vladvolk/iStock via Getty Images

Investment Thesis

Twilio Inc (NYSE:TWLO) has obviously embarked on an aggressive expansion plan, given the flurry of M&A activities in the past few years. This has naturally led the company to command the lion’s share of 38% in the CPaaS market by 2021, based on Synergy Research Group. However, the management has also proved rather prudent, with reduced reliance on debt and reasonable share dilution thus far.

We are already witnessing excellent results, with TWLO delivering impressive growth in active customer accounts by 14.5% YoY, from 240K in FQ2’21 to 275K in FQ2’22. Furthermore, the company still reported exemplary revenue net dollar-based expansion of 123% in FQ2’22, pointing to robust market demand.

Naturally, these metrics indicate a notable slowdown from FQ1’22 YoY growth of 41% in accounts and 127% in dollar-based expansion, due to the worsening macroeconomics over the past few months and the hypergrowth during the pandemic. However, we must remind investors that these temporary headwinds will naturally be resolved by mid-2023, once the economy recovers. Therefore, not an accurate reflection of TWLO’s fundamental performance.

Despite the appearance of maximum pain, we remain bullish about TWLO’s prospects, since adoption still stands to grow at a satisfactory rate post-reopening cadence, given the projected global growth of the Communications Platform as a Service (CPaaS) market from $6.3B in 2022 to $59.36B in 2032 at a CAGR of 25%. Analyst Matt VanVliet of BTIG said:

Twilio is the clear market leader in the nearly $80bn CPaaS [communications platform as a service] market that is growing in excess of 20% annually. We expect Twilio to continue to gain market share with the broadest and best product offering, elevated investment in R&D and M&A to maintain that competitive positioning, and accelerating end-market demand for omnichannel communications capabilities that can be embedded in every step of the customer journey. (Nasdaq)

TWLO Continues To Perform With A Growth At All Cost Strategy

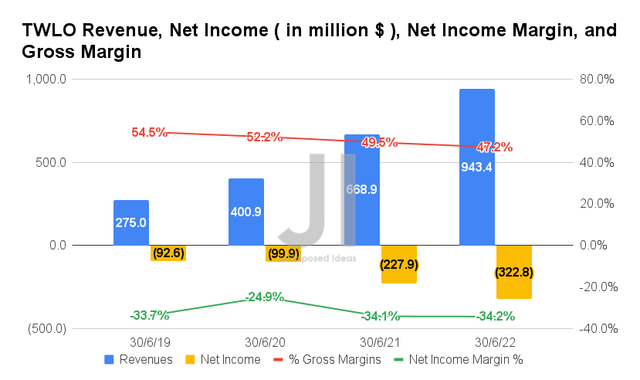

In FQ2’22, TWLO reported revenues of $943.4M and gross profits of 47.2%, representing an increase of 41% though a notable decrease of 2.3 percentage points YoY, respectively. Given the impact of inflation and partly, the growth in its international segment, the company reported net incomes of -$322.8M and net income margins of -34.2% in FQ2’22, representing a decline of 41.6% and in line YoY, respectively.

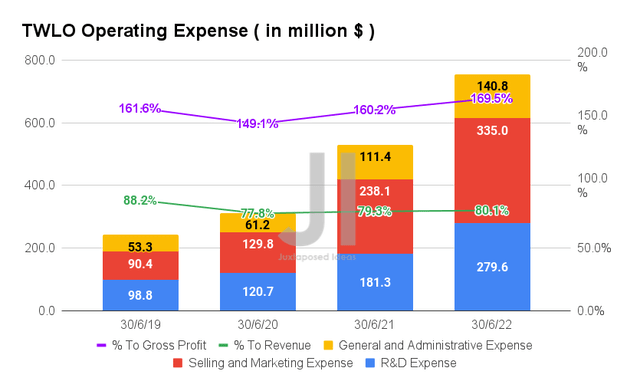

Part of its lack of profitability is also attributed to its elevated operating expenses. By FQ2’22, TWLO reported operating expenses of $755.4M, representing a massive increase of 42.3% YoY. Since the pace of growth accelerated faster than its sales, it is natural that the company continues to struggle with unprofitability thus far. The ratio of the operating expenses to its growing revenues remains elevated at 80.1% and to gross profits at 169.5% in FQ2’22.

