Drepicter

Severe skin conditions are often terribly disfiguring. Avita (NASDAQ:RCEL) has developed a cell based system to treat such conditions. Unfortunately it is struggling to scale its business as I will explain.

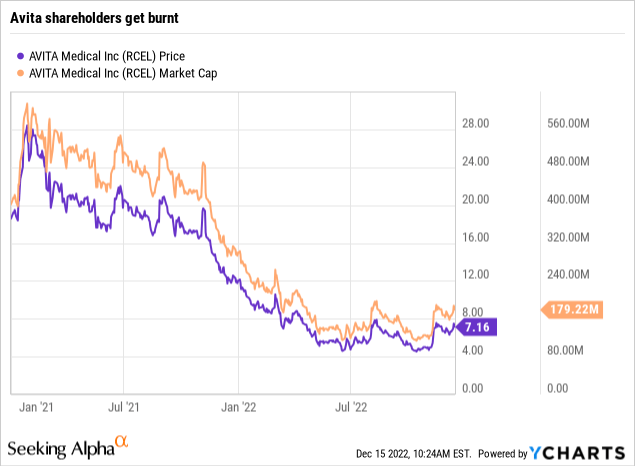

In my most recent Avita article, 05/2021’s “AVITA: Recell’s Growing Upside”, (“Upside”), I was quite bullish about the company’s prospects. At the time it boasted a $0.5 billion market cap. It has worse than stagnated since; its market cap has dropped significantly.

In this article, I discuss Avita’s recent performance and its near term catalysts that could see it regaining, and surpassing, its former heights.

Avita has proven unable to realize on its huge potential in recent quarters.

Upside succinctly synopsized Avita’s business at the time. It described its initial commercial product granted preliminary market approval [PMA] from the FDA in 2018; it went on to note:

The FDA’s approval document characterized the device as an Autologous Cell Harvesting Device (RECELL Device) for use by licensed health care professionals who have been trained in its use.

The RECELL Device administers a specially prepared group of cells which have been harvested from the patient, dubbed Spray-On Skin Cells. It is indicated for use in:

… treatment of acute thermal burn wounds in patients 18 years of age and older. The RECELL Device is used… at the patient’s point-of-care to prepare autologous Regenerative Epidermal Suspension (RES™) for direct application to acute partial-thickness thermal burn wounds or application in combination with meshed autografting for acute full-thickness thermal burn wounds.

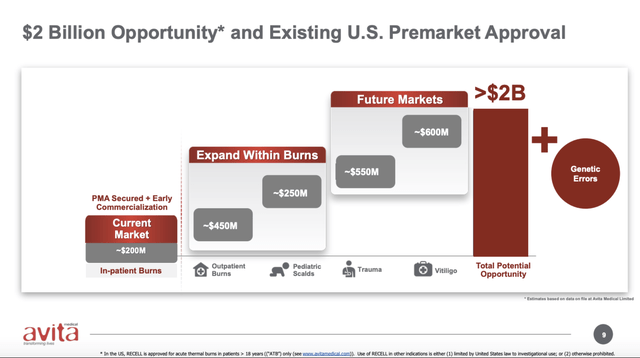

At the time Avita was touting a market potential as shown on the slide below:

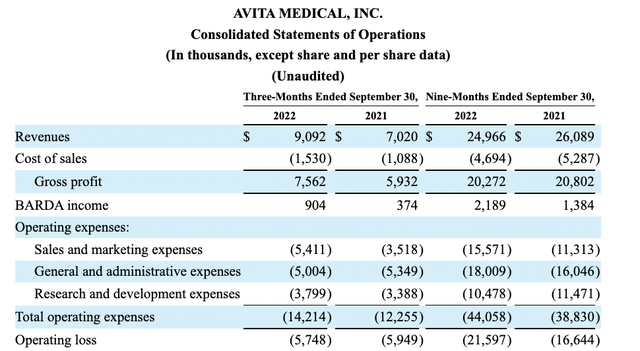

Fast forward to Q3, 2022. Avita’s Q3, 2022 10-Q includes the following excerpted financial data:

Both its quarter over quarter and its nine month over nine month results are discouraging.

Focus on nine month gross profit for 2021 compared to 2022 results where the situation is most extreme; we see a small drop in gross profit Y/Y. Over the same period when gross profit is dropping, sales and marketing expenses increase by a hefty >27% from $11,313 million to $15,571 million.

When sales and marketing expenses go up while gross profits are declining, as they did on a nine month basis, it sends a rude message. Looking just at Q3, 2022 gross profits are $7,562 million; for Q3 2021 they are $5,932 million. That shows an encouraging >20% growth. On a current quarterly basis gross profit seems to be recovering.

During Avita’s Q3, 2022 earnings call (the “Call”), CFO Holder reported a revised 2020 annual revenue guidance of:

… $33 million to $34 million from $30 million excluding BARDA revenues, which represents an approximate 33% increase year over year. We continue to project BARDA revenues of approximately $0.3 million in calendar year 2022.

If you do the math this guidance seems to reflect a straight-line stretching out of Avita’s 2022 nine month revenues of $24,966 as reflected in its 10-Q, to a full 12 months. No expense guidance is given during the Call.

Avita’s share price has dropped heavily despite ongoing successes with the FDA.

Not surprisingly, Avita’s revenue struggles have lead to unpleasant share price ructions. As shown by its chart from the start of 2021, Avita has been a tough hold.

It started 2021 trading at $19.14. It rose to a high of $28.18 on 02/04/2021.

