solarseven

Introduction

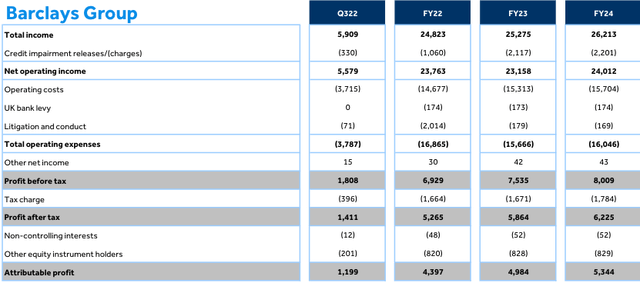

Barclays PLC (NYSE:BCS) reported 3Q22 results on 26 October 2022. The 3Q22 performance was slightly ahead of consensus estimates, with the bank generating a healthy RoTE (return on tangible equity) of 12.5%. This note takes a look at what consensus estimates imply for future returns on BCS stock, and discusses some key areas of uncertainty that are relevant when considering forecast earnings estimates.

RoTE Improvement – Consensus Implies Strong Returns

According to the latest BCS publication of analyst consensus estimates (refer to Chart 1 below) market expectations point to a FY24E tangible net asset value per share, TNAV, of 364p and a FY24E RoTE of 10.1%. The closing price of Barclays on the London Stock Exchange on 09 December 2022 was 159.48p, which equates to ~55% of the group’s reported 3Q22 TNAV of 286p. Delivery of results consistent with consensus forecasts can be expected to drive strong shareholder returns from the combination of TNAV growth and a narrowing (or perhaps even elimination) of the stock’s discount to TNAV.

If BCS is able to achieve a FY24 RoTE of 10.1% (as per consensus estimates) and demonstrate to the market that the group can generate around this level of RoTE on a sustainable basis, it is reasonable to assume that BCS shares will trade roughly in line with TNAV by FY24. Based on these assumptions, and allowing for the consensus forecast growth in TNAV, the BCS share price has scope to increase from its current level of ~160p to reach ~364p – this implies a very healthy return of +128% over a (roughly) two-year period. Consensus forecasts for dividend payments suggest that dividend income could deliver an additional 10% over the next two years or so (again based on the current price of ~160p per share).

At this point I should stress that I find the type of analysis outlined above to be overly simple. However, I do not disagree with the implied conclusion that BCS is currently a STRONG BUY. Recognising the importance of maintaining a balanced view, in the rest of this note I highlight a few areas that I think currently contribute to quite high levels of forecasting uncertainty for BCS.

Chart 1 – Barclays PLC Consensus 13 October 2022:

Source: Barclays Investor Relations website – Barclays PLC Consensus 13 October 2022.

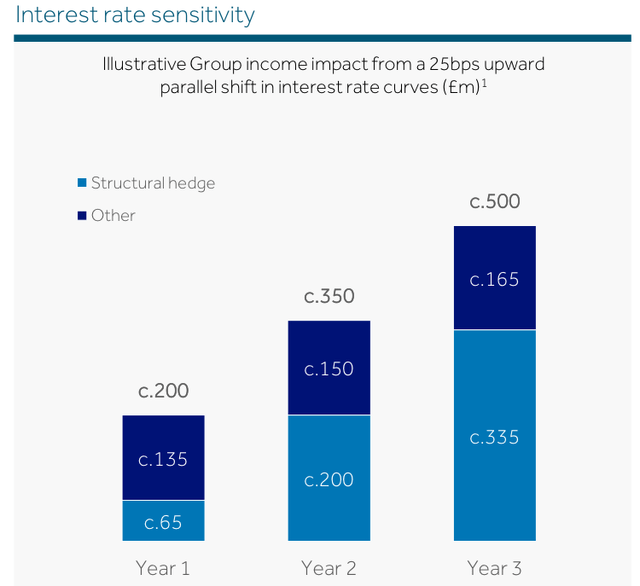

Interest Rate Sensitivity Upside – What About Competition?

BCS bulls often point to the slide below and stress the potential earnings upside to the bank from higher interest rates. The idea that an increase in interest rates of only 25bp can generate £500m of additional pre-tax profit is rather exciting given the expectation of continued rate hikes from the Bank of England and the Federal Reserve.

