Hollie Adams/Getty Images News

Super Pumped: The Battle For Uber Technologies (NYSE:UBER) was a recent show on Showtime based on the rise and fall of Travis Kalanick, UBER’s founder. While the show displayed an internal battle in both the marketplace and in the board room, shareholders continue to fight a battle against UBER’s declining share price. Since UBER went public in 2019, shares have declined by -48.66%, and YTD shares have declined by -51.44%. Uber closed with a share price of $21.34 on 7/1/22 and a market cap of $41.90 billion. The biggest question now is whether shares of UBER have been establishing a bottom or if sub $20 is on the horizon?

My feeling is that UBER is an innovative company that changed an entire industry, but its stock isn’t a great investment. Living in NYC and remembering the days before UBER, I think it would be difficult to say transportation pre-Uber was better. UBER revolutionized transportation, made it efficient, and created a system that fixed a problem. Often the best companies fix problems, and anyone who has visited or worked in NYC knows the difficulties of hailing a cab. While UBER has made transportation more pleasant, and early-stage investors have seen large returns on their investment, many investors of UBER in the public market are not as fortunate. When I look at UBER’s numbers, the $41.9 billion market cap doesn’t make sense, and while many investors won’t like what I am about to say, I believe shares are still overvalued. UBER has generated $21.4 billion of revenue in the TTM with $4.18 billion in cash on the books, so there is value in the company, but a $41.9 billion valuation for a company that is still losing money isn’t realistic to me.

Taking a realistic approach to UBER’s current valuation

In 2020 hyper-growth became a focal point in the markets. Regardless of the reason, one of the dominant valuation factors was growth at all costs and putting an overwhelming emphasis on price to sales. Growth is a critical component for any company, but the market moved away from core fundamentals, and maybe it still has. In 2020 and even part of 2021, not many investors were discussing free cash flow (FCF) or concerned with the bottom line, and that ultimately became a huge problem. We lived through a short period where unprofitable companies had $100 billion market caps because their revenue was aggressively growing. UBER was one of these companies, and while its revenue grew from $3.85 billion in 2016 to $17.46 billion in 2021, it only generated an annual profit in 1 of these years.

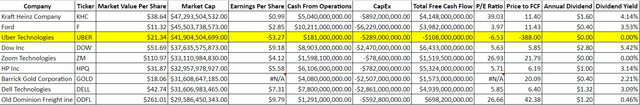

Steven Fiorillo, Seeking Alpha

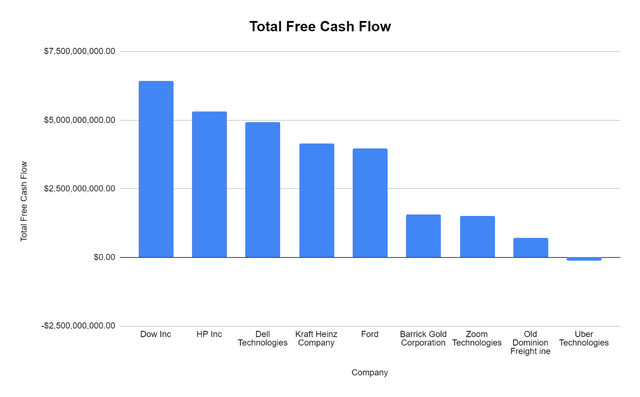

I looked at the largest publicly traded companies and selected several companies that are around UBER’s market cap, some are larger, and some are smaller. In the table above, I compared their market caps, EPS, cash from operations, CapEx, FCF, and dividends if the company has a dividend program. $1 of revenue is $1 of revenue, and $1 of FCF is $1 of FCF no matter what industry a company operates in. One of the main functions of a business is to make money, so I like to look at companies in multiple industries. The companies I am comparing UBER against are:

UBER has a $41.9 billion market cap and is the 3rd largest company on this list. I captured different types of companies for this comparison so it wouldn’t be a biased approach.

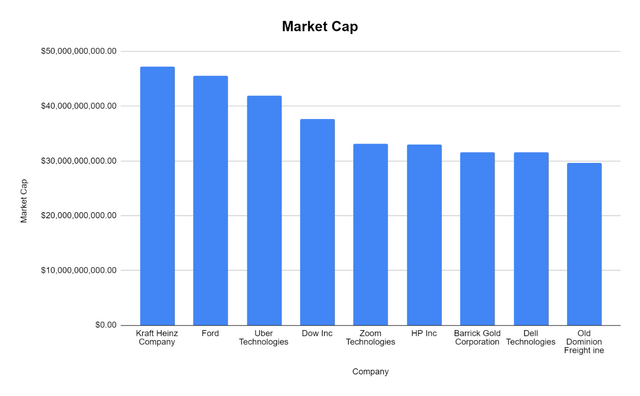

Steven Fiorillo, Seeking Alpha

UBER has generated $181 million of cash from operations over the previous trailing twelve months (TTM). This is the lowest amount of all of the companies I selected. UBER is the 3rd largest company by market cap and the lowest generating business of cash. My first red flag is that UBER is valued at $41.9 billion and generated $181 million in cash from operations while companies such as DOW generates $8.9 billion and DELL generates $7.8 billion in cash from operations and have less than a $40 billion market cap.

