U. J. Alexander

Author’s Note: This article was published on iREIT on Alpha/Dividend Kings back in November of 2022.

Dear subscribers,

I’ve been reporting on and calling BASF (OTCQX:BASFY), among others, to be one of the better plays available in the EU for the past half-year or so. The company might not have looked the part, given everything that’s going on. However, in the recent bout of market reversal, things might have indeed been starting to take a different tune.

Remember, I’ve impaired and discounted my overall targets for BASF several times, accounting for Wintershall DEA, for energy troubles, for other issues several times now. An analyst-wide PT of €90+ turned into one of around €55-€60/share, and it was justified.

All of this led to my current, 5.2% position in BASF yielding well over 6.5% on my current cost basis – and that’s from the largest chemical company on earth.

At times, it traded below COVID-19 levels. In the background of Ukraine, Wintershall DEA decided to stop paying a dividend (to owners like BASF), as well as heavily impair its Nord Stream 2 asset. It also completely wrote off financing and stopped additional project payments to Russia.

On a high level/model level, the ceased dividend impacts the income from equity associates. Most of my colleagues have impaired Wintershall assets by around €4-€5B – I’ve put it around €4.6B, which impacts NAV by around 14% and puts BASF NAV/share closer to €70 than to €80. Wintershall has a strong Russian footprint – around 2/3rds of the company’s business is located here.

I view much of the impairing done on the sell-side of things as excessive – and the trends that we’re starting to come out of BASF headquarters is telling “my side” of the story.

What am I talking about?

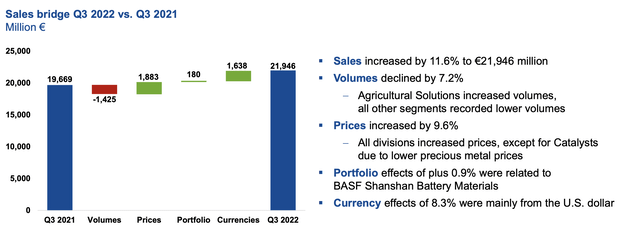

Despite massive inflation, energy prices, China restricted by COVID and restrained macro, and increased interest rates, top-line production grew by 2% in 3Q22, and BASF recorded a moderate demand growth in key customer areas. This especially came from logistics and agro, while infrastructure was predictably down.

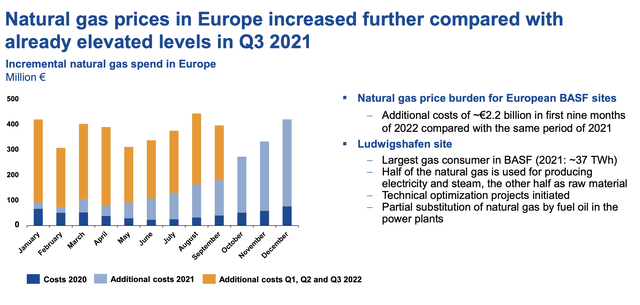

On a before-special items level, the company achieved very solid EBIT despite massive input headwinds and energy pricing issues. Highlights came in, especially from downstream segments, which managed to push prices. Nat gas continues to be a headwind, and one the company does not expect to disappear in the near term, with Ludwigshafen being an especially heavy consumer. The company has started substitution work, which is starting to see results.

Operational earnings remain pressured in legacy areas, especially Germany, and BASF is taking actions to ensure permanent cost reductions and structural areas, expected to generate savings of over half a billion per year.

But again, sales are solid.

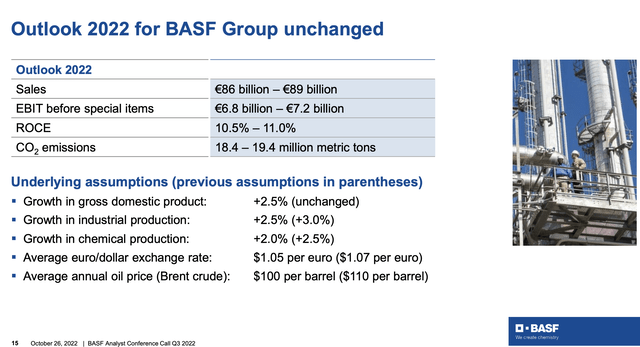

What’s more, the company managed positive FCF, something many analysts did not expect, despite massive CapEx, and retains an industry-leading balance sheet with a 50.6% equity ratio. The outlook also remains completely unchanged, with a €7.2B high-level EBIT before special items, and growth across the board of around 2.5-3% in GDP and production. This also assumes a $100/barrel of Brent Crude, which we’re already below on an annual basis.

