Deagreez

2022 has been a terrifying time for many investors, and not just because we’ve had a bear market.

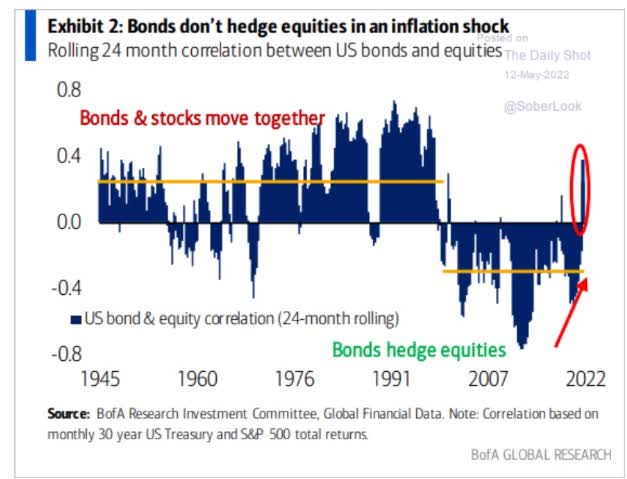

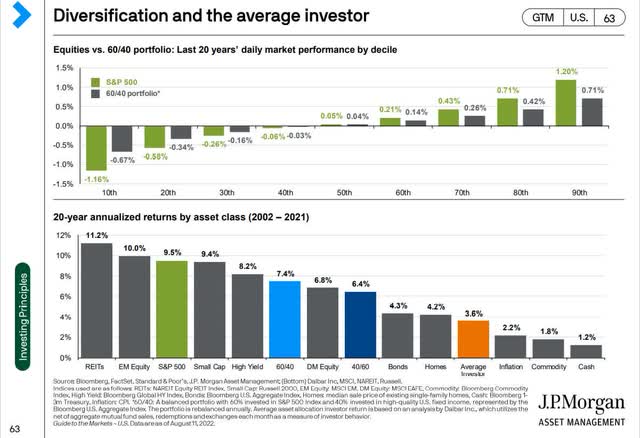

Since WWII, bonds have risen or remained stable 92% of the time when stocks have fallen. In other words, a 60/40 retirement portfolio is a very simple, effective, low-cost hedge fund.

One that has helped the average investor achieve 2X better returns than their peers purely because they can sleep well at night during the market’s inevitable corrections and bear markets.

The 8% of times when stocks and bonds fall together tend to be periods of inflationary shocks like we’re living through now.

Daily Shot

When stocks become positively correlated to bonds, bear market pain can be amplified for investors who are used to relatively mild declines.

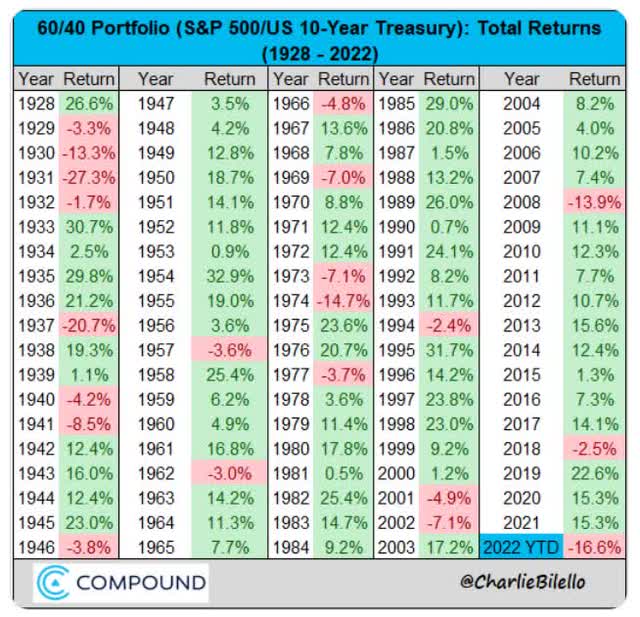

Outside of the Great Depression, the Financial Crisis, and the stagflationary hell of the 70s, the largest decline for the 60/40 was a mild 8.5% pullback in 1941.

But in 2022, we faced a perfect storm of historic proportions. 10-year yields, from a record low of 0.5% in August of 2021, soared to a peak of 3.5% on June 14th, 2022. This was driven by the highest inflation in 41 years, a peak 9.1% in June.

As a result, the 60/40 fell as much as 17% this year, as bonds sank 12%, 4X their previous worst year since 1972.

The good news is that most blue-chip economist firms, such as Bank of America, Morgan Stanley, and JPMorgan, along with Schwab and Fidelity, expect the worst is over for bonds.

They are telling clients that it’s safe to get back into long-duration US treasuries and that a 60/40 is likely to start working again, especially if we get a recession in 2023.

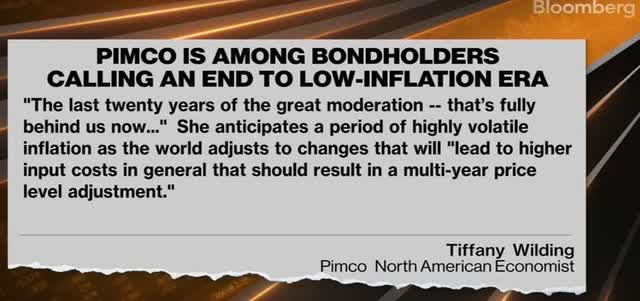

But not everyone is so confident about the fate of bonds in the coming years.

PIMCO, the world’s bond king manager, thinks that several factors could cause permanently higher inflation, and thus the pain for bonds could last for several more years.

Ray Dalio, the founder of Bridgewater, the world’s largest hedge fund, agrees, thinking that inflation getting stuck at 3% to 4% could cause bonds and stocks to languish for several years.

- as well as the S&P falling another 25% before finally bottoming

Goldman Sachs isn’t as gloomy as PIMCO, but they think the Fed might hike rates to 3.75% and keep them there for up to two years. That could certainly result in long-term repricing for stocks and bonds and a multi-year recovery for anyone owning a balanced portfolio like a 60/40.

- Goldman also thinks stocks could fall 25% more if we get a recession

What can smart long-term investors do about the potential for inflation to remain elevate for years, forcing the Fed to hike rates to as much as 5% to 6% (according to Bridgewater and Deutsche Bank)?

This is where alternative assets can be highly useful.

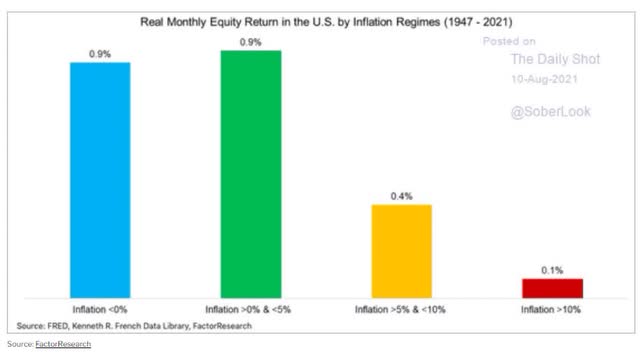

That’s because historically, stocks deliver excellent returns as long as inflation is under 5%. If inflation is higher than 5%, returns are cut by almost 60% and slightly negative on an inflation-adjusted basis.

This means that stagflation remains a real risk we must all consider, even if US inflation isn’t like to fly off to crazy European levels.

