onurdongel/E+ via Getty Images

Investment thesis

TC Energy Corporation (NYSE:TRP) is a dividend aristocrat and a primary choice for income investors. This will not change in the upcoming years in my opinion due to the consequences of the Ukrainian war and North America’s energy independence incentives. The company has a bigger than usual debt-to-equity ratio however almost all of its debt is in long-term fixed rated debt which makes it relatively secure, especially with the current record inflation environment. I am only neutral on TRP due to its fair valuation but I believe long-term income investors can benefit from adding TRP to their portfolio.

Business Model

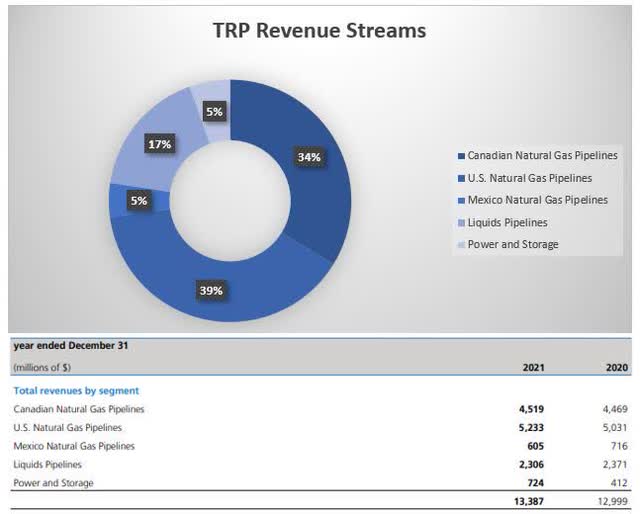

TC Energy is a more than 70-year-old Canadian midstream natural gas company but it also operates as an energy infrastructure company in North America. They operate 93,300 km (57,900 miles) of pipeline and more than 653 billion cubic feet of natural gas storage in Canada, the U.S., and Mexico. In addition, the company has a smaller network of crude oil pipelines (4,900 km) and 7 power generating facilities which are capable of supplying more than 4 million homes. The vast majority of the company’s revenue comes from its gas pipelines (approximately 77%). The U.S. and Canadian pipelines are responsible for the lion’s share of TRP’s income while in terms of assets the company has approximately 45% of its total assets in the U.S.

External factors in favor

The Ukrainian war changed a lot of things in the natural gas industry within a matter of weeks. Natural gas prices skyrocketed and in addition, the Russian oil sanctions affected the market heavily. The U.S. and the EU strike a fast LNG deal as the EU seeks to cut off Russian supply (however, even with this deal it is still impossible in the short term). U.S. policymakers started to claim that this is also an energy war and that the U.S. needs to be “energetically independent“. This will translate to faster gas permits, fewer regulations for pipelines, or regulations that were on the table will be postponed to secure North America’s energy independence. All of this rapid change is in TRP’s favor. They will be in a better position for lobbying, they will be able to require capital for certain projects, and push successfully for fewer regulations. In addition, TRP’s suppliers will pump natural gas as fast as they can due to the widening profit margins. And as it seems at the moment this war is not going to be ending soon so the elevated natural gas prices will remain with us. In addition, according to the EIA, U.S. natural gas consumption will steadily increase until 2050.

TRP’s valuation

There is no doubt that TRP is a stable company, especially with the external factors turning in their favor. The company has a debt-to-equity ratio of 1.59x which might seem high in this sector and you would be right. However, most of their debt is long-term and fixed-rate debt (approximately 86% of the total debt is long-term debt). In addition, the high inflation will be also in their favor with the fixed-rate debt they carry for the long-term, so I am not too worried about their 1.59x debt-to-equity ratio.

