Grand Warszawski

Investment Thesis

Whether Nancy Pelosi bought shares in Amgen (NASDAQ:AMGN) or not, the stock is a strong money-maker with very shareholder-friendly management. An anchor for the portfolio in stormy times. The share is trading very close to its fair value and should provide the shareholder with mid to high single-digit returns over the next few years.

The rumors of Pelosi’s buy

This is really just a rumor, but at least an exciting coincidence. A Twitter account with 800k followers spread the news but without naming a source. This account is a former moderator of the notorious Reddit group WallStreetBets, hence the name WSB Mod.

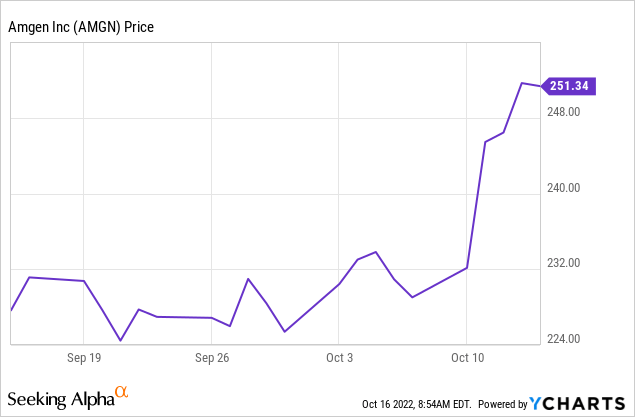

Normally this would not interest me at all, but it caught my attention because the timing was perfect. The tweet was published on October 9, which means the alleged purchase must have been before that. From October 10, the stock shot up. What happened? The purchase of NPlate for acute radiation sickness was announced a few days earlier; here is an article from October 4. On October 11, Amgen received a bullish call from Morgan Stanley on the potential of obesity candidate AMG133. But that’s not all. On October 11, this was also published:

BridgeBio Pharma (BBIO) stock rose ~4% on Oct. 11 after the company said the U.S. Food and Drug Administration (FDA) granted fast track designation to BBP-398 in combination with Amgen’s Lumakras for adult patients with previously treated, KRAS G12C-mutated, metastatic non-small cell lung cancer.

Normally, I would not pay much attention to such an unproven tweet and would assume that the share has only risen because many followers of the creator have bought. But the fact that there are several exciting news about the company shortly after this tweet is interesting. So either WSB Mods had a lot of luck, or there is a way to find out Pelosi’s trades before they have to be made public. Alright, enough speculation. If anyone has more information about it, please post it in the comments.

Valuation

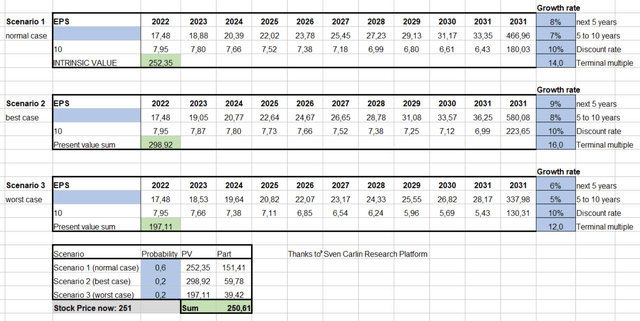

I have created a detailed analysis with three different scenarios to determine the current fair value with a discounted cash flow model. The normal scenario is the most probable variant and uses the EPS growth rate of the last five years (8%). Of course, one has to estimate the growth figures roughly, and the calculation is not exact. Nevertheless, I find this helpful approach, as it allows us to at least approximate a fair value. In other words, if a share were strongly overvalued or undervalued, it could be seen here. According to the numbers I used, the fair value is almost equal to the current share price. Of course, you can change the figures slightly, and then you are either slightly overvalued or undervalued. But you would have to change a lot to get completely different results, so we can say that the share is fairly valued according to this method.