- Citigroup expects UK inflation to peak in January 2023 at 18.6%

Commodities: The Historical Stagflation Hedge

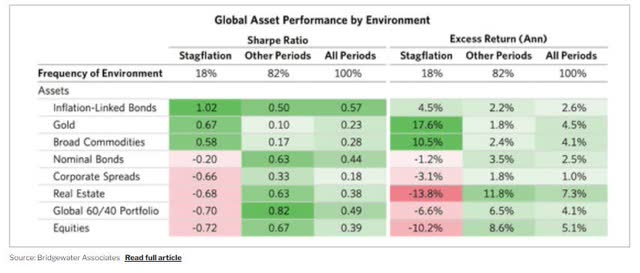

Since 1950 we’ve had stagflationary conditions about 18% of the time. Gold and commodities both delivered exceptional returns, beating risk-free treasuries by 11% to 18% per year.

This is a big reason why the SPDR Gold Trust ETF (GLD) and the Invesco DB Commodity Index Tracking Fund (DBC) have swelled to almost $60 billion in assets under management or AUM.

Investors shell-shocked by crashing bond prices and desperate for some place to hide in this inflationary hell went with the time-tested option of gold and commodities, the two best stagflation fighters in history.

Gold And Commodities Are Not As Safe As You Might Think

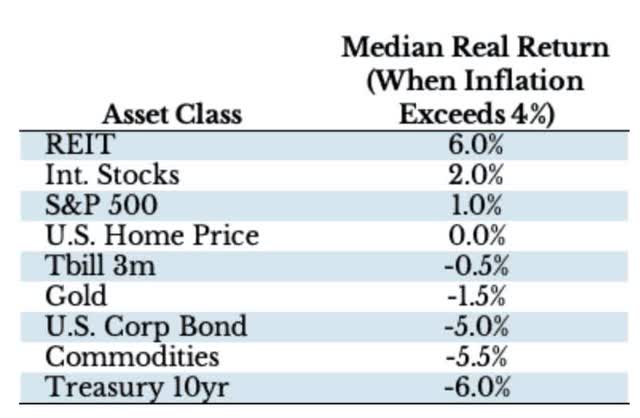

Since 1971, including the entire stagflation decade we all hope never repeats, gold and commodities have not actually been that great of an inflation hedge if inflation was above 4%.

Median Inflation-Adjusted Returns Since 1971

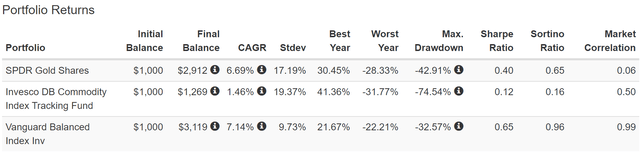

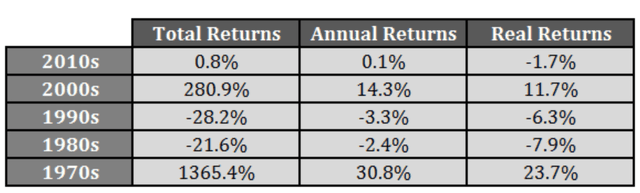

Even more troubling is that the last 16 years have been a very weak time for both GLD and DBC.

Historical Returns For Gold And Commodities Since 2006

(Source: Portfolio Visualizer Premium)

In the last 16 years, gold has underperformed a 60/40, with twice the annual volatility.

- Gold delivered 32% lower negative volatility-adjusted total returns than a 60/40 (Sortino ratio)

- commodities delivered 83% lower negative-volatility-adjusted total returns than a 60/40

(Source: Portfolio Visualizer Premium)

Gold did relatively well in terms of average historical returns though it still underperformed the 60/40.

Commodities have delivered horrible returns, including -0.5% CAGR average 15-year rolling returns. Adjusting for inflation, things look even worse for commodities.

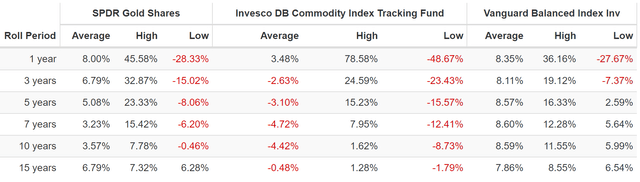

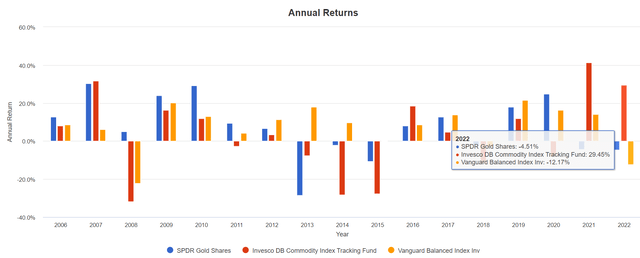

Inflation-Adjusted Returns Since 2006

(Source: Portfolio Visualizer Premium)

Gold has almost kept up with a 60/40 but commodities? They delivered -1% annual returns, just as they have over the last 100 years.

| Stock | Ticker | Inflation-Adjusted Return Since March 2006 |

Annual Real Return Since March 2006 |

| SPDR Gold Shares | GLD | 97% | 4.3% |

| Invesco DB Commodity Index Tracking Fund | DBC | -15% | -1.0% |

| 60/40 | VBINX | 109% | 4.7% |

(Source: Portfolio Visualizer Premium)

Gold has almost kept up with a 60/40 but commodities? They delivered -1% annual returns, just as they have over the last 100 years.

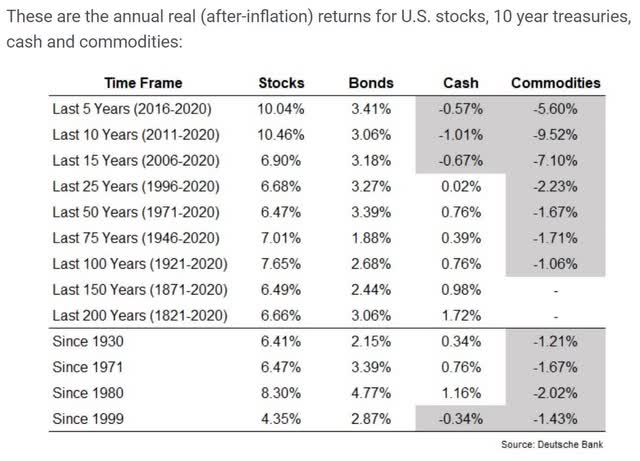

Commodities deliver terrible inflation-adjusted returns for 100 years and every long-term time frame.

Do you know what 100 years of negative 1.1% annual returns means? A 97% statistical probability that commodities are a terrible long-term investment.

- stocks are up 1,590X over the last 100 years, adjusted for inflation

- commodities are down 67% over the last 100 years, adjusted for inflation

- $1 invested in stocks in 1921 is worth $1,590 today in real terms

- $1 invested in commodities in 1921 is worth $0.33 today

- stocks outperformed commodities by 4,818X over the last 100 years… adjusted for inflation

Does that mean that commodities can’t serve a useful role? If you’re willing to trade them rather than buy and hold forever, yes.

But remember that companies and economies grow by becoming productive and learning to do more with less. That’s why the 100-year trend for commodities has been downwards and why something like DBC is a terrible idea for long-term buy-and-hold investors.

