peshkov

(Note: This article appeared in the newsletter on May 13, 2022, and has been updated as appropriate.)

Headwater Exploration (OTCPK:CDDRF) (HWX:TSX) offers very strong growth in an extremely profitable basin. Because of those two very unusual characteristics, the stock is probably a lot cheaper than it may first appear to be. The unusual amount of profitability allows for far more free cash flow to fund a much faster than usual growth rate. The area itself is still being “nailed down” as there is a mad rush to control acreage. All of this is very good for shareholders looking for a lower than usual upstream risk while getting a growth rate more often seen in the tech industry than in the oil and gas industry.

(Canadian Dollars Unless Otherwise Stated)

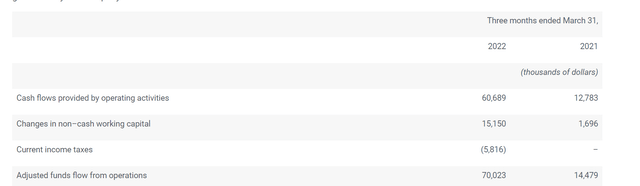

Headwater Exploration Cash Flow Report First Quarter 2022. (Headwater Exploration First Quarter 2022, Earnings Press Release)

Cash flow took a huge jump from the previous year. This is the kind of occurrence that makes ratio analysis tough. It is also a great problem to have. So many will decide cheap or expensive based upon the historical numbers without realizing the effect of rising commodity prices and fast growth combined. Cash flow growth is likely to remain phenomenal for a few years even if oil prices ease somewhat from current levels.

When a company grows at the pace of this company, then sooner or (or probably not) later that stock price will respond to the rapid growth. All of a sudden, the cash flow is approaching the C$300 million annual rate. Most of us figured originally that C$200 million in cash flow would at least be reached on a quarterly basis by year-end. Thanks to rising commodity prices, the company blew right through that idea and is now likely to head towards at least a C$400 million annualized rate by the end of the fiscal year.

The nice part about this is that production is at a relatively low rate so that management can maintain a breathtaking pace of production growth for some years. The very low breakeven point for many of these wells will mean that the company can grow rapidly under a very wide variety of industry conditions. Very few times is a true growth company found in a cyclical industry. This is likely to be one of those very few times.

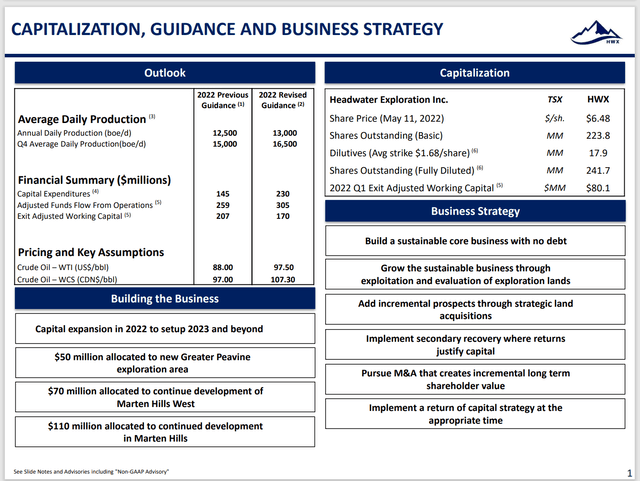

Headwater Exploration Updated Guidance (Headwater Exploration May 2022, Corporate Presentation)

Management is cheerfully raising the cash flow projection and the capital budget by a lot. The balance sheet remains debt free even under the revised guidance assumptions because management began with a decent cash balance and no long-term debt. Therefore, any cash flow timing issues are easily handled.

The big news is that funds flow will pass the C$1 per share mark. At the current rate of growth, the funds flow may well pass the C$2 per share mark unless commodity prices retreat substantially. Even then, the rapid growth will likely make up for a lower cash price in short order.

