ImagePixel

The Invesco DB US Dollar Index Bullish Fund (NYSEARCA:UUP) provides exposure to the returns of the U.S. dollar against a basket of 6 major world currencies. If inflation were to return in the coming months, then I believe the Fed will have to fulfill its ‘higher for longer’ monetary pledge. This should lead to a resumption of the U.S. dollar bull market.

Fund Overview

The Invesco DB US Dollar Index Bullish Fund gives investors exposure to a rising U.S. dollar against a basket of the six major world currencies: Euro, Yen, British Pound, Canadian Dollar, Swedish Krona, and Swiss Franc.

The UUP fund invests in futures contracts (“DX Contracts”) that are based on the Deutsche Bank Long USD Currency Portfolio Index – Excess Return (“Index”). DX Contracts are traded exclusively on the ICE Futures Exchange. The UUP Fund also invests in U.S. treasury bills and money market funds to earn short-term yields.

UUP is popular with investors, with $1.3 billion in fund assets. UUP charges a 0.75% management fee and a 0.77% total expense ratio.

DX Contract Specification

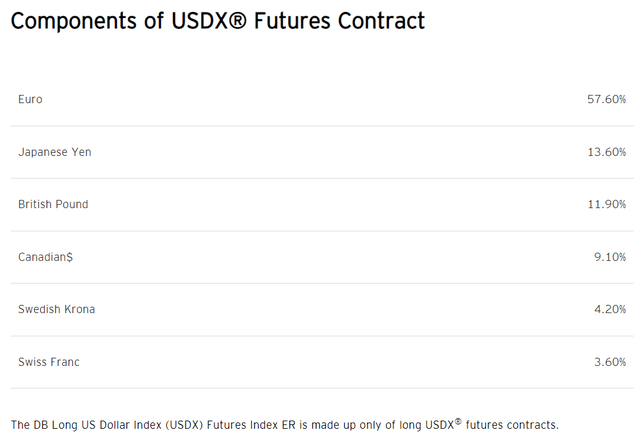

The DX future contract is heavily weighted towards the Euro, Yen, and British Pound, with the three currencies holding a combined 83.1% weight (Figure 1).

Figure 1 – DX futures contract specification (invesco.com)

Portfolio Holdings

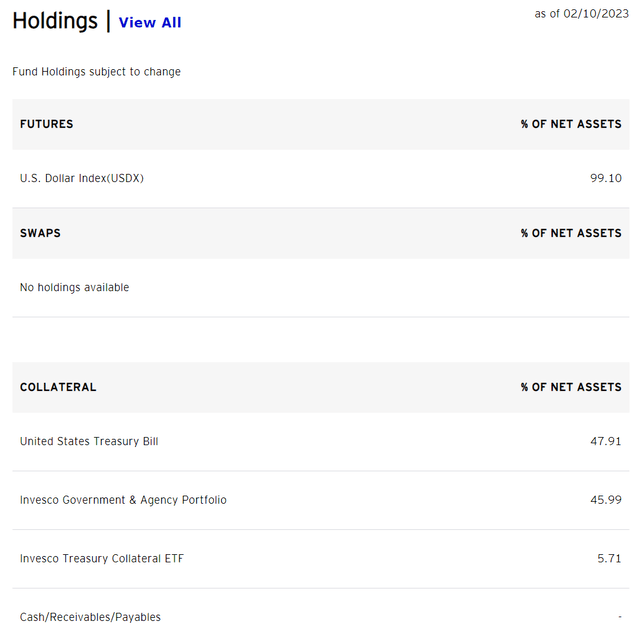

In addition to holding DX futures, the UUP fund also holds U.S. treasury bills and other short term money market instruments, as shown in figure 2 below. Note that although the value of the UUP may fluctuate with changes in the value of the treasury bills and money market securities, the majority of the fund’s returns are generated via increases or decreases in the value of the DX futures position.

Figure 2 – UUP holdings (invesco.com)

Distribution & Yield

The UUP ETF paid a nominal $0.2466 / share distribution in 2022, which translates into a trailing 0.9% yield.