There is nothing wrong with hedging, but you want to ensure your hedged assets generate positive inflation-adjusted returns over time.

But what about gold? Hasn’t it proven to be a source of positive returns over time, especially during stagflation? Well, yes and no.

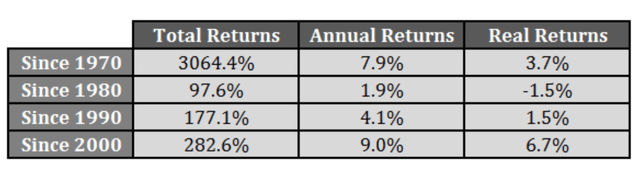

Gold Returns Since 1970

Ben Carlson (Source: Ben Carlson)

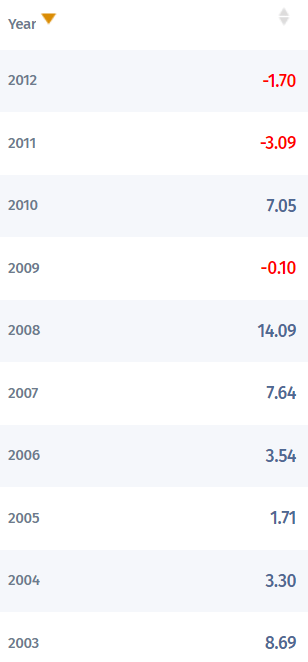

In the 1970s, after the US went off the gold standard, gold had its best bull market in history, delivering Buffett-like 23.7% annual returns. And since that peak? From 1980 to today, gold has delivered -1.5% inflation-adjusted returns.

- -47% real returns over 42 years

OK, maybe that was because gold became overvalued after that epic 14X bull market in the 1970s? Maybe 42 years of terrible returns have made it cheap and ready to roar like a champion in this stagflation shock?

(Source: Portfolio Visualizer Premium)

Despite the worst inflation in 41 years, Gold has been a terrible stagflation hedge.

After 42 years of absolutely atrocious returns, in the perfect environment for gold, that will likely never be repeated in our lifetimes, gold is down 10%.

Bottom line, if you want to hedge against stagflation, you need alternative assets, but you can’t just buy and hold commodities or gold and necessarily expect to do well over time.

Why Hedge Funds Are A Potentially Superior Way To Hedge Against Stagflation

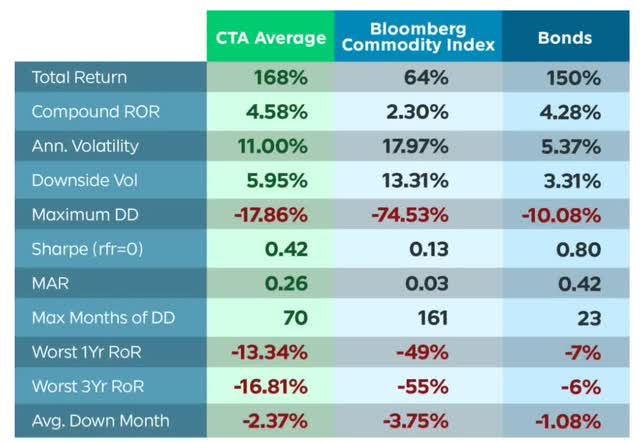

Hedge funds are far better at profiting from commodities during super cycles than buying and holding commodity ETFs like GLD and DBC. Barclay’s CTA hedge fund index is proof of this.

The Barclay CTA Index is a leading industry benchmark of the representative performance of commodity trading advisors. There are currently 416 programs included in the calculation of the Barclay CTA Index for 2021. – Barclay’s

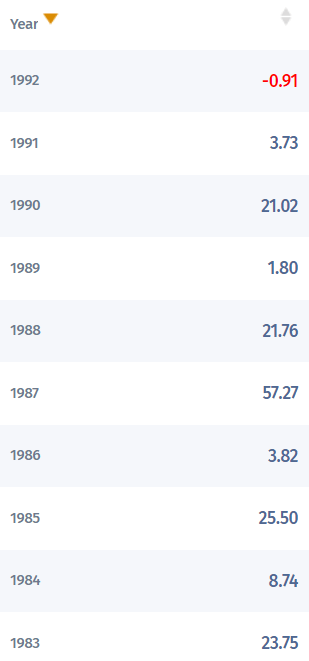

It tracks the 416 largest hedge funds that trade commodities. And look how it’s done since 1980 (when the index began), which includes the two worst periods of stagflation in US history.

Hedge Fund Returns Since 1980

(Source: Barclays) (Source: Barclays) (Source: Barclays) (Source: Barclays) (Source: Barclays)

- From 1980 to 1982, during the double-dip stagflation recession and bear market, hedge funds delivered 137% total returns (inflation peaked at 15% in March 1980)

- in 1987 (Black Monday crash), they soared 57%

- in the 1990 oil spike recessionary bear market (-20% S&P), they rose 21%

- in the 1997 Asian currency crisis, they rose 11%

- during the tech crash, they delivered positive returns every year

- in 2002 the S&P fell 22%, and hedge funds were up 12%

- in 2008 the S&P fell 37%, and hedge funds were up 14%

- YTD hedge funds are up 8% in the 2022 bear market (another stagflationary shock) – gold is down 5%

But guess what? There are several major downsides to hedge funds.

- retail investors can’t buy them

- the best ones are closed to new money

- they charge high fees (as much as 5% of assets and 50% of profits)

- selecting the ones that will work in any given year is difficult to do

Institutional fund managers often use “funds of funds” that own a basket of hedge funds.

- And add another layer of fees

Since 2001, hedge funds delivered just 1.6% CAGR returns net of fees.

Hedge Fund Returns Since 2001

But they actually delivered better returns than bonds and far more than commodities.

- Hedge funds historically deliver 4.6% annual returns

- but 66% of those returns are eaten up by fees

Wouldn’t it be wonderful if there was a low-cost way for average investors like us to profit from the expertise of the world’s best hedge funds in alternative strategies? Imagine being able to go long or short:

- stocks (US and international and emerging market)

- bonds

- currencies

- commodities

Fortunately, there now is.

The Vanguard Of Hedge Funds

Several hedge fund ETFs use managed futures to recreate the strategies used by the biggest hedge funds.

These are liquid alternative ETFs because, unlike hedge funds that can lock up your money for years, you can get your money back at any time, just like any other stock.

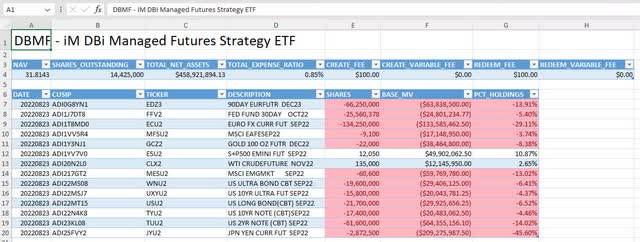

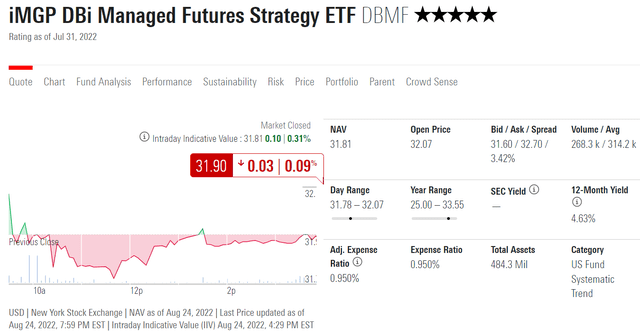

The largest of these is iM DBI Managed Futures Strategy ETF (DBMF), which was founded by Andrew Beer to be the “Vanguard of hedge funds.”