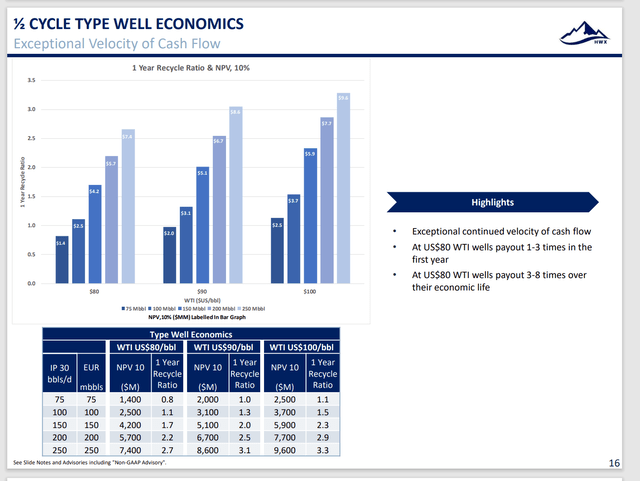

Headwater Exploration Well Profitability Characteristics (Headwater Exploration May 2022, Corporate Presentation)

Behind all of these rosy thoughts are some very profitable wells. Any time a well pays back within a year, the operator is generally looking at some very profitable wells. Very few wells pay back 3 times within a year, basically at any price that most can imagine. That means the operator can in theory drill up to 3 wells with the same money for a very fast cash flow build. The proof of that is in the fast cash flow build shown above (given what most would regard as very little production for that cash flow).

Current prices practically make these wells a “license to print money”. Hence, the emphasis on production growth rather than paying shareholders. This is going to become a company that reaches some considerable cash flow and sales size to be reckoned with in short order.

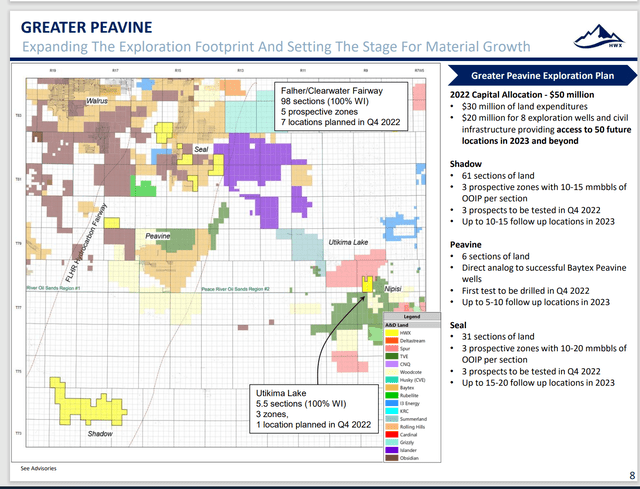

Headwater Exploration Map Of Holdings (Headwater Exploration May 2022, Corporate Presentation)

The best part about a lot of this is the map above that shows a considerable amount of land that is claimed by no one. Of course, there is always the risk that they already found all the oil they are going to find. Right now, that appears to be unlikely. The company picked up a sizable amount of acreage. Therefore, management is likely to have at least one rig drilling exploration wells.

What is even better is that management has mentioned (again) that several of these leases, if not all of them, have multiple intervals. So, there are definitely enough possibilities here to keep management busy for at least a decade or two.

Most likely, geographic diversification is way down the list of priorities (if it even makes the list at all). This area is just so profitable compared to anything else the industry offers that it makes sense to develop this area as much as management can.

Earnings have already broken into the profitability zone. Those figures are likely to move up sharply throughout the year. This company is very likely to pass a C$1 annualized rate very soon per share.

Depending upon both exploration results and upon the price of heavy oil in the future, management can add rigs as needed (and as the cash flow can handle). Because this is a heavy oil opportunity (with a possibility of some medium oil), the balance sheet is likely to remain debt free.

The problem with projecting heavy oil profitability during a downturn is that oftentimes the heavy oil discount from WTI pricing often expands to narrow or even eliminate the margin. Therefore, a strong balance sheet with a decent cash balance is called for in case production has to be shut-in to slow losses during a downturn.

Offsetting that is the fact that management has a goal to keep the total of production and transportation costs in the C$10 range. So, this oil should cash flow even during a downturn and even with a widening heavy oil discount.

The management experience combined with the debt-free balance sheet and high cash balance eliminates a lot of small company risk. The rather modest stock price when compared to the very strong growth prospects makes this one of the better industry bargains.

The stock price fell back with the price of oil. That presents a buying opportunity to consider for those that did not already decide to invest in this company.

Personally, I intend to hold unless the stock becomes seriously overpriced or until the growth story ends. Right now, we are at the beginning of the growth story. Management is busy acquiring leases in the area and clearly plans to acquire more leases in the near future (because it is in the capital budget). Therefore, the growth story is far from over. This company represents a pure play of a very profitable area. Not many companies can make that claim.

Be the first to comment