LeoPatrizi/E+ via Getty Images

The Avantis U.S. Equity ETF (NYSEARCA:AVUS) is an actively managed investment vehicle supposed to provide exposure to a broadly diversified basket of U.S. stocks, with attention paid to their valuation and quality.

Ideally, the AVUS portfolio should exhibit better value characteristics than the iShares Russell 3000 ETF (IWV), as well as Vanguard Russell 3000 ETF (VTHR), which track its benchmark, combined with higher overall profitability, a mix worth paying attention to during a bear market, since cheaper valuation means lower growth premia (hence, a smaller downside when growth prospects are being trimmed and stocks are consequently repriced lower) and better profitability which implies there are more self-sufficient names in the mix, something of importance amid burgeoning interest rates.

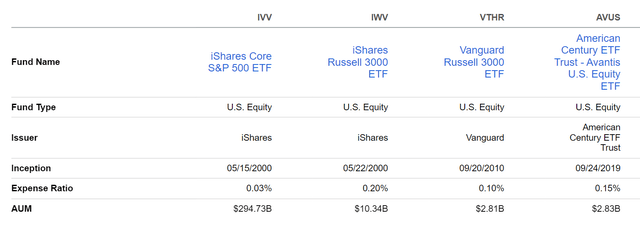

AVUS features a proprietary active strategy, with scarce details available on how exactly it selects stocks for its portfolio. What we can say for sure is that it makes additions/deletions comparatively rarely as its turnover is rock-bottom, at just 4%, so its portfolio is arguably homogenous most of the time, precisely like IWV and the iShares Core S&P 500 ETF (IVV), which have turnover at 4% and 3%, respectively.

We also know that AVUS uses the adjusted book to price ratio when deciding whether a stock has attractive value characteristics and that the adjusted cash from operations to book value ratio influences its opinion on whether a company sports quality characteristics, while other metrics could be considered if necessary. More details could be found in the prospectus and the factsheet on the Avantis website.

At the same time, please do note that the Russell 3000 index, unlike the S&P 500, does not have a quality screen; specifically, delivering net income is not obligatory to qualify for inclusion. Even though a constituent does not immediately lose its place in the S&P in case its LTM earnings dive below zero, and in the current iteration, there are a few loss-making names in the IVV portfolio, the net profit rule still adds a small layer of safety. Below, we will see how this together with market cap weighting affected IVV’s exposure to the profitability factor.

Did AVUS’ strategy deliver? Mostly so, with nuances.

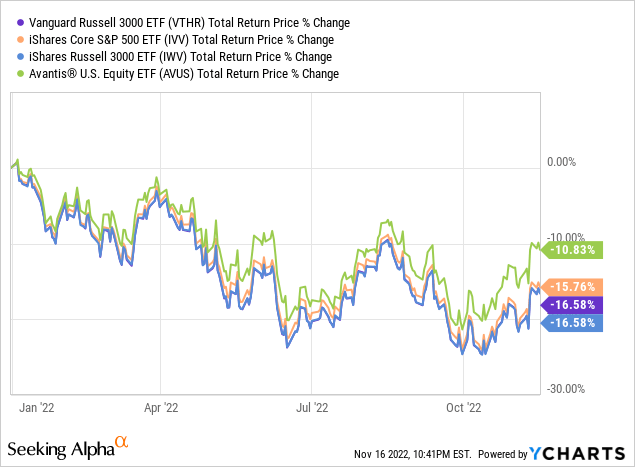

Incepted in September 2019, AVUS outperformed IWV during the October 2019 – October 2022 period, with 2022 to date being especially strong compared to the S&P 500 and Russell 3000 tracking EFTs. Well, after a fashion, as by the bear market standards, a 10.8% decline is not that bad.

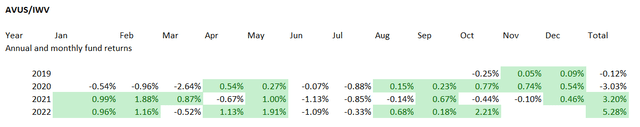

Interestingly, over the period analyzed, AVUS delivered positive return during 24 months out of 37, while IWV did so only in 23 months, and IVV in 22.

The table below comparing IWV’s and the Avantis fund’s performance with excess returns highlighted in green helps to contextualize this.

