Leestat

Introduction

The last twelve months have seen economic activity recover strongly from the Covid-19 pandemic with 2022 being especially strong for many companies. Although the German chemical giant, BASF (OTCQX:BASFY) sees their share price suffering heavy losses year-to-date as they find themselves vulnerable to the geopolitical fallout following the Russian invasion of Ukraine, which means their dividend might not survive winter as the threat of Russia cutting gas supplies to Europe looms large.

Executive Summary & Ratings

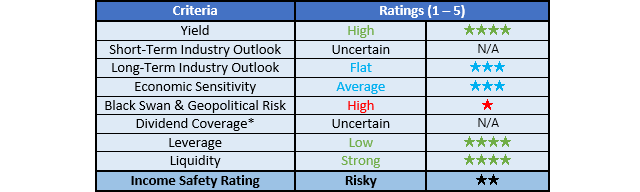

Since many readers are likely short on time, the table below provides a very brief executive summary and ratings for the primary criteria that were assessed. This Google Document provides a list of all my equivalent ratings as well as more information regarding my rating system. The following section provides a detailed analysis for those readers who are wishing to dig deeper into their situation.

Author

*Instead of simply assessing dividend coverage through earnings per share cash flow, I prefer to utilize free cash flow since it provides the toughest criteria and also best captures the true impact upon their financial position.

Detailed Analysis

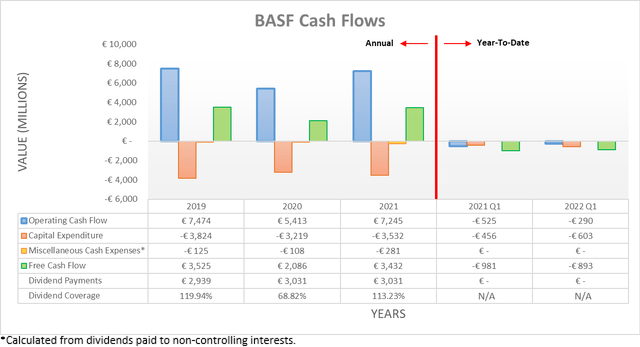

When reviewing their cash flow performance, it was not surprising to see that 2020 was a difficult year as the Covid-19 pandemic ravished the global economy and as a result, pushed their operating cash flow down to €5.413b, which was 27.58% lower year-on-year versus its previous result of €7.474b during 2019. Similar to many other companies, 2021 saw a solid recovery with their operating cash flow coming in at €7.245b and thus effectively back to its pre-Covid-19 level with the first quarter of 2022 subsequently enjoying even more improvements.

Even though on the surface, their operating cash flow of negative €290m during the first quarter of 2022 appears anything but stellar, this is simply due to a routine working capital build and thus why the first quarter of 2021 also saw a negative result of €525m. If these are removed, their underlying operating cash flow was €2.892b for the first quarter of 2022 and thus a very impressive 28.65% higher year-on-year versus their equivalent previous result of €2.248b during the first quarter of 2021. It appears that their soon-to-be-released second quarter of 2022 results will see this strength continue with their preliminary results for adjusted EBIT easily beating estimates.

Whilst undeniably positive, the big question overhanging at the moment is the risks surrounding gas supplies from Russia, which they are reliant upon and behind their share price losing more than a third of its value thus far into 2022. Recently, the International Energy Agency warned that Europe should brace for gas flows to completely cease, which creates the scary possibility that they could run out of gas during the coming Winter, thereby spelling extremely severe problems for their industrial companies, such as those producing chemicals.

This geopolitical risk has been building throughout recent months, ever since Russian troops crossed into Ukraine in late February with the most recent concerns surrounding the Nord Stream 1 pipeline and whether it would see gas flows after its scheduled maintenance in late July. Thankfully as of the time of writing, Russia resumed these gas flows but alas, they remain insufficient to remove the risk of gas rationing during the coming winter or even more worryingly, it does not alleviate the concern that Russia is utilizing their gas supplies as a weapon in response to the tough stance Europe has taken regarding the Russian invasion of Ukraine. This means that the risks of Russia further cutting their gas supplies persist well into the future and thus begs the question of how BASF would fare if Germany loses Russian gas supplies.

They have assets across the globe but their flagship Ludwigshafen chemical plant, which happens to be the largest one in the world, resides within their home country. According to an interesting article published by The Economist, this plant sees complete reliance upon Russian gas via a pipeline with approximately half used as feedstock for chemicals with the other half utilized to generate its electricity. Even if gas flows fall below 50%, they cannot simply reduce production and have to halt operations and thus if this comes to pass, obviously their earnings will not look remotely the same.

According to a report by Fitch Ratings, less than 20% of their total revenue is generated by assets located in Germany. Whilst this sounds bad but not necessarily extremely severe on the surface, it should also be considered that if Russian gas flows to Germany cease, which is a major global economy, it would also certainly plunge the world into a recession, especially for the former that analysts see losing over 10% of its GDP. Since chemical demand and thus profitability is tied closely to economic activity, as evidenced during 2020, it seems reasonable to expect that there would be a far larger impact upon their earnings than circa 20%.

