Yossakorn Kaewwannarat/iStock via Getty Images

Halozyme Therapeutics (NASDAQ:HALO) is in the process of integrating a significant recent acquisition into its business. Its Q2 2022 earnings call (the “Call“) provides a first look at this important transaction.

In this article, I evaluate the investment profile of Halozyme and its therapeutic delivery technologies. I report on how it has parlayed these technologies into existing and prospective growing revenues from multiple sources.

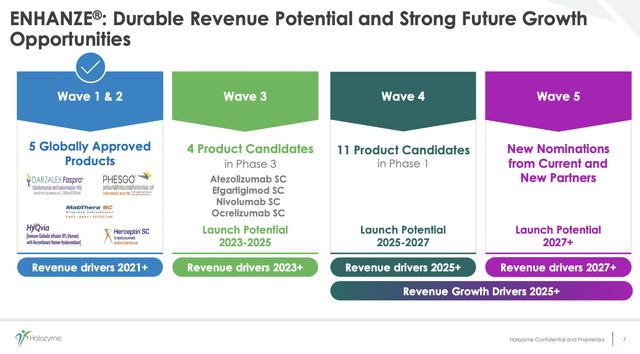

Halozyme has mapped out a future growth trajectory in waves taking it to 2027 and beyond

Halozyme’s Q2 2022 earnings presentation slide 7 below provides an overview of its anticipated growth drivers for its subcutaneous drug delivery technology:

ENHANZE future growth opportunities (s28.q4cdn.com)

The initial 2 waves reflect deals that are in hand for therapies that are globally approved. Wave 3 reflects less secure opportunities for therapies that are still in phase 3 development. Wave 4 includes 11 early-stage therapies that are in phase 1. The stated dates of launch potential are optimistic in my view particularly for phase 1 projects.

During the call, CEO Torley advised that mature Wave 1 therapeutics such as subcutaneous Herceptin and MabThera still produce meaningful revenues but are in modest decline. More encouragingly, wave 2 therapies in launch phase such as subcutaneous formulations of PHESGO and DARZALEX are growing nicely.

Not surprisingly where there is a choice between administering a therapy subcutaneously and by infusion, patients select subcutaneous by a wide margin. According to Q2 earnings presentation slide 8, DARZALEX FASPRO enjoyed an 83% share of total US DARZALEX sales in Q2 2022.

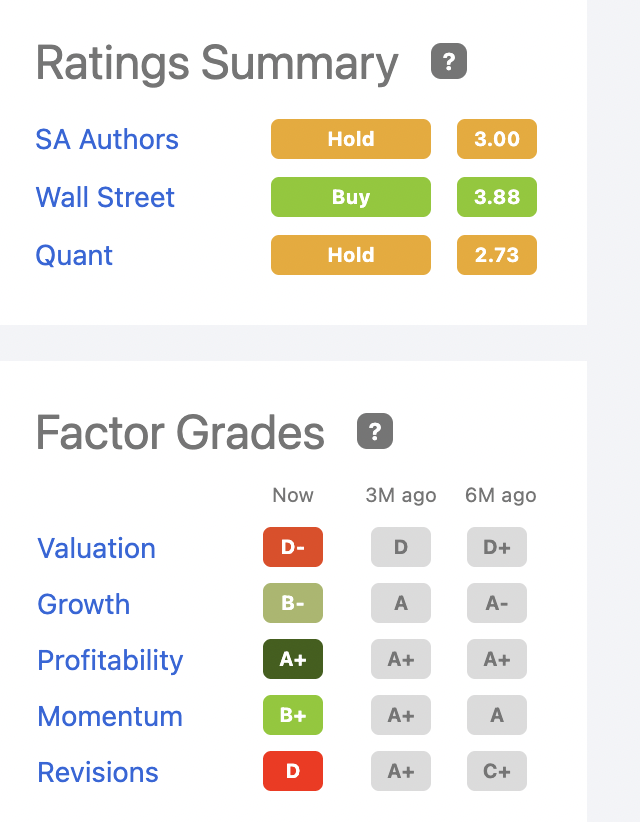

Slide 8 from this presentation shows more detail on four of its near-term Wave 3 growth drivers:

Halozyme’s subcutaneous drug delivery technologies have attracted significant deals with a wide spectrum of pharma players. In its Q2 2022 10-Q, it calls out 12 collaboration partners with heavyweight pharmas including the three listed in the slide above and others like Pfizer (PFE), AbbVie (ABBV), and Eli Lilly (LLY). Its 03/2022 deal with Roche (OTCQX:RHHBY) subsidiary Chugai is exemplary of its deal structure; it provided Halozyme $25 million upfront plus up to $160 million in development, regulatory, and sales-based milestones.

