tupungato

Nordea (OTCPK:NRDBY) is one of the best banks in Europe and its recent quarterly earnings were positive, supported by higher interest rates. The bank has an excess capital position, being a strong support for its capital return policy.

Company Overview

Nordea Bank AB is a Swedish bank, even though it is domiciled in Finland, with a diversified exposure across Scandinavian countries. Its current market value is about $34 billion, being one of the largest banks in Europe by this measure, and trades in the U.S. on the over-the-counter market.

Nordea is present in Sweden, Finland, Denmark, Norway and some Baltic countries, being the bank with a better geographical diversification across Nordic banks. Its main competitors are mainly local banks in each country where it operates, such as Swedbank (OTCPK:SWDBY), DNB (OTCPK:DNHBY), or Danske (OTCPK:DNKEY).

Nordea’s business is heavily exposed to retail banking, which generates more than half of its earnings, while the rest comes from wholesale banking, wealth management, and asset management. Like most of its Nordic peers, Nordea has a quality profile among the European banking sector, due to very low levels of credit losses across economic cycles, leading to superior levels of profitability compared to the vast majority of European banks.

As I’ve not covered Nordea for some time, I think it is now a good time to revisit its investment case, considering that it has announced today its most financial figures related to the last quarter.

Earnings Analysis – Q3 2022

Nordea has reported today its financial figures related to Q3 2022, beating estimates both at the top and bottom lines, as the bank’s business benefited from higher interest rates and resilient credit quality.

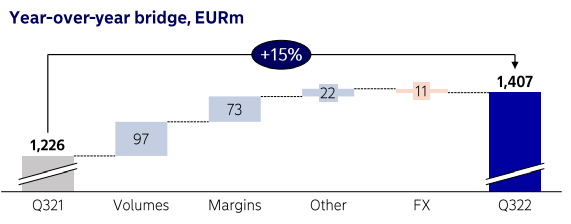

In Q3 2022, its revenues amounted to €2.5 billion (+7% YoY), being some 4% above expectations, driven by higher net interest income (NII). Indeed, NII was up by 15% to €1.4 billion, as shown in the next graph, supported by higher interest rates in Europe and higher loan volumes, considering that its loan book increased in the past quarter, especially in the corporate segment (+12% YoY) while mortgages were up by 4% YoY.

NII (Nordea)

Given that NII represents some 56% of total revenue, after many years of muted top-line growth due to the low interest rate environment, Nordea is now in a good position to benefit from rising interest rates, as the European Central Bank only started to raise its benchmark rate last July and more hikes are expected in the coming quarters.

This is positive for NII and the bank’s net interest margin (NIM) because deposits are usually stickier and asset sensitivity to higher interest rates is generally higher than for liabilities, leading to higher NIMs in a rising interest rate environment. This was already visible in the past quarter given that Nordea’s NIM increased to 1.16%, compared to 1.01% in Q3 2021, and further gains are likely in the coming quarters.

Beyond higher NII, the bank also reported an increase in trading income (+18% to €264 million), but on the other hand commissions showed some weakness (-3% YoY to €816 million).

Regarding costs, due to high inflation levels and pressure on staff costs, Nordea reported an increase in total expenses of 4% YoY, to €1.14 billion, being nevertheless a lower increase than compared to revenue growth. This means that Nordea was able to report positive operating jaws (revenue growth minus cost growth), a positive trend for its efficiency. Indeed, its cost-to-income ratio, a key efficiency ratio across the banking sector, improved slightly to 48% in the last quarter, which is a level that compares well with other large banks in Europe.

Regarding asset quality, this has remained at very low levels over the past few years, which is a distinctive factor for the Nordic banking industry, compared to the rest of Europe. Nordea is no exception and its loan losses have remained at minimal levels for many years, a profile that is justified by strong economies in the countries where the bank is present.

Despite the current increasing economic uncertainties in Europe, due to high inflation and an energy crisis, Nordea’s credit quality remained at very good levels, given that is provisions for credit losses amounted to just €58 million in Q3 2022, or only 7 basis points of average loans. Note that in the previous year the bank performed provision reversals, as Covid had a smaller impact on credit quality than expected during 2020 and Nordea, like most banks, was able to reverse provisions.

Despite Nordea’s higher operating leverage, the increase in provisions almost wiped out its operational gains, and Nordea’s net income only increased by 2% YoY, to €1.3 billion. Its return on equity ratio was 12.7%, a very good level of profitability within the European banking sector, while its EPS increased by 8% YoY to €0.27, due to a lower number of shares.

For the full year, Nordea expects to report an ROE above 11%, while it expects the cost-to-income ratio to be between 48-49% despite the cost pressures from high inflation levels. The economic uncertainty and lower economic growth expected should last for some more quarters, which may offset to some extent gains from higher interest rates. The Nordic economic region is expected to face a recession in 2023, with Sweden expected to be among the weakest countries, due to lower household spending and a cooling real estate market, not boding well for Nordea that is significantly exposed to this country.

Capital And Dividends

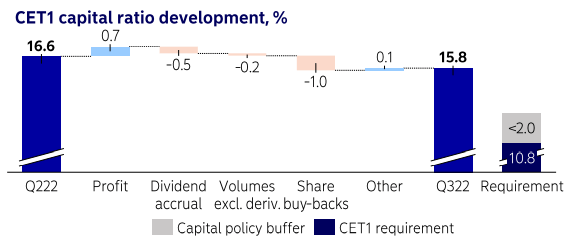

Another attractive feature of Nordic banks in general is superior capitalization levels compared to other banks, a profile that is also shared by Nordea. At the end of last September, its CET1 ratio was 15.8%, a level that is above the European banking sector average and well above its regulatory requirement of 10.8%. This means that Nordea has an excess capital position, allowing it to have an attractive shareholder remuneration policy.

Indeed, due to this strong capitalization, Nordea got authorization from the European Central Bank to perform share buybacks, having bought some €3.5 billion of its own shares over the past few quarters, and a further €1.5 billion was also approved recently and is in progress. While share buybacks and dividend distributions have a negative effect on the bank’s capital ratio, its buffer to regulatory minimum is so large that Nordea is not expected to change its capital return policy much in the near term.

Capital (Nordea)

Regarding its dividend, like many European companies, Nordea only does one distribution per year, decreasing somewhat its income appeal to U.S. investors. Its last dividend was paid last April, and the next one is only expected to be distributed during the end of Q1 2023 or beginning of Q2.

Related to 2021 earnings, Nordea’s dividend was €0.69 per share, a slight decrease from the previous year. Its dividend payout ratio was 72%, an acceptable level for a bank with a strong capitalization. At its current share price, Nordea offers a dividend yield of close to 7%, being quite attractive for income investors and seems to be sustainable due to the bank’s defensive profile and its excess capital position.

Conclusion

Nordea has a quality profile within the European banking system and its operating momentum is positive, supported by higher interest rates and loan growth. Due to an excess capital position, Nordea is currently providing an attractive shareholder remuneration policy, both from a high-dividend yield and share buybacks, being a good background for a higher share price in the coming months.

Moreover, Nordea is currently trading at a small premium to book value (1.16x book value), a valuation that is justified by the bank’s fundamentals and close to its historical average during the past couple of years, thus Nordea seems to be an interesting income play right now.

Be the first to comment