Nagalski/iStock Editorial via Getty Images

Investment thesis

Diageo (NYSE:DEO) is a high-quality company with crash-proven management, an excellent portfolio, and a geographically well-diversified business. The projected annual total return (capital gains plus dividends) of 11.9% until 2024 looks attractive. In addition, US investors benefit from a historically weak British pound and thus favorable share prices.

Motivation for this article

When I started investing in common stocks, my portfolio quickly reached 40+ individual titles. This is a high-quality company trading at a discount, that’s a very promising mega trend I shouldn’t miss, you need high dividend growth businesses, and so on. I guess most of you know what I am talking about. Over the years I realized that it is hard to keep up with all the corporate news and I was not really able to enjoy all my investments.

Warren Buffett made many smart statements in his investment career and this one is my favorite: “If you aren’t thinking about owning a stock for ten years, don’t even think about owning it for ten minutes.” I asked myself the question (some time ago), which companies in my portfolio meet this “10 years” criterion? And I was able to answer this question immediately. Why am I telling you all this? Because Diageo is on this list.

Why is the “10 years” question so important?

What I am about to say may be taken for granted by many, but I would like to emphasize it once again. If you are absolutely convinced of a business and its products it is much easier to stick to it even in very difficult times. Getting back to Warren, it is also very helpful if you really understand the business model and how it is affected by the current situation.

I started my first position in Diageo in the Covid crash year of 2020 because I was absolutely convinced of the positive long-term outlook. The company owns some of the best-selling alcoholic beverages brands, the business is geographically well-diversified and the management knows what they are doing. In addition, Diageo also has exposure in the high-end luxury segment through their 34% stake in Moët Hennessy and you get a decent dividend from a UK-based company (no withholding tax). Well, we will get back to the UK aspect in a moment.

All in all, will I stick with Diageo for another eight years? Absolutely.

Thanks, Downing Street

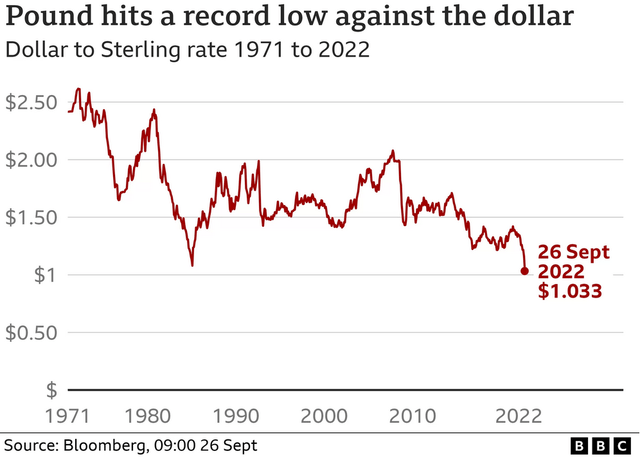

Admittedly, I am a bit envious of US investors. The government in London has been doing everything it can for months to get you a more favorable entry price. At the end of September, the value of the British pound has fallen to a record low against the US dollar.

Diageo’s one-year performance at the London Stock Exchange is shown below.

A minus of 9.14% YTD and stagnation after one year is not spectacular but considering the brutal downward trend that we have seen on the broad market, it’s not that bad. US investors benefit from the weak British pound, the stock is down about 25% YTD in US dollar, and can collect shares of a high-quality company like Diageo at a lower price.

It’s not only the stock price for foreign investors but also the earnings reporting of a UK-based company that is affected by the pound’s downward movement. Diageo’s US business contributes roughly 40% to the overall revenue and its contribution is expected to further increase. However, that’s more short-term noise and I am only interested in buying more shares at an attractive valuation for the long term.

High-quality and high valuation?

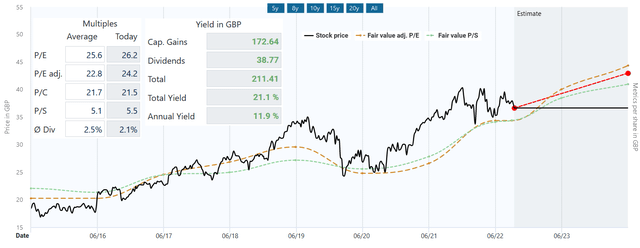

The dynamic fair value calculation of DividendStocks.Cash was utilized to analyze Diageo’s current valuation. The tool allows the selection of a representative time period in terms of growth and other operating parameters. More details about the procedure can be found here.

Note: stock price is in British pounds trading at LSE.

The current valuation of the stock is analyzed using two ratios: adjusted price-earnings and price-sales. Based on the time period between 2014 and 2024 (estimated by analysts), the calculated fair value multiples are 22.8 for P/E adj. and 5.1 for P/S.

Historically, the stock price matched the fair value multiples quite well but got somehow disconnected beginning of 2019. It followed a period of overvaluation, short periods of fair valuation during the Covid crash in 2020 before it become overvalued again. It’s not a screaming buy at current (pound) levels but a projected annual total return (capital gains plus dividends) of 11.9% until 2024 is attractive. Please keep in mind that the 2024 numbers are based on 17 analysts’ estimates and there are uncertainties. For US investors today’s valuation looks much more attractive considering the strong US dollar. In my opinion, it is a good time to start a long-term investment or add more shares to an existing position.

Risks to consider

No doubt, a few risks also need to be briefly discussed. Inflation is everywhere and high commodity prices have an impact on Diageo’s profitability. However, its strong brands provide pricing power to compensate for some of the headwinds. At the same time, some of their customers may think twice before buying expensive spirits during a recession. Finally, the virus is still around and some countries still have restrictions and social distancing.

Conclusion

Diageo is a high-quality company with an excellent portfolio and a geographically well-diversified business. The management proved during the Covid pandemic that they can handle even the most difficult situations.

Looking at the current valuation, the stock is not a screaming buy. However, a projected annual total return (capital gains plus dividends) of 11.9% until 2024 is attractive. In addition, US investors benefit from a historically weak pound. When I look at the chaos in the British government, we can assume that the exchange rate of the pound will continue to fall (this is of course also meant somewhat ironically).

Be the first to comment