wisanuboonrawd/iStock via Getty Images

Co-produced with Treading Softly.

How much do you know about Yellowstone park? One fact that seems to be common is the knowledge of “Old Faithful.” It’s a geyser that shoots off hot steam on a recurring basis. About every 91 minutes, Old Faithful erupts for 90 seconds to 5 minutes.

It has been doing this for a long, long time. Something you can essentially set your watch to and know will occur. Rarely can we find these recurring, reliable, and steady events in life. Even sunrise and sunset are adjusted every few days as the earth travels around the sun and wobbles on its own axis.

When it comes to investing, every portfolio needs to have a few of its own Old Faithfuls to keep it running on time. I like to call them foundational or anchor stocks, depending on the word picture we’re trying to paint.

Investments that will help you reliably meet your goals. Investments that do not need you to babysit them actively. Investments you can set and forget.

Management teams are exceptionally important to the success of a company or fund. So we want to focus on high-quality, skilled, and shareholder-friendly management teams.

So for income investors, we have two Old Faithful investments to look into today.

Let’s dive in

Pick #1: EPD – Yield 7.6%

Enterprise Products Partners L.P. (EPD) is a blue chip in the MLP sector. Energy can be a tough business, with “boom and bust” style cycles. When energy is profitable, politicians love to call it a “windfall.” When energy isn’t profitable, it’s a sector with a very high number of bankruptcies and pain for investors.

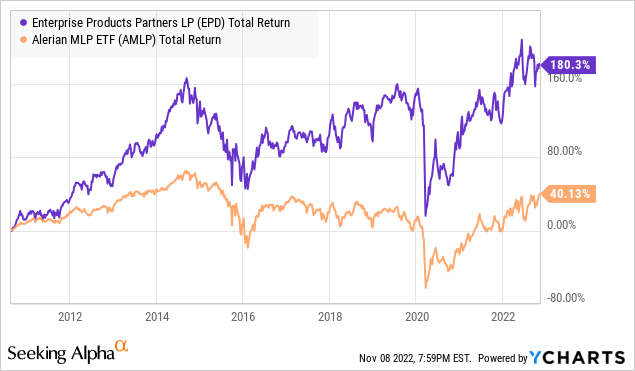

Having a high yield isn’t all that special. All MLPs have high yields. What makes EPD special, is that it has been able to hike its distribution every single year for 24 years. Over that period, EPD has been through some booms and several busts in the MLP sector.

Energy investors remember the pain in 2015 as commodity prices crashed and bankruptcies riddled the sector. They remember the COVID crash. EPD handily outperformed the Alerian MLP ETF (AMLP) through those tough times.

Today, things are different. In 2022, energy has been one of the strongest-performing sectors.

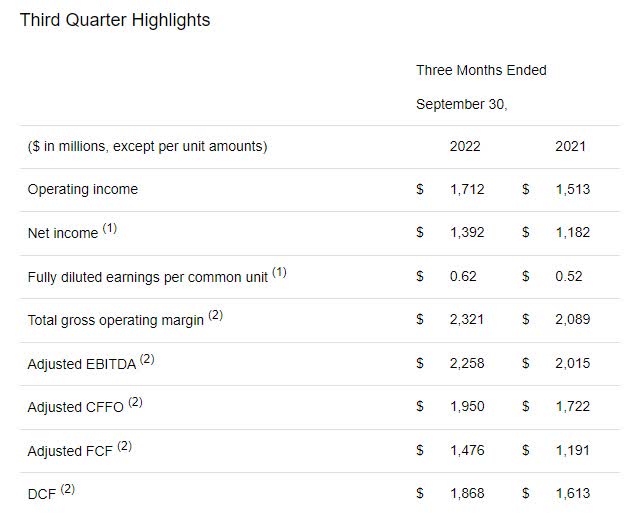

With the strength of the sector, it isn’t at all surprising that EPD continues to produce great earnings. Distributable cash flow increased 16% year over year, from $1.6 billion to $1.9 billion.

We could highlight everything that went up, but it will be a lot shorter for us to highlight the metrics that are down year over year: Nothing.

EPD Q3 2022 Earnings Press Release

Not a surprise, it is a great time to be in the energy industry and you can do well buying any MLP. So why buy EPD? Because we all know that good times aren’t going to last forever. Right now, making money operating an MLP is so easy that anyone could do it. Five years from now? That might be different.

So while we are riding the wave of good fortune for MLPs, we want to be invested in a company that we know can weather any nasty surprises. We want an investment that will provide us with a reliable and growing distribution today and tomorrow.

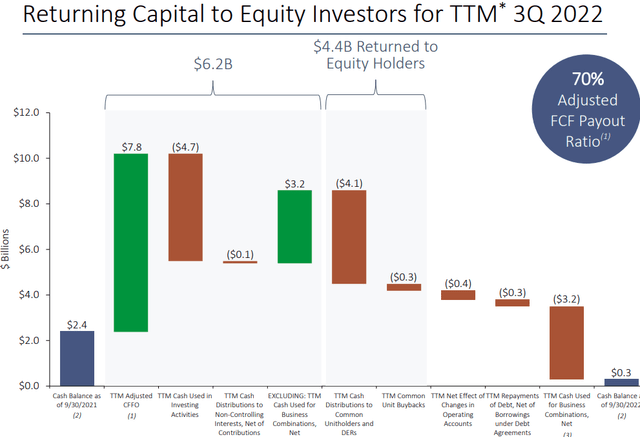

EPD’s DCF covers its distribution by 1.8x. This allows EPD to fund all of its capital expenditures with cash flow. It doesn’t have to tap the equity markets, it doesn’t have to take out debt to expand. It can tap the equity and debt markets only when it can do so at attractive prices – using cash flow from operations to fund the rest.

