Nikada/E+ via Getty Images

Looking for new ideas for your income portfolio? You may want to check out B. Riley Financial (NASDAQ:RILY), an investment bank/merchant bank which utilizes its balance sheet to create fees, to create investment opportunities and make money for clients and shareholders.

You may never have heard of this company, but RILY ranked No. 2 on Fortune Magazine’s fastest growing companies list for 2021, which ranks the top performing publicly-traded companies based on revenue, profits and total returns over the three-year period ending June 30, 2021.

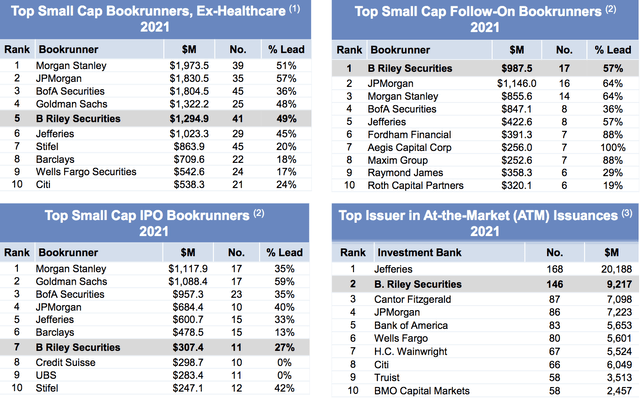

RILY has a strong franchise in the small cap arena: It placed No. 1 in small cap bookrunning, and No. 2 in At-The-Market issuances in 2021, and was also in the top 10 for small-cap IPOs and ATM issuances.

RILY site

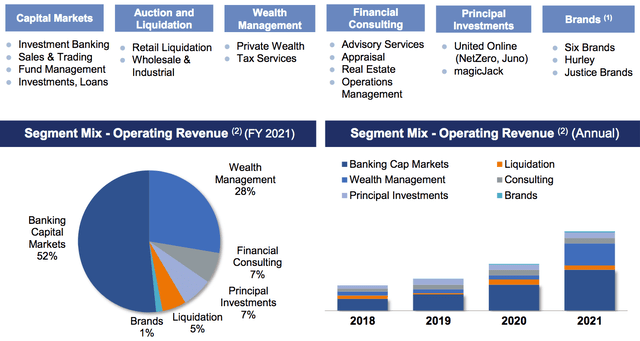

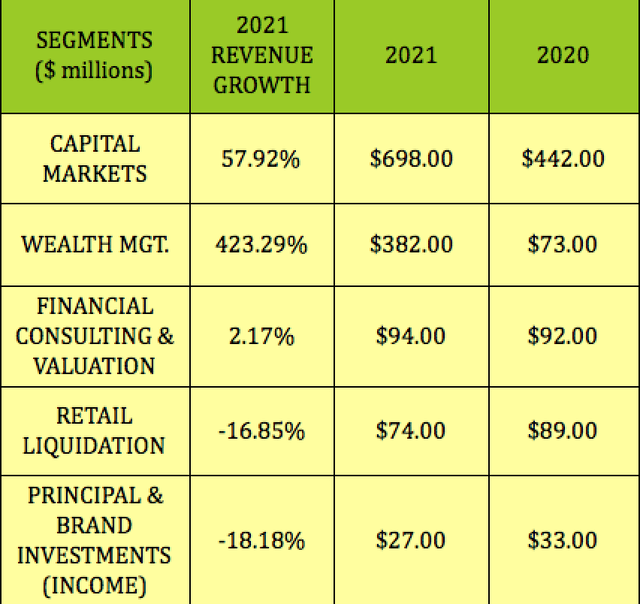

RILY’s main segments are Capital Markets, with 52% of 2021 revenue, and Wealth Management, with 28%. It’s also active in Financial Consulting, Principal Investments, Liquidations, and Brand Investments. It owns United Online, and 40% in of MagicJack, both of which provide ongoing earnings for RILY.

