MarsBars

Social Security is otherwise known as America’s pension plan. The self-employed, big employers and their employees dutifully contribute to the plan on a recurring basis, with the expectation that the program will help fund living expenses in their retirement years.

However, the solvency of the program is up for perennial debate. This includes a 2020 report from the Social Security Board of Trustees, which estimated that there will be a $16.8 billion funding shortfall between 2035 and 2094, which could result benefits cuts in 15 years should this issue be left unresolved.

That’s why I wouldn’t count too much on Social Security and would rather focus capital on putting money to work in income generating investments. Here are two high yielding names that could help existing retirees and those planning for retirement.

Pick #1: Verizon

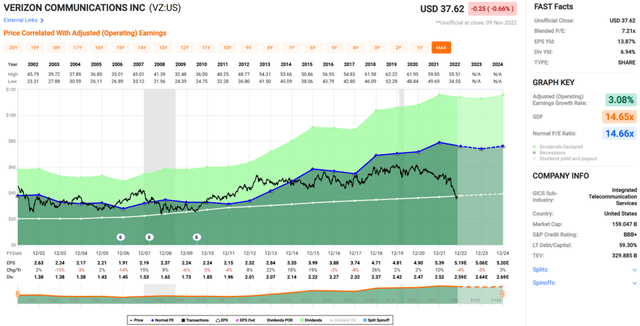

Verizon (VZ) may be an ideal high yielding buy for conservative investors. It currently yields a historically high 6.9% dividend yield that’s well covered by a 49% payout ratio. While its dividend growth isn’t high, with a 5-year CAGR of just 2.1%, it does have a long track record of growing its payout over 18 consecutive years. Plus, I believe the high starting yield more than makes up for the low dividend growth rate.

Verizon has gotten cheap over investor concerns on price competition from the likes of AT&T (T) and T-Mobile (TMUS). However, it shouldn’t be ignored that Verizon has a solid reputation with enterprise customers. It was the addition of business accounts that helped Verizon achieve a net 8,000 additional postpaid customer adds during the third quarter.

Looking long-term, I believe the big 3 carriers are going to be rational in their pricing, especially since T-Mobile merged with Sprint, thereby removing 1 competitor off the table. Plus, Verizon recently announced a first of its kind partnership with Apple (AAPL), introducing an unlimited bundle in which Verizon customers have access to Apple services all under one subscription. Moreover, fixed wireless is still in its nascent stages, and gives Verizon a long-term growth opportunity to take market share away from Comcast (CMCSA) and Charter Communications (CHTR) in the home broadband segment.

Lastly, Verizon is rather cheap at the current price of $37.62 with a blended PE of just 7.2x, sitting well below its normal PE of 14.7. Analysts have an average price target of $45.90, implying potential for double digit returns especially when factoring in the generous dividend yield.

Pick #2: Starwood Property Trust

For those investors with a little more appetite for risk and a higher yield, Starwood Property Trust (STWD) should be considered. STWD is a commercial mortgage REIT that’s survived multiple real estate cycles since its founding in 1991. It’s led by long-time Chairman and CEO, Barry Sternlicht. Since inception, STWD has deployed $93 billion in capital and manages a portfolio of over $27 billion across debt and equity investments.

STWD’s business model is rather diverse, as it’s more than just a commercial mortgage shop, with ownership in physical real estate, and residential and infrastructure lending arms. Nonetheless, commercial lending represents over half of the portfolio, and is well-diversified across multifamily, office, hotels, retail, and mixed use. This segment is conservatively managed with a 61% weighted average loan-to-value, helping to ensure that borrowers have significant skin in the game.

Meanwhile, STWD just closed a strong third quarter, with $1.3 billion in investment activity, including $0.9 billion in commercial lending, all of which were floating rate, which is helpful in a rising rate environment. Also encouraging, undepreciated book value increased by 0.18 quarter on quarter to $21.69, which means that STWD is currently trading at a 6% discount at the current price of $20.39.

Importantly, STWD’s $0.48 quarterly dividend is well-covered by distributable earnings of $0.51 during the third quarter, and it’s modestly leveraged at a debt to equity ratio of 2.4x, with $1.3 billion available liquidity to take advantage of opportunistic growth.

As such, I find STWD to be attractively priced at the aforementioned discount to undepreciated book value. Analysts have a consensus Buy rating with an average price target of $25, implying potential strong double digit total returns.

Investor Takeaway

It’s hard to predict where Social Security will be years from now. Rather than wishing and hoping that it will be there when one retires, investors may want to consider stocks that generate income now and into the future. I believe VZ and STWD are two good starting points for a well-diversified income portfolio, generating high dividends for potential partial income replacement now and down the line into one’s retirement years.

Be the first to comment