The same trends that are driving positives in Yara (OTCPK:YARIY) are driving excellent trends in BASF. I say again to those doubting BASF – you are underestimating the fundamentals of this business. Even in this environment, BASF is able to generate significant EBIT on the basis of those operations. The company was trading like dirt – as though it’s on its way down to serious issues. The dividend is covered, and there’s no forecast from any analyst here that the company, at this time, means to touch or reduce it.

The question that analysts seem preoccupied with is just how deep and how long the trough will be before BASF gets back to normal-level earnings, and how this could not be impacting the dividend.

My answer to that is the following.

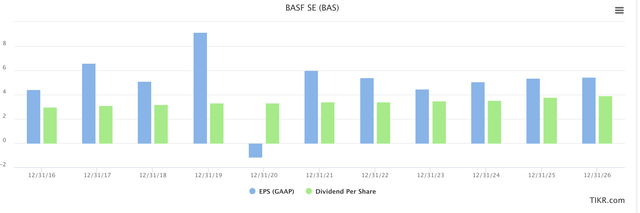

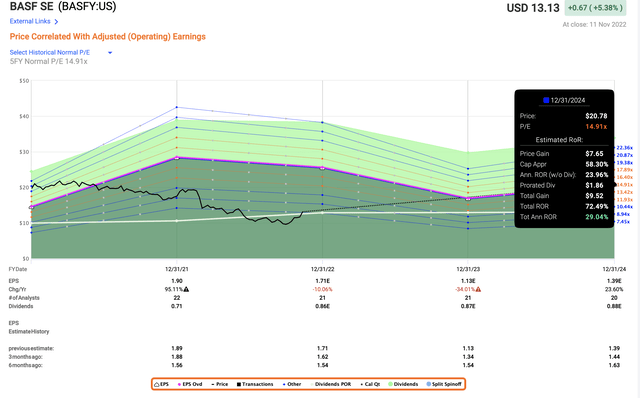

BASF earnings/dividends (TIKR.com/S&P Global)

Even during times of negative GAAP, the company never touched the dividend – and the current forecasts do not even call for anything close to negative GAAP. The company’s current dividend is amply covered, and that is not currently expected to change in the next few years. Analysts expect 2022E to be bad, but 2023E to be worse. This is a possibility, but there’s a not-inconsiderable amount of ambiguity/uncertainty here that I want to clearly point out.

None of this is to say that there aren’t challenges or risks to BASF – but in where the company currently trades, these risks and downsides need to be seen in context to what the company is and offers. The main risk to the company at the current time still remains the price for gas. While I could try to forecast various scenarios here, the fact remains that this key uncertainty, which is part of what’s driven the share price as it has, is still too unsure to be “called” with any level of confidence at this time.

For that reason, I’ll stay conservative here and say that uncertainty does remain.

However, one of the key trends and things I really want to point to is the size and scale of BASF and how it compares to other players in the Industry. Very, very few companies can measure with BASF – and the future here is worse for small players, not better. At current times, the EU has around 7,000 pages of specific regulations for the chemical industry that need to be followed and adhered to.

Implementation of continent-wide ESG deals and regulations will expand this to 25,000 pages of regulation. You may ask yourself how smaller or medium-sized companies plan to make sure that they’re following this without the compliance and related costs basically eating significantly into margins – and you would be right in asking this.

This is why I am aligning myself with world-leading chemical producers, as opposed to smaller ones. Because BASF has the resources to not only decide, but to move on if they don’t want to have their main assets in Europe.

What I am trying to say here, aside from the fact that I’m following high-level EU deals and regulations closely, is that BASF remains a very, very high-level play.

I often get questions that drill down into very specific, one-sided issues, such as the current impact of Ludwigshafen, or how BASF will handle things at a specific site. While these questions are not irrelevant, I want to point out that I view BASF as a multi-year high-level play, and the possibility for the company relocating large parts of its assets and capacities are scenarios I have accounted for.

Many readers also assume that there is some sort of EU-wide current price/gas or electricity crisis. But this is not the case. Currently, we have negative electricity prices in Sweden. Gas in Germany gas at TTF prices, which in late October closed at €100 for the forward months, so €100 per megawatt hour. At this very same point in time a day earlier, you could buy spot gas in other countries at prices of €20 to €25 per megawatt hour.