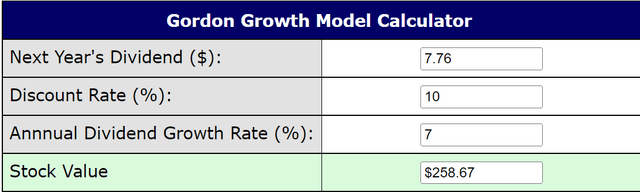

Another possible valuation method for steady dividend increases is the Gordon growth model, which measures the value by summing the values of all of its expected future dividend payments, discounted back to their present values. I have chosen 7% as a long-term dividend increase. In the last five years, the annual growth was 11%. According to this method, the share trades very slightly below its fair value.

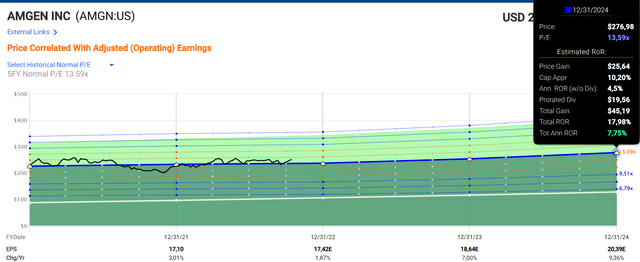

According to fastgraphs, we can expect a return of 7.7% over the next few years if the stock trades at its long-term average P/E level at the end of 2024. This is roughly in line with EPS growth and the long-term market average. For a solid, defensive company, I think that’s fine. Especially if you also hold riskier positions in your portfolio.

Buybacks lead to EPS growth

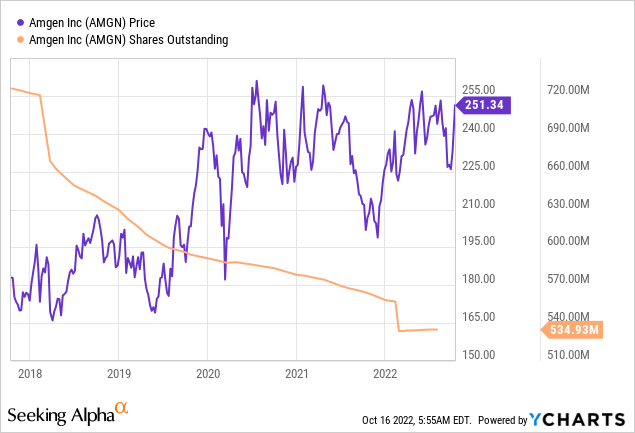

In the last five years, they have repurchased almost 30% of the shares, which is an insane pace. Thus, they have increased EPS from $12.58 in 2017 to $17.10 in 2021. Revenue growth over the last five years has been only 2.7% per year. That’s very low even for value stocks. The stock gets only a C- in the Seeking Alpha Quant rating.

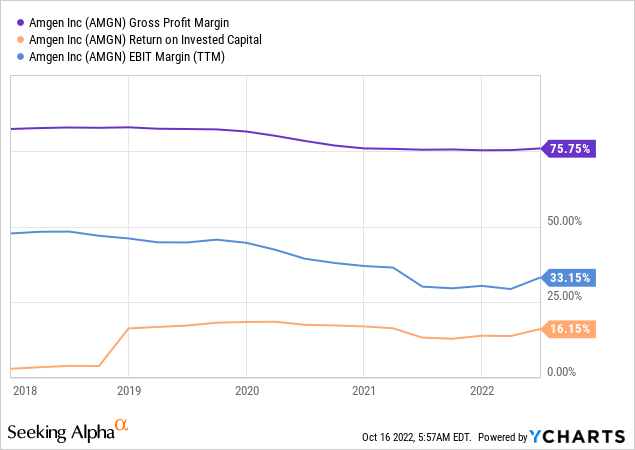

Profitability is enormously strong in all metrics and accordingly receives an A+ in the quant rating. After a slightly weaker phase in 2021, margins are already picking up again.