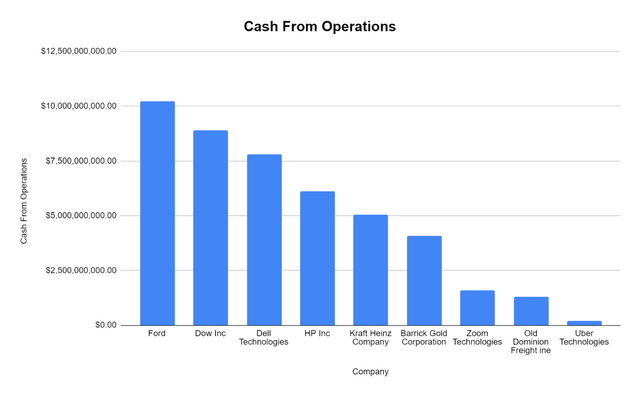

Steven Fiorillo, Seeking Alpha

When I look at FCF, UBER’s valuation looks like a complete misevaluation. UBER has generated -$108 million in FCF over the TTM, which is nowhere near some of the other companies I have selected. Today you can pay $41.9 billion for UBER, which generates a negative FCF of $32.96 billion for HPQ, which generates $5.32 billion in FCF.

Steven Fiorillo, Seeking Alpha

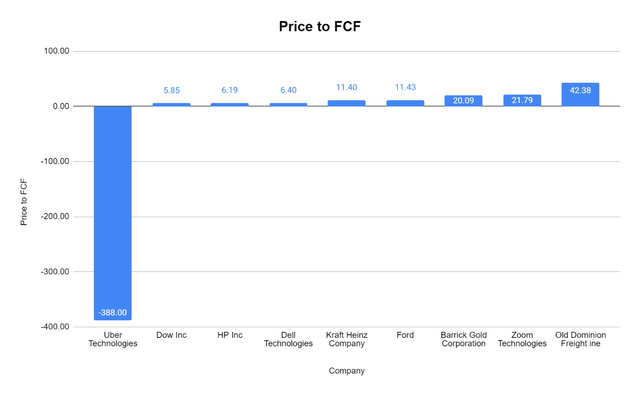

I am happy that more people are discussing FCF because this has been a metric I utilize when making decisions of where to allocate capital. FCF is one of the most important valuation metrics to determine a company’s profitability. With every investment being the present value of all future cash flow, the amount you pay for a company’s FCF is important. When you buy just 1 share of a company’s stock, you’re buying an equity position. While you’re not buying the entire business, it’s important to look at the investment as if you’re buying the entire company. If a company is generating $1 billion in FCF, would you pay $50 billion for the company? This is an unanswerable question on its own because growth plays a factor. If the company is growing its FCF by 50% YoY, it would take just over 9 years to generate over $50 billion of FCF. In this case, paying 50x FCF would make sense if the rate that its FCF increased stayed at 50% indefinitely. If the FCF was stagnant with no growth, paying $100 billion for the company wouldn’t make sense as it would take 50 years to generate your original investment in FCF. Since the past is only an indication of what might happen in the future, it’s important to look at a company’s FCF to market cap multiple. This tells an investor not only how much a company is trading for based on its FCF, but if you were to buy the entire company, how many years it would take at the current FCF generated to produce the purchase price in FCF.

I always look at the price to FCF metric because I want to pay the lowest price for a company’s FCF. Uber trades at a negative FCF ratio, and my question is, why would anyone pay more for a company that has negative FCF and earnings than for a company that generates billions in profits? I am not saying that UBER is worthless, it’s a great company that has generated over $20 billion in revenue over the TTM with more than $4 billion in cash, but it loses money. If you were going out to buy a business, let’s say a liquor store, for argument’s sake, would you pay more money for the business that is generating fewer profits? While there are certainly other variables that come into play, most likely, you wouldn’t pay more money for a business that was generating less profit unless there were aspects that could become more valuable in the future, such as its level of inventory, the trajectory of land prices if the building was included, etc.

