Scharfsinn86

Note: I have covered Ballard Power Systems (NASDAQ:BLDP) previously, so investors should view this as an update to my earlier articles on the company.

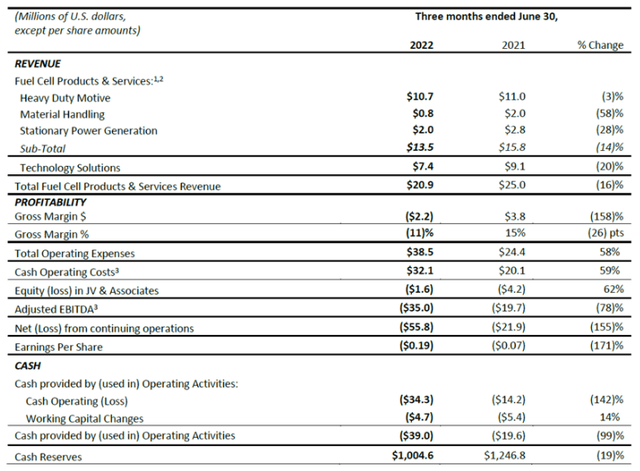

Earlier this month, leading Canadian fuel cell systems developer Ballard Power Systems (“Ballard” or “Ballard Power”) reported another set of disappointing quarterly results:

The company missed consensus expectations on both the top and the bottom line while gross margins moved further into negative territory:

We saw continued gross margin compression in the quarter and anticipate continued pressure throughout 2022, but we are confident in our plan to expand margins in the mid- to long-term as we transition to commercial scale production.

On the conference call, management attributed the ongoing margin deterioration to discounted product pricing in combination with inflationary pressures which resulted in already competitively priced backlog orders becoming unprofitable on a gross margin basis.

In the question-and-answer session, at least one analyst appeared perplexed by management’s admittance to material pricing concessions for its latest generation product platform:

Jeff Osborne

(…) I’m not sort of following, Randy, maybe I haven’t had enough coffee, but the move towards the new platforms, why do you need to discount? (…)

I’m just trying to understand why when a platform gets more energy dense, you need to lower the cost?

Randy MacEwen

Yes. No. It’s a discussion we’ve had with — particularly with the bus OEMs for some time, of leaning forward on the cost structure to make sure that the total value proposition for the bus operators and the OEMs work as well. And it’s not just us that’s been doing that, we’ve been seeing other participants in the value chain supporting this to get the demonstration fleets out in the marketplace. So I would say that’s part of it.

The other is just there is a cost required for these operators to transition from one product to the next product, and part of the way to help incentive them to move to that next product is the pricing strategy.

While quarterly cash usage of $65.0 million represented a new all-time high, the company still has approximately $1 billion in cash and cash equivalents, sufficient to fund the business for up to five years at the current pace of cash burn.

New order intake was highly disappointing as the company’s book-to-bill ratio dropped from approximately 1.3 in the first quarter to below 0.6 sequentially.

In Q2, Ballard delivered $20.9 million in revenue and secured new orders totaling $12.3 million. This activity translates to an order backlog of $91.2 million at the end of Q2. This is softer than planned, as a number of expected sizable orders have shifted out.

On the conference call, management blamed delays in fuel cell bus orders, as well as rail and stationary power applications but expected most of these opportunities to close over the next 12 months.

As a result, total order backlog was down by almost 10% quarter-over-quarter to $91.2 million, while the 12-month backlog decreased from $65.8 million to $61.4 million sequentially.

Even after a series of downward revisions over the past couple of months, the current 2022 consensus revenue estimate of $103.1 million appears way too high, particularly given the weakness of the near-term order book.

Quite frankly, I would be surprised to see sales exceeding $90 million this year which would calculate to an almost 15% year-over-year decrease.

In China, the company’s joint venture with Weichai Power (OTCPK:WEICF, OTCPK:WEICY) continues to suffer from a lack of clarity regarding the country’s new subsidy regime which has been exacerbated by COVID-related restrictions and lockdowns.

In Q2, sales of the joint venture were below $1 million, down almost 80% sequentially.

While Ballard Power has started the process to establish a small fuel cell module production facility in Oregon, management reiterated its intent to abstain from electrolyzer manufacturing and green hydrogen production for the time being:

Our view is that, that’s a fairly significant and demanding exercise, and there’s not a full 100% overlap in terms of the technology. And so for us, focusing on the fuel cell market opportunity and driving success there is important.

Bottom Line

No light at the end of the tunnel for Ballard Power shareholders as FY2022 is shaping up as an ugly combination of negative top-line growth and record cash usage of well above $200 million.

With no near-term prospects of achieving commercial scale, the company is basically back to what it has been for most of its existence, a provider of engineering solutions and custom-made fuel cell systems for all kinds of pilot projects.

While Ballard Power has sufficient liquidity for the next couple of years, near- and even medium-term business prospects appear far weaker than previously anticipated by market participants.

In contrast to Plug Power (PLUG), the company is unlikely to be a major beneficiary of the Inflation Reduction Act (“IRA”). That said, the IRA provides for an up to $40,000 Commercial Clean Vehicle credit for fleet operators which can be applied to fuel cell electric trucks and buses that are being tested and deployed around the U.S.

Given the company’s large cash balance of approximately $3.35 per share, I am keeping my rating at “hold” for now.

Be the first to comment