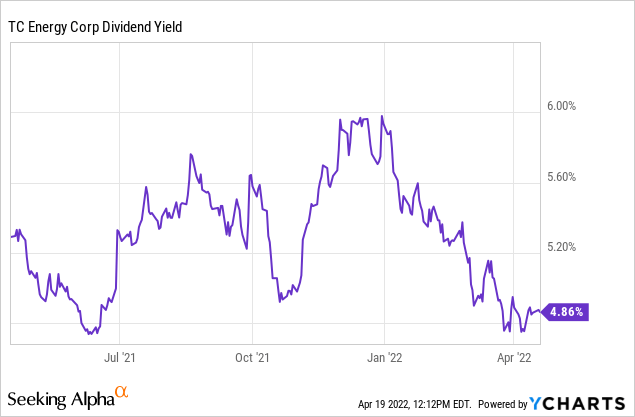

TRP has a forward Non-GAAP P/E ratio of 17.06 higher than the sector median of 10.31 which would indicate that TRP is way overvalued but compared to TRP’s own 5-year average P/E ratio of 16.24 the current figure is only slightly higher. In addition, if we compare TRP to Enbridge Inc. (ENB) we can see a lower P/E ratio because Enbridge has a forward P/E ratio of 18.93. In terms of TRP’s dividend yield, it is trading at its lowest 15% of the last 12 months and you could have bought the stock with a better dividend yield at almost any other time of the year. This suggests a slight overvaluation but taking into consideration all the internal and external factors I would say TRP is fairly priced at the moment.

Company-specific Risks

There are several risk factors for TRP however, most of them are not as relevant as before the Ukrainian war. Such as the regulations risk or the ESG-related risks because they are still on the table but TRP’s management tries to soften these risk factors. The energy transition is a real risk even in the shorter term because as the natural gas price skyrockets, the price of alternative energy sources such as renewables will be competing with natural gas. But the largest risk factor I see is the accident risk. We cannot calculate a potential gas pipeline explosion but there is a chance that it can happen. I brought a 2017 example to have an understanding of what will happen to the stock price in the event of an accident. In 2017 a pipeline operated by Kinder Morgan (KMI) exploded and created a massive fire. It was a relatively „small” incident but the stock price fell by almost 10% in the next months. In case of a larger accident, the impact can be larger on the stock price not to mention the compensation TRP might have to pay or the legal settlement costs. This is why I think in the upcoming years this risk can have the largest negative impact on TRP.

My take on TRP’s dividend

Current dividend

TRP is a Canadian dividend aristocrat with a 32-year consecutive dividend payment history. This should not come as a surprise, because TRP is very similar to Enbridge in terms of history, sector, income streams, and dividend policy. TRP is yielding at 5.03% at the moment. In the last 10 years, the management could increase the dividend by a yearly average of 5.14%.

Future sustainability

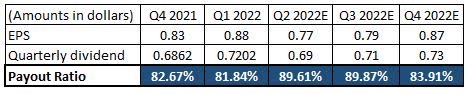

The payout ratio is around 80-90% which is acceptable for a well-established large company. Due to TRP is not a growth stock and operating in a very capital-intensive sector the payout ratio is considered to be in the safe zone. We can expect a slow and consistent dividend growth just like we are used to with TRP. Analysts estimate a 3.26% dividend increase in 2022 and a similar increase in 2023 as well. The consensus rate is $0.7125 per share quarterly. I believe due to the external positive factors and positive regulations, this dividend increase can exceed the expectations for the upcoming years.

The table is created by the author. All figures are from the company’s financial statements and SA Earnings Estimates.

Final thoughts

Almost all external factors are in TRP’s favor such as the skyrocketing natural gas prices, the U.S. and Canadian growing energy demand until 2050, the positive changes to regulations due to the war, and the high inflation helping reduce their fixed-rate debt over the long term. These external factors are supported by stable and secure internal factors of TRP. I am only neutral on TRP due to its 22% price appreciation since the start of 2022 but long-term income-seeking investors can calmly add the company to their holdings because TRP will provide a reliable income source for them.

Be the first to comment