Today, ZM trades at 21.79x its FCF, has generated over $1.5 billion of FCF in the TTM, has over $5.7 billion of cash & short-term investments on the books, and has been profitable since 2019, and is valued at $33.11 billion. UBER being valued at more than a company such as ZM is questionable at best, and when you look at a company such as HPQ that trades at 6.19x FCF when generating $5.32 billion of FCF, UBER’s valuation really doesn’t make much sense.

Steven Fiorillo, Seeking Alpha

Why I don’t see things getting much better for UBER in the short-term

I dislike the trajectory of UBER’s numbers, and except for its revenue, the underlying metrics are concerning. UBER has fantastic growth on its top line as not many companies have reached the $20 billion revenue mark, and this should be celebrated.

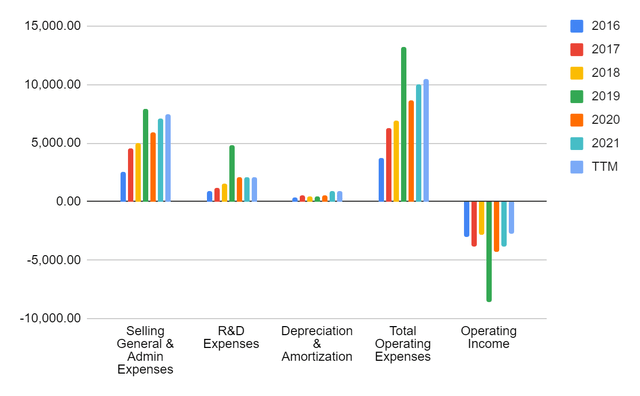

The problem is the expenses. It costs money to make money, but in UBER’s case, it costs money to lose money. 2018 was the best year for gross profit margins as UBER had a 39.6% gross profit margin. Since its decline, UBER has been operating at a 36.02% gross profit margin. For many companies, a 36.02% gross profit margin would be fantastic, and while additional costs of revenue normally fuel revenue growth, it’s not leaving enough gross profit to pay for its operating expenses.

After the last report, UBER had generated $21.41 billion in revenue, and their cost of revenue was $13.7 billion, leaving them with $7.71 billion in gross profit. Since 2016, there hasn’t been a single year where UBER was left with an operating profit after operating expenses were factored in. This is a huge problem for me when looking at the valuation.

Steven Fiorillo, Seeking Alpha

2019 was an anomaly as UBER’s operating expenses increased drastically. Taking 2019 out of the equation, I am not thrilled with what I am seeing on the selling, general, & admin expenses and the total operating expenses in general. If you were to normalize 2019, both of these categories would have seen a YoY increase in the capital spent. In 2020 UBER spent $8.65 billion on operating expenses; in 2021, it grew to $10.06 billion, and in the TTM, operating expenses have cost UBER $10.5 billion.

While revenues are increasing and the losses on the amount of operating income generated have decreased, UBER still has -$2.79 billion in operating income in the TTM. These costs impact UBER’s bottom line and its EPS. As the spread between revenue and cost decreases over time and total operating expenses continue to increase, UBER will have difficulty running the company in the black on a GAAP methodology. This is also why I look at FCF as a measure of profitability; it’s a better measure of the cash generated since GAAP accounting principles on profits aren’t factored in. UBER is still generating negative FCF, and I do not see a path to profitability on a GAAP level with expenses increasing in the short term.

The other problem is that UBER’s total cash is depleting. In 2019 UBER had $11.31 billion of cash on the books. Since then, their cash has decreased by -$7.13 billion (-63.02%), and UBER is still burning cash today. UBER has $9.82 billion in equity on the books, of which 42.62% is their cash stockpile. As UBER continues to burn cash, its balance sheet weakens, and shareholder equity disappears. Until UBER can get to an operating profit and FCF positive, I would be very concerned about its depleting cash level.

Conclusion

I don’t think UBER’s valuation makes a lot of sense at this level. It’s much easier to go from $1 billion to $2 billion than from $20 billion to $40 billion of revenue. UBER has already reached the $20 billion revenue mark and still isn’t profitable. UBER can absolutely become profitable, and its story is far from being written in stone, but the current metrics aren’t favorable. At this point, I would need to see FCF profitability, an operating income, and a lower valuation to get excited about UBER. The current valuation seems very inflated to me, and I think there is more downside to come in the short term for shareholders. UBER has $9.8 billion of equity on the books, and after thinking about its revenue generation and overall business, I don’t believe UBER is worth more than $15 billion today in market cap. It’s really difficult to justify any type of valuation past $15 billion when you can buy ZM for $33.1 billion, and it’s generating $1.5 billion in FCF with $5.7 billion in cash on the books.

Be the first to comment