Created by the author using data from Portfolio Visualizer

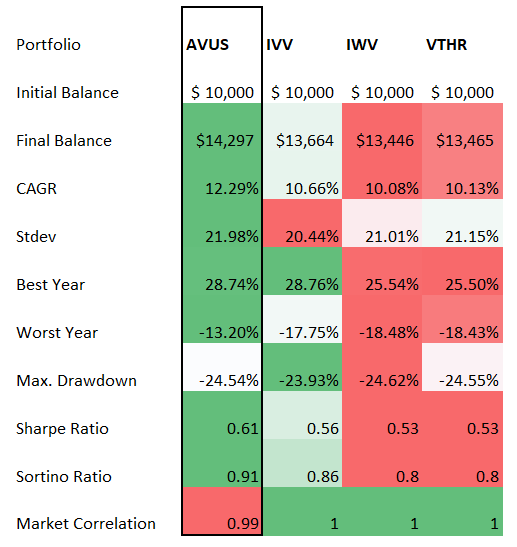

Overall, the CAGR it achieved is 2.21% higher compared to IWV, 2.16% compared to VTHR (due to differences in fees shown below), and 1.6% compared to IVV, a decent result, yet the highest standard deviation in the peer group is a disappointment.

Seeking Alpha

However, risk-adjusted returns (the Sharpe and Sortino ratios) were unrivaled.

Created by the author using data from Portfolio Visualizer

Delving deeper into the portfolio: tilt towards smaller, cheaper companies

As of November 11, AVUS oversaw a portfolio of 2,298 equities. The depth of exposure is smaller compared to IWV’s 2,589 stocks, more likely owing to the fact a few Russell 3000 constituents did not pass the quality or value test or both. Interestingly, amongst the stocks AVUS sees little value in are Philip Morris International (PM) and Altria (MO). For me, it is unclear why exactly the fund ignored them since both are valued adequately and are grossly profitable.

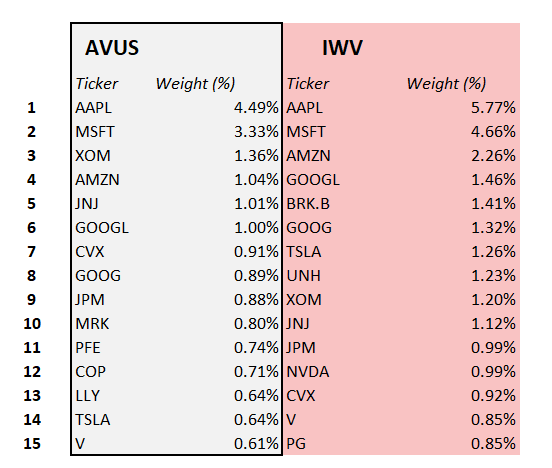

The table below provides a look at the top fifteen holdings. As can be seen, AVUS underweights the $1 trillion league (the WA market cap reflects that clearly); it is also of interest to see ConocoPhillips (COP) in the 12th place with 0.71% weight; in IWV, it has just 0.43%. Overall, we see the portfolio is lighter in mega-caps, with the weighted-average market capitalization standing at ~$295.4 billion vs. IWV’s ~$409 billion, as per my calculations.

Created by the author using data from the funds

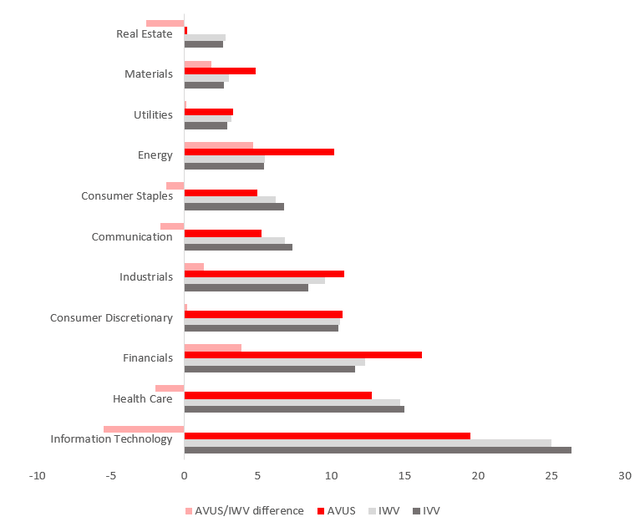

Regarding sectors, AVUS is meaningfully overweight financials, industrials, and energy, while exposure to information technology, healthcare, consumer staples, and real estate is reduced. This is consistent with the fund favoring cheaper, yet quality stocks.

