MattGush/iStock via Getty Images

Earnings of Banc of California (NYSE:BANC) will most probably surge this year due to subdued organic loan growth as well as the acquisition of Pacific Mercantile Bancorp late last year. Further, the margin will likely expand slightly as interest rates surge. Overall, I’m expecting Banc of California to report earnings of $2.02 per share for 2022, up 113% year-over-year. For 2023, I’m expecting earnings to grow by 3% to $2.08 per share. The year-end target price suggests a small upside from the current market price. Therefore, I’m adopting a hold rating on Banc of California.

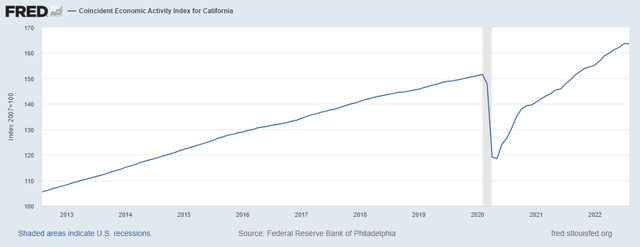

California’s Economic Activity to Sustain Organic Loan Growth

Banc of California’s loan portfolio grew by 2.8% in the first half of 2022, which is not too bad given the company’s history of low organic growth. Going forward, loan growth will likely continue at the first half’s rate. This is because I’m expecting strong economic activity to counter the effect of high borrowing costs on credit demand.

As its name suggests, Banc of California operates throughout the state of California. However, its branch network is mostly concentrated in Southern California, from San Diego to Santa Barbara. Residential loans make up a quarter of total loans, while commercial loans make up around three-quarters of total loans. The economic activity index’s trendline is currently steeper than it was before the pandemic, which shows that the economy is rapidly improving.

Federal Reserve Bank of Philadelphia

Further, the management mentioned in the latest conference call that it is continuing to make key hires in new verticals, which will also support loan growth.

Considering these factors, I’m expecting the loan portfolio to grow by 1.5% every quarter till the end of 2023. This will lead to a loan growth of 6% in 2022. However, the average loan balance will be 20% higher in 2022 relative to 2021 because of the acquisition of Pacific Mercantile Bancorp in October 2021.

Meanwhile, I’m expecting other balance sheet items to grow somewhat in line with loans. The following table shows my balance sheet estimates.

| FY18 | FY19 | FY20 | FY21 | FY22E | FY23E | |

| Financial Position | ||||||

| Net Loans | 7,639 | 5,894 | 5,817 | 7,159 | 7,580 | 8,045 |

| Growth of Net Loans | 15.6% | (22.8)% | (1.3)% | 23.1% | 5.9% | 6.1% |

| Other Earning Assets | 2,370 | 1,280 | 1,415 | 1,502 | 1,415 | 1,458 |

| Deposits | 7,917 | 5,427 | 6,086 | 7,439 | 7,788 | 8,266 |

| Borrowings and Sub-Debt | 1,696 | 1,398 | 822 | 820 | 939 | 967 |

| Common equity | 714 | 717 | 712 | 970 | 997 | 1,109 |

| Book Value Per Share ($) | 14.2 | 14.3 | 14.3 | 16.0 | 16.3 | 18.1 |

| Tangible BVPS ($) | 13.3 | 13.5 | 13.5 | 14.3 | 14.7 | 16.5 |

|

Source: SEC Filings, Author’s Estimates (In USD million unless otherwise specified) |

Margin Barely Sensitive to Rate Changes

Variable-rate loans made up 37% of total loans at the end of June 2022, as mentioned in the latest earnings presentation. In comparison, variable-rate deposits, namely savings, money-market, and interest-bearing checking made up 54% of total deposits, according to details given in the 10-Q filing. Nevertheless, loan repricing will most probably outweigh deposit repricing because Banc of California has a lot of pricing power when it comes to deposits. This is because there is high liquidity in the banking industry following the pandemic-related government payments.

The results of the management’s interest-rate sensitivity analysis given in the 10-Q filing show that a 200-basis points hike in interest rates could boost the net interest income by only 2.1% over twelve months. This analysis is based on the balance sheet as of June 30, 2022. Changes in the balance sheet will provide further opportunities to increase the margin. Banc of California will likely originate new loans at a higher yield than the existing portfolio average. Therefore, loan additions will lift the average earning-asset yield in the coming quarters. The management also mentioned in the conference call that new loan production in the third quarter should expand the margin.

On the other hand, the management is planning to grow certificates of deposit balances so it can lock in rates ahead of the upcoming interest rate hikes, as mentioned in the conference call. This action will lead to a big jump in deposit costs in the third quarter, and smaller increases subsequently.

Overall, I’m expecting the margin to grow by ten basis points in the second half of 2022 and another ten basis points in 2023.

High Inflation to Reverse Some of the Recent Asset Quality Gains

Banc of California reported a large provisioning reversal of $31.5 million in the first half of 2022. Asset quality improved substantially as non-performing loans were down to 0.6% of total loans at the end of June 2022 from 0.86% at the end of June 2021, as mentioned in the presentation. As a result, the allowance to non-performing loan ratio has improved from 155% at the end of June 2021 to 224% at the end of June 2022.

