Javier_Art_Photography

There is no doubt that Cathie Wood’s ideas and her ARK Innovation ETF (ARKK) are two of the most widely followed and talked about topics in the investment news today. Like the old saying goes: “When she is good she is very, very good, but when she is bad…”. When she was good you could have bought ARKK back in October of 2014 at around 20.38 and rode it all the way through to its all-time high of 159.70 in February 2021 and made around 783% of your investment. When she was bad if you bought ARKK on its high in February 2021 at 159.70 and rode it down to its low of 35.10 in May of 2022, you would have lost around 78% of your investment. That’s some Good, Bad and Ugly!

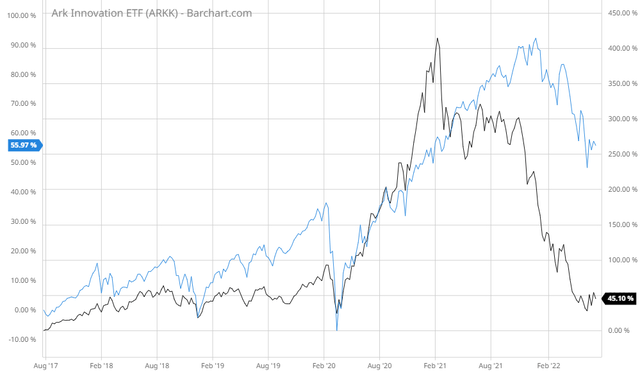

Let’s look at a Percentage change comparison of the performance of ARKK to the Benchmark S&P 500 Index over past 5 years:

It’s easy to see that in Bull markets ARKK outperforms the S&P 500 Index but in Bear markets it really tanks much faster.

What if you considered the 34 holdings in ARKK as a Watchlist and downloaded those holdings, sorted them by the best performance and cherry picked the best ones? Consider the holdings as a buffet prepared for you by Chef Cathie Wood. Now there is no way you could eat all 34 of the offerings and by the way some of them are just terrible so what will you try first?

When I used by my custom view on Barchart for my ARKK watchlist the genetic biotech company Beam Therapeutics (BEAM) outperformed the others with a monthly return of 80.34%. Although I personally have bought the stock for several of my portfolios, I’m not recommending it as a buy for everyone but here is some information for you to determine if it might be right for you.

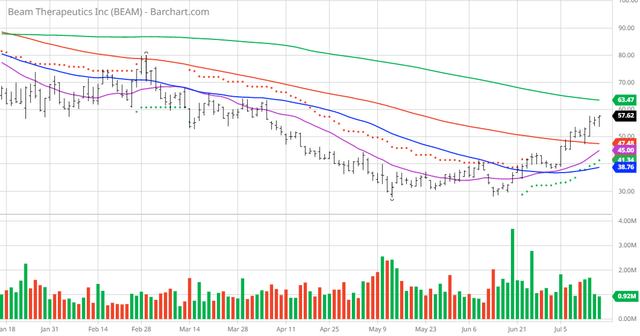

This is a chart of Beam’s price vs various Daily Moving Averages over the last 6 months:

Beam Therapeutics Inc., a biotechnology company, develops precision genetic medicines for patients suffering from serious diseases in the United States. The company is developing BEAM-101 for the treatment of sickle cell disease and beta thalassemia; BEAM-102 for the treatment of sickle cell disease; and BEAM-201, an allogeneic chimeric antigen receptor T cell for the treatment of relapsed/refractory T-cell acute lymphoblastic leukemia; and BEAM-301, a liver-targeted development candidate for the treatment of patients with Glycogen Storage Disease Type Ia. It also develops therapies for alpha-1 antitrypsin deficiency; ocular diseases; and other liver, muscle, and central nervous system disorders. The company has an alliance with Boston Children’s Hospital; a research and clinical trial collaboration agreement with Magenta Therapeutics, Inc.; license agreement with Sana Biotechnology, Inc.; and a research collaboration with the Institute of Molecular and Clinical Ophthalmology Basel. It also has a research collaboration agreement with Pfizer Inc. and Apellis Pharmaceuticals, Inc.; and collaboration and license agreement with Verve Therapeutics, Inc. The company was incorporated in 2017 and is based in Cambridge, Massachusetts. – Source: Seeking Alpha

Barchart’s Opinion Trading systems are listed below. Please note that the Barchart Opinion indicators are updated live during the session every 20 minutes and can therefore change during the day as the market fluctuates. The indicator numbers shown below therefore may not match what you see live on the Barchart.com website when you read this report.

Barchart Technical Indicators:

- 8% technical sell signals but increasing to a hold

- 38.20 negative Weighted Alpha

- 32.35% loss in the last year

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 13 new highs and up 80.34% in the last month

- Relative Strength Index 73.75%

- Technical support level at 54.91

- Recently traded at 57.62 with 50 day moving average of 68.76

Fundamental factors:

- Market Cap $4.05 billion

- Revenue expected to be down by 30.40% this year and down another 13.70% next year

- Earnings estimated to increase by 25.30% this year, decrease by 12.30% next year but continue to compound at an annual rate of4.10% for the next 5 years

Analysts and Investor Sentiment — I don’t buy stocks because everyone else is buying but I do realize that if major firms and investors are dumping a stock it’s hard to make money swimming against the tide:

- Wall Street analysts have 7 strong buy, 2 buy, 4 hold opinions on the stock

- The analysts’ consensus price target is 35.70 with some as high as 145.00

- For some reason, the individual investors are not following the stock on Motley Fool

- 10,950 investors are monitoring the stock on Seeking Alpha

Ratings Summary

Factor Grades

Quant Ranking

Sector

Industry

Ranked Overall

Ranked in Sector

Ranked in Industry

Be the first to comment