Despite a very conservative payout ratio, EPD is still returning an impressive $4.4 billion to equity holders over the past year. Source.

We expect that the energy bull market is far from over. Especially with natural gas, which EPD has significant exposure to. We can ride the bull as long as it can run with EPD, secure in the knowledge that the distribution is well-covered, will likely continue climbing every year, and that the company can weather any economic conditions.

Note: EPD issues a K-1 at tax time.

Pick #2: PDO – Yield 11.1%

Income investors love “special” dividends. I can’t blame them. You buy a company for the income, and then at the end of the year, you get an oversized payout. A little extra spending money for the holiday season or an extra dose of cash to reinvest when many others are “tax loss selling.”

The problem is that typically share prices increase after a special dividend is declared. Buyers will come in and bid up the price. If you wait until a special dividend is declared, you are likely too late to benefit from it. I can’t guarantee a special dividend, but we can look at the numbers and make an educated guess.

PIMCO Dynamic Income Opportunities Fund (PDO) is a prime candidate for a special dividend. Why?

- PIMCO has a history of issuing special dividends for funds when net investment income significantly exceeds the dividend.

- PDO had a special dividend last year, suggesting that PIMCO is following its historical strategy with PDO.

- PDO has substantial UNII (undistributed net investment income) and continues to cover its dividend by a significant amount.

- Our outlook is that PDO’s NII is likely to continue rising.

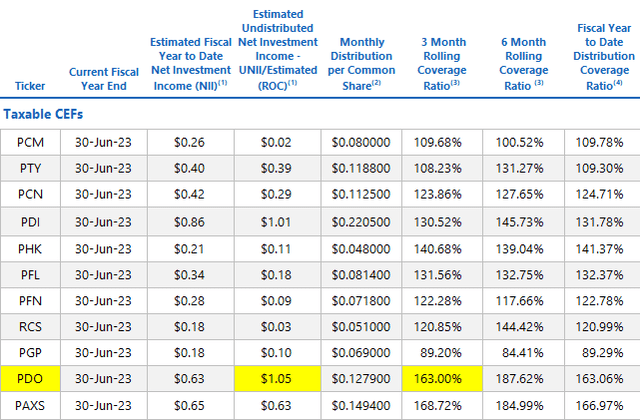

When we look at PIMCO’s UNII report, we can see that PDO is ahead of its peers with a UNII of $1.05. Another HDO holding, PIMCO Dynamic Income Fund (PDI), is on its heels at $1.01/share.

PDO has had 163% coverage in the past three months.

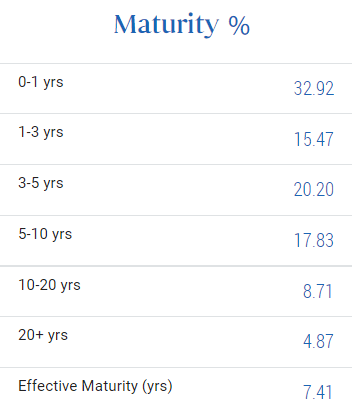

When we initially looked at PDO, we noted PDO’s short duration as a benefit:

The flexibility with PDO’s short duration will be very beneficial over the next 2-3 years and should give PDO a leg-up compared to other funds.

PDO’s dividend coverage and excess UNII are a byproduct of its shorter duration and a significant amount of near-term maturities.

PDO continues to have a duration of approximately 3.27 years, and with 1/3rd of its portfolio maturing within the next year, it will have significant capital to reinvest at higher interest rates.

PDO

Like several of PIMCO’s funds, PDO has a diverse array of investments with concentrations in non-agency mortgages and high-yield corporate credit. One area that is new to PDO is a significant increase in Commercial Mortgage Backed Securities. Which now make up nearly 18% of PDO’s portfolio.

PIMCO made its reputation by stepping in and buying residential mortgages at the height of the foreclosure crisis. They recognized the great opportunity when others were running in fear. Buying mortgages at steep discounts and realizing the great returns that others were throwing away.

These are stressful times for the bond markets. Rates are rising, prices are falling, and many investors are just throwing bonds in the trash out of fear. PIMCO is once again there, buying up assets at discounted prices. With significant maturities over the next year, PDO is well-positioned to have ample capital available to invest in opportunities as they arise.

We are happy to add shares of PDO, collecting a generous yield immediately, having a great chance of a special dividend in December, and benefiting over the long run from PIMCO’s superior management as they identify new opportunities in tumultuous bond markets.

Dreamstime

Conclusion

EPD and PDO are both run by excellent management teams that have a history of providing strong income to their shareholders. EPD has raised its distribution every year for decades. PDO is a newer fund on the block, but its management team from PIMCO has a long, storied history of running outstanding income-generating funds with market-beating returns.

These types of investments are ones that I like to place into the “Old Faithful” category in my portfolio. I own them, along with thousands of High Dividend Opportunities members. While I monitor all my investments, I do not stress that these reliable income-paying securities will stop soon.

They pay out month after month, quarter after quarter.

This reliability helps fuel my retirement income, which produces a significant side effect – reduced stress. Little in life is as stressful as finances can be when money is in short supply and expenses are plentiful. So to combat this, knowing how volatile the market can and will always be, I invest for reliable income. This way, no matter how much the market would be willing to buy out my entire portfolio for each day, I know how much it will continue to pay me for owning it.

This way, I can budget with confidence. I can buy groceries and not worry about next month’s income this month. This is a huge blessing when you are living on a fixed income and every dollar matters.

That’s a blessing that income investing provides! May you be blessed with it as well.

Be the first to comment