The 10-Q describes its ENHANZE technology as follows:

Our first commercially approved product, Hylenex® recombinant, (“Hylenex”), and our partners’ approved products and product candidates are based on rHuPH20, …[which] temporarily increases dispersion and absorption allowing for improved SC delivery of injectable biologics, such as monoclonal antibodies and other large therapeutic molecules, as well as small molecules and fluids. We refer to the application of rHuPH20 to facilitate the delivery of other drugs or fluids as our ENHANZE® drug delivery technology (“ENHANZE”). We license the ENHANZE technology to form collaborations with biopharmaceutical companies that develop or market drugs requiring or benefiting from injection via the SC route of administration. … data have been generated supporting the potential for ENHANZE to reduce patient treatment burden, as a result of shorter duration of SC administration. ENHANZE may enable fixed-dose SC dosing compared to weight-based dosing required for IV administration, and potentially allow for lower rates of infusion related reactions. ENHANZE may enable more flexible treatment options such as home administration by a healthcare professional or potentially the patient. Lastly, certain proprietary drugs co-formulated with ENHANZE have been granted additional exclusivity, extending the patent life of the product beyond the patent expiry of the proprietary IV drug.

This last-mentioned potential of extending a therapy’s patent expiry is highly significant. Such an extension alone could be worth the entire expensive endeavor of adding a subcutaneous option.

Halozyme makes for an attractive differentiated investment

Halozyme is like a selective biotech mutual fund in a single company. Its ENHANZE-based revenues from its impressive group of collaborators appear likely to grow nicely over time. This is a story that has been growing for a long time.

A sampling of the many deals listed in its Q2 10-Q (pp. 45-48) it has pulled in over the years includes:

- A December 2006 collaboration and license agreement granting Roche a worldwide license to develop and commercialize product combinations of rHuPH20 and up to twelve Roche target compounds, now including Herceptin SC, MabThera SC, TECENTRIQ, and OCREVUS among others; Roche has subsequently signed deals for up to three additional targets;

- a September 2007 collaboration and license agreement providing Baxalta a worldwide, exclusive license to develop and commercialize product combinations of rHuPH20 with GAMMAGARD LIQUID, now used in HYQVIA and others;

- a December 2012 collaboration and license agreement, granting Pfizer a worldwide license to develop and commercialize products combining its rHuPH20 enzyme with Pfizer proprietary biologics in primary care and specialty care indications; Pfizer has elected five targets and has returned two targets;

- a December 2014 collaboration and license agreement granting Johnson & Johnson’s (JNJ) Janssen a worldwide license to develop and commercialize products combining rHuPH20 enzyme with Janssen proprietary biologics directed to up to five targets, now including DARZALEX FASPRO in multiple indications;

- a December 2015 collaboration and license agreement granting Lilly the worldwide license to develop and commercialize rHuPH20 enzyme with Lilly proprietary biologics directed to up to five targets.

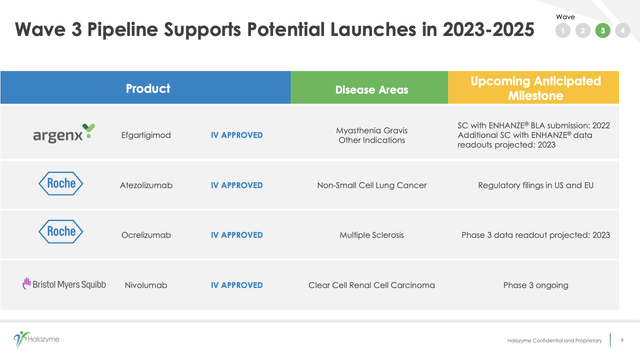

Slide 6 below from the presentation describes Halozyme’s general deal structure for its ENHANZE collaborations:

Those mid-single digit royalties are a major attraction. Single digits may not be much on one therapy. However, when you add them to a growing list of therapies, it becomes quite significant.

Beyond its ENHANZE-based collaborations, it also has several collaborations that it labels as device collaborations in its 10-Q. These include deals that it acquired with its Antares acquisition, described in Antares final 10-Q inter alia as several deals with Teva (TEVA) including:

- generic equivalents of EpiPen and EpiPen Jr.