He recently did an hour-long interview with Bloomberg on their wonderful podcast “What Goes Up,” in which he explained how this ETF works. But first, here’s a little background on Andrew Beer.

25 years of experience in the hedge fund business since joining the Baupost Group, Inc., one of the world’s premier hedge fund firms, as a portfolio manager.

In 2003, Andrew founded Pinnacle Asset Management, a leading commodity investment firm with approximately $3 billion under management today and recipient of numerous industry awards.

He was also a founder of Apex Capital Management, one of the first institutional-quality hedge funds focused on the Greater China region that peaked at approximately $1.5 billion in assets before the financial crisis. Andrew holds an MBA from Harvard Business School as a Baker Scholar and his AB degree with high honors from Harvard College. – iMGP Funds

DBMF is co-managed with Mathias Mamou-Mani

15+ years of experience in asset management, including 6 years at Dynamic Beta investments overseeing quantitative research, including proprietary replication and liquid solution models, risk systems, and trade implementation.

From 2001 to 2006, Mathias worked as a consultant/project manager on critical information systems projects for the French Ministry of Defense, France Telecom, and Lafarge.

Mathias holds an MBA from the NYU Stern School of Business, specializing in Quantitative Finance, and degrees from the University of Paris Dauphine, France. – iMGP Funds

What Makes DBMF Different Than Most Hedge Fund ETFs

There are four major economic regimes.

- accelerating growth and rising interest rates

- slowing growth and rising interest rates (the current one)

- accelerating growth and falling interest rates

- slowing growth and falling interest rates

Most hedge funds have their own quantitative models for what to do with stocks, bonds, currencies, and commodities in each of these regimes.

Based on their proprietary models about what the economy is likely to do next, they make short to medium-term investments by buying or shorting commodities, currencies, stocks, and bonds.

Hedge fund ETFs have their own models or attempt to replicate one or a handful of ETFs using public filings (such as 13-Fs).

This creates the same problem as a big institution trying to pick which hedge fund to use in any given year.

- the “hottest” funds take outsized bets in one direction and get lucky

- money pours into them, chasing performance, and then mean reversion results in far lower returns

So what Andrew Beers and Mathias Mamou-Mani did with DBMF is to use the blue-chip consensus of the 20 largest hedge funds in the world.

- on the theory that the 20 largest represent the “smartest money” in the industry

- with the best risk management

- and the best analysts and models

This is a sound theory as it basically replicates the blue-chip economist consensus approach used by Bloomberg, FactSet, and Reuters.

The 20 largest hedge funds, such as Bridgewater (the largest one on earth with $140 billion in assets under management), collectively know what they are doing better than any individual fund manager.

DBMF’s algorithms scan public filings from the 20 largest hedge funds and then use the most liquid futures to replicate the overall blue-chip hedge fund consensus.

Why use highly liquid options?

- 0.1% annual expenses for trading

The spreads for currencies alone can be 1%. For commodities, even more. It takes an experienced asset manager with economies of scale to be able to deliver alternative strategies like these for this low a cost.

- 0.85% management fee

- 0.1% expense fee

- 0.95% overall expense ratio

You won’t find a hedge fund that charges less than 1% management fees plus a performance fee of 10% to 50%.

DBMF is trying to be the Vanguard of hedge funds by using a rules-based quantitative approach and low-cost options.

- better returns than its peers

- with lower costs

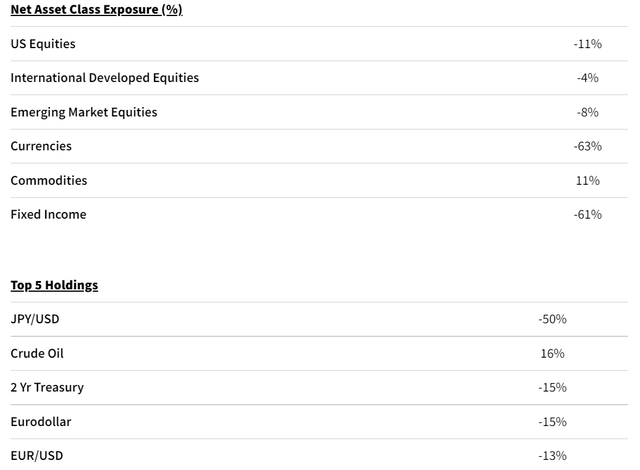

What DBMF Owns (The Blue-Chip Hedge Fund Consensus)

The blue-chip hedge fund consensus nailed it in 2022.

- short US stocks

- short international stocks

- short emerging markets stocks

- short bonds

- long commodities (especially oil)

- short the Euro

- massively the short the Yen

- long the dollar

DBMF is doing all this through 14 futures contracts though in the past they have owned as many as 39.

I can say from personal experience, having spent five years trying to master commodities, currencies, and options strategies, that:

- trading these alternative assets is very hard

- like day trading stocks (this is why 98% of people lose money)

- it’s also highly expensive, with spreads of 1+% on even the largest and most liquid currencies and commodities

DBMF’s approach is a simplified method of recreating the blue-chip hedge fund consensus.

- If Bridgewater is short Peruvian coffee futures DBMF doesn’t care

- it only wants to recreate the most important macro trends as determined by the 20 largest hedge funds

In 2019 the blue-chip consensus was “risk on,” meaning net long stocks.

In 2021 it was also “risk on,” and DBMF had a great year.

This year the consensus was highly “risk-off,” and DBMF has delivered the mirror image of the S&P, +24% YTD vs. -24% peak decline.

DBMF: The King Of Hedge Fund ETF Performance

The future doesn’t repeat, but it often rhymes. – Mark Twain

Past performance is no guarantee of future results. Still, studies show that over time, blue-chips with relatively stable fundamentals or superior management offer predictable returns based on yield, growth, and valuation mean reversion.

So let’s examine why DBMF is my favorite high-yield stagflation hedging strategy.

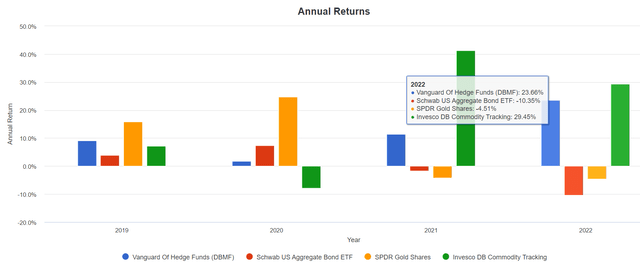

And while 3 years of data isn’t statistically significant, 2019, 2020, 2021, and 2022 represent some of the most extreme market conditions in US history.

- 2 strong market rallies (2019 and 2021)

- the worst economy in history

- the fastest growth in history

- the fastest bear market in history

- a 100% 12-month market rally

- record low-interest rates

- the fastest rise in interest rates in 40 years

- the highest inflation in 40 years

- two black swan events (Pandemic and Russian invasion)

So let’s examine why DBMF is the gold standard of hedge fund ETFs.

