Scott Olson/Getty Images News

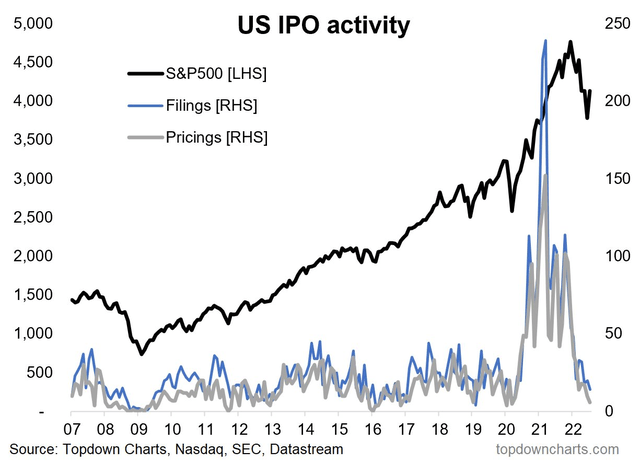

This year has seen muted IPO activity compared to the hot market of 2021. Earlier this week, The Wall Street Journal reported that the domestic IPO market is on pace for its worst year in decades after the market peaked in Q3 2021, according to Wall Street Horizon.

The total count of U.S. IPOs has indeed plunged according to data from Topdown Charts. Toss this graph in the pile proving just how speculative 2021 was.

IPO Activity Plummets

One recent new listing is a household name and certainly not as sexy as so many tech startups from last year. There are, however, key events and dates to know about it.

According to Bank of America Global Research, Bausch + Lomb (NYSE:BLCO) is a global eye health company with strong brand recognition with a broad product portfolio of contact lenses, over-the-counter drops and solutions, ocular surgery equipment and instrumentation, and branded and generic prescription pharmaceuticals to treat a wide variety of eye conditions. BLCO operates in three primary segments – Vision Care, Surgical, and Ophthalmic Pharmaceuticals.

The Ontario-based $5.4 billion Health Care Equipment & Supplies industry company within the Health Care sector trades at a 15.6 price-to-earnings ratio using 2022’s earnings estimates, according to Seeking Alpha’s data. BLCO does not pay a dividend.

The company handily beat earnings expectations back on August 4, but its stock price reaction was muted. There has been volatility, however, around a patent ruling with its Xifaxan GI medication. In late July, an unfavorable ruling by a Delaware court hurt BHC shares, but BLCO would not discuss its impact on BLCO’s Q2 earnings call. According to BofA, BLCO is planned to be spun off from BHC, but BHC did not provide more details on the event on its earnings call earlier this month, per BofA.

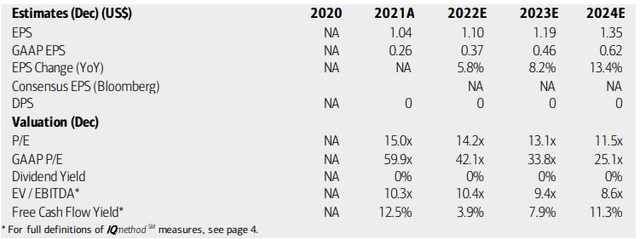

On valuation, analysts at BofA see reasonable upside to earnings in the years ahead with an acceleration through 2024. As a result, the valuation should grow solid if shares remain rangebound following the IPO last quarter. The stock trades at a reasonable EV/EBITDA multiple and is forecast to generate solid free cash flow in the coming years.

BLCO Earnings, Valuation, Free Cash Flow Forecasts

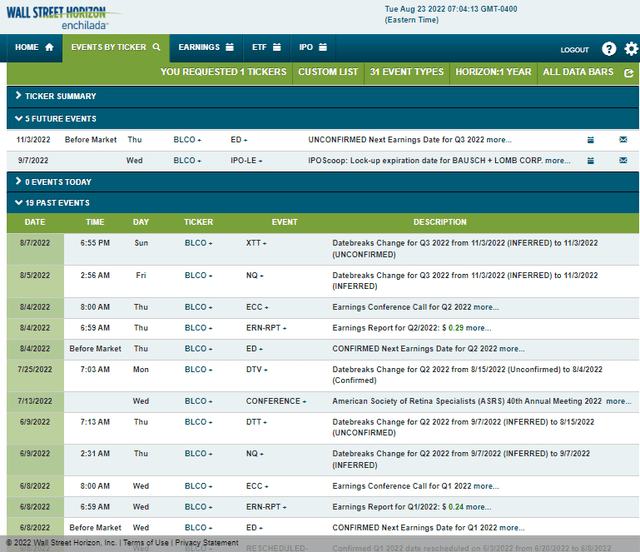

Bausch + Lomb’s corporate event calendar has a key IPO lock-up expiration date on Wednesday, September 7, according to Wall Street Horizon. Investors should be careful about a flood of supply hitting the market as early investors potentially cash out. After that, the firm’s Q3 earnings date is unconfirmed for Thursday, November 3, BMO.

BLCO Corporate Event Calendar: IPO Lock-Up Expiration Looms

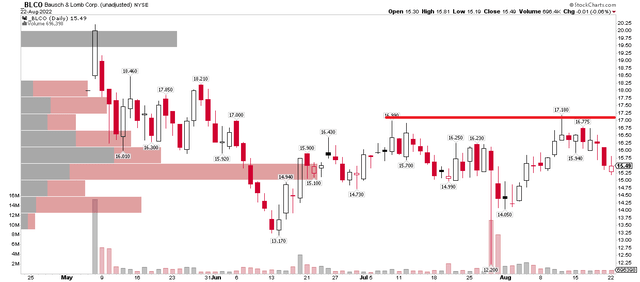

The Technical Take

With limited trading history given the May IPO, it’s tough to pinpoint specific support and resistance levels on the chart. nevertheless, I see a problematic spot for the bulls near $17. There’s broad support around the current price, as indicated by the “volume by price” feature on the left side of the chart.

Notice the large number of shares traded in the $15 to $15.50 range, which is about where the stock closed on Monday. I look for support down to $15. With all IPOs, it is important to remember the IPO price – $18 in the case of BLCO. After the stock surged above $20 on day one of trading, $18 proved to be minor resistance when shares fell below the offering price. Overall, it’s a messy chart, but there is some support here, but $17 and $18 might be tough to get through.

BLCO Technicals: $17 Resistance & $18 IPO Price

The Bottom Line

I have a ‘hold’ on Bausch + Lomb. The valuation looks good, but there’s uncertainty surrounding one of BHC’s key drugs that could impact BLCO. Moreover, an IPO lockup period expiration could be bearish next month. Finally, the chart does not show a clear trend and there isn’t much price history to determine very strong supply and demand levels.

Be the first to comment