Lurin/iStock via Getty Images

The Road Has Been Bumpy Since 3Q21

A great deal has changed since my previous Seeking Alpha note on Barclays PLC (NYSE:BCS). Whilst I viewed a potentially unpleasant twist in the COVID-19 tale (which came along in the form of Omicron) as quite likely back in October, I was certainly not anticipating that Russia would invade Ukraine. Nor would I have anticipated that CEO Jes Staley would leave the bank under the cloud of a probe into his links with Jeffrey Epstein. We often see management change following the appointment of a new CEO, but the departure of CFO Tushar Morzaria announced in conjunction with the release of the 4Q21 result is disappointing. The departure of both the CEO and CFO in such close proximity is clearly not good news for BCS shareholders. These unanticipated external and internal events are examples of the uncertainties that exist in investment markets and remind us why we should maintain a sense of humility as analysts and investors about how much we can ‘really know’.

Subsequent to the 4Q21 release, another material event occurred that many analysts would probably describe as unanticipated – being the 28 March 2022 announcement of a £450m loss (after tax) emanating from the BCS investment banking division and relating to structured products. Of course, I would agree that the exact nature, timing and size of the loss was not forecastable, however I would argue that this type of outcome can be expected to occur from time-to-time in investment banking operations. Despite employing lots of skilled and experienced staff in compliance and risk roles, and spending vast amounts of money on regulatory and risk-management systems, investment banks somehow manage to find ways of occasionally shooting themselves in the foot.

It is baffling how a sophisticated group like BCS, which is the sixth largest global investment bank, could exceed a security issuance limit by $15.2bn (73% above the registered maximum). Seasoned followers of banks won’t take much comfort from the wording included in the BCS announcement extracted below, and it would be prudent to allow for further losses/costs associated with the review that will follow. My valuation analysis set out later in this note makes an allowance for total losses/costs associated with this problem of £1,000m (after tax) – that might be on the high side of ‘best estimate’, but I would rather set my valuation on a conservative basis given the potential for other material problems to be uncovered by the review.

Barclays has commissioned an independent review of the facts and circumstances relating to this matter including, among other things, the control environment related to such issuances. Separately, regulatory authorities are conducting inquiries and making requests for information.

Source: Barclays 28 March 2022 Announcement.

Some shareholders are likely to call for a few heads to roll as a result of this investment banking debacle. It is rather ironic that had C.S. Venkatakrishnan (Venkat) not been appointed to replace Jes Staley, he may well have been a candidate for the chopping block. Venkat was Head of Global Markets prior to becoming CEO, and the Group Chief Risk Officer when the securities in question were registered. Had the structured products error been picked up before Staley’s departure, would Venkat have got the gig? In my view, probably not.

Digital Emphasis

Over recent years, countless articles have been written by authors predicting doom for traditional banks; considered unable to compete against nimble and innovative Fintech, the only remaining question for some commentators has been how quickly traditional banks become extinct. The recent excited frenzy around the DeFi movement has taken the rhetoric to a new level. It would be foolish to ignore the challenge that banks face from neobanks and the like, but it would be equally foolish to swallow the hype surrounding Fintech and DeFi. Believers in the ‘banks are doomed’ story often fail to recognise two important issues. Firstly, banks have the capability and resources to adapt and respond to the competitive threat. Secondly, Fintech bulls are overly optimistic about the ability of niche digital operators to operate across the broader banking product spectrum, particularly in relation to effective management of credit risk over an economic cycle.

In the FY21 results materials, CEO Venkat addressed the challenge of delivering ‘next-generation consumer financial services’ in detail, emphasising this as one of the bank’s three biggest strategic priorities (the other two key areas of focus are global capital markets and the transition to a low-carbon economy). In terms of considering the risk of material market share loss to Fintech challengers, I take comfort from the fact that BCS is placing so much focus on the digital strategy.

We see the dominant business challenge for the next decade as continuing to transform Barclays to deliver services digitally, with ease, flexibility and adaptability. We will need to compete not just with other banks for talent and ideas, but with well-funded, superbly equipped and lightly regulated – therefore more fleet- footed – technology firms. This is particularly true in our consumer businesses, where we have set a clear priority to deliver next generation, digitised consumer financial services.