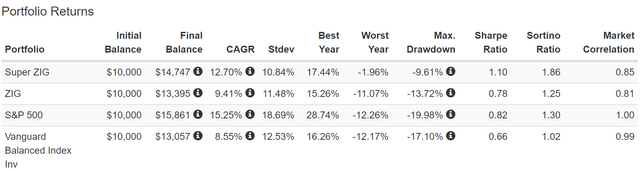

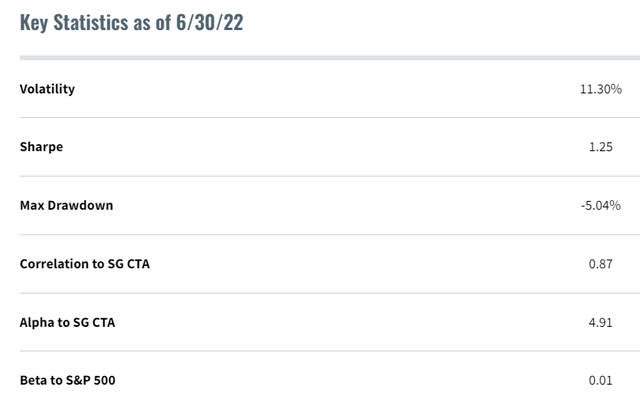

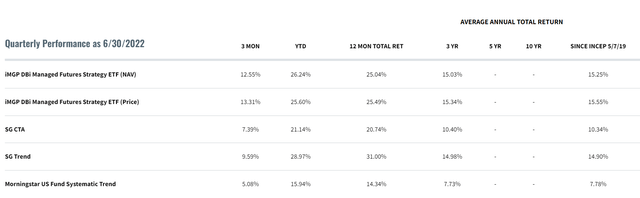

Since its inception in May 2019, DBMF has delivered 4.9% better annual returns than all hedge funds. Its correlation to the stock market is 0.01, making it a potentially attractive diversification tool.

And its volatility has been very low at 11%, less than a 60/40 portfolio.

DBMF has delivered 15% annual returns since inception, almost matching the S&P 500 (which almost no hedge fund has done).

The average hedge fund during this time delivered 10% annual returns, and the average Morningstar tracked hedge fund 8%.

Over the last three years, DBMF has delivered 41% annual returns, almost as good as the S&P 500.

- hedge funds have delivered 22% total returns

- every major single hedge fund ETF peer has underperformed hedge funds, and the market

Let’s put this simply. Stocks with no hedges deliver the best returns.

High-priced hedge funds deliver superior returns to hedge fund ETFs… except the Vanguard of hedge ETFs.

- Low costs and the top 20 hedge fund consensus beats all its peers

Morningstar rates DBMF 5 stars, and US New and World Report ranks it #1 among alternative ETFs.

Do you know why? Because its returns since inception have been in the 85th percentile.

- better than 85% of hedge funds in the world

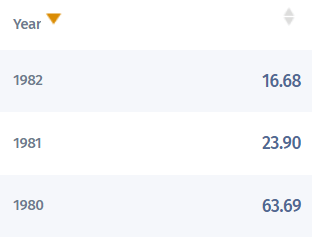

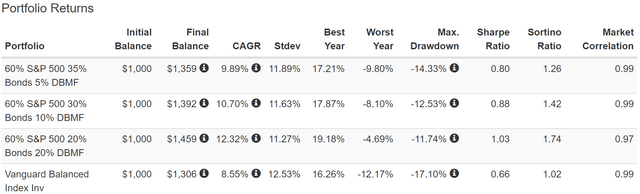

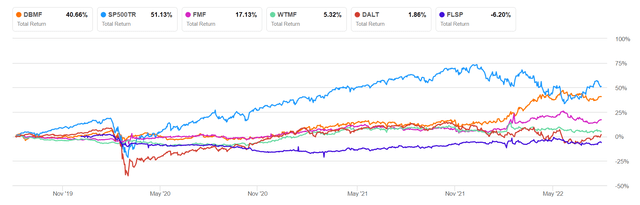

Historical Returns Of The 3 Largest Hedge Fund ETFs Since June 2019

(Source: Portfolio Visualizer Premium)

DBMF has run circles around its peers and a 60/40 since inception.

- A 2.99 Sortino ratio is the highest I’ve ever seen for any fund, ETF, stock, or portfolio

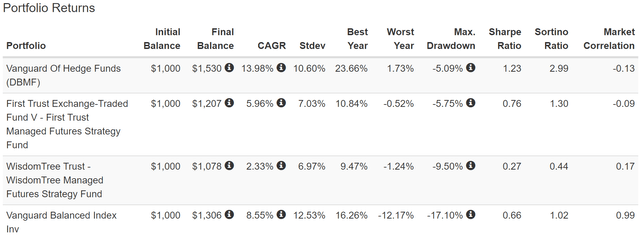

Historical Returns Of The DBMF And Popular Hedging Strategies Since June 2019

(Source: Portfolio Visualizer Premium)

DBMF has outperformed gold and bonds in the last three years. It underperformed commodities but, with a 5% peak decline, delivered more than 2X better negative-volatility adjusted returns than DBC. That’s because commodities have already suffered a 32% crash in the last three years.

- Its market correlation of -0.13 is similar to long-bonds (-0.1)

- and better diversification power than gold, commodities, or its peers

Its peak decline has been almost 1/3 that of gold.

(Source: Portfolio Visualizer Premium)

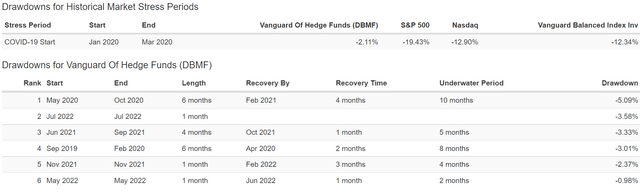

In the Pandemic, DBMF fell 2%, 6X less than a 60/40 and 10X less than the S&P 500.

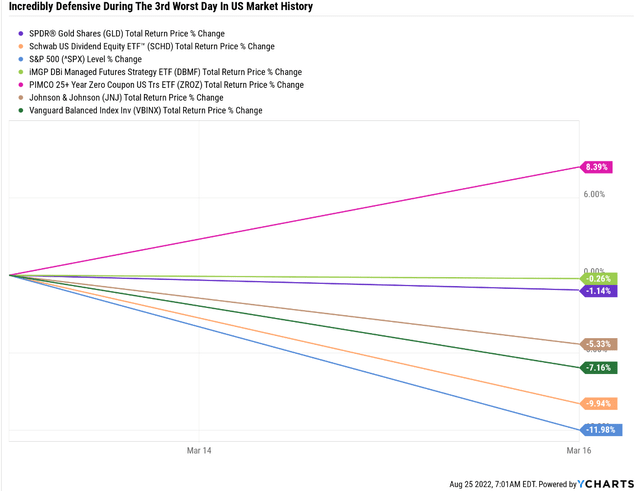

March 16th, 2020: 3rd Worst Day In Stock Market History

On the 3rd worst day in US market history, when the S&P and Nasdaq fell 12%, high-yield blue-chips fell 10%, and even JNJ and MO, two defensive Ultra SWAN dividend kings fell 5%, DBMF was flat and slightly better than gold.

Long-duration bonds, like ZROZ, soared 8% that day.

