SL_Photography/iStock Editorial via Getty Images

The Q4 and FY2021 Earnings Season for the Silver Miners Index (SIL) has finally ended, and one of the most recent companies to report its results was Avino Silver & Gold (NYSE:ASM). Given that operations were shuttered for most of the year due to a temporary closure, we saw another year of limited production and sales, but 2022 should be a much better year with operations ramping up towards pre-COVID-19 mining rates. After a 25% rally off its lows, I do not see Avino near a low-risk buy point, but I continue to see the stock as a Speculative Buy at US$0.75 as a trading vehicle.

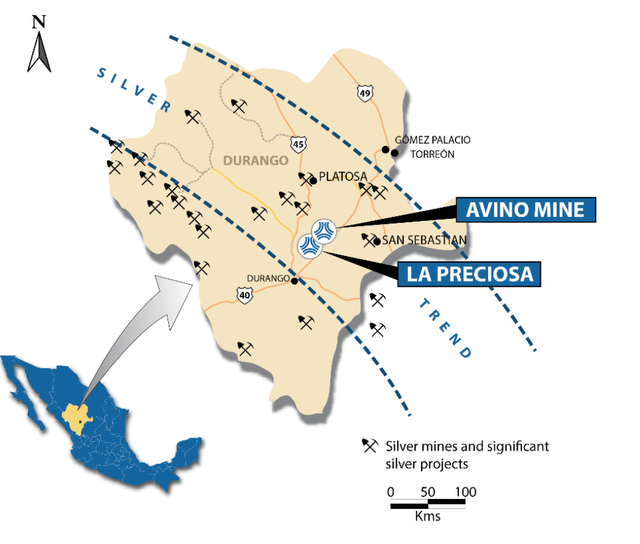

Avino Mine (Company Presentation)

Avino released its Q4 and FY2021 results last month, reporting quarterly production of ~541,400 silver-equivalent ounces [SEOs], a significant improvement on a sequential and year-over-year basis. This increase was helped by the restart of operations in August and a progressive ramp-up towards year-end. The higher Q4 production helped push the company’s annual production to ~840,000 SEOs, a 20% improvement from FY2020 levels when operations were temporarily suspended. Let’s take a closer look below:

Avino – Quarterly Production Results (Company Filings, Author’s Chart)

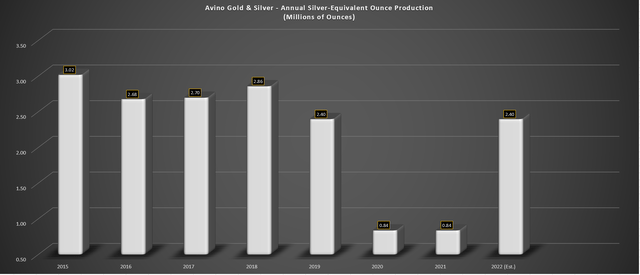

As the chart above shows, Avino reported a significant increase in tonnes milled during Q4, with the Avino operating reported mill throughput of ~103,500 tonnes, up from just shy of 60,000 tonnes in Q3. This led to a 90% increase in SEO production vs. Q3 2021 levels (~285,500 SEOs), with Avino reporting Q4 production of ~541,400 SEOs. Obviously, this was a welcome development after limited sales for a year leading up to Q3 2021, but as the below chart shows, production was still more than 60% below pre-COVID-19 levels (2019: ~2.4 million SEOs).

Avino – Annual Silver-Equivalent Ounce Production (Company Filings, Author’s Chart)

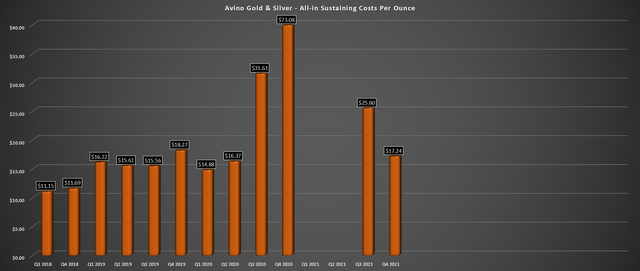

Unfortunately, due to the significant decline in metal sold and the fixed costs of operating a mine, Avino’s costs have skyrocketed and are sitting above pre-COVID-19 levels. This is based on all-in sustaining costs [AISC] of $25.60/oz in Q3 and $17.24/oz in Q4, comparing unfavorably to sub $17.00/oz costs in FY2019 and even less favorably to sub $11.00/oz costs in FY2018 ($10.67/oz). However, this is largely due to the lower sales as the mine continues to ramp up, which can take several months, especially with Avino needing to complete hiring and training.

Avino – All-in Sustaining Costs Per Ounce (Company Filings, Author’s Chart)

The good news is that we continue to see progress ramping up towards its goal of just over 2,000 tonnes per day. Based on this, the company has provided a production estimate of ~2.4 million SEOs in FY2021, translating to a slight increase vs. FY2019 levels (~2.397 million SEOs produced). The higher sales should help to pull down costs slightly due to the high fixed costs of mining, though I would imagine there will be some offset due to inflationary pressures that were not existent pre-COVID-19.