I’m expecting this trend to reverse and non-performing loans to increase in the remainder of the year due to high inflation and the resultant financial stress for borrowers. Hence, the allowance coverage will probably revert to last year’s level, which is still comfortable. I don’t think high inflation will force the company to substantially increase its allowances for expected loan losses.

Overall, I’m expecting the net provision expense to make up 0.17% of total loans (annualized) every quarter till the end of 2023. In comparison, the net provision expense averaged 0.36% of total loans in the last five years.

Expecting Earnings to Surge by 113%

As this year’s average loan balance will be much higher than last year, earnings will also be higher. Further, some margin expansion will support the bottom line. Moreover, the recent acquisition of Deepstack Technologies will boost non-interest income.

On the other hand, inflation-driven strong growth in non-interest expenses will restrict earnings growth. Non-interest expenses will also rise temporarily due to around $1.5 million worth of closing costs for the Deepstack transaction, as mentioned in the acquisition presentation. Further, the management mentioned in the conference call that it plans to invest in some corporate initiatives.

Overall, I’m expecting Banc of California to report earnings of $2.02 per share for 2022, up 113% year-over-year. For 2023, I’m expecting earnings to grow by 3% to $2.08 per share. The following table shows my income statement estimates.

| FY18 | FY19 | FY20 | FY21 | FY22E | FY23E | |||||

| Income Statement | ||||||||||

| Net interest income | 286 | 248 | 225 | 254 | 317 | 348 | ||||

| Provision for loan losses | 30 | 36 | 30 | 7 | (25) | 14 | ||||

| Non-interest income | 24 | 12 | 19 | 19 | 29 | 32 | ||||

| Non-interest expense | 233 | 196 | 199 | 183 | 191 | 191 | ||||

| Net income – Class A | 23 | 3 | (1) | 50 | 124 | 127 | ||||

| EPS – Diluted -Class A ($) | 0.45 | 0.05 | -0.02 | 0.95 | 2.02 | 2.08 | ||||

|

Source: SEC Filings, Earnings Releases, Author’s Estimates (In USD million unless otherwise specified) |

||||||||||

Actual earnings may differ materially from estimates because of the risks and uncertainties related to inflation, and consequently the timing and magnitude of interest rate hikes. Further, a stronger or longer-than-anticipated recession can increase the provisioning for expected loan losses beyond my estimates.

Adopting a Hold Rating

Banc of California is offering a dividend yield of 1.4% at the current quarterly dividend rate of $0.06 per share. The earnings and dividend estimates suggest a payout ratio of 11.5% for 2023, which is below the historical average. Nevertheless, I’m not expecting an increase in the dividend level as the company does not regularly change its dividend.

I’m using the historical price-to-tangible book (“P/TB”) and the peer price-to-earnings (“P/E”) multiples to value Banc of California. The stock has traded at an average P/TB ratio of 1.17 in the past, as shown below.

| FY18 | FY19 | FY20 | FY21 | Average | ||

| T. Book Value per Share ($) | 13.3 | 13.5 | 13.5 | 14.3 | ||

| Average Market Price ($) | 18.9 | 14.6 | 12.1 | 18.5 | ||

| Historical P/TB | 1.42x | 1.09x | 0.90x | 1.29x | 1.17x | |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/TB multiple with the forecast tangible book value per share of $14.7 gives a target price of $17.2 for the end of 2022. This price target implies a 1.9% upside from the October 5 closing price. The following table shows the sensitivity of the target price to the P/TB ratio.

| P/TB Multiple | 0.97x | 1.07x | 1.17x | 1.27x | 1.37x |

| TBVPS – Dec 2022 ($) | 14.7 | 14.7 | 14.7 | 14.7 | 14.7 |

| Target Price ($) | 14.3 | 15.8 | 17.2 | 18.7 | 20.2 |

| Market Price ($) | 16.9 | 16.9 | 16.9 | 16.9 | 16.9 |

| Upside/(Downside) | (15.5)% | (6.8)% | 1.9% | 10.6% | 19.3% |

| Source: Author’s Estimates |

Historically, Banc of California’s P/E multiple has been very erratic. Therefore, it’s best to take the peer average to value the company instead of the historical average. As of the close of October 5, the peer average P/E ratio was around 9.7x, as shown below.

Multiplying the average P/E multiple with the forecast earnings per share of $2.02 gives a target price of $19.6 for the end of 2022. This price target implies a 16.0% upside from the October 5 closing price. The following table shows the sensitivity of the target price to the P/E ratio.

| P/E Multiple | 7.7x | 8.7x | 9.7x | 10.7x | 11.7x |

| EPS 2022 ($) | 2.02 | 2.02 | 2.02 | 2.02 | 2.02 |

| Target Price ($) | 15.6 | 17.6 | 19.6 | 21.6 | 23.7 |

| Market Price ($) | 16.9 | 16.9 | 16.9 | 16.9 | 16.9 |

| Upside/(Downside) | (7.9)% | 4.1% | 16.0% | 28.0% | 40.0% |

| Source: Author’s Estimates |

Equally weighting the target prices from the two valuation methods gives a combined target price of $18.4, which implies a 9.0% upside from the current market price. Adding the forward dividend yield gives a total expected return of 10.4%. As this total expected return is not high enough for me, I’m adopting a hold rating on Banc of California.

Be the first to comment