Georgijevic/E+ via Getty Images

Agenus (NASDAQ:AGEN) had a disruptive 2021, when its accelerated approval BLA for balstilimab in 2nd line cervical cancer had to be withdrawn under unhappy circumstances, and its self-declared key asset, next-generation CTLA-4 agent, AGEN1181 (botensilimab), produced some promising early data in a group of solid tumors. However, the BLA withdrawal determined the stock’s price action – the company was cut to nearly half in size in terms of market valuation.

Botensilimab scored another win just last week when on June 29, the company announced positive early-stage data for botensilimab and balstilimab combination in patients with microsatellite stable or MSS colorectal cancer.

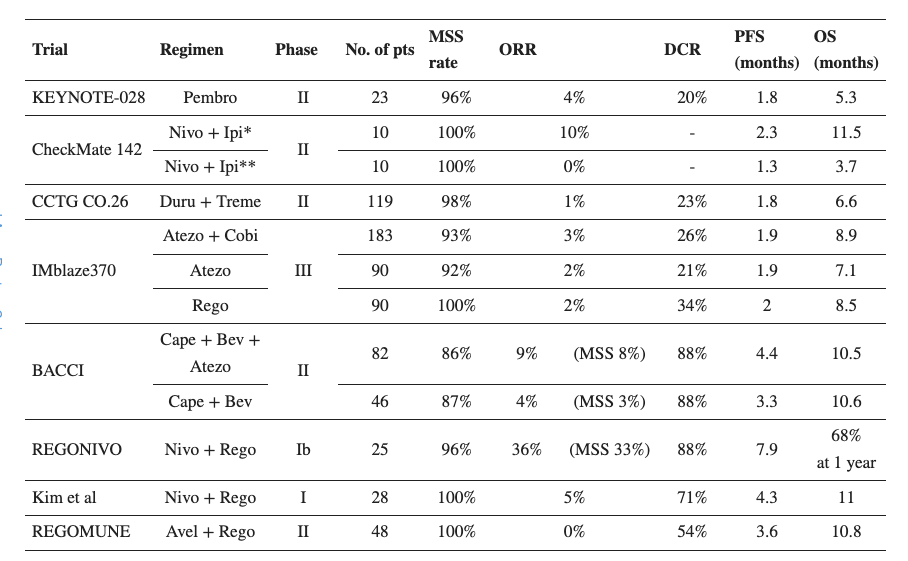

MSS CRC is a very difficult to treat form of CRC. MSS occurs in up to 85% of all CRC patients. A microsatellite is a chain of DNA repeats. When these microsatellites occur in the same number throughout the body, it is considered stable; otherwise, it is microsatellite instability or MSI. This is classified as MSI-HIGH, MSI-LOW and MSS. Research has shown that MSI-HIGH CRC patients have a much better prognosis than MSI-LOW or MSS patients. However, many drugs, for example Keytruda, are only approved for MSI-HIGH CRC patients; the more difficult to treat MSI-L/MSS CRC patients have fewer options. Tumors with the MSS phenotype “often exhibit a lower tumor mutation burden and fewer tumor-infiltrating lymphocytes than dMMR/MSI-H, leading to immune tolerance and evasion in the tumor microenvironment.” Thus, currently approved or pipeline immunotherapies often have very low ORR or disease control rates in the CRC population:

Peer trial data (Research report)

With that background in mind, it is interesting to see that Agenus’ combo therapy worked very well in the MSS population. This phase 1b study evaluated 1 or 2 mg/kg of the anti-CTLA-4 compound, botensilimab, and 3 mg/kg of anti-PD-1 molecule balstilimab in patients with microsatellite stable colorectal cancer (MSS CRC). Patients were heavily pretreated, with a median of 4 prior lines of therapy, including about a third of the patients having previously received immunotherapy. 41 patients were evaluable at data cutoff, and these demonstrated a 24% overall response rate. This is interesting because a major trial of Keytruda showed a 0% response rate in an MSS CRC patient population (n=18), and many other immunotherapies, as we saw in the table above, saw very poor ORR.

Other elements of the data were:

The disease control rate, a measure combining partial response and stable disease, stood at 73%, while 50% of objective responses were found to have more than 50% tumor reduction.

In terms of durability, 80% of objective responses were ongoing as of the data cutoff, with 30% of objective responses exceeding one year.

Botensilimab was well tolerated during the study, the company said, noting that there were no grade 4/5 treatment-related adverse events.

The discussion above shows Botensilimab’s potential. Agenus had a lot of bad luck with balstilimab, but as I discussed before, balstilimab monotherapy was something of a non-starter to begin with, and the BRAVA trial was going to cost them probably more than they could make from balstilimab monotherapy. Now they have a drug with better potential, they are planning to run a series of phase 2 trials investigating botensilimab as monotherapy and in combination with balstilimab in MSS-CRC and gynecological cancers (ovarian and MSS-endometrial cancer), and it appears from early indications that they may do very well in the trial.

Other key data from the company material:

Monotherapy activity:

-

Four cases of confirmed objective response – first reported CTLA-4 monotherapy response in endometrial, pancreatic and PD1 r/r cervical

-

Multiple responses in patients expressing the low-affinity FcyRIIIA receptor (F/F), who are unlikely to respond to first-generation CTLA-4

Combination activity (botensilimab + balstilimab)

-

CRC: 14 of 20 pts benefited from combo; 4 PRs, 10 SDs

-

Ovarian: 5 of 9 patients benefited from combo; 3 PRs, 2 SDs

-

Endometrial: 3 of 3 pts benefited from monotherapy and combo; 1 CR, 2 PRs

-

Durability: Responses in this Phase 1 trial have been durable, with half lasting at least 24 weeks and the majority ongoing

The company has a number of other assets besides the two already discussed. I will leave those for a future article.

Financials

AGEN has a market cap of $548mn and a cash reserve of $263mn as of the last quarter. They recently received a $5mn milestone payment from Gilead for AGEN2373, with up to $570 million in future potential option fees and milestones. The company recognized $26mn in revenues in this quarter, mainly from royalties and milestone payments. R&D spends were $42mn and G&A were $18mn, with non-cash interest payment taking up another $14mn this quarter. At that rate, the company has cash for maybe another 4 quarters. Cash position has improved vastly since November, when they had just $72mn – mainly because of a large licensing revenue they recognized in that month.

Bottom Line

AGEN has picked up nicely from its nadir last year. The stock hasn’t gained all that much because this is a terrible period for the entire industry. However, the company has managed to pull away from disaster, and they have now posted convincing early data. I believe AGEN is now looking very interesting.

About the TPT service

Thanks for reading. At the Total Pharma Tracker, we offer the following:-

Our Android app and website features a set of tools for DIY investors, including a work-in-progress software where you can enter any ticker and get extensive curated research material.

For investors requiring hands-on support, our in-house experts go through our tools and find the best investible stocks, complete with buy/sell strategies and alerts.

Sign up now for our free trial, request access to our tools, and find out, at no cost to you, what we can do for you.

Be the first to comment