Michael Vi

I was very outspoken about how Alex Karp conducted himself on the Q2 earnings call and changed the narrative around my investment thesis. I went from being ultra-bullish to neutral because I didn’t know how his message would be perceived. There is no need for me to wait until the 2022 results are released; I believe Palantir (NYSE:PLTR) is a strong buy for long-term investors willing to take on additional levels of risk. I recently increased my position in PLTR by 4.88%, and I am very bullish on not just their long-term prospects but the windfall of new deals that have been announced. PLTR is expanding its reach after announcing new commercial deals with Lockheed Martin (LMT), Tampa General Hospital, Cleveland Clinic, and Crisis 24, in addition to expanding its partnership with the CDC, the military, and the FDA. I believe that many investors can’t get past the black box stigma of PLTR, and are overlooking the fact that PLTR has developed multiple vertical platforms with its clients that can be monetized throughout their industries.

Palantir

Palantir is finishing 2022 strong, and it will be interesting to see what else is announced

PLTR has been on fire in Q4, announcing deals left and right. PLTR and Concordance Healthcare Solutions, one of the largest independent healthcare distributors in the U.S., announced a partnership to build a fully integrated medical supply chain ecosystem. PLTR continued its expansion in Australia as they partnered with WesTrac, a leading provider of heavy mobile equipment and aftermarket services to the Australian mining and construction sectors. PLTR and Tampa General Hospital announced a partnership where they will deploy data and analytics through a connected hospital platform. The Cleveland Clinic signed a 10-year agreement with PLTR to create a virtual command center that can improve patient flow management by bringing together patient data, necessary clinical procedures, and available resources. PLTR and Crisis24 signed a multi-million dollar long-term strategic partnership to transform security and risk management. Lastly, PLTR and LMT announced a collaboration to deliver modern software to support Navy combat systems.

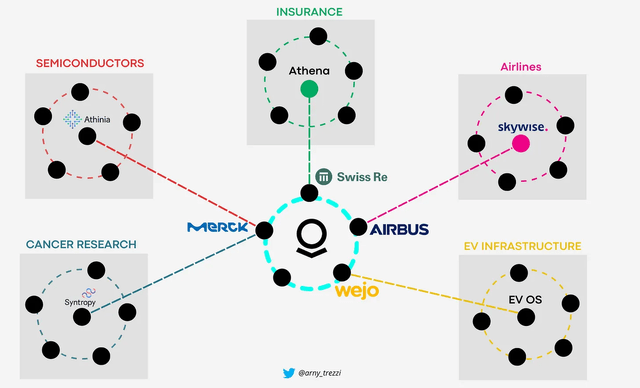

PLTR is a different type of company as they are not selling a software platform that confines clients to a box. PLTR has developed vertically integrated industry-specific platforms with its current partners, in addition to implementing their platforms within a client’s network infrastructure rather than developing a new platform. This allows PLTR to establish a foothold within specific sectors indirectly and generate additional revenue when other companies utilize their new systems. By partnering with companies such as Merck (MRK), Airbus (OTCPK:EADSF), and Hyundai Heavy, PLTR becomes entrenched in their industries. PLTR has dedicated software platforms (Foundry, Apollo, and Gotham) that can be adopted but, building out vertical platforms that can be marketed from within allows PLTR to drive incremental revenue as these systems grow.

On the government side, PLTR announced a $443 million dollar contract with the CDC over the next 5 years, a $22 million expansion with the FDA, and an $85.1 million contract over 5-years with the United States Army Material Command. PLTR continues to be a strong ally and partner to the U.S. government, and the government continues to expand its business with PLTR. The House just passed the annual National Defense Act in a 350-80 vote. On top of the $813 billion budget, an additional $45 billion bonus was authorized, which will be allocated toward research, development, test and evaluation, operation and maintenance, military construction, and defense-related nuclear programs. A total of $858 billion has been authorized for 2023, and PLTR is in prime position to have a larger portion flow into its coffers as its business operations with the U.S. government expand.