The 60/40 fell 7.2% that day, much less than the S&P, which is what it was designed to do.

- A 60% stock, 20% ZROZ, and 20% DBMF portfolio would have fallen 5.6% that day

- 54% less than the market

(Source: Portfolio Visualizer Premium)

And DBMF is up 24% in 2022, while gold is down 5%.

- Gold failed in the highest inflation environment in 41 years

Andrew Beers says his company’s backtests indicate that DBMF, had it existed, would have delivered:

- 21% returns in 2008

- 20% returns in 2002

Given the historical outperformance of the CTA index, I consider these claims to be credible.

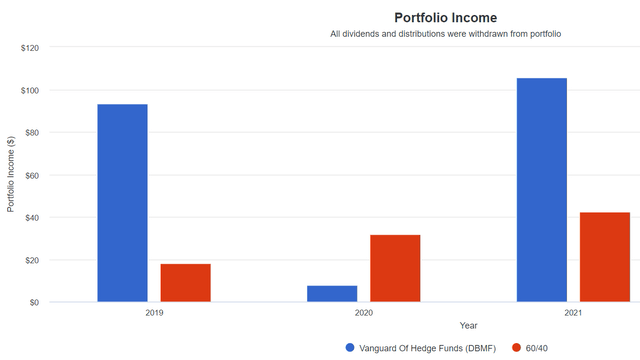

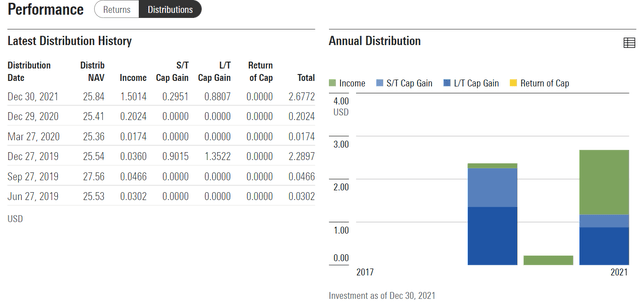

DBMF: A Variable But Very Generous Yield

(Source: Portfolio Visualizer Premium)

DBMF pays an annual dividend in which it pays investors almost all of its annual gains.

DBMF now pays its dividend at the end of the year, and the distribution is a mix of income and short and long-term capital gains.

DBMF Historical Dividends

| Year | Total Return | Annual Dividend (Yield) |

% Of Returns Paid In Dividends |

| 2019 | 9.27% | 9.3% | 100% |

| 2020 | 1.72% | 0.8% | 47% |

| 2021 | 11.40% | 10.6% | 93% |

| Average | 80% |

(Source: Portfolio Visualizer)

This implies two exciting possibilities.

- DBMF’s expected potential future return is approximately 9% to 10%

- 5% historical outperformance of the CTA hedge fund index

- and hedge funds historically deliver 4.6% returns

If DBMF’s strategy works as well as its historical backtests and 3 years of actual results, its average yield should be approximately 7% to 10% over time.

It also implies that DBMF’s 2022 dividend (paid in early January) could be 19% to 24%.

- don’t get too excited about this

- there is a significant catch I’ll talk about in the risk section

How To Use DBMF Properly Within Your Portfolio

In his Bloomberg interview, Andrew Beers was clear about the right and wrong ways to use DBMF.

- it was designed to augment the hedging allocation of a 60/40

- meaning replace some of the 40% allocations to cash/bonds

When my best friend saw these low volatility, incredible returns in 2022, and a 3.0 Sortino, he asked me: “Why shouldn’t I put all my retirement savings into DBMF? Why own anything else when you can get returns this good, with volatility this low, and yield this high?”

Those are all very good questions, and here is why you shouldn’t ever go all into any hedging strategy.

- stocks are the best-performing asset in history

- owning anything else is about diversifying fundamental and volatility risk

- hedge funds historically deliver 4.6% annular returns since 2001

- slightly better than bonds and a lot better than commodities

- and half the returns of the stock market

- DBMF MIGHT deliver 9% to 10% CAGR annual returns over time

Basically, hedge funds are like insurance policies, but unlike insurance (or options), they pay you a positive return to own them.

- the same with bonds and gold (over the very long term)

But since stocks go up 76% of all years, being a 100% hedge fund will cause underperformance and drive you crazy with jealousy.

- Resulting in market timing and wealth-destroying portfolio churn

Even The Best Hedge Funds Will Lose To The Market Over Time

| Year | DBMF | 60/40 | S&P 500 | SCHD | SCHZ (All US Investment Grade Bond) | EDV (Long Duration US Treasuries) |

| 2019 (Starting In June) | 9.2% | 12.1% | 18.7% | 19.1% | 3.4% | 5.3% |

| 2020 | 1.7% | 16.3% | 18.3% | 15.1% | 7.5% | 23.6% |

| 2021 | 11.4% | 14.1% | 28.5% | 29.9% | -1.7% | -6.2% |

| 2022 | 23.7% | -12.2% | -12.3% | -4.8% | -10.4% | -31.0% |

| Average | 11.5% | 7.6% | 13.3% | 14.8% | -0.3% | -2.1% |

| Median | 10.3% | 13.1% | 18.5% | 17.1% | 0.9% | -0.5% |

(Source: Portfolio Visualizer)

Stocks help us eat well but bonds help us sleep well.” – Wall Street adage

You do not compare stock returns to bond returns because they are different asset classes designed to do very different things.

DBMF’s historical median returns thus far have crushed other hedge funds, gold, and bonds.

They should not be expected to keep up with the stock market or blue-chip dividend stocks.

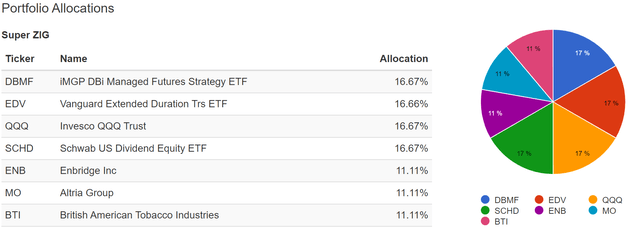

The Right Way To Use DBMF (If You Are Comfortable With Its Risk Profile)

(Source: Portfolio Visualizer)

My Uncle’s target allocation for his Super ZEUS Income Growth Portfolio is here.

After presenting my uncle with all the good, bad, and ugly facts, he put 50% of his hedging allocation into DBMF.

- 33% blue-chip dividend ETFs (50/50 growth and yield)

- 33% hedges (risk-free bonds and the Vanguard of hedge funds)

- 33% high-yield, low volatility, defensive Ultra SWAN dividend aristocrats and kings

Why is my Uncle sleep so well with this Zen Extraordinary Ultra SWAN or ZEUS income growth portfolio?