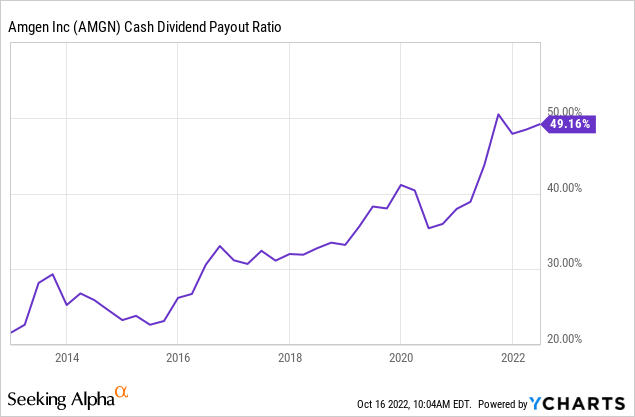

The dividend increase was also solid, with 11% per year over the last five years. With the enormous cash flow the company generates, we can assume that there will continue to be dividend increases and share buybacks. However, I believe they will not be able to sustain this high growth percentage.

Worldwide diversified

I like when companies are positioned globally. Local recessions and currency fluctuations are balanced out. Also, some regions of the world are stagnating in population while others are still growing. It is a massive advantage for a company like Amgen; when countries become wealthier, i.e., the middle and upper classes grow, this leads to better healthcare systems which means more people who need the drugs get them. On the one hand, the middle class is growing in many countries, and on the other, the population worldwide is getting older. For this reason, I believe that drug manufacturers will enjoy a structural tailwind for decades to come.

According to the full-year report on the 2021 business, sales growth in the U.S. was 12%, and in the Asia-Pacific region, 36%. However, overall, 2/3 of sales are generated in the US.

Risks

Amgen has only about 25 different drugs on the market right now, which is not a lot and means there is a significant concentration on single drugs. At some point, patents on these will expire, giving them competition. Some main revenue drivers will expire within the next few years, like Prolia. Seeking Alpha author Eugenio Catone recently wrote an interesting article about this, which every Amgen investor should read.

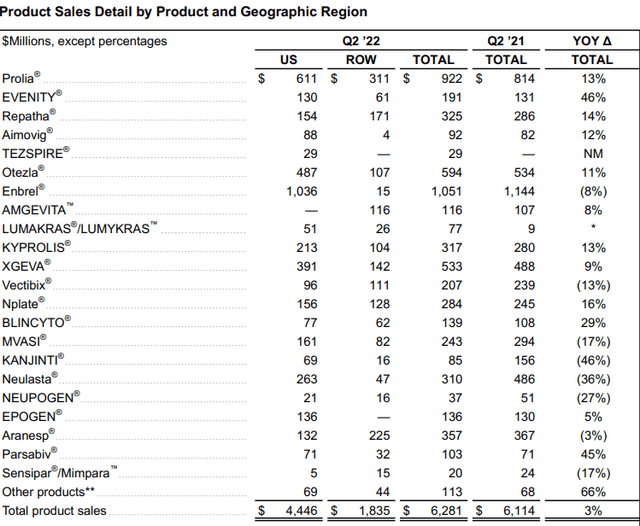

Another risk is that the transition to declining sales is very narrow. In the following overview, you can see that the YoY growth in sales was only 3%, and some drugs had strongly declining sales. Probably also this 3% was only achieved by price increases. This, in combination with expiring patents, provides constant pressure to bring new successful drugs to the market.

Amgen Q2 2022

Conclusion

I think a buy rating is appropriate, as the company will still make money for investors over the next few years. However, from my point of view, on closer inspection, it is not quite as perfect as it seems. EPS is growing faster than sales because of the buybacks. However, I think when a company is almost stagnant in sales, this is a bit dangerous, especially when some money-makers will soon lose their patents. Given that, I can’t imagine that the dividend will continue to grow as fast as it has in the past. The payout ratio has been increasing for years and is now over 50%. However, it’s still a money-printing machine, and shareowners will also benefit from this.

Be the first to comment