Alex Wong/Getty Images News

Investment Thesis

In the face of a bear market and a 35% decline in the shares of Bank of America (NYSE:BAC), we argue now is the time to buy. With recession news swirling, Wall Street is selling cyclicals at a huge discount. Warren Buffett’s early mentor Benjamin Graham once advised:

The intelligent investor is a realist who sells to optimists and buys from pessimists.

Bank of America has had a turbulent past, but in the decade ahead, strong industry tailwinds and a low valuation could carry the company to a market-beating return of 11% per annum.

Higher Rates For Longer

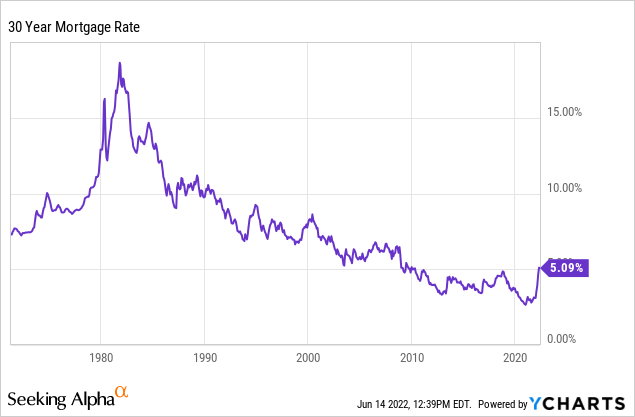

With mortgage rates rising in the United States and across the world, there is no better time than the present to hedge against higher rates. Interest is set to take a larger percentage of consumers’ disposable income in the years ahead. In fact, the 30-year mortgage rate hit a 50-year low in 2021. A reversion to the mean is coming, and banks are the beneficiary.

Why do we believe higher rates are sustainable? The American consumer has a strong balance sheet going into this rate increase. House debt to GDP has decreased significantly since the global financial crisis:

Household Debt To GDP (FRED Economic Data)

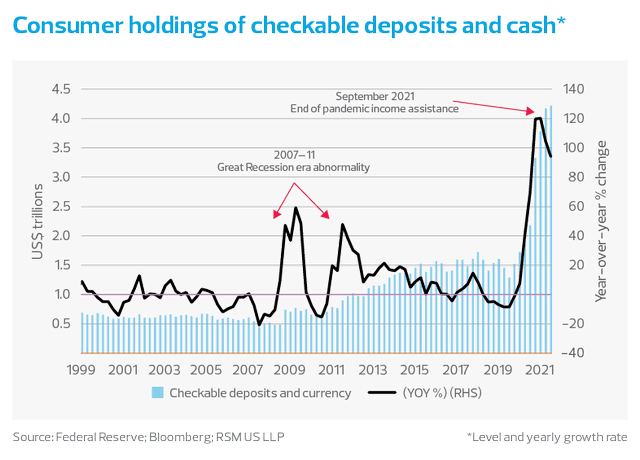

On top of this, consumers are still sitting on a lot of cash:

Cash Balances of U.S. Consumers (RSM)

Within the banking industry, there appears to be room for loan growth or higher interest rates in the decade ahead, maybe both.

A Comparative Analysis

| Bank of America (BAC) | JPMorgan Chase (JPM) | Wells Fargo (WFC) | Citigroup (C) | |

| ROE | 12% | 15% | 11% | 9% |

| P/B | 1.1 | 1.3 | 0.9 | 0.5 |

| P/E | 9 | 8 | 7 | 5 |

Source: Image created by author with data from Seeking Alpha

BAC boasts a very fair valuation. It is not as cheap as Wells Fargo and Citigroup, but there are reasons for that. The market is giving Bank of America a slight premium based on what is seen as a conservative loan portfolio. Bank of America is a well-run bank, with the second highest return on equity of its peers. The company has the backing of famed investor Warren Buffett, who owns a large equity stake that he began accumulating in 2011.

Let’s take a look at the competition. JPMorgan Chase has an industry-leading investment banking arm, which has resulted in its higher return on equity of late. JPM benefits from both a high and low interest rate environment, and sailed smoothly through the global financial crisis. Citigroup is undergoing structural changes and has had its valuation beaten down by Wall Street. Wells Fargo has had a turbulent past, suffering from poor management and declining book value.

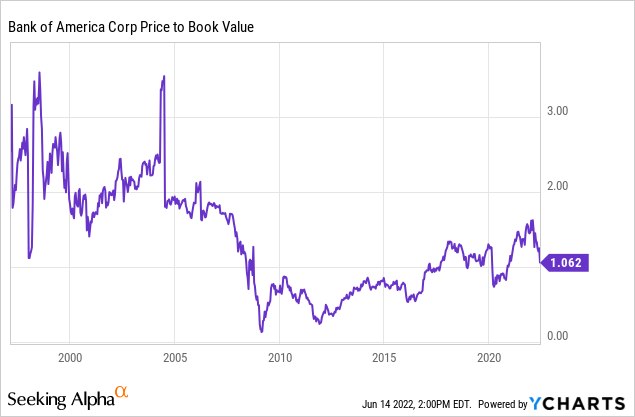

Bank of America shows strength as a Main Street banking institution. In the decades to come, Wells Fargo analyst Mike Mayo believes Bank of America is set to grow traditional banking revenue at a higher clip than its peers. BAC benefits when interest rates are around their 5000-year mean of 5%. During a period of normal interest rates, in the late ’90s and early ’00s, Bank of America traded at 2x book value:

Risks

In the short term, many are calling for a recession. U.S. banks are better capitalized now than they were in 2008, but Bank of America may have to build more loan-loss reserves. Under terrible economic conditions, poorly managed banks can fail. We do not see an over-leveraged consumer, but there are some localized issues in corporate debt. Sharply increased rates could hurt demand for new loans, especially if the economy continues to struggle.

A long period of low or negative rates could also hurt Bank of America in the longer term. When growth is stagnant, corporations and consumers are over leveraged, and interest rates are inadequate, banks struggle to grow as we have seen in Europe and Japan.

Valuation

The economy has been hot over the past year, and Bank of America may need to build its loan-loss reserves for the next recession. To normalize earnings, we have taken the average earnings of the past three years, which included a 2020 recession. On the current shares outstanding, that amounts to $3.02 per share.

Over the next decade, we believe BAC can grow its normalized earnings at 6% per annum, resulting in 2032 EPS of $5.41. Shareholders should benefit from moderately higher interest rates, loan growth, buybacks, and digitalized operations. As younger generations bank more on the company’s easy-to-use mobile app, costs are reduced.

Our 2032 price target is $73 per share, implying a return of 11% per annum with dividends reinvested. A conservative terminal multiple of 13.5 has been applied, which is appropriate for this level of growth. If managed properly, Bank of America should withstand economic change and deliver cash to shareholders for decades to come.

Conclusion

The bear market has presented the intelligent investor with an opportunity. Should rates revert to their 5000-year mean, Bank of America will be the beneficiary. We see a resilient American consumer that can afford to pay more interest in the decade ahead. BAC has a fair valuation and enduring industry tailwinds. If Brain Moynihan can navigate the risks ahead, we see a return of 11% per annum for long-term investors.

Agree with the Macro, but uncertain about the Micro? Check on my article on the Vanguard Financials ETF (VFH), VFH: Financials Set To Outperform.

Be the first to comment