Now, this is one day. There are significant differences depending on the regional trading prices within Europe over the last 6 months. All of these trends are something BASF deals with and that is also why things are currently as volatile as they are. It’s also why when someone asks these relatively granular issues, not only is it hard to give a good response, it’s not that relevant on a long-term high level.

In the end, I want to make one thing clear.

BASF is cheap, as I see it.

We currently trade the world’s largest chemicals company as though neither of the Nord Stream pipelines exists any longer, and as though the current pricing volatility will remain forever.

And remember, BASF is profitable despite all of this.

If you at any time believe that things will normalize, the logical outcome is that BASF is undervalued. That is my very basic current forward-looking thesis – which coincides with other theses for similar European companies currently trading in the mud.

Some of the expectations for negativity have already been dashed. The winter? It’s expected to be unusually warm this year, which lowers the reliance on Nat gas somewhat for heating – even if we’ll see just how much as we move into 4Q22 and 1Q23.

Again, I expect BASF to generate worse earnings over the next few years. Normalization will take time to 2024E or 2025E. But my target, having bought BASF at a price below €50 on average, is a 100%+ RoR – and I see that possible within less than 5 years.

Valuation for BASF

It’s entirely possible that the current time marks the last time you can buy BASF close to €50/share for the foreseeable future. Even using significantly more negative forecasts than the native GAAP forecasts for the German ticker, you can see a massive upside to where the company is currently trading.

BASF remains an A-rated chemicals company – and it’s the largest on earth, bar none. You may believe that the company will not normalize again – to which I say I believe it will.

The current analyst trends highlight everything that I believe is flawed about street analyst trends. Going into the war, the company’s targets were still above €75/share, with 15-17 analysts at “BUY”, only for analysts to completely retreat when prices fell below €45-€47. We’re now down to 11 analysts out of 24 at “BUY” or equivalent, with ranges from €31 to €79/share, with averages around €55/share.

So you’re fine with buying this great business at close to €70/share with an €85/share PT but not at €40 with a €60/share PT? The picture this gives me is “Buy high, sell low”.

When the company fell, I made extensive forecasts to see where I believe the company would go, and whether the company was in any sort of fundamental danger (meaning bankruptcy). My answer to this remains “No.”

Here are some of the impairments I’ve made to my forecast model.

- A GDP Slowdown

- €4-€5B impairment on Wintershall DEA, based on its 50-62% dependence on Russia, and the 72.7% BASF Stake, due to dividend postponements, Nord Stream 2 financing, no additional Russian projects/transactions

- Increased energy cost for all of the company’s segments, though primarily for the operations in the EU, lowering my top-line long-term growth rate by 100 bps.

- Significantly changed NAV/SOTP valuation multiples for the company’s Oil/gas business (Wintershall). The value of the reserves is unchanged.

- It’s also conceivable that finance costs/debt spreads might increase slightly due to the postponed IPO, which nullifies the expected cash injection and may necessitate the green debt market with a somewhat higher debt cost.

- I’m risk-adjusting my valuation for the segment and cutting it to less than €4B in valuation for the entire BASF stake. For the remaining segments, I use EBITDA multiples ranging from 4.5X (chemicals) to 13.5X (AGRI). The adjusted NAV comes to around €59B on a net basis, which comes to a treasury-adjusted NAV/share of €66-€67 on a per-share basis, down from the mid-70s.

At any conservative multiple, DCF still shows us a target of above €60/share.

On a growth/NAV-specific basis, BASF’s previous targets have been significantly cut into due to the valuation uncertainty from the Oil/Gas business, as well as Wintershall DEA. This has impacted the company’s short and medium-term results heavily.

However, any realistic set of long-term assumptions still shows us a significant upside from the current share price, even if I wouldn’t go as far as targeting over €80 in the near term or in the near future.

BASF requires a longer period of time to get that 50-100% dividend-inclusive return.

I still expect ~5 years for this to materialize.

Unlike my analyst colleagues, I am not shifting my PT for BASF at this time.

My PT remains €71/share for the longer term – and I see no reason at this time to cut it.

So, BASF remains a “Buy” here. And it might potentially be the last time we see it this cheap for some time.

Be the first to comment