RILY site

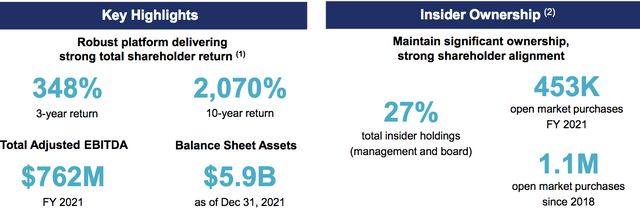

With such scant coverage in the media, you may be tempted to think that RILY was a small, backstreet firm, but it’s far from that:

RILY was founded in 1997, and publicly listed in 2014. It has 200 offices across the US, with 2000 employees, and 20 years of continuous growth.

Insiders Buying:

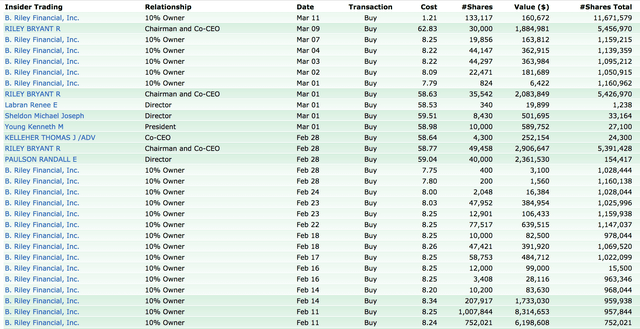

The firm also has significant insider ownership, at 27%, with 457,000 shares bought in 2021.

RILY site

That pattern has continued in 2021, with ~441,000 shares bought in March, and ~2.38M bought in February by the firm and insiders:

FVZ

Earnings:

RILY has acquired several companies, such as National, FocalPoint, and Great American Group, which is primarily a retail liquidation business.

It also purchased four telecom and communication assets, two wealth management businesses, a forensic accounting litigation support restructuring business, a portfolio of retail brand licenses, a loan receivables, portfolio, and several smaller complementary assets.

Management has moved to diversify RILY’s operations more toward complementary businesses which are cash flow generative and mostly uncorrelated assets, which also can have the effect of offsetting growth headwinds.

This was in evidence in 2021, when RILY’s two biggest segments, Capital Markets and Wealth Management, both had very strong growth, at ~58% and 423%, respectively. Financial Consulting was up 2%, but Retail Liquidation was down ~-17%, and Principal & Brand Investment Income was down -18%.

Hidden Dividend Stocks Plus

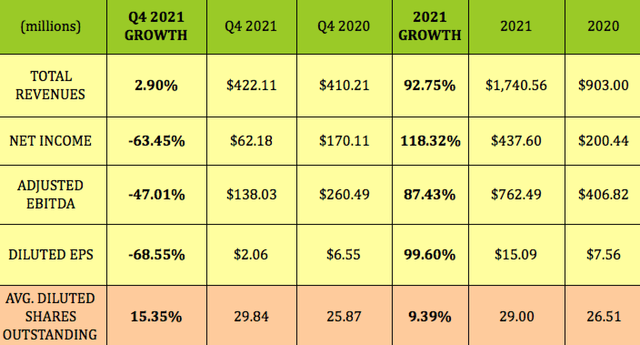

While overall revenue was up ~3%, the capital markets slowed significantly in Q4 ’21, with IPOs, secondaries and SPAC offerings coming to a halt over the last two months. which led to lower net income, EBITDA, and EPS vs. Q4 ’20.

Looking at the full year of 2021 shows very strong growth across the board, with revenue up ~93%, net income up 118%, EBITDA up 87%, and EPS up ~100%, even with 9.39% growth in the share count.

