Dmitriy Yermishin/iStock via Getty Images

Thesis

We updated in our pre-earnings article on Star Bulk Carriers Corp. (NASDAQ:SBLK) that investors should take the opportunity to cut exposure. The steep sell-off in SBLK has also met our price target. Accordingly, SBLK has fallen more than 22% (having factored in its recent dividend payout), as it underperformed the market significantly.

We surmise that the market has renewed its focus on the looming recession as it continues to digest stocks that have experienced significant appreciation over the past year.

As a result, SBLK has nearly given up all its gains from 2022, even having factored in its dividend. As a result, its YTD total return fell to 0.99% as of September 7’s close.

However, we believe that the steep sell-off in SBLK could soon be nearing a bottoming process, as we gleaned that its selling pressure has subsided. Also, we believe its valuation seems more reasonable now, even as we dialed down its dividend yield to account for potential weakness moving ahead.

Notwithstanding, SBLK could still experience some near-term downside volatility, given the force of the downward momentum. Therefore, we urge investors to consider layering in over time.

As such, we revise our rating on SBLK from Sell to Buy.

Star Bulk’s Massive Growth Continued To Decelerate

The macro headwinds have continued to hamper the ongoing growth momentum in dry bulk shipping in Q2, as inflation headwinds and a looming recession have continued to be at the forefront of investors’ concerns.

China’s COVID lockdowns and weak industrial production also impacted shipping demand. Coupled with the Fed’s hawkish stance, the market is justifiably concerned whether the dry bulk leaders like Star Bulk can continue generating robust growth as it laps challenging comps from FY21.

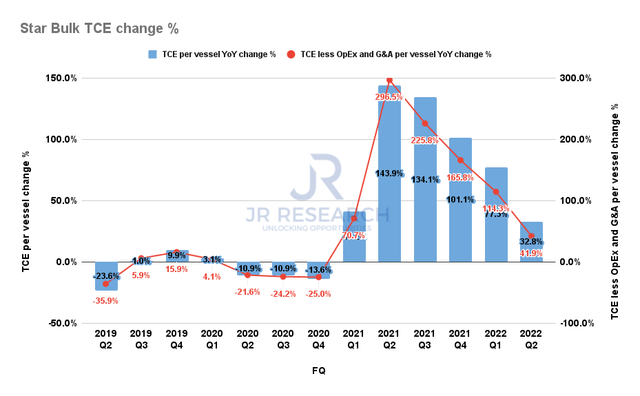

Star Bulk TCE metrics change % (Company filings)

Therefore, investors should not be surprised that the growth in Star Bulk’s time charter equivalent (TCE) rates per vessel have moderated significantly from its 2021 highs, as seen above.

Star Bulk posted a TCE per vessel growth of 32.8% in Q2, down from Q1’s 77.3%. It also marked Star Bulk’s fourth straight quarter of decelerating TCE per vessel growth deceleration amid worsening macro headwinds.

Notwithstanding, Star Bulk’s solid cost base helped to sustain its TCE per vessel (less OpEx and G&A) growth rate better, as it posted an increase of 41.9% in Q2. Management also articulated its cost advantages, as it highlighted:

Despite continued adverse COVID-related expenses and inflationary pressures, which have a direct impact on our operating expenses, the combination of our in-house management and the scale of the group enable us to sustain a very competitive cost base and maintain our position as the lowest-cost operator amongst our peers. (Star Bulk FQ2’22 earnings call)

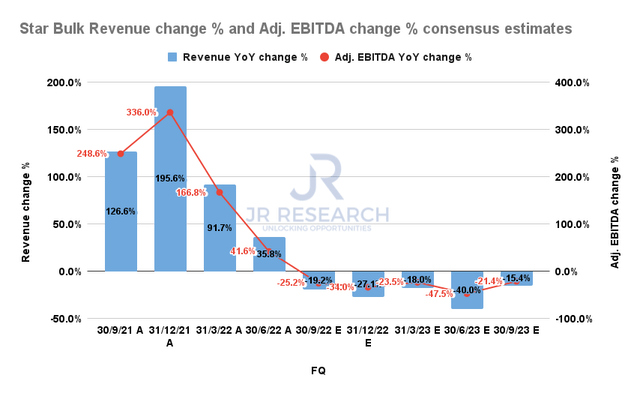

Star Bulk revenue change % and adjusted EBITDA change % consensus estimates (S&P Cap IQ)

The consensus estimates (very bullish) suggest that Star Bulk’s revenue growth could continue to moderate through FY23, impacting its operating leverage.