Returns

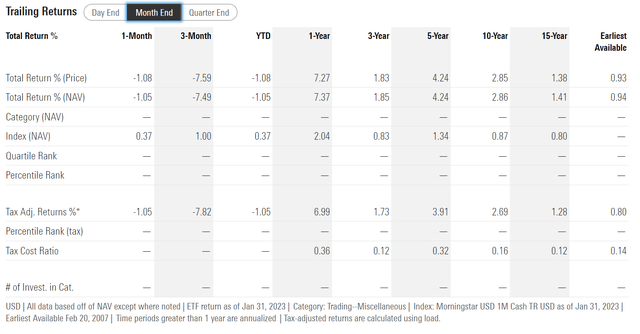

Figure 3 shows the historical returns of the UUP ETF. Over the long-run, the UUP has not generated high average annual total returns, as the fund only has 3/5/10Yr average returns of 1.9%/4.2%/2.9% respectively to January 31, 2023.

Figure 3 – UUP historical returns (morningstar.com)

However, UUP is mostly used by investors to speculate on the direction of the U.S. dollar and can generate substantial returns on a short time horizon. For example, in 2022, the UUP fund generated total returns of 9.5%, despite a sharp year-end decline.

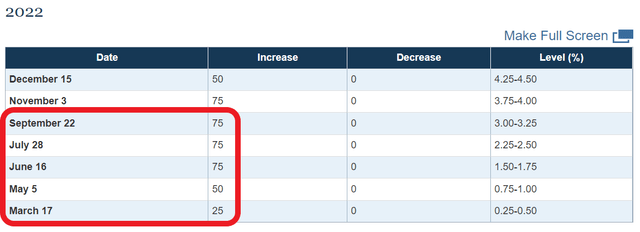

In fact, UUP’s 2022 can be thought of a year of two halves. During the first 3 quarters of the year, the U.S. dollar rallied sharply against global currencies as the Fed was one of the most hawkish of the major central banks in their fight against inflation, having raised the Fed Funds rate by 300 bps from March to September (Figure 4).

Figure 4 – FOMC policy decisions in 2022 (FOMC)

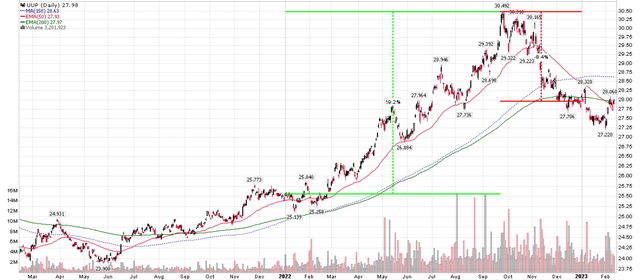

The Fed’s hawkishness and a flight to safety from market declines led to a 19% rally in the UUP fund, as shown in figure 5 below.

Figure 5 – UUP rallied 19% in the first 3 quarters of 2022 before falling 9% (Author created with price chart from stockcharts.com)

However, by October, with U.S. headline inflation showing signs of peaking, the Fed began floating the notion of a slowdown in the pace of Fed rate hikes. At the same time, although the ECB in Europe began hiking interest rates later than the Fed (ECB’s 1st hike in this cycle was in July vs. March for the Fed), by September/November, the ECB had overtaken the Fed in hawkishness, with consecutive 75 bps hikes and the promise to do far more (Figure 6).

Figure 6 – ECB policy decisions in 2022 (ECB)

The differing relative path of monetary policy led to a dramatic decline in the U.S. dollar, with the UUP falling by 9%, as shown in figure 5 above.

Loosening Financial Conditions Reigniting ‘Animal Spirits’

