loops7

What Bearish Sentiment Currently Does to Biotech industry and Bavarian Nordic A/S (OTCPK:BVNRY)

Aside from companies in the oil and natural gas sector and some utilities, whose stocks have soared on the back of strong stimulus from record fossil fuel price increases in the spot market, all other industrial sectors have collapsed under the pressure of strong market headwinds.

Aggressive interest rate hikes by western central banks, leading to a recession, and the negative impact of the war in Ukraine, with skyrocketing energy bills, have led to widespread negative sentiment in stock markets.

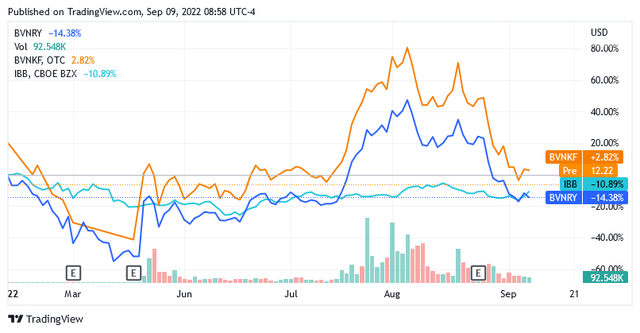

One of the subsectors that have suffered the most from the economic turmoil caused by the above factors is the biotechnology subsector, whose stocks are down an average of 10.9% year-to-date, as shown in the chart below. The iShares Biotechnology ETF (IBB) was used as a measure of industry performance.

Among the biotech stocks that certainly didn’t shine during the period, Bavarian Nordic A/S stands out as its shares fell more than the exchange-traded fund, losing 14.4% in the OTC market under the symbol BVNRY.

In fairness, shares of Bavarian Nordic A/S have also outperformed the benchmark when traded under the symbol (OTCPK:BVNKF) on the OTC market, with a marginal jump of 2.8% this year [at the time of writing this article].

However, while the market for BVNKF shares is not very dynamic with an average trading volume of around 4,830 shares in the last 3 months, the market for BVNRY shares is significantly more active, allowing for comparison with the exchange-traded funds. As of this writing, an average of 253,700 shares have traded under the symbol BVNRY over the last three months, which definitely suggests that Bavaria Nordic A/S stock has disappointed more than its own industry.

However, there is a Reason for Optimism when Analyzing the Chart in Tandem with Today’s Challenges for the Biotech Stock

A closer analysis of the chart for BVNRY stock is pointing to a rebound in the stock price from mid-May, leading to a quarterly uptrend ending around Aug. 17-18. The share price recouped a very good chunk of the previous loss and approached the Aug. 30, 2021 high of $19.25 before falling back to the current $11.23.

Shares most likely rallied after one of US President Joe Biden’s administration chiefs told reporters last May that cases of the monkeypox virus infection could be rising in the United States.

Although this type of infection is hardly dangerous for the general public, the source added, the news has been very well received by the market as Bavarian Nordic is currently working on a medicinal cure for the monkeypox virus.

The monkeypox infection – which is currently being closely monitored by the nation’s healthcare systems and the World Health Organization [WHO] – will most likely continue to drive traders’ interest in Bavarian Nordic shares.

As Bavarian Nordic’s portfolio is currently focused on COVID-19 and the Ebola virus, significant improvements in the respective drug pipelines or updates in the fight against the diseases are likely to result in strong upward pressure on the share price. This is because the coronavirus continues to threaten global health and Ebola continues to cause worrying epidemics in Africa.

Bavarian Nordic A/S’s Role in The Biotechnology Industry

Headquartered in Hellerup, Denmark, Bavarian Nordic commercializes life-saving vaccines against infections that threaten global public health, as well as developing and manufacturing these remedies.

Currently, the Danish biotech markets smallpox vaccines, as it has long been the supplier to the US government, and monkeypox vaccines in the United States, where they have received approval from the US FDA, as well as the respective regulatory bodies for Europe and Canada.

Bavarian Nordic A/S’s commercial product portfolio also includes market-leading vaccines to protect against rabies and tick-borne encephalitis [TBE], as well as the Ebola vaccine licensed to Johnson & Johnson’s (JNJ) Janssen Pharmaceutical Companies and the development of a next-generation vaccine against the COVID-19 virus.

The Portfolio of Products that the Company Markets

In summary, the company markets Rabipur-RabAvert for rabies in 20 countries, Encepur for TBE in 12 countries of the European Union and sells Jynneos-Imvamune-Imvanex [for smallpox and monkeypox] to governments.

Furthermore, it has licensed the Mvabea vaccine [against Ebola] to Janssen, which can supply high-risk areas in West Africa, and it can commercialize the Ixiaro vaccine [against encephalitis] in Germany and Switzerland under license from Valneva SE (VALN).

Bavarian Nordic may market and distribute Dukoral vaccine [against cholera] in Germany and Switzerland under license from Valneva SE and may market and distribute Heplisav-B vaccine [against all known subtypes of hepatitis B virus] in Germany under license from Dynavax Technologies Corporation (DVAX).

Sales and Profitability Declined Recently, but the Company is Preparing for a New Era of High-Risk Tropical Infections and Coronaviruses

In the first six months of the current year, this portfolio of marketed and licensed vaccines had products sold for total revenue of Danish krone [DKK] 857 million [approximately $120.83 million], reflecting a 16.6% year-over-year decline in USD currency.

Rabies and TBE vaccines [up 24.8% yoy] accounted for 65.8% of total revenue, Smallpox/Monkeypox vaccines [down 65.2% yoy] accounted for 13.7% of total revenue and Ebola vaccines [down 66.3% YoY] accounted for 3.5% of total revenue.

