nopparit/iStock via Getty Images

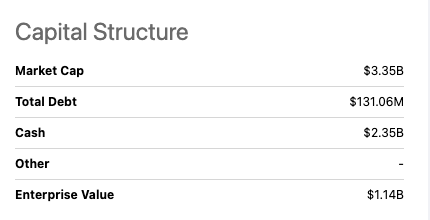

You rarely see a biotechnology firm that becomes profitable in less than ten years of performance. Vir Biotechnology, Inc. (NASDAQ:VIR), a firm with a market cap of $3.35 billion, started on the right foot with a strong management team, initial backing from big names such as the Gates Foundation, pushed along by its COVID-19 treatment sales partnership with GSK (GSK), is doing just that; however, it may only be temporarily. Last fiscal year, the company reached profitability. Trading-wise, it has yet to make investors particularly happy, with losses of 36.07% year to date.

Year to date stock trend (SeekingAlpha.com)

Biotechnology firms can bring in huge gains or losses based on how optimistic or pessimistic investors feel towards drug trial news rather than the results of earnings reports. VIR’s multi-dimensional way of conducting research is resulting in positive progress, which could deliver sales in the long run. This is a company, run by a highly experienced leadership team, with long-term cash availability, pipeline progress and strong collaborations for further long-term upside. Although cautious of short-term diminishing sales as COVID testing becomes less prominent, I believe there are significant factors to warrant a speculative bullish stance on this stock.

Overview

VIR was born with a golden spoon in its mouth to supporting backers such as ARCH Venture Partners and Bill & Melinda Gates Foundation. It was launched to cure, prevent and treat antibiotic-resistant severe infectious diseases worldwide. The company takes on hepatitis B, Influenza A, HIV, TB and SARS-COV-2 from research to commercial stages through a multi-program, multi-platform approach. The company is led by industry expert, George Scangos, previously CEO and board member of Biogen (BIIB), a $40.82 billion large-cap stock.

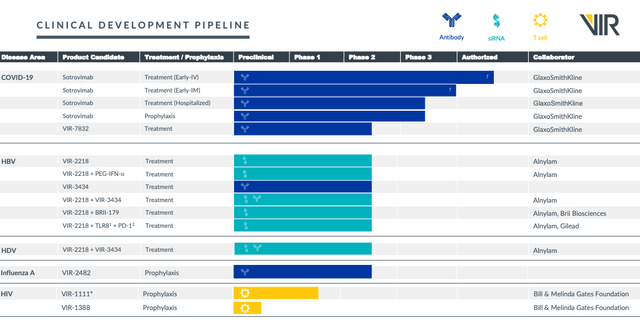

It had a feeble early performance on the stock market post its IPO on the 11th of October 2019. However, the company already has a profitable portfolio since the Fiscal year end of 2021. It has antibody treatments such as Sotrivimob and VIR-7832 with some impressive results. This is a company with an excellent deep pipeline and taking on successful trials through collaborations with other prominent organisations such as GSK, Alnylam (ALNY) and the Bill & Melinda Gates Foundation. Below we can see the various products in the company’s pipeline, with a promising number of products in the second phase of research.

Clinical Pipeline (Investor Presentation 2022)

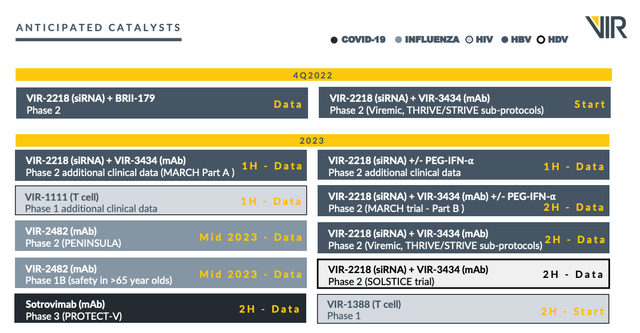

The company is working on a treatment for HBV, affecting 296 million people worldwide, including six million children. The disease contributes to 820,000 deaths every year. It is a terrible disease that often leads to liver cancer. They have various applications in different phases. Below is a timeline with anticipated catalysts. We can see that the company has the capacity, the investment and the partnerships to work on many different product candidates for various diseases, which increases the probability of positive results.

Anticipated Catalysts (Investor Presentation 2022)

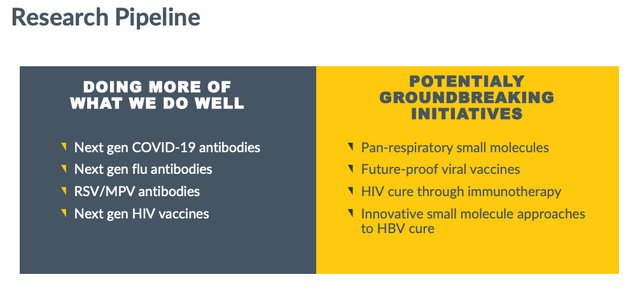

The more significant part of the company’s sales has come through a partnership with GSK to produce COVID-19 treatment. It also has a manufacturing agreement with Samsung Biologics to manufacture its SARS-COV-2 antibodies. Forward-looking, it has obtained increasingly significant and long-term capital, allowing future research into next-gen antibodies and vaccines for serious diseases.

