peshkov/iStock via Getty Images

(Note: This article appeared in the newsletter on July 1, 2022.)

Antero Resources (NYSE:AR) stock was hit hard by investors heading for the exits because of the issues associated with the Freeport LNG downtime headlines. The reaction demonstrates that the casino atmosphere of the market survives despite the bear market that is now in full swing. It does not demonstrate that there is a big problem to overcome. Once the market realizes that “it corrected way past the marker” there will undoubtedly be a re-evaluation to a far more realistic stock price valuation.

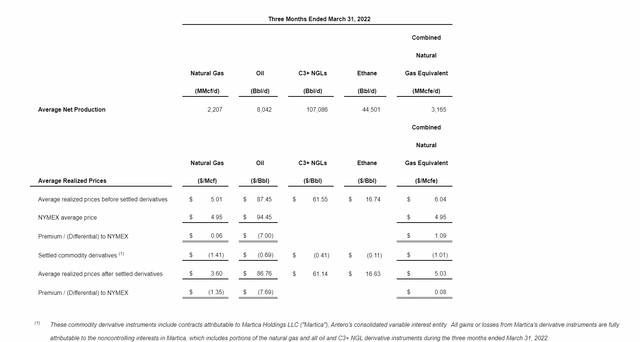

Antero Resources First Quarter Production And Realized Prices (Antero Resources First Quarter 2022, Earnings Press Release)

As shown above, the production is very roughly one-third liquids and the rest natural gas. The liquids have a slightly higher percentage of revenue because they are proportionately more valuable. That is shown by how much they add to the average selling price above. The liquids production is largely priced independently of the natural gas prices (except for ethane). There is a natural production buffer to any natural gas issues in this liquids production and sale.

From the natural gas pricing reaction combined with the stock price reaction, one would think that the Freeport LNG facility is a significant part of the natural gas picture. It clearly is a big part of the ability to export. But North America exports a relatively small part of the total production (though that small part is growing).

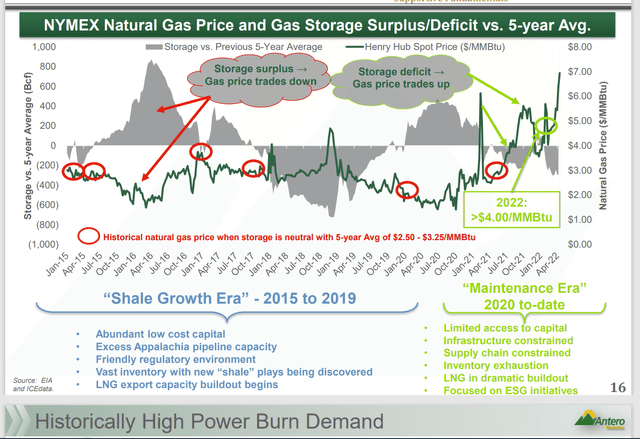

Antero Resources Presentation Of North American Natural Gas Supply And Demand (Antero Resources Presentation At J.P. Morgan Energy, Power & Renewables Conference June 23,2022.))

The important situation is shown above. Currently there is far more demand than there is supply. North America actually needs the supply here. That storage deficit is huge relative to any one supplier of natural gas or natural gas liquids.

This is a very fragmented market with a lot of buyers and sellers. Usually, any one buyer or seller can go offline with minimal effect. But you would not know that from the market’s reaction. One would have thought that a catastrophe occurred.

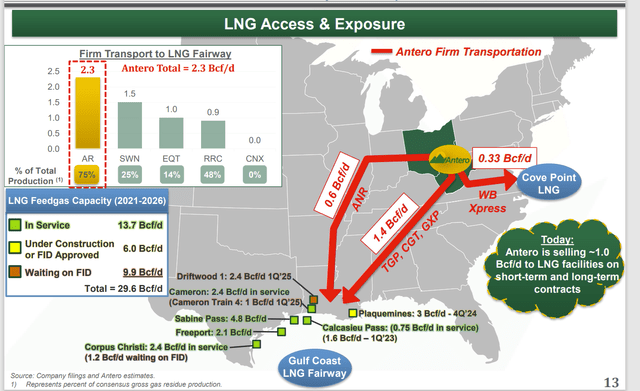

Antero Resources Transportation Commitments To LNG Facilities (Antero Resources Presentation At J.P. Morgan Energy, Power & Renewables Conference June 23,2022.)

The company has a lot of committed transportation to this part of the industry. One part of the commitment is the Freeport LNG facility that is now offline. But there are clearly plenty of alternatives in the area.

In the same first quarter press release, management mentioned that they are releasing extra transportation capacity as needed. That would imply that management has some flexibility in the current situation. As noted above there are plenty of alternatives in the area. It would not be unusual for management to contract for more capacity than they need and then sell that extra capacity until they need it.