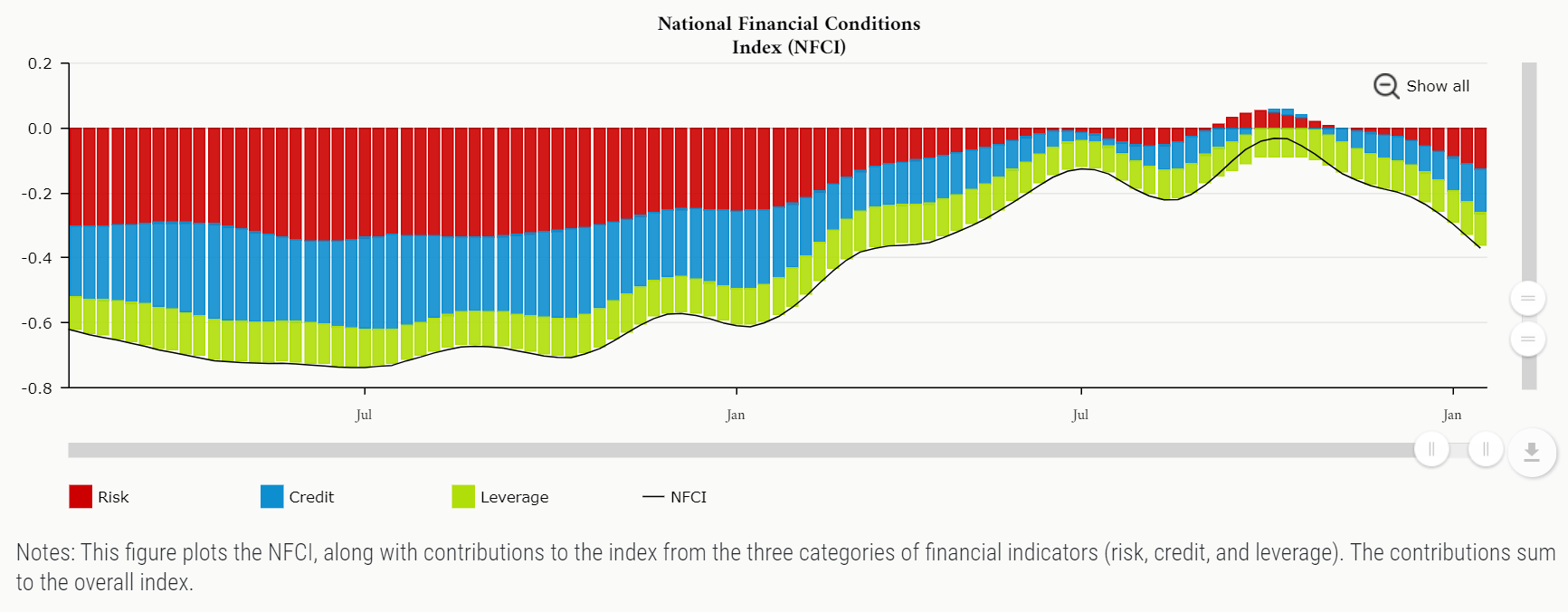

The 2022 declines extended into January 2023 as investors began to price in a ‘soft landing’ and the Fed failed to push back against loosening financial conditions from a rebound in financial markets. In fact, according to the Chicago Fed’s National Financial Conditions Index, financial conditions are now as loose as they were in early 2022, before the Fed began its series of interest rate hikes!

Figure 7 – Financial conditions have loosened to early 2022 levels (Chicago Fed)