As is common for companies who experience a sharp share price increase, Avita took advantage of the situation by announcing a capital raise on 02/21/2021. Two days later it priced the offering at $21.50. This $21.50 was pretty much a cap on shares into the summer of 2021. It was finally bested on 06/28/2021.

From that point forward its shares bounced with little conviction, but with a heavy downward bias. They dropped to a low <$10.00 on 01/19/2022 on revenue concerns. Since that time shares have been on a persistent downward slide. They hit a 52 week low of $4.41 on 10/13/2022.

Despite its share price drops, the FDA has generally responded favorably to Avita’s RECELL device. As previously noted it granted it a PMA in treatment of acute thermal burn wounds in patients 18 years of age and older back in 2018. Since that time the FDA has supported Avita’s RECELL project as follows:

- In June 2021, the FDA approved expanded use of the RECELL System in combination with meshed autografting for acute full-thickness thermal wounds in pediatric and adult patients.

- In February 2022, the FDA approved a PMA supplement for the RECELL Autologous Cell Harvesting Device, an enhanced ease-of-use device aimed at providing clinicians a more efficient user experience and simplified workflow.

- Investigational Device Exemptions (“IDEs”), which have enabled the Company to initiate pivotal clinical trials to further expand the indications of the RECELL System for the treatment of soft tissue repair and vitiligo.

Avita’s planned FDA applications for soft tissue repair and vitiligo are important near term catalysts.

Soft Tissue Repair

Recently in 11/2022, the FDA granted Avita’s RECELL device Breakthrough Device designation for its proposed soft tissue repair indication. This designation assures Avita prioritized review and interactive communication with the FDA throughout its premarket review phase.

Avita submitted RECELL for FDA approval in this indication on 12/12/2022. During the Call Avita’s new CEO Corbett reported that it expected approval in 06/2023. He further noted:

…The soft tissue repair market will expand our hospital call point and treating physician call points by nearly three times.

In response to a question during the Call as to sales force coverage, Corbett confirmed that the three times call points referred to the size of the entire market. As such Avita anticipated it would need to expand its sales force. He promised more details in Avita’s Q4 call.

Avita exudes confidence on the likelihood of its soft tissue indication approval. Given the FDA’s apparent satisfaction with RECELL generally as reflected by its actions to date, I am also optimistic.

Vitiligo

For those unfamiliar with vitiligo it is a:

…chronic autoimmune disease that attacks pigment producing cells, resulting in spots or patches of lighter or white, deep pigmented skin. Although non-threatening, non-life threatening, it can occur anywhere on the body and can result in severe psychological denotations due to perceived disfigurement.

It affects 2% of the world’s population, including ~6.5 million Americans. The RECELL system offers significant help to this group who are otherwise stranded without meaningful options. An independent panel of experts who reviewed Avita’s study reported:

…56% of RECELL treatments, versus 12% of control treatments resulted in repigmentation of more than 50% of the treated area. The CRC also reported 36% of RECELL treatments versus 0% of control treatments result in repigmentation of at least 80% of the treated area, establishing super-superiority for the primary endpoint.

At the same time that the FDA granted soft tissue its RECELL device Breakthrough Device designation, it also granted it to Avita’s vitiligo indication. Similarly FDA submission for vitiligo is expected in 12/2022 with approval in 06/2022.

Thereafter the timing between the two indications diverges sharply. The difference has to do with reimbursement. Soft tissue reimbursement is already set. For vitiligo Avita targets it to take until 01/2025 to work out an acceptable reimbursement program.

Avita’s risks should be carefully considered before investing.

Avita has its attractions. It also has significant risks. The three risks which are top of mind for me are FDA, competition, and market risk. The most glaring of these is its risk that the FDA reject or delay its soft tissue repair application or, once Avita applies for its vitiligo indication, that it be rejected or delayed.

For the soft tissue indication, one potential rough spot is the fact that, on first review, it did not meet its pre-specified primary endpoint. On a subsequent review, Avita determined that an error had interfered with its first analysis. In response to a request for more color on this apparent flip flop. CEO Corbett explained that during a standard data review and verification:

…a 100% review of the source endpoint data against the clinical database to make sure that when you submit, you have it right and subject to an FDA examination of the same data you don’t want to have any errors.

In its second go at the data, Avita discovered issues with two trial participants:

One had a data entry error and one subject should have been excluded from the analysis as they had surgery to remove a medication implant that was right in the RECELL wound and interfered with the healing. So that is really just those two patients and it was really part of the standard source endpoint data review.

Any time a pivotal trial has missed its primary endpoint it is a big deal. I can envision that the FDA decide that the data is tainted and it could require a new trial.

As for competition, Avita’s 10-Q has no disclosures on this risk; however its 10-K has a competition heading. It describes its competition in the burns market as:

…the current standard of care, primarily split-thickness autografts. Although the RECELL System is complementary with autografts for the treatment of many burn injuries, we face competition from this traditional surgical procedure for many burn patients. … We face additional competition in the burns market from other FDA-approved products such as Epicel® provided by Vericel Corporation as well as from Stratagraft® provided by Mallinckrodt.

As for market risk, Avita is a small cap company with limited resources. It generates recurring losses with an accumulated deficit of $252 million. In a risk-off market such as we currently have it may face a deficit of buyers with resultant share losses.

Conclusion

Avita offers an excellent opportunity for investors to build a position in an out of favor small cap which offers near term catalysts that could vault the shares to multibagger territory. As such I rate it a speculative buy.

The opportunity carries significant risks as noted and as otherwise listed at length in its 10K.

Be the first to comment