Source: Barclays FY21 Results Announcement, page 4.

What would lead me to change my view and jump onto the ‘banks are doomed’ bandwagon? It would take something very radical – such as the whole financial system moving onto blockchains, with digital currencies issued directly by governments. For me, at present, such a scenario registers as a very low probability outcome.

Structural Cost Actions

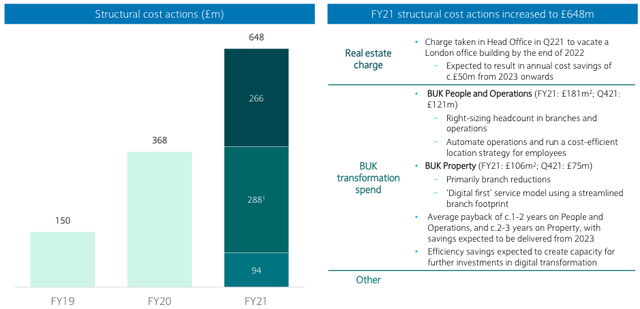

With the market quite understandably focused on the upside income benefit from higher interest rates (see my previous notes for discussion of that topic), relatively little attention is being paid to the solid work that BCS has done and continues to do on costs. Unlike many peers, BCS includes structural cost program expenses within its reported expense base, rather than hiding them away ‘below the line’. Prior to FY20, structural cost actions were not overly material in the context of the total group expense base; however, BCS has taken significant upfront costs in FY20 and FY21 that will generate meaningful cost savings from FY23 onwards. A chunk of these cost savings are likely to be reinvested back into the business and directed towards digital transformation, however I would still expect to see some bottom line benefits emerge. Structural cost actions are anticipated to continue in FY22, although at a lower level than seen in FY21.

Barclays FY21 Results Presentation, slide 19.

FY21’s 13.4% RoTE = Not Sustainable

Barclays delivered a record Group profit before tax of £8.4bn, and return on tangible equity (ROTE) of 13.4%, resulting in a meaningful increase in distributions equivalent to 15p per share

Source: Barclays FY21 Results Announcement, page 2.

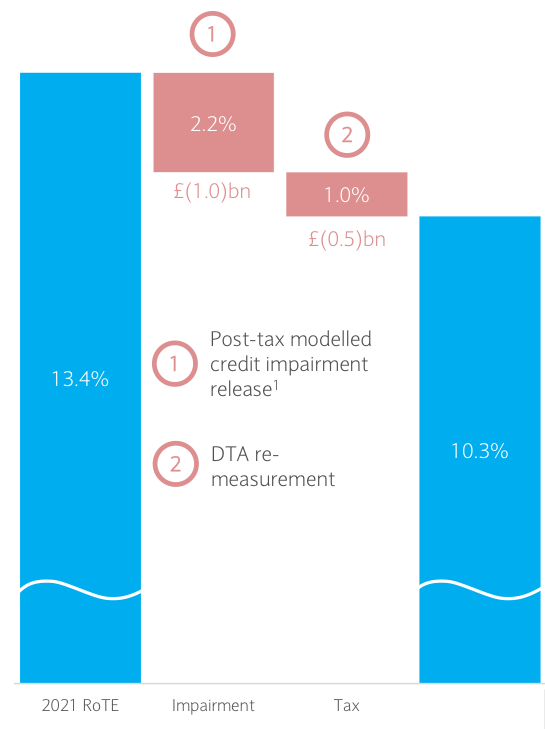

The FY21 headline result for BCS was very strong, however it received a significant boost from a) write-backs of hefty provisions for bad and doubtful debts (BDD) that were established in 2020, and b) a once-off low tax rate triggered by UK corporate tax changes. Clearly then, the reported 13.4% RoTE is not a true representation of the group’s underlying rate of return. BCS highlighted this issue in the results materials, and pointed towards a more representative adjusted RoTE of 10.3%. Not all companies are this transparent about unsustainable boosts to profits.

Source: Barclays FY21 Results Presentation, slide 33.