Research pipeline (Investor Presentation 2022)

Financials and valuation

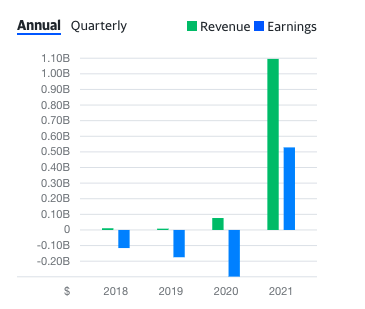

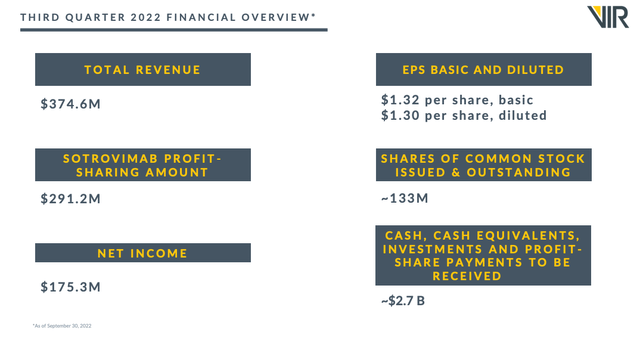

For the first time since its launch in early 2017, VIR produced a profitable year in fiscal 2021. This year the company’s top-line results tripled year on year. Last quarter the company’s net sales were $374.6 million, with net income at $175.3 million. The primary growth driver has been its revenue from COVID-19 treatment Sotrovimab, a collaboration with GSK available in over forty countries. It is improbable that these high sales numbers will continue, with analysts predicting an 80% decline in sales for next year.

Annual financials (Finance.yahoo.com)

Below is an overview of the financial highlights of last quarter. The most notable is the company’s $2.7 billion in cash, equivalents and profit share payments to be received from GSK.

Q3 2022 Highlights (Investor Presentation 2022)

Cash availability is very important to consider for a biotech company as it means they can further R&D investments and operational growth. The company currently has $2.7 billion in cash and equivalents in addition to a profit-sharing payment from GSK, which will allow several years of further innovative progress. Due to the size of the company’s shareholders, we see a very low debt-to-equity ratio of 0.06

Capital structure (SeekingAlpha.com)

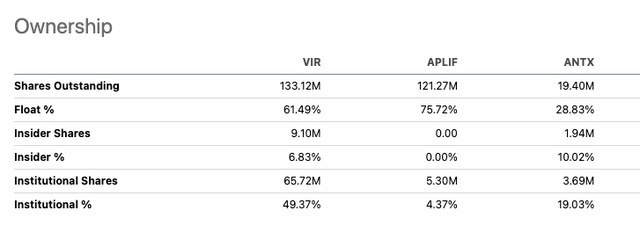

I have compared VIR to two other biotechnology peers taking on serious infectious diseases, AN2 Therapeutics, Inc (ANTX), founded in 2017 with a market cap of $192.28 million, and Appili Therapeutics Inc. (OTCQX:APLIF) with a market cap of $4.88 million founded in 2015. These companies are much smaller, but a clear indicator of strength for VIR is its institutional ownership providing the company with serious capital for growth opportunities. SeekingAlpha’s Quant Rating has given VIR A grades across all factors. However, these are heavily influenced by COVID-19 sales performance.

Ownership Comparison (SeekingAlpha.com)

Risks

Investing in the biotechnology industry is risky; you can follow the progress of research and consider a company’s financial position and research capabilities; however, results can take years, and many biotech firms fail to succeed. The biotechnology industry has just come off the back of a booming performance due to COVID-19, which was impossible to predict three years ago. Although VIR has shiny numbers right now, the company’s future success lies in the strength and outcomes of its research in treating, curing and preventing serious diseases. And whether the company will be successful is based on speculation about the future value of its pipeline. Future scenarios are challenging to predict.

Final thoughts

If you decide to invest in this company, it should be based on more than the financial performance over the last year, which is highly skewed due to the COVID-19 sales partnership with GSK. Investors should be aware of the speculative nature of the industry. What excites me is the capable management team, the initial investors in it for the long run and the collaborative research approach, which has been delivering results into further research phases. The company has been set up to treat serious infections that significantly impact millions of people worldwide. Due to the importance of this ongoing research, the company will continue to have sufficient long-term funding and thus improve its likelihood of success in the long run. Therefore I recommend a cautiously bullish stance on this stock.

Be the first to comment