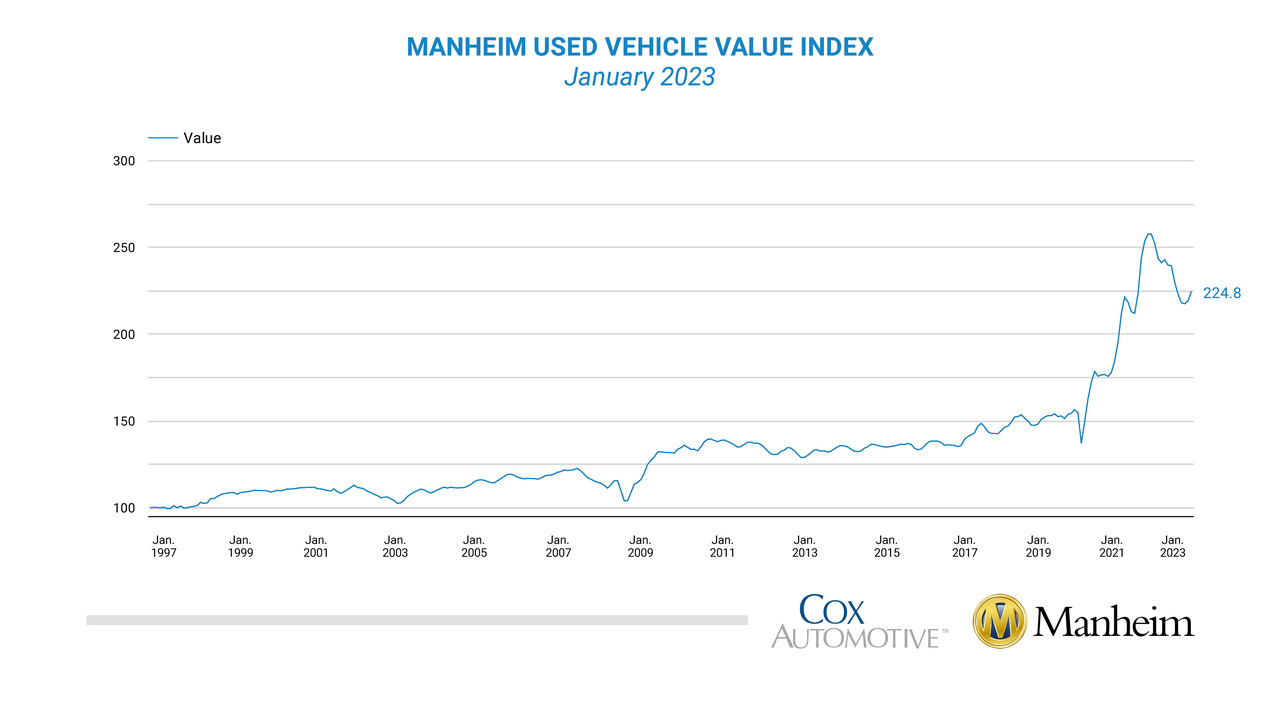

The problem with loose financial conditions is that it risks reigniting ‘animal spirits’ that had been one of the main drivers of 2021/2022’s inflation episode. Already, we have seen a rebound in housing activity and a surge in meme stocks. Used car prices, which had been the inflation canary in the coal mine in 2021, showed a surprise 2.5% MoM jump in January (Figure 8).

Figure 8 – Used car prices surprisingly increased in January 2023 (Manheim.com)

If inflation returns in the coming months, the Fed may have to turn hawkish again and honour their ‘higher for longer’ pledge.

NFP Surprise Cause Sharp Repricing Of Fed Terminal Rates

In hindsight, the extremely strong non-farm payrolls figure on February 3rd could prove to be the major inflection point against the ‘soft landing’ debate. The January 2023 jobs report showed that U.S. non-farm payrolls increased by 517,000, blowing past estimates which called for a 185,000 increase. December and November payrolls were also revised significantly higher and the unemployment rate fell 0.1% MoM to 3.4% vs. an estimate of 3.6%.

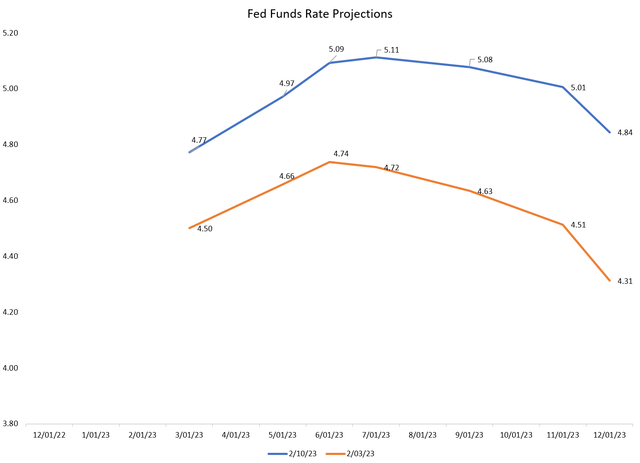

The strength of the labour market, combined with the rekindled animal spirits mentioned above, suddenly changed investors’ perception of the Fed’s terminal rate (higher) and willingness to cut interest rates in 2023 (for longer).

In the span of a week, investors have added a full rate hike (25 bps) into their forecasts for 2023 peak Fed Funds Rate and reduced their 2023 rate cut expectations by 13 bps (Figure 9).

Figure 9 – Investors pricing in higher for longer (Author created with data from CME)

Suddenly, the Fed’s ‘higher for longer’ pledge sounded much more credible, and the UUP rallied over 2% in the past 2 weeks in response.

CPI Release Will Be A Key Catalyst

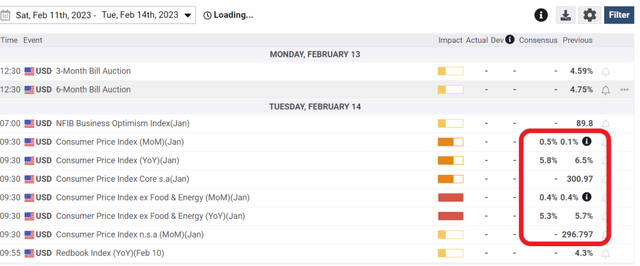

To say the upcoming January CPI report on February 14th will be a key catalyst is a gross understatement. For now, forecasters are expecting U.S. headline inflation of 0.5% MoM or 5.8% YoY, and core inflation of 0.4% MoM and 5.3% YoY (Figure 10).