Nonetheless, we expect to see a meaningful moderation ahead, as TWLO cuts costs by slowing down new hires and office closures moving forward. These efforts would likely pay off from FQ3’22 onwards, with improved operating metrics and non-GAAP profitability ahead, despite the one-time write-offs.

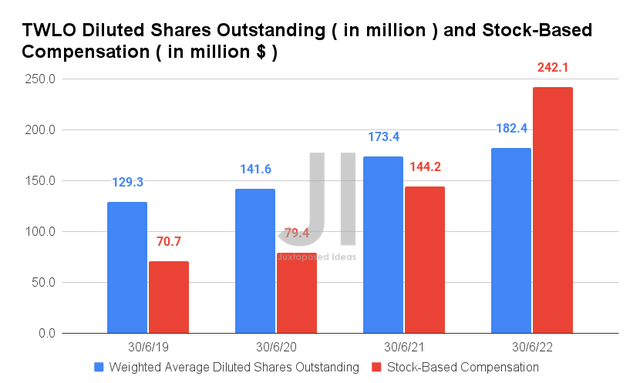

Notably, TWLO’s Stock-Based Compensation (SBC) has also increased exponentially in the past two years, at an alarming CAGR of 74.62%. By FQ2’22, the company reported SBC expenses of $242.1M, representing a massive increase of 67.8% YoY and 342.4% from FQ2’19 levels. Thereby, contributing to its deepening GAAP net losses thus far.

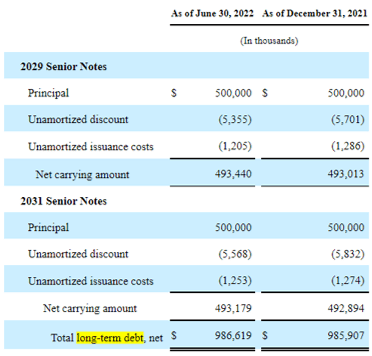

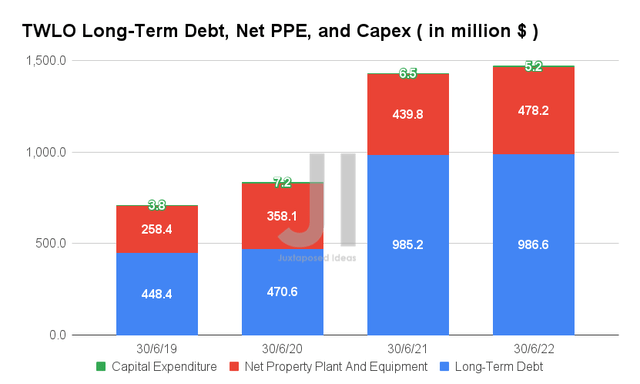

In addition, TWLO continues to moderately dilute its long-term shareholders to 182.4M by FQ2’22, through a mix of capital raises and aggressive M&A activities, on top of the above-mentioned SBC. These represent a notable share dilution of 217.4% since its IPO in 2016, with a total share count of 83.89M then. Not too bad, in our opinion, since these strategies have also been top-line accretive and notably reduced the impact on the company’s debt obligation from $1.21B in FQ1’21, to $985.2M in FQ2’21, and finally to $986.62M in FQ2’22.

TWLO Debt Maturity

Seeking Alpha

In addition, TWLO remains well positioned for long-term growth with sustainable capital management in place, since these debts would only mature by 2029 and 2031. In the meantime, the company continues to invest in its long-term capabilities with a capital expenditure of $5.2M to its net PPE assets of $478.2 in FQ2’22.