While I am excited about many things for PLTR, the partnership with LMT could be the most beneficial. We can’t quantify the impact yet, but LMT is one of the largest vendors to the DOD. PLTR has won countless contracts from the DOD over the years, and its systems are utilized for many mission-critical aspects. A successful joint venture with LMT could amplify these effects as it could entrench PLTR even further within the military-industrial complex. If the joint venture goes well, PLTR could win additional contracts because of the working relationship and network effects with LMT.

Building out 3 scenarios for PLTR and what I am basing my investment on

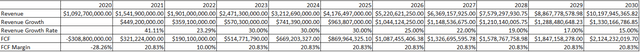

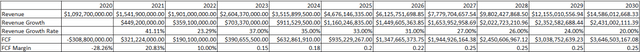

In this section, I am taking PLTR’s current data and building out 3 revenue and FCF projections for PLTR. These are my personal scenarios for what PLTR could achieve into 2023. I am providing a weak, moderate, and strong projection in my opinion so I can provide a range. Then I will explain how I am assigning the multiple and arriving at my possible valuation for PLTR.

Everything comes down to dollars and sense, and I am going to update my model once again. Unfortunately, there isn’t a perfect way to value companies, and everyone has their own method. My preference is basing projections on free cash flow (FCF) because $1 of revenue and $1 of Free Cash flow [FCF] equals $1 of revenue and $1 of FCF regardless of the company’s name or sector it does business in.

Every investment is the present value of all future cash flow. Therefore, as an investor, I factor into my investment thesis a company’s FCF valuation. I have discussed FCF for years because I feel one of the most important valuation metrics is the FCF to Market Cap multiple a company trades at. Coincidently this hasn’t been a widely discussed valuation metric. FCF represents a company’s cash after accounting for cash outflows to support operations. I like to use this metric rather than net income because FCF is a measure of profitability that excludes the non-cash expenses and includes spending on equipment and assets. It’s also a harder number to distort or manipulate due to how companies account for taxes, and other interest expenses. This is also the pool of capital companies utilize to pay back debt, reinvest in the business, pay dividends, buy back shares, and make acquisitions.

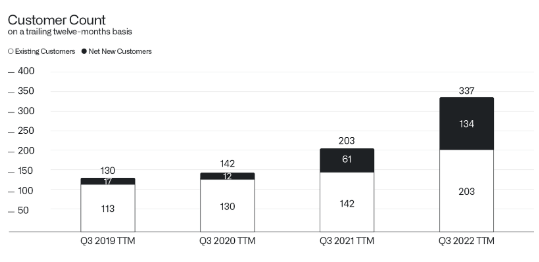

In 2021, PLTR ended the year generating $1.54 billion in revenue and $321.22 million of FCF for an FCF margin of 20.83%. PLTR is now guiding for $1.9 billion of revenue as its midpoint for the fiscal year of 2022. This is a YoY increase of $359.10 million, which is a 23.29% growth rate. PLTR’s FCF margin has declined in the first 9-months of operations from 21.07% in 2021 to 7.86% in 2022. In the first 9 months of operations in 2021, PLTR generated $1.11 billion of revenue and $233.64 million of FCF for a 21.07% FCF margin. YTD over the first 9 months of 2022, PLTR’s revenue has increased by 25.99% YoY ($288.23 million) to $1.4 billion, but its cash from operations has declined by -$95.45 million (-39.70%), and their CapEx has increased by $28.33 million (417.60%), placing its FCF at $109.87 million. PLTR’s FCF margin has declined by -13.20 percentage points to 7.86% from 21.07% YoY.

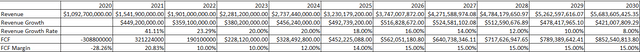

Scenario 1 – Poor Performance

PLTR’s growth has slowed, and its margins have compressed in 2022. What if it stays like this? Even though I have become bullish again, I need to prepare myself for an unfavorable outlook. In this scenario, I have PLTR’s revenue growth declining YoY and its FCF margin reaching 15% and never returning to a 20% plus environment. This would put PLTR’s revenue at $5.68 billion in 2030 and its annual FCF at $852.54 million.