Hidden Dividend Stocks Plus

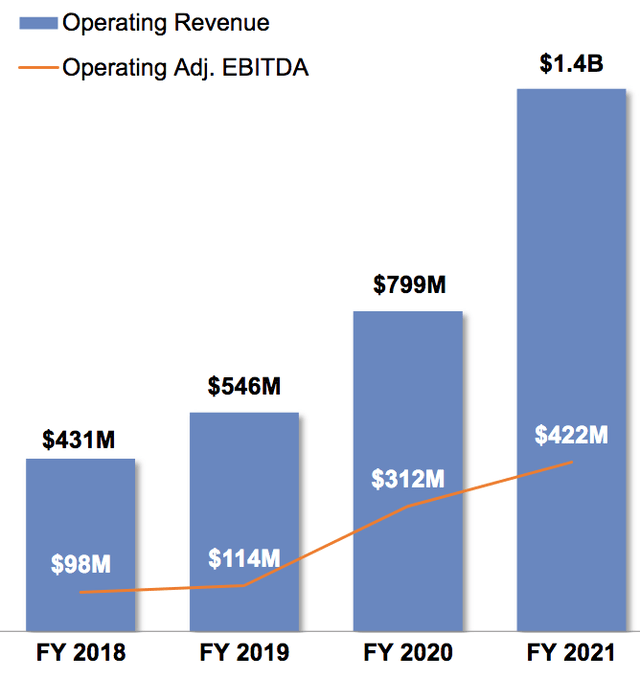

Looking back further, you can see strong revenue and EBITDA growth in 2019 and 2020, which really took off in 2021:

RILY site

Dividends:

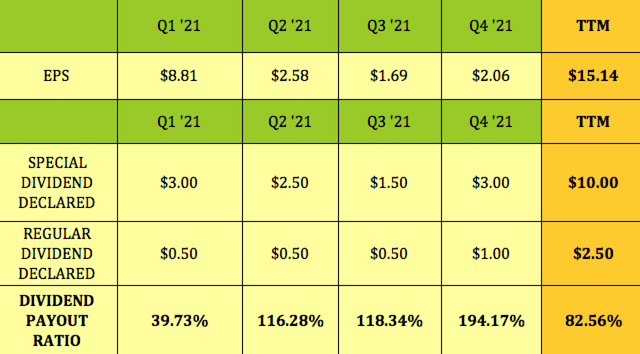

One feature of RILY’s business model is that it has episodic windfalls, which can lead to special dividends. This was the case in 2021, during which RILY paid out $10.00/share in special dividends.

Management then raised the regular quarterly dividend by 100% in Q4 ’21, from $.50 to $1.00:

Hidden Dividend Stocks Plus

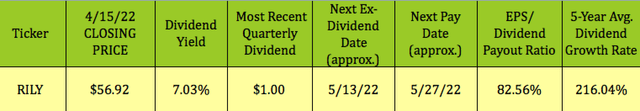

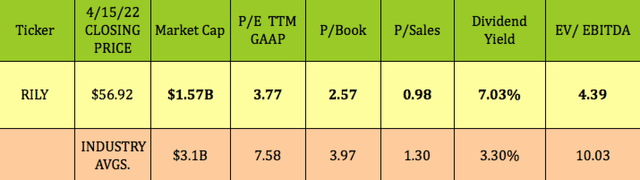

At its 4/15/22 closing price of $56.92, RILY yields 7.03%, with an 82.56% dividend payout ratio, due to the $10.00 in special dividends it paid out in 2021. On a regular dividend basis, its trailing dividend payout ratio is just 16.5%. It should go ex-dividend next on ~5/13/22.

That huge 216% five-year dividend growth figure is mainly due to the $10.00 in special dividends in 2021. But, even if we strip out those dividends, the five-year dividend growth rate is ~65%.

Hidden Dividend Stocks Plus

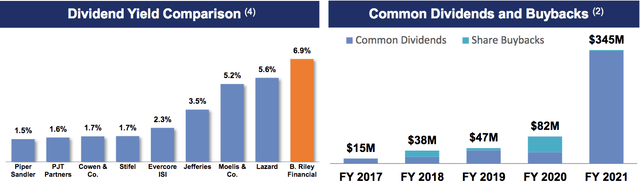

Compared to its peers, RILY’s dividend yield is at the top of the heap, ~7%, vs. the nearest yield of Lazard (LAZ) at 5.6%. The combo of dividends and buybacks quadrupled in 2021, to $345M:

