Kimberly White

This article is first in a series that provides an ongoing analysis of the changes made to Bridgewater Associates’ 13F portfolio on a quarterly basis. It is based on their regulatory 13F Form filed on 5/13/2022.

Bridgewater Associates was founded by Ray Dalio in 1975. It is one of the largest hedge funds in the world and is focused on Global Macro as an investing theme. Over the years, they have pioneered several related strategies: absolute return, risk parity, alpha overlay, etc. One distinct factor that separates them from most other hedge funds is that they only accept institutional money rather than taking investments from accredited investors who can meet their minimums.

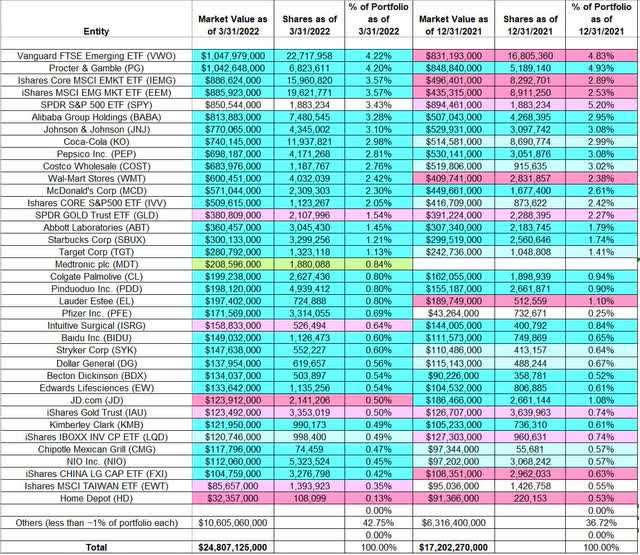

Assets Under Management (AuM) is at around $140B. The 13F portfolio is less than ~20% of their total AUM. This quarter, the 13F portfolio value increased from $17.20B to $24.81B. The holdings are diversified with recent reports showing around 1000 different stakes. Around 37 of them are significantly large (more than ~0.5% of the 13F portfolio) and they are the focus of this article. The top three individual stock positions are at ~11% while the top five holdings are close to ~16% of the 13F assets: Procter & Gamble, Alibaba Group Holdings, Johnson & Johnson, Coca-Cola, and PepsiCo.

Note 1: The firm uses asset class diversification among uncorrelated positions to achieve absolute returns. As such the stakes can be on or against debt, equity, and other markets around the world. To learn more about their unique investment philosophy, check out their video channel and Ray Dalio’s books.

Note 2: It was reported last month that Bridgewater Associates had built a $10.5B bet against European businesses including ASML Holding (ASML), TotalEnergies SE (TTE), Sanofi (SNY), and SAP SE (SAP).

New Stakes:

Medtronic plc (MDT): MDT is a 0.84% of the portfolio position established this quarter at prices between ~$101 and ~$112 and the stock currently trades below that range at $89.50.

Stake Increases:

Vanguard FTSE Emerging Markets ETF (VWO): VWO is currently the largest 13F position at 4.22% of the portfolio. It was first purchased in 2009. The position size peaked at over 115M shares in 2014. This is compared to 22.72M shares currently. Recent activity follows. 2020 saw a ~45% selling at prices between ~$31 and ~$50 while in Q3 2021 there was a stake doubling at prices between ~$49 and ~$53. Last quarter saw a ~30% selling while this quarter there was a similar increase. VWO currently trades at $41.64.

Procter & Gamble (PG) and Johnson & Johnson (JNJ): PG is a large (top three) 4.20% of the portfolio stake. It was established in H2 2020 at prices between ~$120 and ~$144. H1 2021 saw a ~80% stake increase at prices between ~$124 and ~$139. Last two quarters also saw a ~45% increase at prices between ~$139 and ~$164. The stock currently trades at ~$146. The 3.10% JNJ stake was a small position in their first 13F filing in Q4 2005. The stake has wavered. The current position was built during the four quarters through Q2 2021 at prices between ~$137 and ~$171. Last two quarters have seen a ~55% stake increase at prices between ~$155 and ~$180. The stock currently trades at ~$179.

iShares Core MSCI Emerging Markets ETF (IEMG) and iShares MSCI Emerging Markets ETF (EEM): The large (top three) 3.57% IEMG stake was first purchased in 2016. The position size peaked at over 15M shares in 2017. The stake had since been sold down. Recent activity follows. Q3 2021 saw a ~225% stake increase at prices between ~$61 and ~$67. That was followed with a stake doubling this quarter at prices between ~$51 and ~$62. IEMG currently trades at ~$49. The large (top five) 3.57% EEM position is a long-term stake that has been in the portfolio since 2010. The sizing peaked at close to 80M shares by 2014. Since then, the stake has wavered. Recent activity follows. Q1 2021 saw the position sold down to a minutely small stake at prices between ~$52 and ~$58. Next two quarters saw the position rebuilt at prices between ~$50 and ~$56. Last quarter saw a ~55% selling at prices between ~$47 and ~$53 while this quarter there was a stake doubling at prices between ~$41.50 and ~$51. EEM is currently at ~$40.

Alibaba Group Holding (BABA): The fairly large 3.28% BABA stake was established in the 2018-2020 timeframe at prices between ~$132 and ~$310. Q3 2021 saw a ~130% stake increase at prices between ~$145 and ~$220. Last two quarters have seen another similar increase at prices between ~$77 and ~$178. The stock currently trades at ~$122.