Source: Barclays 3Q22 Presentation, slide 7.

The assumption that all (or a very high proportion) of this interest rate leverage will fall to the bottom line is optimistic in my view. As with most areas of financial services, competitive pressure remains alive and well in retail and corporate banking markets throughout Europe and North America. I do expect that banking ROE’s will improve from the influence of higher interest rates, but the ROE expansion effect of higher interest rates will be dampened significantly by natural competitive tension. The temptation to ‘reinvest’ the ROE boost in lower product pricing in order to gain market share (or to support other growth metrics) will prove too tempting to resist for some banks; peers of the first-mover will follow suit, reacting to the risk of market share loss and/or relative balance sheet shrinkage.

In addition to the drag from competitive tension, it is likely that a proportion of the extra net interest income generated will feed through into higher staff remuneration levels. Banks also have a tendency to allow expenses to creep up when income levels increase – ambitious technology projects are an obvious candidate to chew up earnings that might otherwise have been distributed to shareholders.

Taking this type of thinking a step further, analysts and investors should also be mindful of the consequences of higher interest rates on other factors that drive bank earnings. A slowdown in system credit growth rates can be quite painful for banks that have high levels of largely fixed costs. An economic recession triggered by higher interest rates has obvious potential negative consequences for bad debt costs.

In summary, I see interest rate leverage as a bullish point for BCS, but I caution investors not to take illustrative scenarios such as the one presented in the chart above at full face value. Second order impacts at the individual company level, along with the highly competitive nature of banking at a market level, are important considerations that should not be overlooked.

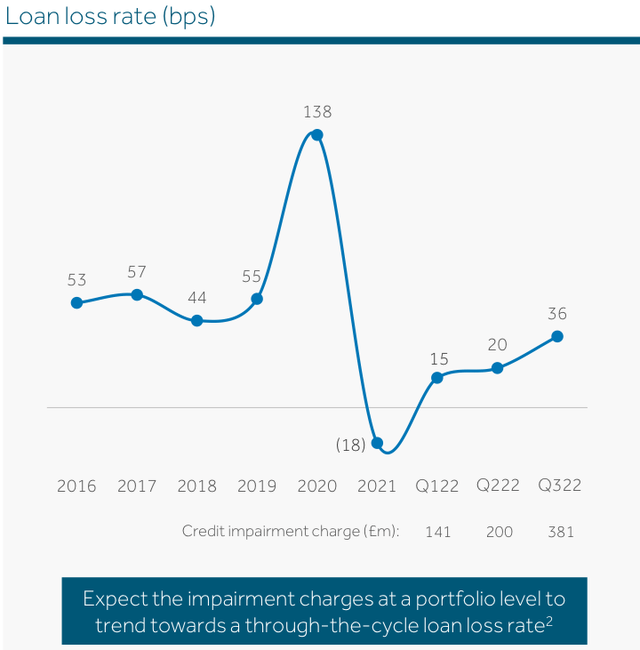

Higher Bad Debt Charges Ahead

In common with many other banks, BCS established large bad debt (impairment) provisions during COVID-19 that proved to be overly conservative. BCS is now running down these excess COVID-19 provisions. An outworking of this dynamic is that current reported bad debt loss rates are lower than would otherwise be the case without the provision releases. Combine this with the fact that the impact of an expected UK recession is not yet apparent in bad debt loss rate numbers, and it becomes clear that the potential for error in analyst bad debt forecasts is very high.

To help to illustrate this point: BCS reported a 3Q22 bad debt loss rate of 36bp, but this included a ~£300m release of post-model-adjustments (relating to COVID-19 provisions). Without the post-model-adjustments release, the 3Q22 bad debt loss rate would have been 64bp, which is actually above the normal (or ‘through-the-cycle’) range that CFO Anna Cross pointed to in the 3Q22 management speech of 50bp to 60bp. Incidentally, I allow for a normalised bad debt loss rate in my valuation that is slightly above the top end of the CFO’s suggested range.

Source: Barclays 3Q22 Presentation, slide 10.