Financial Results

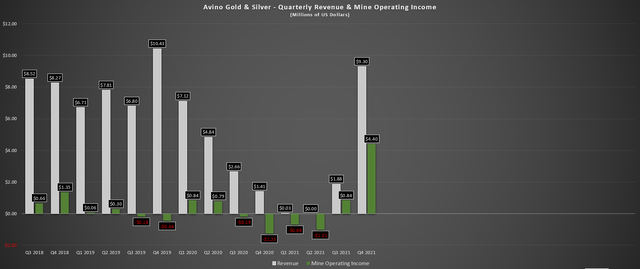

Given the increase in sales in the most recent period, revenue has finally begun to trend higher, and the mine was able to generate positive income in Q4. This was evidenced by quarterly revenue of $9.3 million and mine operating income of $4.4 million, a significant improvement from the year-ago period. The increase in revenue helped maintain Avino’s strong balance, with Avino ending the year with just over $30 million in working capital.

Avino – Quarterly Revenue & Mine Operating Income/Loss (Company Filings, Author’s Chart)

Assuming the silver price continues to hold its ground or trend higher, Avino should be able to generate meaningful revenue in FY2021 and see decent margins relative to pre-COVID-19 levels. This is because while Avino may have had slightly lower costs in FY2019 ($17.19/oz), it was working with much lower metals prices than it is today (FY2019 average silver price: $17.40/oz). Hence, even if we see some cost creep due to inflationary pressures, the Avino operation should be quite profitable at $24.50/oz.

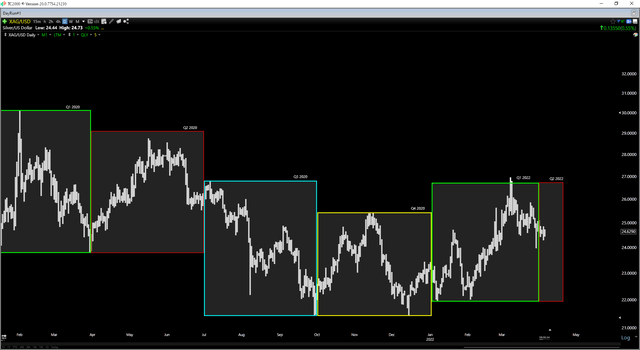

Silver Futures Price (TC2000.com)

Notably, Avino’s improved balance sheet, thanks to its timely share sale during last year’s spike in silver prices in Q1 2021 above US$1.80 per share has helped the company to improve its Avino operation. This includes meaningful investments in constructing a dry stack TSF, the construction of new buildings for its geological team and community outreach, and higher exploration expenditures. Finally, the company is also completing work on its Oxide Tailings Resource to move this to Pre-Feasibility level short-term. Let’s take a look at Avino’s valuation below:

Valuation & Technical Picture

Based on an updated share count of ~130 million fully diluted shares (post-La Preciosa transaction), Avino’s market cap comes in at ~$122 million at a share price of US$0.94. This is a very reasonable valuation for a small-scale silver producer, even if the company is a relatively high-cost producer, with costs likely to come in close to $17.00/oz in FY2022. In fact, based on Avino’s ~116 million silver-equivalent ounces at its main operation, the company has a valuation of roughly $1.05 per SEO. This valuation ascribes zero value to cash or the nearby and newly acquired La Preciosa Project until there’s high confidence that this resource can be extracted profitably.

Avino’s Projects/Operations (Company Presentation)

Having said that, I generally prefer to avoid single-asset producers, and that’s especially true when it comes to those in less favorable jurisdictions. Over the past 18 months, I would argue that Mexico is a tricky jurisdiction to operate in, with a permitting dispute at San Jose (FSM) and Great Panther (GPL) still struggling to get updated permits from CONAGUA. This doesn’t mean that Avino won’t succeed in Mexico, given that every situation is different, and it certainly offers high leverage to silver. Still, if I’m going to buy single-asset producers, I want a major differentiator such as very high margins or a world-class ore body from a grade standpoint, which is not the case with Avino.

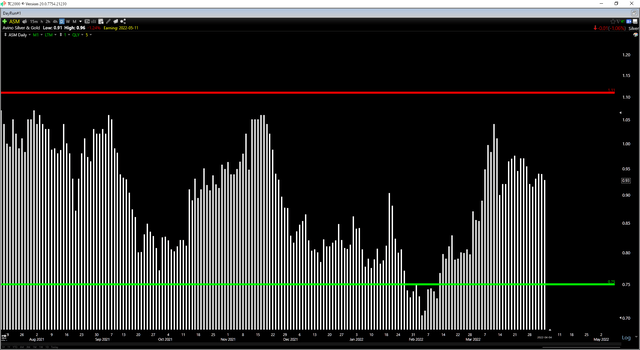

Given that Avino doesn’t have a clear differentiator relative to peers, I do not see the stock as investable, but the stock is a decent trading vehicle for those looking for silver exposure due to its liquidity relative to peers (2.0+ million shares traded per week). However, after the recent rally, the stock has found itself just above the middle of its new expected trading range. This is based on resistance at $1.11 and support at $0.75. So, while Avino is cheap, its reward/risk ratio is less favorable currently, and 20% above where I noted the stock would be a Speculative Buy at US$0.78.

ASM Daily Chart (TC2000.com)

While I am not elated with the 19% share dilution that came with the La Preciosa acquisition, Avino does have a clean balance sheet, a satisfactory operation, and upside from La Preciosa if it can find a way to extract these ounces profitably. This makes Avino a decent trading vehicle, but the key is to buy at or below support when it comes to micro-cap names, and this would require a dip to US$0.75 or lower. Therefore, while I am currently Neutral on Avino after its sharp rally, I would view the stock as a Speculative Buy at US$0.75 or lower.

Be the first to comment