Created by the author using data from the funds

More specifically, this Avantis ETF portfolio includes 139 energy equities, while IWV holds only 127. For instance, AVUS is long UK-based TechnipFMC plc (FTI) and Switzerland-based Transocean Ltd. (RIG) which are absent in the IWV portfolio. Meanwhile, the iShares ETF invested in Energy Fuels (UUUU) and Borr Drilling (BORR), while AVUS ignored them. Here, I believe the reason could be their lackluster profitability characteristics and uncomfortable valuation. Uncoincidentally, both have poor Quant Valuation and Profitability grades.

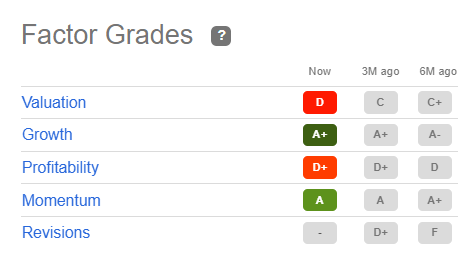

BORR Factor Grades (Seeking Alpha)

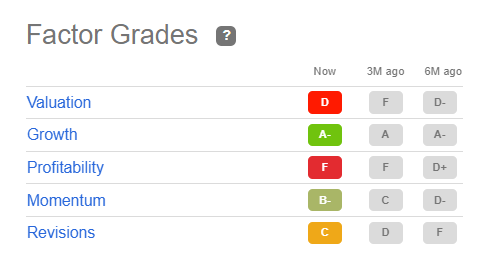

UUUU Factor Grades (Seeking Alpha)

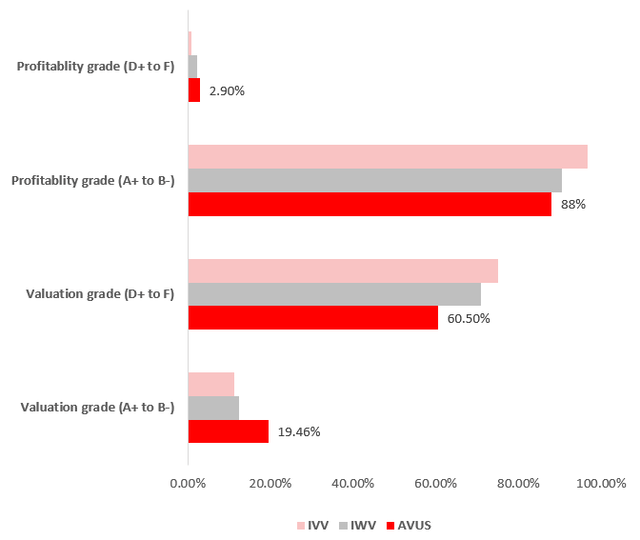

Delving deeper into multiples and margins, capital efficiency data, we see that this portfolio has smaller exposure to high-quality stocks (~88% vs. ~90%) than IWV as revealed by the Quant data analysis, with its results shown below.

Created by the author using data from Seeking Alpha and the funds

Still, it should also be noted that while 4.6% of holdings in AVUS are unprofitable, the figure is 6.36% for IWV.

At the same time, I found out that AVUS has more assets allocated to seemingly undervalued stocks (B- grade and better) and lower exposure to overvalued (D+ and worse).

Summing up, we see that AVUS has certainly succeeded in selecting underappreciated stocks, yet it slightly lags on quality. Meanwhile, IVV’s exposure to the profitability factor is unrivaled. So for investors seeking even more robust quality (which comes with a premium, though), the S&P 500 ETF should be a better option.

Final thoughts: is it worth investing in AVUS for exposure to quality?

AVUS has demonstrated comparatively stronger performance than IWV this year and since inception, partly owing to lower fees. Unfortunately, its strategy has not been properly tested yet as the fund has just three full trading years in the books, most of which were heavily influenced by the headwinds stemming from the pandemic.

What we still could assume cautiously looking at its 37-month track record is that it tends to underperform broader, less picky IWV when interest rates trend lower and capital is abundant, and, contrarily, do better when hawks prevail. Hence, it should deliver returns similar to the Russell 3000 ETFs over the longer term navigating the loose and then tight monetary policy regimes, probably outperforming IWV slightly but only because of its marginally lower expense ratio.

Speaking of IWV, I see little reason for investing in a seemingly broad equity basket as market-cap weighting eliminates most of the benefits of breadth and depth of exposure, with smaller holdings (typically value stocks) having a microscopic impact on total returns, if at all.

In sum, I believe plain-vanilla alternatives like IVV deserve more attention. Owing to the market-cap weighting schema, they should always have modestly higher quality than IWV (and on par or better than AVUS) since mega-caps have quality premia factored in their multiples. All in all, AVUS earns a Hold rating.

Be the first to comment