Figure 10 – January CPI estimates (fxstreet.com)

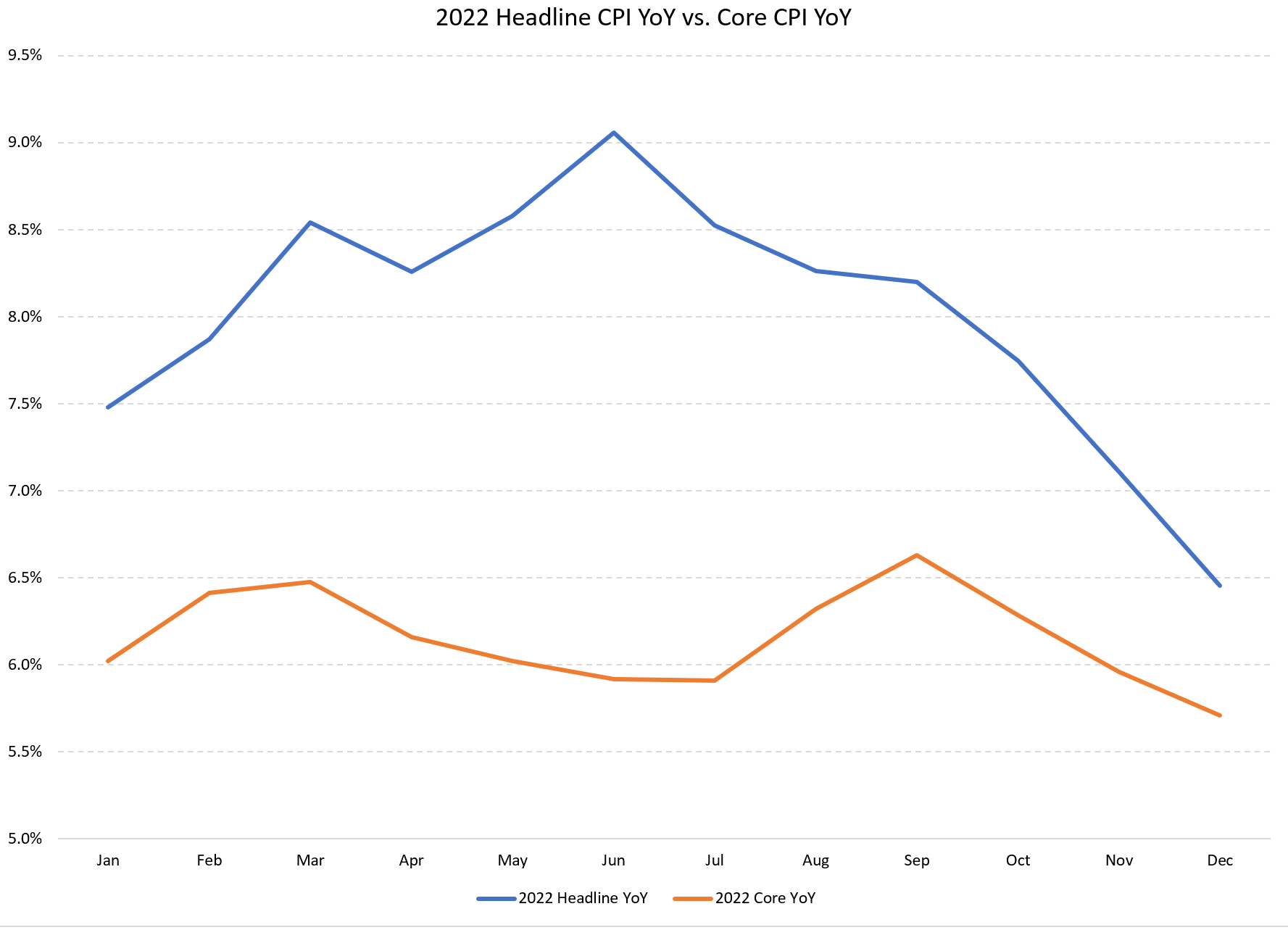

Expectations are consistent with an improvement from December’s 6.5% YoY headline inflation rate and 5.7% YoY core inflation rate (Figure 11).

Figure 11 – Headline vs. Core CPI Inflation in 2022 (Author created with data from BLS)

However, recent revisions (due to revisions of the seasonality factors) to December’s CPI figure could muddy the January CPI results. Originally, December’s reported headline CPI was -0.1% and core CPI was +0.3% MoM. However, revisions on February 10th showed actual December headline CPI inflation was +0.1% MoM and core CPI was +0.4%. November and October inflation rates were also revised higher.