But the other thing to note is the small volumes compared to the storage shortage noted before. We did not even get to the usage yet and already this looks like a minor industry event. More to the point, the company appears to be sending about one-third of its natural gas production to the Southern locations shown above. This plant is likely a part of that one-third (and not a large part either).

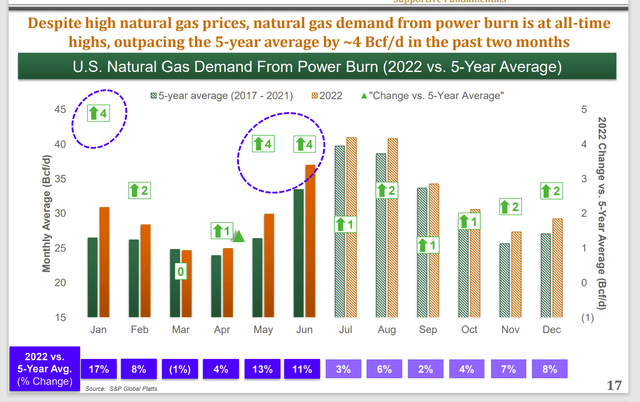

Antero Resources Presentation Of Electrical Power Generation Use Of Natural Gas (Antero Resources Presentation At J.P. Morgan Energy, Power & Renewables Conference June 23,2022.)

This is just one of the many uses of natural gas. All by itself, power generation has risen as more costly alternatives were shut down to convert to both cheaper burning and less polluting natural gas. The results are shown above.

There are reports of another La Nina summer. Should that materialize as planned, the extra natural gas usage that accompanies a very hot La Nina summer could well result in the gas that would have gone the LNG route to instead be used by power plants. There are a lot of other uses that have converted to natural gas as well. That does not appear to be taken into account by the market reaction.

But as is typical of the market these days, the stock price reaction was severe because in general investing results this fiscal year are not that good. There appears to be a general panic of even worse results by overestimating risk. Right now, the market worries about losses even as the actions taken result in losses. This particular market mood will likely pass. But it will take time.

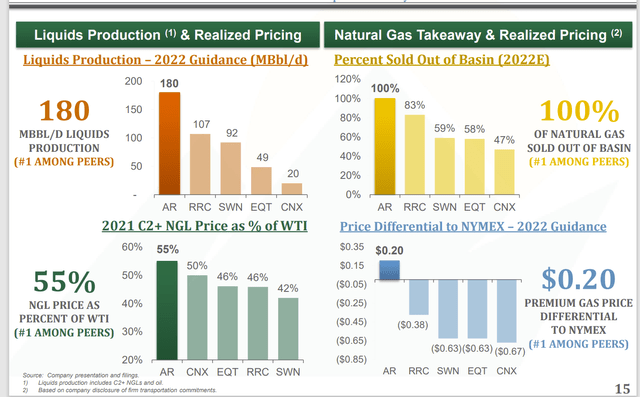

Antero Resources Sales Advantage When Compared To Basin Competitors (Antero Resources Presentation At J.P. Morgan Energy, Power & Renewables Conference June 23,2022.)

Antero Resources already has a giant advantage of selling natural gas outside the basin. That has resulted in a pricing advantage that persists over time.

Now admittedly, prices dropped quite a bit. But it does appear that demand will remain strong enough to “sop up the difference” easily caused by a plant downtime. This is an industry that even the big players do not really dominate. Frankly even the larger producers do not have enough market share to influence pricing and supply. So, one LNG plant going offline is likely to prove to be an easily surmountable obstacle that natural gas prices will easily overcome.

The pricing volatility is caused by traders that were bullish in pricing going bearish “all at one time”. But the picture of demand and supply presented above should demonstrate that there is a good chance that the market will overcome the announcement. That would mean natural gas prices would bounce back.

But even the worst-case scenario is that the LNG plant will be offline for months (not years). That should mean 2 to 3 quarters of reporting. That hardly justifies the removal of a huge chunk of company value that occurred with the news announcement.

Then again, this market panics and then goes overboard with the optimism. Unfortunately, that likely means the correction has a long way to go. Generally, corrections or bear markets do not end until proper investment discipline is restored.

That likely means the current pullback is a buying opportunity for anyone who missed getting onboard earlier. The rally has come a long way from the stock price lows. But then again, this stock, like many in the industry, fell quite a bit on the way down. Generally, good managements will see their stock rise to previous cyclical highs and then surpass that high by the amount of inflation (at least). If that is the case, then this stock would be at least a double from the current price over time. It may be a triple as management has raised the financial ratings on the debt considerably and grown production tremendously in the years since the stock price last reached its peak. We will have to watch as the current recovery proceeds. In the meantime, the stock price clearly has a lot more upside potential than downside potential at the current price.

Be the first to comment