Ignoring the volatility during the pandemic, you can see that it has been around 50-60bps. Although this is sensitive to the portfolio mix, we think this is a reasonable range to be considering for our through-the- cycle loan loss rate.

Source: BCS 3Q22 Management Speech, page 9.

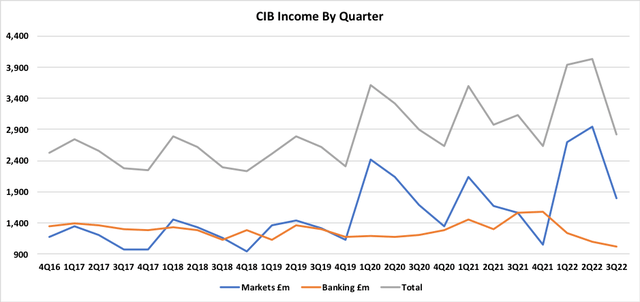

Markets Income

Markets income (reported in the Corporate & Investment Bank, CIB, which is a division of the Barclays International segment) has been high relative to historical levels. Chart 2 below plots quarterly income for CIB’s Markets and Banking reporting lines; the boost to Markets income relative to the pre-COVID-19 era is striking. At some point we will see a reduction in volatility in global markets and this will trigger a fall in Markets income. The timing of the fade in volatility is quite uncertain, but I am confident that it will occur. I’ve analysed the performance of BCS’s Markets income in previous articles (including my prior note published in July 2022) and I continue to allow for a material reduction in such earnings in my fundamental valuation of the bank. Whilst overall my view is that the sell-side is probably too bullish on Markets income, I think it is also important to recognise that BARC has done a good job in this area of the business.

Chart 2:

Source: Prepared by author based on Barclays financial reports.

Lazy Deposits

Banks are currently enjoying the benefit of higher interest rates. Part of this benefit comes from higher yields that are available on the bank’s own assets, and this aspect of the improvement in income should be durable. Another component of the income improvement has come from the fact that banks do not need to pass on the full benefit of higher interest rates to depositors. To the extent that customers typically maintain a certain level of day-to-day liquidity in non-interest paying accounts, some of this income benefit for banks will also be durable in nature.

In contrast to deposits relating to day-to-day liquidity needs, banks do tend to pass through higher interest rates, at least in part, to savings account customers – this is a competitive market after all. Industry commentary suggests that retail depositors have been somewhat slow to start moving their savings balances into higher interest rate product offerings; this could well be a behavioural hangover of the close-to-zero interest rate environment that persisted during the COVID-19 pandemic, when there was little financial benefit to be gained from shopping around for higher rates (moving from 0.1% to 0.2% hardly seemed worth the bother to many people). At some point I expect this ‘lazy money’ to wake up to the opportunity cost of inaction and move into products that offer higher interest rates – this will be a headwind for future bank net interest margin expansion.

Expenses & FX

Inflationary pressures imply that the uncertainty regarding future expenses is much higher than normal. Consensus forecasts regarding banking operating expenses therefore have potential to be considerably more ‘wrong’ and subject to subsequent revision than we might ordinarily expect. Throw into the mix foreign exchange rate volatility, and forecasting expenses for an international bank such as BCS becomes something of a guessing game.

Tax-Grabs

Bank-bashing is part of the political landscape in many countries. Safe in the knowledge that a voter backlash is highly unlikely, it is tempting for governments seeking to fill budget holes to target banks for sector-specific tax-grabs. Spain and Hungary have already announced ‘windfall tax’ regimes for banks, and it would not be at all surprising if other governments make similar moves. For markets such as the UK and USA, where the imposition of government mandated product pricing controls is highly unlikely, banks may be able to gradually recover some of the earnings downside of windfall taxes by pulling price levers, but this tax-grab downside risk is well and truly on the table for BCS and peers.

Summary

Based on my fundamental analysis and valuation work, I continue to see significant upside in the BCS share price, and I maintain my rating of STRONG BUY. However, it is important to recognise the high degree of uncertainty regarding the earnings outlook for BCS and peer banks. Leverage to higher interest rates is an obvious bull point for the stock, but it is prudent to consider how much of this potential rate leverage will actually fall to the bottom-line.

Be the first to comment