Gold price started a major decline below the $1,800 support zone. Crude oil price is attempting a recovery wave from the $93.20 zone.

Important Takeaways for Gold and Oil

· Gold price struggled above $1,800 and declined against the US Dollar.

· There is a key bearish trend line forming with resistance near $1,750 on the hourly chart of gold.

· Crude oil price started a downside correction from the $109 and $110 resistance levels.

· There is a major bearish trend line forming with resistance near $100.10 on the hourly chart of XTI/USD.

Gold Price Technical Analysis

Gold price struggled to gain pace above the $1,815 resistance zone against the US Dollar. The price started a fresh decline and traded below the $1,800 pivot level.

There was a clear move below the $1,785 support zone and the 50 hourly simple moving average. The price even traded below the $1,750 level and formed a low near $1,732 on FXOpen. It is now consolidating losses above the $1,730 level.

On the upside, the price is facing resistance near the $1,750 level. There is also a key bearish trend line forming with resistance near $1,750 on the hourly chart of gold.

The trend line is near the 23.6% Fib retracement level of the downward move from the $1,814 swing high to $1,732 low. A clear upside break above the trend line and the 50 hourly simple moving average could send the price towards $1,762.

The main resistance is now forming near the $1,775 level. It is near the 50% Fib retracement level of the downward move from the $1,814 swing high to $1,732 low.

A close above the $1,775 level could open the doors for a steady increase towards $1,800. The next major resistance sits near the $1,815 level. On the downside, an initial support is near the $1,735 level. The next major support is near the $1,725 level, below which there is a risk of a larger decline. In the stated case, the price could decline sharply towards the $1,700 support zone.

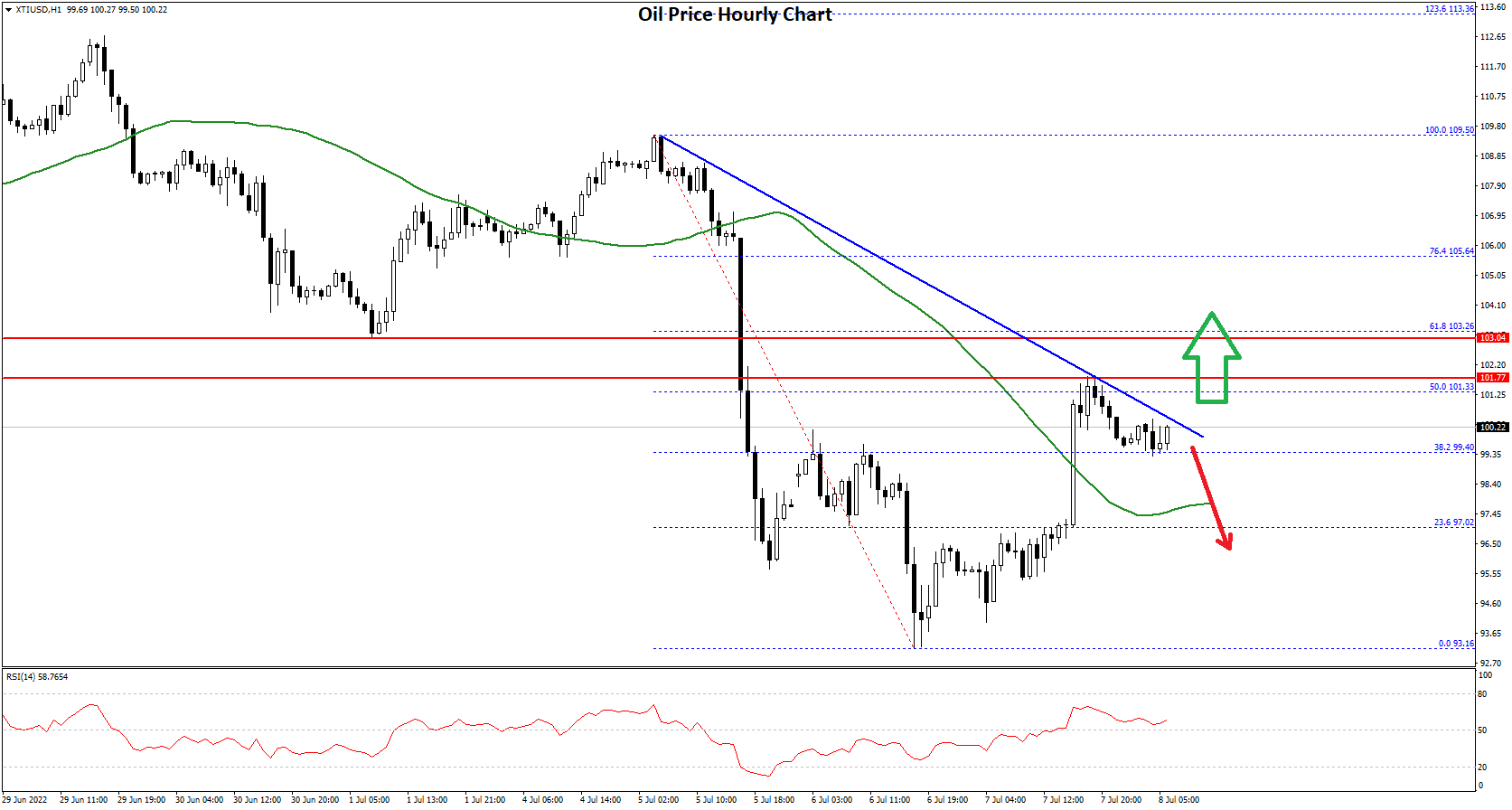

Oil Price Technical Analysis

Crude oil price also struggled to stay above the $110 level and started a fresh decline against the US Dollar. The price declined below the $105 support zone to move into a bearish zone.

There was a clear move below the $100 support zone and the 50 hourly simple moving average. The price traded as low as $93.16 and the price is now correcting losses. There was a move above the 23.6% Fib retracement level of the downward move from the $109.50 swing high to $93.16 low.

On the upside, the price is facing resistance near the $100.00 level. There is also a major bearish trend line forming with resistance near $100.10 on the hourly chart of XTI/USD.

The next key resistance is near the $101.30 level or the 50% Fib retracement level of the downward move from the $109.50 swing high to $93.16 low, above which the price might accelerate higher towards $105 or even $110.

On the downside, an immediate support is near the $98.50 level. The next major support is near the $95.50 level. If there is a downside break, the price might decline towards $93.20. Any more losses may perhaps open the doors for a move towards the $90.00 support zone.

This forecast represents FXOpen Markets Limited opinion only, it should not be construed as an offer, invitation or recommendation in respect to FXOpen Markets Limited products and services or as financial advice.

Be the first to comment