I have two comments on these revisions. First, higher revised inflation rates suggest that financial markets were too eager to believe in the ‘soft landing’ narrative and perhaps have loosened financial conditions too prematurely. Second, if historical inflation rates are revised higher, than the inflation index level is likewise higher, which makes the upcoming January CPI figure easier to ‘beat’.

In any event, the upcoming CPI release will be closely watched by all financial market participants for clues on whether the Fed will have to pursue a ‘higher for longer’ set of monetary policy.

If inflation proves sticky, then the Fed will have no choice but to continue raising interest rates to a higher level and holding interest rates higher until inflation declines to their 2% target. This scenario will be very bullish for the U.S. dollar and the UUP ETF.

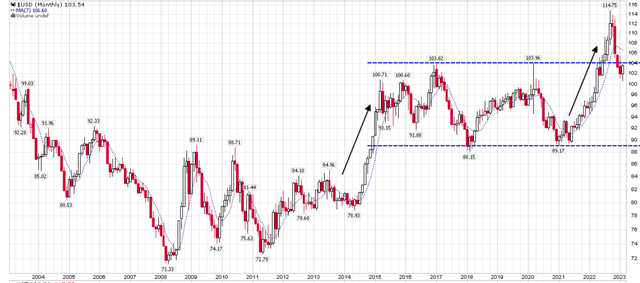

Technicals At Key Support

As I wrote in a recent article on the WisdomTree Bloomberg U.S. Dollar Bullish Fund (USDU), technically, the U.S. dollar has retraced back to multi-decade breakout levels. This area would be an ideal launching point if the U.S. dollar were to resume its uptrend (Figure 12).

Figure 12 – U.S. dollar at key breakout level (Author created with price chart from stockcharts.com)

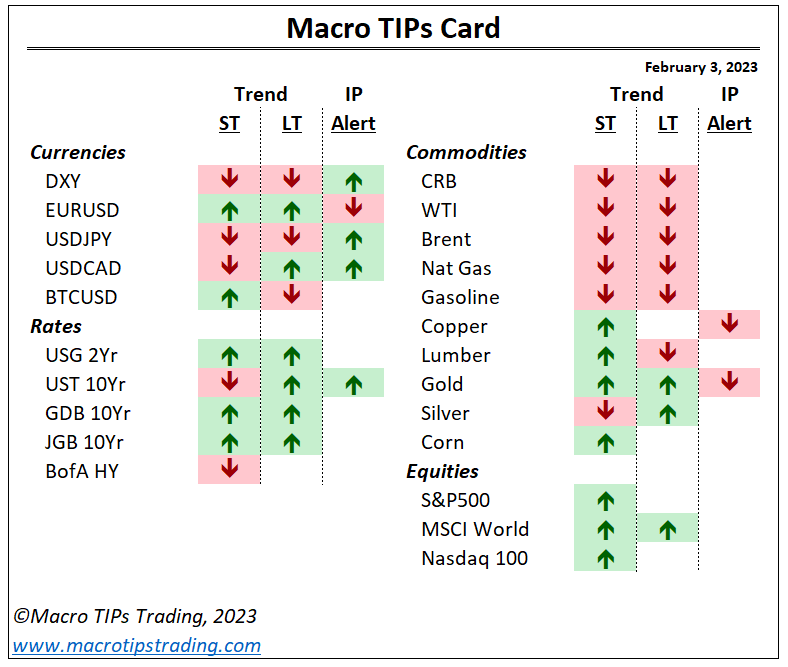

My trend analysis has been highlighting a potential inflection point in the U.S. dollar since February 3rd (Figure 13). I also warned of a top in the U.S. dollar back in October.

Figure 13 – U.S. dollar inflection alert since February 3rd (Author created)

Risk To UUP

The biggest risk to the UUP fund is if inflation continues to moderate in the coming months. This will allow the Fed to stop raising interest rates and perhaps even reduce interest rates in the second half of 2023. A dovish Fed will weaken the U.S. dollar’s relative position against other global currencies.

Conclusion

The UUP fund gives investors exposure to the returns of the U.S. dollar relative to a basket of 6 major world currencies. If inflation were to rear its ugly head again in the coming months, then I believe the Fed will have to fulfill its ‘higher for longer’ monetary pledge, which should lead to a resumption of the U.S. dollar bull market.

Be the first to comment