MoMo Productions

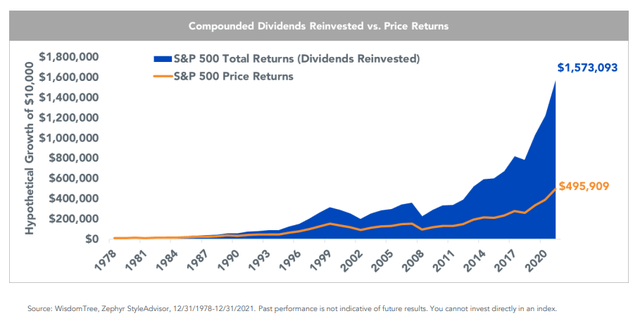

Dividends have produced a substantial chunk of long-run total returns in the stock market. According to WisdomTree ETFs, since 1978, dividends and reinvested dividends have contributed 69% of the U.S. stock market’s return.

Dividends Matter, Indeed

Global X ETFs

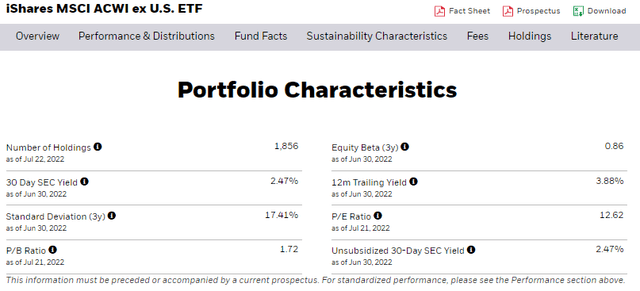

While the yield on the U.S. stock market is about 1.6%, using the Vanguard Total Stock Market Index ETF (VTI) as a proxy, foreign stocks feature a higher yield. The iShares MSCI ACWI ex-U.S. ETF (ACWX) has paid out a 3.9% 12-month trailing yield.

Foreign Stocks Boast a Decent Yield These Days

iShares

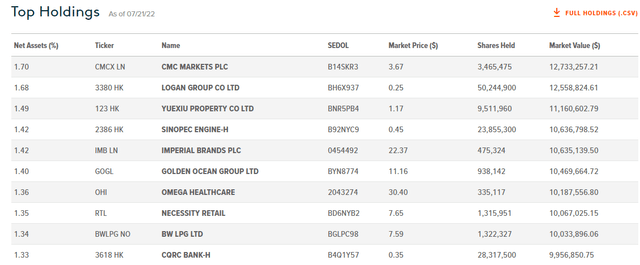

Investors today might be tempted to shoot for the moon with only the highest yielding stocks around the world. Like with just about any strategy you can think of, there is an ETF for that.

The Global X SuperDividend ETF (NYSEARCA:SDIV) provides access to 100 of the highest dividend-paying equities around the world, according to the fund’s website. Moreover, SDIV pays a monthly distribution. The 12-month trailing yield is a whopping 13.15% as of July 21 – that’s above the payout rate on the U.S. high-yield bond market. Does that sound too good to be true? Well, it is and it isn’t.

Sure, you may have that yield, but investing in only the very highest dividend stocks carries an added amount of risk. Just take a look at the fund’s top holdings. You’ve likely not heard of many of these securities.

SDIV’s Top 10 Holdings: Obscure Names

Global X ETFs

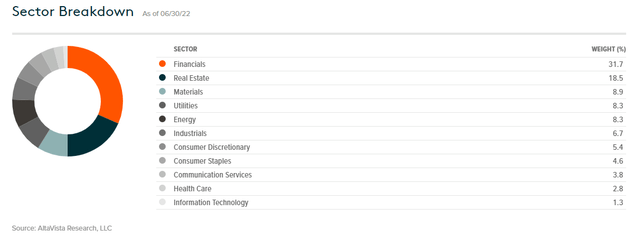

With any ETF, knowing the sector composition is also critical to grasping your risk exposure. SDIV is focused heavily in the Financials sector – many emerging and frontier markets are weighted into Financials, which tend to pay high yields, but once again, they feature a high standard deviation in their share prices. Real Estate is also a big piece of SDIV while growth areas like Information Technology and Health Care barely hold any exposure in the fund.

SDIV Sector Exposure: Heavy Into Financials & Real Estate, Light on TMT

Global X ETFs

Also adding to SDIV’s high-risk profile is the country breakout. China, Brazil, and Hong Kong are material parts of the fund. Those are not the most stable and/or developed markets in the world by any means.

SDIV Country Exposure: Some Risky Nations Hold Weight

Global X ETFs

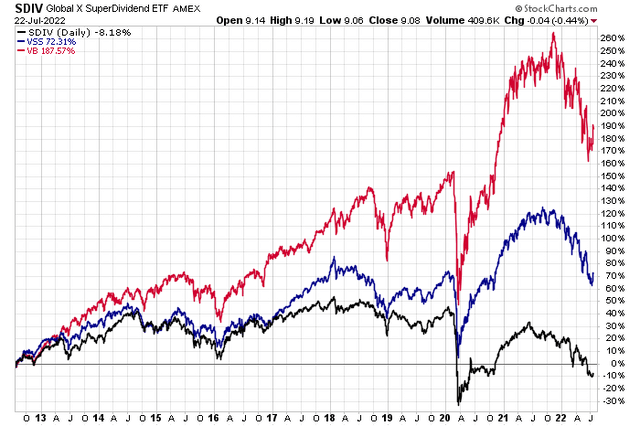

I also noticed the weighted average market cap of the fund is under $7 billion, so it is essentially a small-cap ETF. As for performance, it has been a dud over the last decade. I chose to compare it to both the Vanguard Small Cap ETF (VB) and Vanguard FTSE All-World ex-US Small-Cap Index ETF (VSS) to get a picture of the global small-cap universe. Survey says: SDIV is a loser versus both.

SDIV: A Loser Compared to U.S. And Foreign Small Cap Funds

Stockcharts.com

The Bottom Line

The Global X SuperDividend ETF sounds like an intriguing product – a mandate to invest in the 100 highest dividend yield stocks from around the world. Unfortunately, you gain exposure to small and risky niches of the global stock market. If you are going for a dividend-oriented portfolio, I’d say stick with tried-and-true large-cap value type of funds. You can also venture out onto the risk spectrum with something like VSS which has a yield close to 3.5%, double that of the S&P 500.

Be the first to comment