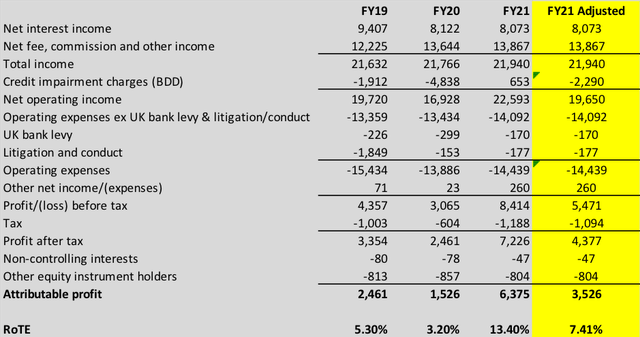

In Table 1, I adjust the FY21 performance by replacing the BDD release of £653m with a normalized charge for the year of -£2,290m and allowing for a tax rate of 20%. I arrive at a normalized RoTE of 7.4%. This outcome is well below the 10.3% adjusted RoTE put forward by BCS – the difference is due to the fact that the BCS adjustment does not fully allow for BDD costs to return to normalized levels.

Table 1:

Source: Author’s calculations based on Barclays financial reports.

The adjusted RoTE of 7.4% is not exactly exciting, and is well below the bank’s medium-term RoTE target of 10%. However, is it low enough to justify BCS trading at ~50% of NTA? In my view the answer to that question is definitely ‘no’.

Updated Valuation Analysis

For valuation purposes, I generally rely upon an assessment of normalized earnings. Essentially, my goal is to arrive at a point-in-time estimate of how I expect a company to perform on a ‘through-the-cycle’ or ‘sustainable earnings’ basis. My analysis suggests that BCS is currently holding significant excess BDD provisions – which implies that a standard normalized earnings approach may understate the value of the company. BCS management flagged the issue of excess BDD provisions in the FY21 materials:

We’ve included in the appendix an updated slide on the Macroeconomic Variables and Post- Model Adjustments, and you’ll note that we’re still holding £1.5bn in management adjustments.

Source: Barclays FY21 Management Speech, page 12.

We reported an impairment release of £0.7bn, but have maintained strong coverage ratios, and we expect the run rate for impairment to be below the pre-pandemic levels over the coming quarters.

Source: Barclays FY21 Management Speech, page 19.

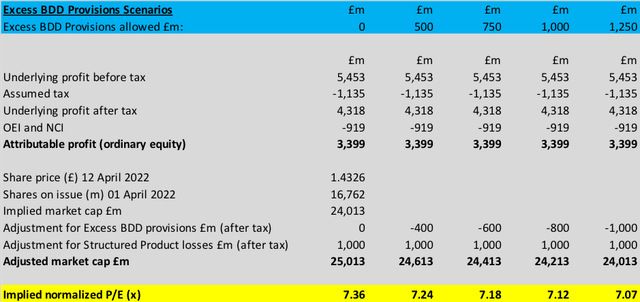

To capture the value potential of excess BDD provisions, the valuation framework presented in Table 2 below makes an adjustment to the BCS market capitalisation to allow for the after-tax value of different levels of assumed excess BDD provisions. On the other side of the equation, I have allowed for a total value loss associated with the structured product problems in the investment banking division of -£1,000m after tax. I then use this adjusted market capitalisation measure to arrive at a normalized P/E ratio.

Table 2:

Source: Author’s calculations based on Barclays financial reports.

Conclusion

An experienced, capable and stable leadership team is something that I regard as important for a strong investment case; BCS no longer ticks that box given the departure of both the CEO and CFO. The fact that the new CEO and CFO are both internal appointments softens the blow and reduces the risk of a strategy reset and associated costs/disruption.

Recent events cause me to feel less enthusiastic about describing BCS as a high-quality business, but I do not expect to see material new negative issues emerge in coming months (other than relating to the review into structured products described above).

My conservatively set valuation framework points to a normalized P/E of around 7.1x to 7.4x (based on the London Stock Exchange closing price of £1.4326 on 12 April 2022). At that level of P/E, a rating of STRONG BUY is justified.

Be the first to comment