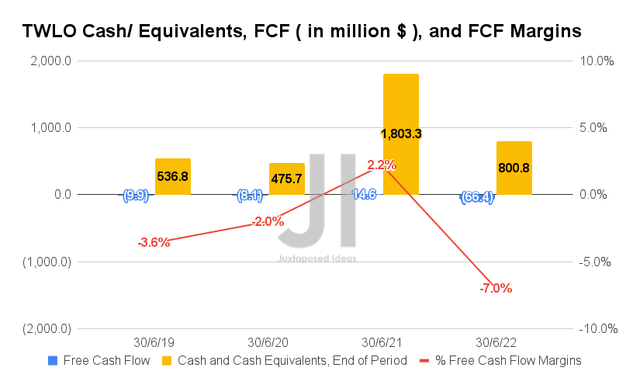

Despite its negative Free Cash Flow (FCF) of -$66.4M and an FCF margin of -7% in FQ2’22, TWLO still reports sufficient cash and equivalents of $800.8M on its balance simultaneously. Thereby, reducing the need for another capital raise in the short term, since the management also guided breakeven by FY2023. However, we may potentially see another share dilutive effect or debt leveraging over the next two years, given the company’s minimal profitability through FY2024.

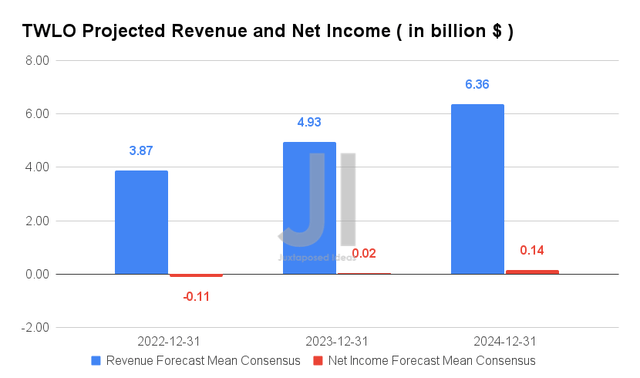

Over the next three years, TWLO is expected to report revenue growth at a CAGR of 30.83%, while potentially reporting a net income break even by FY2023. For FY2022, consensus estimates expect the company to report revenues of $3.87B and net incomes of -$0.11B, representing an excellent increase of 36.2% and 88.4% YoY, respectively.

Nonetheless, these stellar numbers were shadowed by TWLO’s softer guidance for FQ3’22 revenues between $965-975M, compared to estimates of $979.32M. Therefore, we are not surprised by the stock decline of -22.8% post-earnings call, from $98.19 on 04 August to $75.73 on 25 August 2022. Nonetheless, we believe that this creates the most opportune timing for investors who have been waiting to add this stellar stock since the pandemic highs.

So, Is TWLO Stock A Buy, Sell, or Hold?

TWLO 5Y EV/Revenue and P/E Valuations

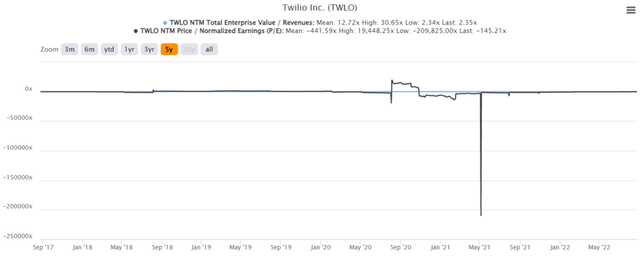

TWLO is currently trading at an EV/NTM Revenue of 2.46x and NTM P/E of -150.83x, lower than its 5Y EV/Revenue mean of 12.72x though massively improved from its 5Y P/E mean of -441.61x. The stock is also trading at $75.73, down 79.6% from its 52 weeks high of $373, nearing its 52 weeks low of $72.48.

TWLO 5Y Stock Price

Nonetheless, consensus estimates remain bullish about TWLO’s prospects, given their price target of $139.17 and an 83.77% upside from current prices. Therefore, given the relatively attractive risk/reward ratio, investors with a long-term trajectory and higher tolerance for risk may consider nibbling at these levels. The stock seems to be forming a sustainable support level, though bottom fishing investors may potentially wait for $60s before adding.

Therefore, we rate TWLO stock as a speculative Buy for now.

Be the first to comment