Coca-Cola (KO) and PepsiCo (PEP): The four quarters through Q2 2021 saw a ~8.2M shares KO stake built at prices between ~$45 and ~$56. That was followed with a ~40% stake increase this quarter at prices between ~$58 and ~$63. The stock currently trades at $62.91, and the stake is fairly large at ~3% of the portfolio. PEP built up occurred in a similar fashion. The four quarters through Q2 2021 saw a 2.7M shares stake built at prices between ~$129 and ~$148. That was followed with a ~55% stake increase over the last two quarters at prices between ~$150 and ~$176. The stock is now at ~$170 and the stake is at 2.81% of the portfolio.

Note: Much smaller stakes in these two positions were part of the portfolio during the decade through 2016.

Costco Wholesale (COST), Target Corp. (TGT), and Walmart (WMT): These three stakes were built from H2 2020. The 2.76% of the portfolio COST stake was built during the four quarters through Q2 2021 at prices between ~$305 and ~$395 and the stock currently trades at ~$495. There was a ~30% stake increase this quarter at prices between ~$477 and ~$577. TGT is a 1.13% of the portfolio stake established in H2 2020 at prices between ~$119 and ~$180. Q2 2021 saw a ~55% stake increase at prices between ~$200 and ~$245. That was followed with a ~25% increase this quarter at prices between ~$190 and ~$234. The stock currently trades at ~$150. The 2.42% WMT position was purchased during the four quarters through Q2 2021 at prices between ~$119 and ~$152. Q4 2021 saw the stake sold down by ~45% at prices between ~$135 and ~$151. This quarter saw a similar increase at around the same price range. The stock is now at ~$125.

McDonald’s Corp (MCD) and Starbucks Corp. (SBUX): MCD is a 2.30% of the portfolio position first built during the four quarters through Q2 2021 at prices between ~$184 and ~$237. Last two quarters saw another ~55% stake increase at prices between ~$222 and ~$270. The stock is now at ~$253. The 1.21% SBUX stake was built similarly at prices between ~$74 and ~$118. Last two quarters saw another ~45% stake increase at prices between ~$79 and ~$117. The stock currently trades at $79.24.

iShares Core S&P 500 ETF (IVV): A fairly large stake in IVV was built during the 2017-2018 timeframe at prices between ~$245 and ~$295. It was sold down during the two quarters through Q1 2021 at prices between ~$325 and ~$400. Last four quarters have seen the stake rebuilt at prices between ~$400 and ~$480. The stock is now at ~$391 and the stake is at ~2% of the portfolio.

Note: a much smaller stake in IVV was part of the portfolio during the 2012-16 timeframe.

Abbott Laboratories (ABT), Baidu Inc. (BIDU), Becton, Dickinson (BDX), Colgate- Palmolive (CL), Dollar General (DG), Edwards Lifesciences (EW), Estee Lauder (EL), Pfizer Inc. (PFE), Pinduoduo Inc. (PDD), and Stryker Corp. (SYK): These small (less than ~1.5% of the portfolio each) stakes were increased this quarter.

Chipotle Mexican Grill (CMG), iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD), iShares China Large-Cap ETF (FXI), and Kimberley-Clark (KMB), NIO Inc. (NIO): These very small (less than ~0.5% of the portfolio each) positions were increased this quarter.

Stake Decreases:

iShares Gold Trust (IAU) and SPDR Gold Trust ETF (GLD): These two positions were first built in 2017. A fairly large IAU stake was built in 2017 at an average price of ~$25 per share. There was a roughly one-third stake increase in 2020 at prices between ~$29 and ~$39. Last five quarters have seen the position sold down by ~80% at prices between ~$32 and ~$38. IAU now goes for ~$33 and the stake is now small at 0.50% of the portfolio. A larger stake in GLD was built in 2017 at prices between ~$110 and ~$128. 2020 saw a ~25% selling at prices between ~$140 and ~$191. That was followed with a ~40% selling next quarter at prices between ~$159 and ~$178. Q3 2021 saw a similar increase at prices between ~$162 and ~$171. The stock currently trades at $162, and the stake is at 1.54% of the portfolio. Last two quarters have seen minor trimming.

Home Depot (HD), Intuitive Surgical (ISRG), iShares MSCI Taiwan ETF (EWT), and JD.com (JD): These very small (less than ~0.65% of the portfolio each) positions were reduced during the quarter.

Kept Steady:

SPDR S&P 500 ETF (SPY): A small position in SPY was first established in Q1 2006. An amended filing in Q4 2007 showed a huge 40% of the 13F portfolio stake (~12M shares) established in the high 140s price-range. The position size peaked at ~21M shares by 2011. The decade through 2020 had seen the position reduced to 3.7M shares through minor selling in most quarters. H1 2021 saw another ~45% reduction at prices between ~$370 and ~$430. SPY now trades at ~$389 and it is still a top-five stake at 3.43% of the portfolio. Last three quarters have also seen minor trimming.

The spreadsheet below highlights changes to Bridgewater Associates’ 13F holdings in Q1 2022:

Ray Dalio – Bridgewater Associates’ Q1 2022 13F Report Q/Q Comparison (John Vincent (author))

Be the first to comment