Superior Fundamentals To A 60/40

| Metric | 60/40 | Super ZEUS Income Growth Portfolio | X Better Than 60/40 |

| Yield | 1.6% | 5.0% | 3.13 |

| Growth Consensus | 5.1% | 6.0% | 1.18 |

| LT Consensus Total Return | 6.7% | 11.0% | 1.64 |

| Risk-Adjusted Expected Return | 4.7% | 7.7% | 1.64 |

| Safe Withdrawal Rate (Risk And Inflation-Adjusted Expected Returns) | 2.5% | 5.5% | 2.22 |

| Conservative Time To Double (Years) | 29.1 | 13.1 | 2.22 |

(Source: DK Research Terminal, FactSet)

My uncle’s new Super ZEUS Income Growth portfolio yields 5% and has 11% consensus long-term return potential.

| Investment Strategy | Yield | LT Consensus Growth | LT Consensus Total Return Potential | Long-Term Risk-Adjusted Expected Return | Long-Term Inflation And Risk-Adjusted Expected Returns | Years To Double Your Inflation & Risk-Adjusted Wealth |

10-Year Inflation And Risk-Adjusted Expected Return |

| Super ZEUS Income Growth Portfolio | 5.0% | 6.0% | 11.0% | 7.7% | 5.5% | 13.1 | 1.70 |

| 60/40 Retirement Portfolio | 1.6% | 5.1% | 6.7% | 4.7% | 2.5% | 29.1 | 1.28 |

| S&P 500 | 1.6% | 8.5% | 10.1% | 7.1% | 4.9% | 14.8 | 1.61 |

| Dividend Aristocrats | 2.4% | 8.6% | 11.0% | 7.7% | 5.5% | 13.2 | 1.70 |

(Source: Morningstar, FactSet, YCharts)

This is far higher yield than either a 60/40, S&P or the aristocrats, with superior return potential and, of course, a lot less volatility.

- 2.2X the safe withdrawal rate of a 60/40

- with 3.3X the yield

His old ZEUS Income Growth portfolio had a 4.3% yield and 10% CAGR long-term return potential.

- 0.7% higher yield

- 1% higher long-term return potential

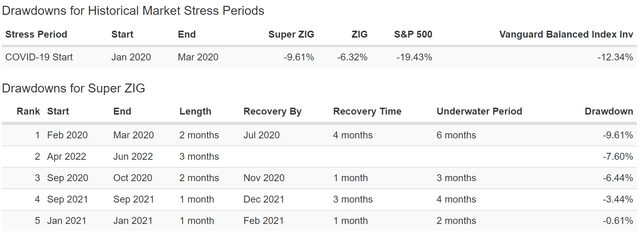

Historical Returns Since June 2019

(Source: Portfolio Visualizer)

In the last three years, ZIG outperformed a 60/40 with very modest declines in the Pandemic and 2022 bear market. But adding DBMF resulted in the following:

- Significantly better returns

- even lower annual volatility

- a peak decline of just 9.6% in the 2022 bear market

33% of this portfolio, through QQQ and EDV, was crushed, with 30% declines.

Yet thanks to the power of blue-chip diversification and prudent asset allocation and risk management, it didn’t even suffer a correction.

(Source: Portfolio Visualizer)

- A decline that’s 1/3rd as bad as the S&P 500.

- With a 5% yield

- And long-term return potential that matches the dividend aristocrats

This is the power of diversification and uncorrelated assets.

(Source: Portfolio Visualizer) (Source: Portfolio Visualizer)

In the 2022 bear market, the peak declines have so far been:

- Nasdaq -30% (-32% intraday)

- S&P -20% (-24% intraday)

- 60/40: -17%

- ZIG: -14%

- SCHD: -10%

- Super ZIG: -9.6%

Do you know what a 66% smaller peak decline in the 11th worst bear market in US history sound? Like an amazing high-yield Ultra SWAN portfolio, which is why my uncle added 17% of DBMF to his portfolio.

But you might not want to buy that much of DBMF, or any at all, and here’s why.

Risk Profile: Why DBMF Is Not For Everyone

There are a lot of complexities to DBMF’s risk profile.

First, it’s only been around for three years.

Yes, management claims its historical backtest of the strategy would have delivered superior results to hedge funds during stagflation and market turmoil.

- we can confirm that hedge funds do well in such periods, but I can’t confirm management’s proprietary backtest data

It will be another two years before there is sufficient statistical data for us even to run a 75-year Monte Carlo simulation to stress test potential future returns and volatility.

- and another eight years before we can say with 90% statistical confidence that DBMF is a good ETF to own long-term

Has DBMF crushed hedge funds since inception? Yes, by 5% annually.

Is its portfolio construction method theoretically superior to any of its peers? Absolutely.

- top 20 blue-chip hedge fund consensus Vs. a single managers opinions

- over time, this should deliver far better and more consistent results

But does that mean DBMF’s low-cost, blue-chip consensus approach is perfect? Absolutely not.

- there is a 3-month lag between when the blue-chip hedge fund consensus makes changes to its portfolio and DBMF does

- a 20-fund consensus will naturally move slower than any individual hedge fund

In Q3, based on the blue-chip hedge fund consensus DBMF:

- Switched from slightly long gold to slightly short

- decreased its shorts on US blue-chips (before a 9% rally in July)

And that brings us to another risk factor to be aware of.

- DBMF is VERY concentrated in its positions

- 50% of the net portfolio is short the Yen (and long USD/Yen)

If the Bank of Japan starts raising interest rates, or the dollar simply pulls back due to a Fed pivot (not likely until 2024), the Yen could soar against the dollar, and DBMF could have a very rough time of it.

Hopefully, the blue-chip hedge fund consensus will adapt again and make sure the portfolio is suitably risk-on for 2023.

- bonds are likely to go up next year, and DBMF is currently 60% net short bonds

- stocks are likely to have a great 2023, and DBMF is short stocks

- the dollar is likely to pull back next year, and DBMF is very long the dollar

- commodities are already pulling back, and DBMF is modestly long commodities (mostly oil)

Bonds are always risk-off, and hedge funds like DBMF change their allocations to shift with the macro environment.

- thus why hedge funds outperform bonds and commodities over time

The top 20 hedge funds represent the best, brightest, and highest-paid experts in this field.

I’m highly confident they will adapt over time BUT not necessarily quickly enough to deliver its likely 9.5% long-term return.

- in 2020 it generated a 1.7% return

- because stocks went from risk-on to risk-off, to a 100% rally, in a matter of months

If the economy changes too quickly, DBMF could suffer a lot worse returns than investors have seen so far.

Finally, let’s talk about that historical 10% dividend yield.

- Almost all capital gains are paid as an annual dividend at the end of the year

Important Things To Know About DBMF’s Dividend

- a mix of income and short and long-term capital gains

- not 100% qualified (LT capital gains are taxed as dividends, ST cap gains and income as non-qualified income)

- at your top marginal tax rate

DBMF doesn’t issue a K-1 (like BX does), but filing each year will be some added tax complexity.

- Your brokerage statement shows the total portfolio income and cap gains mix each year

Due to being a hedge fund, the taxes can be significant.

- Since inception, 29% of returns have been consumed by taxes

- own DBMF for the long-term

- do not trade it to minimize this high tax bill

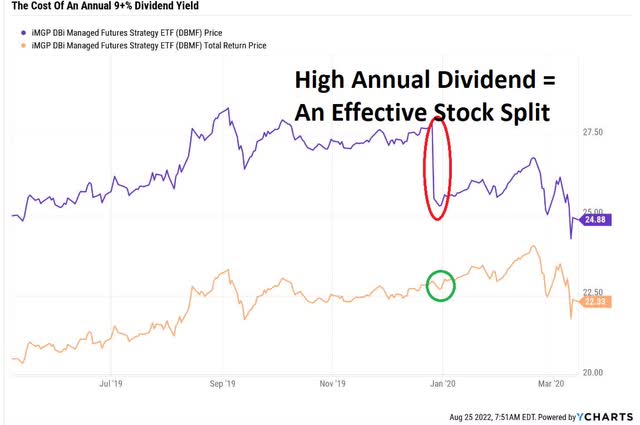

The most important thing to understand about DBMF’s likely 9% to 10% long-term yield is this:

- it’s highly variable

- it’s paid once per year

- it will cause the stock price to crash most years on the ex-dividend date

In 2021 DBMF paid a 10.6% dividend at the end of the year. Investors who were DRIPing suddenly owned 11% more shares at an 11% lower price.

