alvarez/E+ via Getty Images

Despite the fact that Lucid Motors (LCID) stock is already significantly overvalued in my stock appreciation portfolio, I continue to buy the EV company by the truckload. My optimism for the Arizona-based EV company stems from the fact that reservations for the Lucid Air sedan and its various special editions likely increased in 4Q21.

Furthermore, hints of European expansion add a fantasy element to the stock in terms of sales growth. With the exception of Tesla (NASDAQ:TSLA), Lucid Motors has the most favorable risk/reward trade-off in the electric-vehicle sector, and the company could scale deliveries faster than any other firm in the sector.

Lucid Air Value Proposition: An Unbeatable Combination Of Value, Range And Performance

No other EV company in the market has the same potential as Lucid Motors. The electric-vehicle company currently offers one of the most appealing value propositions in the market, owing to Lucid Motors’ ability to provide buyers with a luxury electric-vehicle that is unrivaled in terms of range and performance.

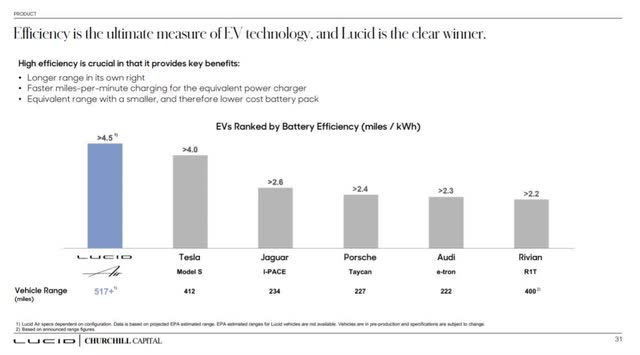

With the Lucid Air, the electric-vehicle that received an official 520-mile rating from the EPA in September, Lucid Motors really upped its design and engineering game. The Lucid Air’s range puts it ahead of other electric-vehicles on the market, including Tesla’s Model S. This efficiency advantage over competitor electric-vehicles is a strong selling point for the Lucid Air, indicating significant upside in reservations and, ultimately, sales.

Source: Lucid Motors Company

Lucid Motors is entering two highly competitive models into the race in terms of actual performance, top speed, and acceleration. The Lucid Air Dream Edition and Lucid Air Grand Touring, special editions of the Lucid Air standard model with unique configuration packages, have top speeds of around 168 mph and outperform competitors such as the Tesla Model S Range and the Porsche Taycan Turbo S. The Lucid Air Dream Edition and Lucid Air Grand Touring also provide competitive acceleration that can compete with competitors’ top-of-the-line models.

The biggest differentiator for Lucid Motors, however, is its competitor-crushing travel range of more than 500 miles. Buyers of electric-vehicles are primarily concerned with maintenance costs and travel range, and Lucid Motors clearly has the upper hand in this regard.

Source: Lucid Motors Company

Reservation Status

We do not know the status of reservations for the Lucid Air models. The most recent known reservation figure was 17K, which was from November. Lucid Motors received approximately 3000 new reservations between September and November. As far as I can tell, the pace of reservations will only pick up in the remainder of the fourth quarter, simply because the start of customer deliveries has resulted in a lot of publicity and, most likely, an increase in reservations.

Lucid Motors will report earnings in late February, at which point the EV company will most likely reveal the current state of reservations. I wouldn’t be surprised if Lucid Motors added 2K reservations to its backlog each month until February, implying that total reservations for the Lucid Air will be between 23K and 24K by the time earnings are due to be reported. In the first phase of its expansion, Lucid Motors intends to increase capacity to 34K. With 24K reservations, Lucid Motors could fill roughly 70% of its annual production capacity by February.

Entry Into The European Market

Lucid Motors confirmed last week, in response to a Twitter question, that the company was preparing to enter markets outside of the United States. Europe will be the first market to be targeted. Despite the fact that the EV maker has not yet confirmed specifics, a market entry into Europe represents a bold move for a company that has only recently begun to deliver its electric-vehicles. It also opens up the possibility of collecting more reservations and, eventually, sales of the Lucid Air. I wouldn’t be surprised if Lucid Motors received 10K-15K reservations in Europe alone in the fiscal year 2022.

Sales Upside

The announcement to enter the European EV market was unexpected and nonchalant, but it will have significant implications for the company’s mid-term sales forecast. So far, I’ve calculated that 100K electric-vehicle sales per year by 2025 translate into a $12.3 billion revenue potential. The projections are based on Lucid Motors’ stated annual production target and a $123K average sales price, assuming a sales mix of 40% Lucid Air, 30% Air Grand Touring, and 30% Air Dream Edition. With Europe added to the mix and potentially adding up to 15K reservations per year, Lucid Motors could generate an additional $1.8 billion in annual sales by 2025.

Potential For Disappointment

Lucid Air delivery expectations are high, and disappointing them would be a major setback for Lucid Motors and investors. However, because Lucid Motors aggressively invests in its production capacity and plans to expand into new markets in 2022, the EV company is likely to accumulate a sizable production backlog this year. The biggest risk for Lucid Motors is that it fails to deliver on time. The EV industry is no stranger to nerve-racking delivery delays, and many companies’ stock prices have suffered as a result. If Lucid Motors can avoid these industry-standard stumbling blocks, it has the potential to delight investors.

My Conclusion

Lucid Motors now accounts for over half of my portfolio, and I believe I have found a real gem here. Reservations are likely to outpace Lucid Motors’ ability to deliver in 2022. This demand overhang is not a bad thing because it has the potential to significantly increase revenue for the EV company. The outlook for Lucid Motors is especially appealing after the company hinted at a market entry into the European EV market, where I estimate an additional $1.8 billion in sales potential by 2025.

Be the first to comment