and developed by the operators in the projects. In other words, royalty companies reap benefits from the optionality of any production growth at zero cost.

Labrador Iron Ore Royalty Corp., aka, LIORC (LIF.TSX)(OTCPK:LIFZF) is a mid-cap royalty company. LIORC receives a 7% gross overriding royalty and a 10 cent per ton commission on all iron ore products produced, sold and shipped by Iron Ore Company of Canada, a joint venture between Rio Tinto (RIO) (operated 58.72%), Mitsubishi (26.18%) and LIORC (15.10%), which operates long-life iron ore mines in Labrador, Canada.

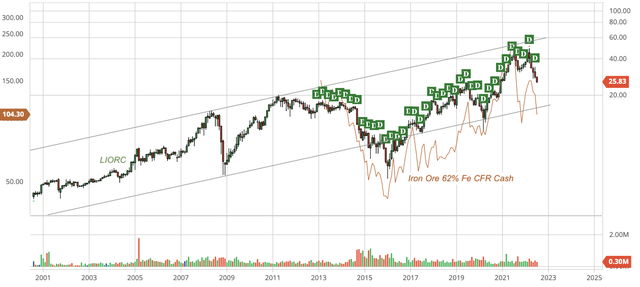

LIORC currently yields a mouth-watering 18.6%, which I expect to soften in the future as Iron Ore Company of Canada executes the ambitious capital expenditure plan and, as a result, declares lower dividends. That uncertainty, in combination with recent volatility in seaborne iron ore prices, will likely create a great entry opportunity in the near future (Fig. 4).

Fig. 4. Stock chart of Labrador Iron Ore Royalty Corp., dividend back-adjusted, shown with dividend payments (D) and iron ore 62% Fe CFR cash price for comparison (Laurentian Research based on Seeking Alpha and Barchart)

Takeaways

Because long-term supply-demand remains structurally robust, I believe the ongoing selloff of commodities represents an opportunity for investors.

In this article, I present two high-quality commodity stocks:

- Halliburton is a leading oilfield service firm. Considering its outsized exposure to short-cycle projects in onshore North America, the undervaluation of its stock relative to peers seems particularly conspicuous.

- Labrador Iron Ore Royalty Corp. deserves a position in any income-oriented portfolio. Ongoing capital spending program and volatile seaborne iron ore prices may create a great entry opportunity in the near future.

Be the first to comment