Sadly no one can ascertain this with certainty, although in my eyes, it would be prudent to stress test against a prolonged loss of half of their earnings, especially as restarting a massive idled chemical plant is not a simple flick of the switch and thereby incurring costs even if gas supplies were restarted. Even though this leaves the outlook for their dividend coverage uncertain going forwards, as their coverage was only an adequate 113.23% during 2021, if they lose Russian gas supplies, it would certainly see their dividend reduced very significantly or possibly even suspended for a number of years. This outlook also begs the question of whether their financial position is prepared for what could prove to be the most difficult winter in decades.

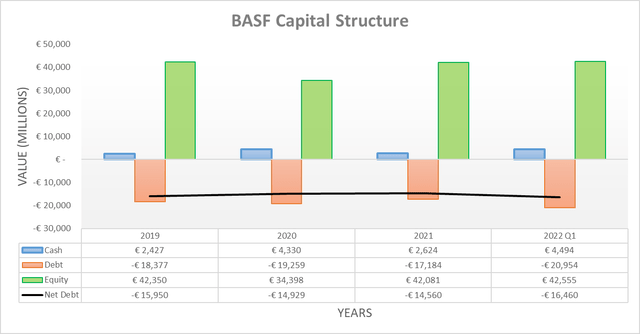

Overall, their capital structure remained broadly unchanged throughout 2019-2021, which is not surprising given their cash flow performance, most notably seeing their net debt decreasing from €15.95b at the end of 2019 to €14.56b at the end of 2021. Whilst it subsequently increased notably during the first quarter of 2022 to €16.46b, this was obviously only due to their routine working capital build and thus does not change anything.

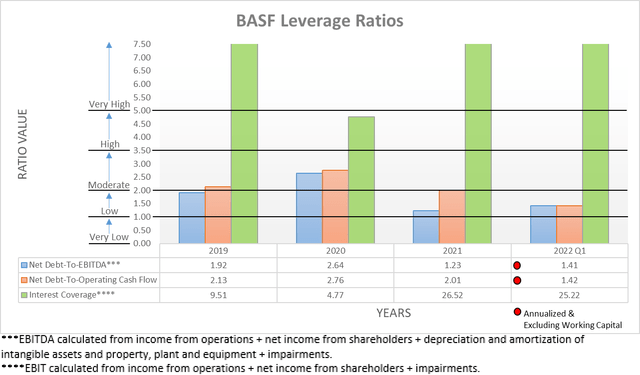

Even though their double-digit billion net debt sounds formidable, thanks to their immense earnings and cash flow performance, it remains easily manageable with a net debt-to-EBITDA and a net debt-to-operating cash flow of 1.41 and 1.42 respectively. These currently sit comfortably within the low territory of between 1.01 and 2.00, although the bigger question is what happens in the future if Russia cuts their gas supply to Europe.

Once again, similar to their cash flow performance, this remains a highly uncertain and volatile situation but thankfully, they are heading into this risky time in a strong position. Even if they were to lose half of their earnings for a prolonged length of time, it would see their net debt-to-EBITDA doubling to 2.82, which despite being much higher in a numerical sense, still only sits within the moderate territory of between 2.01 and 3.50. Whilst not nearly as clean, it would not necessarily endanger their ability to remain a going concern, providing their liquidity remains adequate at a minimum, although it would not resolve the previously discussed cash flow issue that would inhibit their dividends.

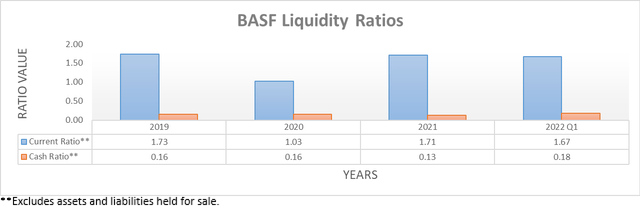

Despite leverage normally receiving the bulk of the attention when it comes to investing, surviving large shocks is normally ultimately determined by liquidity as bankruptcy does not occur until a company cannot meet a liability. Thankfully their low leverage is further supported by their strong liquidity, as evidenced by their current ratio of 1.67 and cash ratio of 0.18. which should provide a sufficient base to outlive any realistic gas and economic shock.

Admittedly, since they are one of the largest and thus most important German companies, they would likely receive emergency liquidity if required from either the public or private sector, regardless of whether central banks further tighten monetary policy. Whilst this would be positive in the sense that they are likely to avert bankruptcy, it would still probably not be on terms favorable to their shareholders and thus this makes their current strong liquidity especially important to hopefully avoid this outcome if Russian gas stops flowing.

Conclusion

Even though shareholders rank at the top when it comes to receiving profits, they rank at the bottom in times of distress and thus their dividends might not survive winter if Germany loses gas supplies from Russia. Sadly, the outcome rests in the hands of Vladimir Putin and remains highly uncertain given the volatile geopolitical backdrop, although thankfully, they are heading into this potentially very cold winter with a well-stocked fireplace, metaphorically speaking, as their leverage is low and liquidity is strong. Even if Russia never reduces gas supplies to Europe during the coming years, I still expect this risk will linger and as a result suppress their share price, which means that I only believe a hold rating is appropriate, despite their otherwise desirable high 8%+ dividend yield.

Notes: Unless specified otherwise, all figures in this article were taken from BASF’s Quarterly Reports, all calculated figures were performed by the author.

Be the first to comment