The remainder of the total revenue [about 17%] came from milestone payments, sales of third-party products and contract work.

For the first six months of the current year, Bavarian Nordic’s net income was a net loss of DKK 509 million [about $71.76 million], reflecting a deterioration of more than 80% from the corresponding period of 2021.

Bavarian-Nordic’s sales have cooled off somewhat, which combined with pressure from higher research and development costs has resulted in a loss of profitability. But ultimately, the company’s shareholders shouldn’t worry about that.

Ebola, smallpox/monkeypox and cholera will continue to be far from negligible markets for vaccines and preventive medical therapies as these infections pose an ongoing global threat. Due to migratory flows from the third world and developing countries, where people flee from natural disasters, social tensions, civil wars and terrorist attacks, the risk of infections crossing borders and then spreading to developed countries is not at all small.

The recent coronavirus provides evidence of what would happen economically and socially if any of these threats spiraled out of control in a global health emergency.

Some Diseases are Endemic in Third World and Developing Countries and Pose a Constant Threat Even to Industrialized Societies: Some Examples

There is currently a risk in some countries that these diseases could lead to very serious outbreaks of infection, against which the WHO and several UN organizations are doing their utmost to provide not only financial aid but also medicines and water purification kits.

Monsoon floods in Pakistan, which have affected more than 33 million people since early June and caused over 1,200 deaths and multiple damages to homes, health facilities and public infrastructure, are causing cholera infections, diarrhea, high airway infections and some skin diseases.

Cases of Ebola infection are common in the Democratic Republic of the Congo, with the last epidemic ending in early July 2022. But a suspected Ebola case involving a 46-year-old woman who died last Aug. 15 in the country’s eastern region has been under investigation since late last month, and a couple of hundred people have also been identified as contact cases. This reignites fears of a new Ebola epidemic in the African country.

As for monkeypox, the infection, which is common in the middle of nowhere in central and western regions of Africa, does not easily spread among humans. Yet, new cases of people carrying the infection are being reported daily in Europe and America, drawing the attention of the WHO and national health systems.

Not to mention the Covid-19 issue which some might consider as being over and instead the onset of just a very few cases are enough to force millions of people under a new lockdown in the industrial megacities of Shenzhen, Guangzhou, Dalian, Chengdu, Shijiazhuang. This, among other things, creates a new economic standstill risk for the world’s second gross domestic product.

The company’s Full-Year 2022 Revenue Guidance

The full-year 2022 revenue forecast has been raised multiple times over the past few months since the monkeypox outbreak began in May, and currently, this forecast calls for revenues of DKK 2.7 billion [about $362.7 million] to DKK 2.9 billion [about $389.6 million] range versus last year revenue of DKK 1.9 billion [about $289.3 million].

The Financial Condition Looks Robust to Support the Development of the Vaccines

The balance sheet appears robust with nearly $459 million in cash and short-term securities against total debt of about $137 million [including capital leases] as of June 30, 2022, to support the continued development of medical remedies against the above threats.

A freeze-dried version of smallpox and monkeypox Jynneos vaccine with boosted shelf life has been developed and is now awaiting expanded FDA approval.

Bavarian Nordic is currently undergoing the phase 3 of a global clinical trial testing its product – called MVA-BN RSV — in elderly people for respiratory syncytial virus. Key results are expected to be released between June and July 2023.

The company is advancing its COVID-19 vaccine product candidate, called ABNCoV2, which has already shown its potential as a booster vaccine against the various mutations in the original strain. The company is currently undergoing a double-blind, plus controlled Phase 3 of a clinical trial to demonstrate that ABNCoV2 is as effective as Pfizer Inc.’s (PFE) Comirnaty vaccine in terms of an immune response. Initial study results should be released sometime in the last quarter of 2022, seeking watchdogs’ approval in less than a year.

Bavarian Nordic is also working on a tumor antibody-boosted therapeutic vaccine called TAEK-VAC, which is being investigated in an open-label phase 1/2 study in patients with breast and lung cancer.

The Stock Valuation – The Share Price isn’t High and has Growth Catalysts

Shares of Bavarian Nordic A/S under the symbol BVNRY changed hands at $11.23 per unit for a market cap of $2.37 billion and a 52-week range of $5.85 to $19.31 as of this writing. The stock is currently trading slightly above the long-term trend of the 200-day moving average of $11.00.

Shares of Bavarian Nordic A/S under the symbol BVNKF changed hands at $32.67 per unit for a market cap of $2.37 billion and a 52-week range of $16.76 to $58.02 as of this writing. The stock is currently trading slightly above the long-term trend of the 200-day moving average of $33.10.

Given the catalysts outlined above, coupled with a stock price that isn’t significantly higher compared to recent valuations, this stock looks like an opportunity to seize. However, the investment comes with the following risk:

The stock has a 5-year monthly beta of 1.39, which means it is more volatile than the market, so the various catalysts could be wiped out by the current headwinds should they prove particularly persistent.

Conclusion – Strong Bearish Sentiment Dragged this Biotech Stock Lower, but there are some Catalysts for a Nice Comeback

Affected by the strong bearish sentiment, this stock hasn’t performed well this year, as have many other biotech stocks.

Recently the company’s revenue and profitability have declined significantly, but shareholders shouldn’t lose faith in this holding.

Bavarian Nordic A/S plays a strategic role worldwide by preventing threats from pathogens that, like the recent experience with the coronavirus, can cause a global economic and social crisis.

Be the first to comment