- DRIPing dividends = an effective stock dividend/split

In other words, the big plunge on the ex-dividend date (the end of December) isn’t real.

- the total return price is unchanged

- you get cash or more shares

So what if you just take the cash every year?

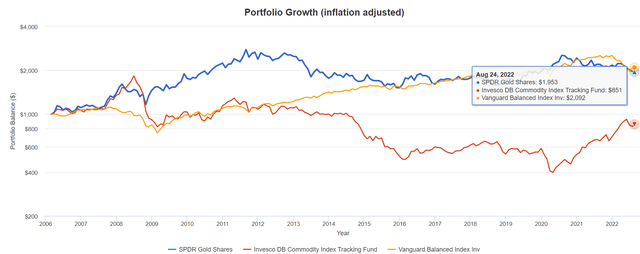

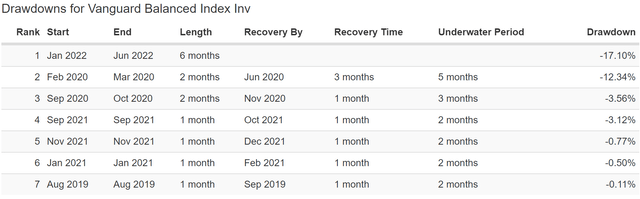

Historical Returns Since June 2016 (No Dividend Reinvestment)

(Source: Portfolio Visualizer Premium)

For high-yield stocks like DBMF, much of the returns can come from dividends. In this case, 50% of historical returns are from dividends.

Note that without dividend reinvestment, the peak decline rises to -13%, though that’s still far better than a 60/40 SCHD or the S&P 500.

And this is hardly the complete risk profile for this complex ETF.

- DBMF prospectus

- 4 pages out of 12 in the prospectus are devoted to risks

- which is actually normal for an ETF

- most companies risk-sections in their 10-Ks run 10 to 30 pages in length

Bottom Line: If You Want To Hedge Against Stagflation, Forget Gold And Commodities And Consider 11% Yielding DBMF Instead

Let me be very clear that hedging is NOT required for investing success.

- only blue-chip stocks are necessary for most people to achieve life-changing income and wealth compounding

Bonds, cash, and alternatives like hedge funds, commodities, and gold, are designed to smooth out returns, so you can sleep well at night and avoid costly mistakes like market timing.

Over the last 20 years, owning stocks, or REITs, was optimal if you wanted to maximize returns.

But the average investor earned just 1/3rd the market’s return and enjoyed half the returns of a 60/40.

That’s because most investors just can’t help themselves. We all say we want to “be greedy when others are fearful,” but that’s much easier said than done.

The right asset allocation for your risk profile, goals, and time horizon is the first step to building the right Ultra SWAN retirement portfolio that can help you retire rich and stay rich in retirement.

Why might you want to hedge against inflation now that it appears to have peaked?

- Because PIMCO, the global bond king, thinks high inflation is here to stay and might weigh on bond returns for years to come (possibly over a decade)

- and plenty of other blue-chips firms agree

Many other blue-chip economist teams, such as Bank of America and JPMorgan, disagree.

Schwab and Fidelity are telling their clients to get long duration, and so is Morgan Stanley.

However, if we get several lost years for bonds, in which a 60/40 might no longer work, DBMF represents the single best stagflation hedge I’ve ever found.

- much lower cost than any hedge fund

- uses the top 20 hedge fund blue-chip consensus to weight its portfolio

- pays a very generous yield (basically all of its returns)

- a potential 24% yield at the end of 2022

- 9% to 10% potential long-term returns (and yield)

Remember that DBMF is NOT meant to be the only thing you own. It’s a hedge fund ETF and will likely underperform blue-chip stocks over time (though it might beat a 60/40, according to analysts).

The Vanguard of hedge funds is a potentially attractive option for anyone looking for hedging assets other than bonds, especially those working during periods of high inflation.

- bonds fail 8% of the time

- hedge funds tend to perform well during these periods

DBMF adapts its portfolio to whatever is most reasonable and prudent for the given economic environment at the time, as determined by the 20 largest hedge funds.

- Bonds are always “risk off”

- DBMF pivots as necessary to deliver superior returns to bonds

The 3-year track record of DBMF is impressive, though not statistically significant.

- max risk cap recommendation is no more than 50% of your hedging allocation

- most investors would be more comfortable with a 5% to 10% allocation in their portfolios

My Uncle’s Super ZEUS Income Growth portfolio shows the right non-correlated blue-chip assets, combining bonds, hedge funds, dividend growth, and high-yield ETFs, and individual blue-chip Ultra SWANs, creates a truly exceptional high-yield, low volatility portfolio.

One that offers a 5% yield, 11% long-term return potential, and 1/3rd the peak bear market declines of the S&P 500 and far less than a 60/40.

But DBMF can be useful for even the simplest investor who wants to hedge against stagflation.

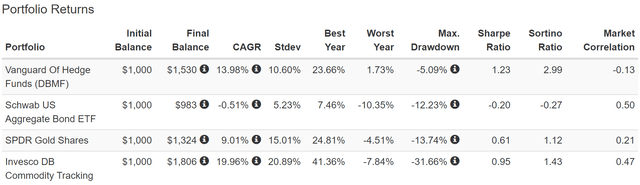

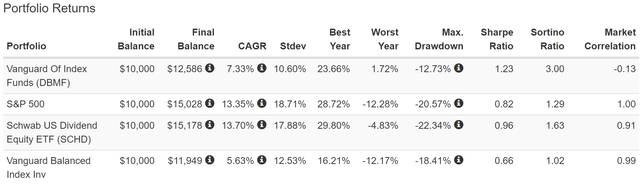

How To Hedge A 60/40 For Stagflation

(Source: Portfolio Visualizer Premium)

According to DBMF’s management, this is how you’re supposed to use this ETF.

- not as a stock to trade

- but as a long-term holding to augment a traditional balanced portfolio

Adding just 5% of DBMF to a 60/40 portfolio increased the negative volatility-adjusted returns by 24%.

And a 20% allocation (the most DK recommends anyone own) increased annual returns by 50% while reducing the peak decline in the 2022 bear market to just 12%.

- 24% to 73% higher negative-volatility-adjusted returns by diversifying a 60/40

And guess what happens to your dividend yield?

- 60/40 yields 1.6%

- 2.1% with 5% DBMF allocation

- 2.5% with 10% DBMF allocation

- 3.4% with 20% DBMF allocation

Did you know that changing just 20% of your portfolio assets can double your dividend yield? Well, it can, and DBMF is how you can do that.

No ETF or stock is right for everyone or perfect. But DBMF represents a potential world-beater high-yield asset that I’m comfortable recommending and will be incorporating into several DK portfolios when it’s time to rebalance.

Be the first to comment