RILY site

Profitability and Leverage:

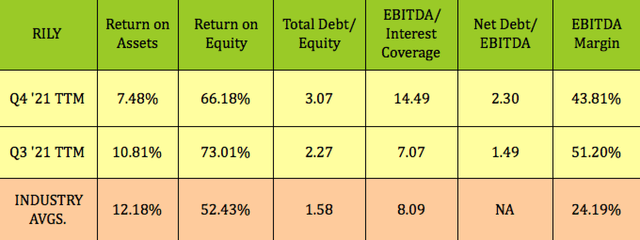

While Q4 ’21 ROA and ROE wasn’t as strong as in Q3 ’21, RILY’s ROE and EBITDA margin remained higher than its peers. Debt leverage increased in Q4 ’21, while interest coverage soared.

Hidden Dividend Stocks Plus

Debt and Liquidity:

In June 2021, RILY closed a deal for a four-year $200.0 million secured term loan credit facility from Nomura and Wells Fargo, and a four-year $80.0 million revolving loan credit facility. In December 2021, RILY entered into a Second Incremental Amendment to the Credit Agreement for an additional $100M.

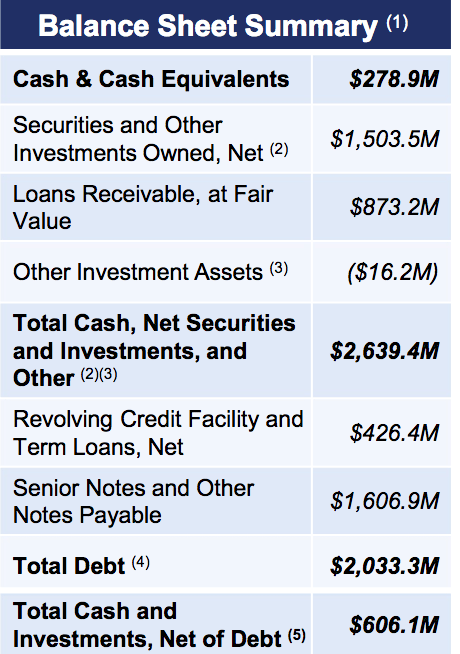

RILY had $279M in cash and ~$27M of availability under its credit facilities, as of 12/31/22.

RILY site

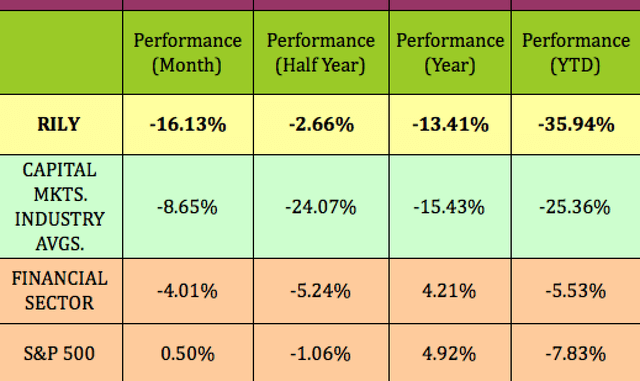

Performance:

As you can see, the Capital Markets industry has fallen out of favor in 2022, with RILY being no exception. The traditional thinking has been that rising rates favor financials, but Mr. Market disagrees so far in 2022.

Hidden Dividend Stocks Plus

Valuations:

Still, falling prices can lead to future opportunity. RILY’s price decline has led it to an extremely low P/E of 3.77X, ~50% of its peers’ 7.58X valuation, while its EV/EBITDA of 4.39X is less than 50% of the 10X peer average. Meanwhile, its 7% dividend yield is over 2X as high as the peer average:

Hidden Dividend Stocks Plus

Parting Thoughts:

While those negative price performance figures are daunting, future opportunities can come from taking a contrarian stance. It may be time to team up with RILY’s insiders and start buying some RILY shares.

All tables by Hidden Dividend Stocks Plus, except where otherwise noted.

Be the first to comment