Scenario 2 – Moderate Performance

In the second scenario, I have 2022 as an anomaly, returning to a 30% revenue growth environment in 2023 – 2025 then declining YoY to 15% in 2030. I kept PLTR’s FCF margin at its 2021 level of 20.83% from 2023 – 2030. If this occurs, PLTR would generate $10.2 billion in revenue and $2.12 billion of FCF in 2030.

Scenario 3 – Strong Performance

In my bullish scenario, I have PLTR growing at a strong rate of 37% in 2023, and not dropping below 30% YoY revenue growth until 2027. I also have PLTR pegged at a 25% FCF margin in 2030. In this scenario, PLTR would generate $14.59 billion of revenue and $3.65 billion of FCF in 2030.

Summary of the 3 Scenarios

Here are the ranges in my scenarios for PLTR in 2030

- Revenue $5.68 billion – $14.59 billion

- FCF $852.54 million – $3.65 billion

Please remember these are my projections, and we will need to see how the decade unfolds to see if any are accurate.

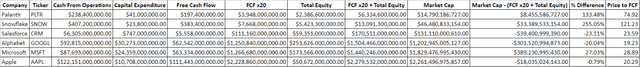

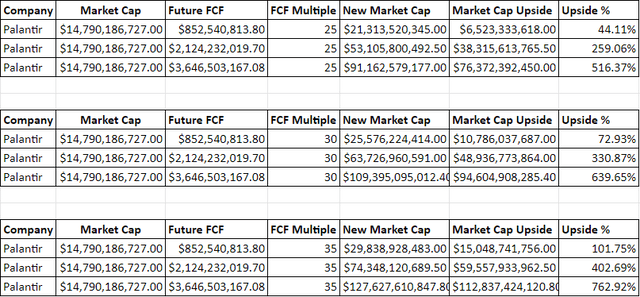

I built a valuation theory based on reverse engineering Apple’s (AAPL) market cap. I picked AAPL because it’s the most profitable company in the market, as it generated $99.8 billion of net income and $111.44 billion of FCF in 2022. If you take the equity on AAPL’s balance sheet and then put a 20x multiple on AAPL’s FCF and combine them, the valuation comes within 1% of AAPL’s market cap today. A few days ago it was a slight premium. I have decided to use AAPL as my baseline and look at companies based off the multiple AAPL is given. I am not saying this is the best way, but I am looking at it because the idea is to generate profits, and AAPL is the most profitable company. I am also looking at the entire company on a price-to-FCF methodology without taking equity into consideration as a secondary approach.

I built a table with AAPL, Microsoft (MSFT), Alphabet (GOOGL), Salesforce (CRM), Snowflake (SNOW), and PLTR. Today PLTR trades at a 133.48% premium to 20x FCF + its equity and a price to FCF multiple of 74.92x. AAPL is trading at a -0.79% discount to 20x FCF + its equity and a 20.29x FCF multiple. The range on FCF multiples for CRM, GOOGL, MSFT, and AAPL is 19.23x – 28.89x. I am looking at these multiples as what PLTR could grow into as their revenue and FCF increases based on mature tech companies.

Steven Fiorillo, Seeking Alpha

Looking at PLTR from a matured FCF multiple, I could see anywhere from 44.11% – 762.92% upside throughout this decade based on assumptions I have made. At a 25x FCF multiple, PLTR could have 44.11% – 516.37% upside. On a 30x FCF multiple PLTR could have 72.93% – 639.65% upside. If a 35x FCF multiple is assigned then the upside could be 101.75% – 762.92% based on my assumptions in 2030.

Conclusion

PLTR could disappoint, or they could outperform my bullish scenario. I have no idea what it will do this is why PLTR is a speculative investment on the growth side of my portfolio. I think PLTR has tremendous potential and, over the next several years, could see its margins expand and its revenue growth remains elevated. I also don’t think it’s unreasonable to think PLTR’s market cap has the potential to exceed $100 billion in 2030. As time progresses, I believe PLTR’s FCF multiple will come down, and its valuation will resemble a seasoned tech company rather than a growth company. I am bullish once again because PLTR continues to establish strong partnerships, and I believe their future could be very bright. Only time will tell, but I am stepping out of the neutral camp, and I think this is a good time to dollar cost average as 2023 and 2024 could be very strong years for PLTR.

Be the first to comment