- generic equivalent to Imitrex’s STATdose Pen, single-dose pre-filled syringe auto-injectors for acute treatment of headaches

- multi-dose pen used in Teva’s generic teriparatide product

Halozyme’s Antares acquisition ushers in a new era

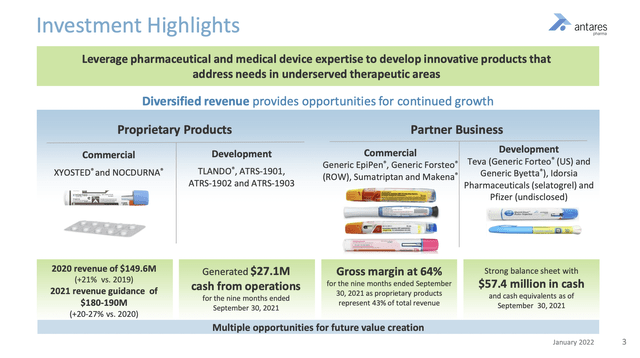

In 05/2022, Halozyme closed on its $1 billion acquisition of Antares Pharma. The acquisition increased Halozyme’s growth profile by adding products as described in Antares’ 01/2022 investor presentation below:

During the Call, CEO Torley reported that at the 90-day mark the acquisition was proceeding according to plan. She stated that the acquisition:

…further expanded our growth opportunities, adding a best-in-class auto-injector vector platform and a specialty commercial business, thereby augmenting Halozyme’s strategy.

These additions further strengthened our position as a leading drug delivery company and expanded our strategy to include specialty products. And we continue to deliver operational excellence, achieving multiple drug delivery, commercial and corporate development milestones.

… It is this combination of opportunity and execution that gives us confidence in our differentiated growth story.

From a development standpoint, she touted their joint teams pursuing a large scale subcutaneous delivery system to provide subcutaneous drug delivery across a spectrum of disease areas. The project combines the innovative Antares auto-injector platform with Halozyme’s ENHANZE technology enabling subcutaneous delivery of IV drugs. It is being developed to work with small molecule drugs and for biologics.

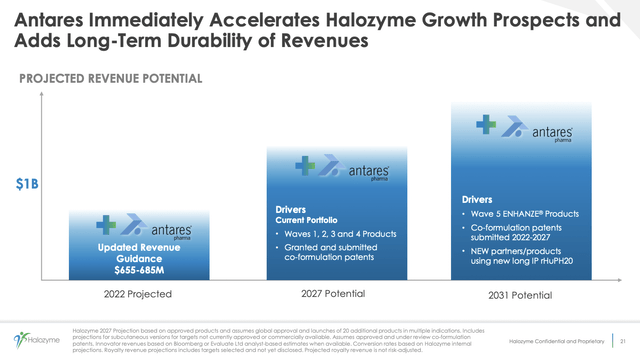

During the Call, Halozyme revised its previous guidance from its prior range of $530 million to $560 million to a new range of $655 million to $685 million. This represents a growth of 48% to 55% over 2021 total revenue of ~$443 million. From midpoint of the prior guidance to midpoint of the new guidance, this represents an increase of $105 million.

This increase reflects not only 2+ full quarters of Antares revenue but also stronger year to date Halozyme performance. Halozyme’s slide 21 below from its Q2 2022 presentation describes the synergistic confluence of the combined companies:

Conclusion

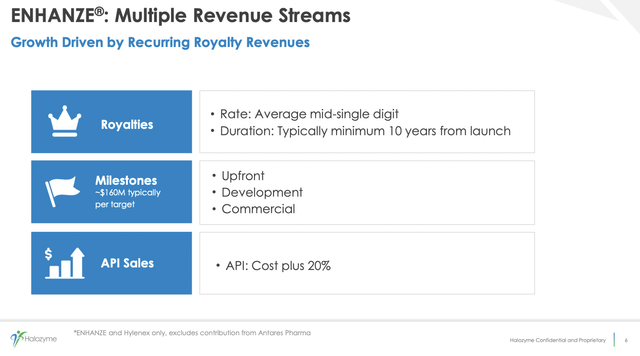

I am attracted to Halozyme by its prospects of generating diverse growing revenues from sundry therapeutics over an extended period. Its current ratings as shown below from Seeking Alpha’s ratings page are decidedly middling:

seekingalpha

I view it as a long-term play. Its D- valuation holds me back from investing more than a nominal sum in the near term. However, I do view this as a definite buy and I expect to acquire additional shares gradually on pullbacks.

Be the first to comment