We believe the estimates seem credible, as the ongoing headwinds in shipping could continue to impede the TCE rates. Star Bulk also highlighted that the impact on container shipping could affect certain dry bulk TCE rates, as port congestion is expected to ease further.

We also gleaned that global container benchmark rates have continued to fall through September. Consequently, we believe the market has been adjusting its expectation of the impact on Star Bulk’s revenue and profitability profile.

Star Bulk’s Dividend Is Safe For Now, But Investors Should Lower Expectations

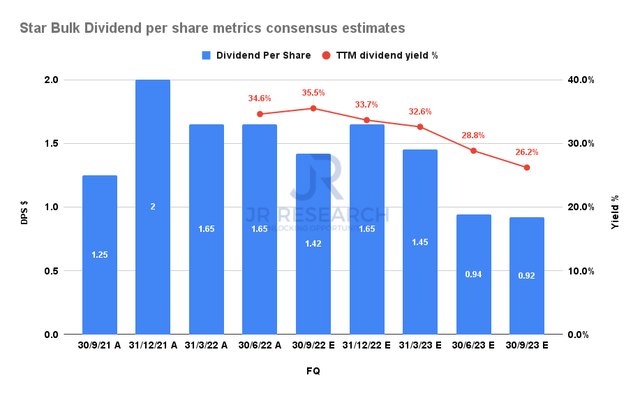

Star Bulk dividend per share metrics consensus estimates (S&P Cap IQ)

Given the potential compression in TCE rates and the impact on Star Bulk’s operating leverage, we expect its dividend per share (DPS) payout to be affected.

As seen above, the consensus estimates suggest that its DPS could move lower through FY23, lowering the market’s expectations of its forward yield. Therefore, we urge investors to apply an appropriate margin of safety in their valuation models to account for the potential compression.

Is SBLK Stock A Buy, Sell, Or Hold?

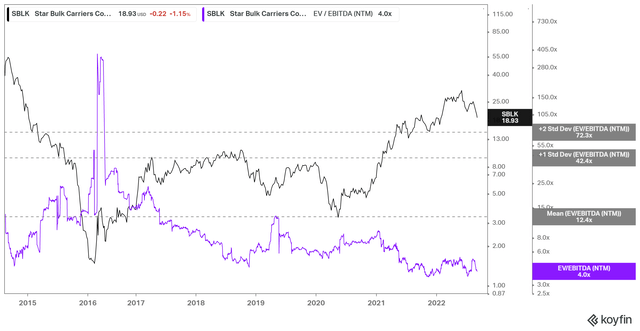

SBLK NTM EBITDA multiples mean valuation trend (koyfin)

SBLK last traded at an NTM EBITDA multiple of 4x, well below its 5Y mean. Its NTM dividend yield of 28.77% is well below its recent yield of 34.6%, indicating that the market has likely adjusted its expectation for potential yield compression.

However, our analysis suggests that investors need to be wary of expecting SBLK to be re-rated toward its 5Y mean of 12x EBITDA. We believe the market has not re-rated SBLK markedly as it is likely anticipating further headwinds on its operating model through the current cycle as Star Bulk’s growth slows further.

Despite that, our internal valuation model indicates that SBLK’s robust dividend yield should support its performance based on a total return framework, as long as dry bulk rates don’t collapse. Our model lowered SBLK’s dividend yield to 15% through FY26, allowing ample room for compression. Given capacity constraints and stable demand flows, management remains confident in a stable dry bulk market. Hence, that remains the most significant risk of our thesis.

Accordingly, we revise our rating on SBLK from Sell to Buy and urge investors to consider layering in their exposure.

Be the first to comment