dima_zel

Overview

I believe Virgin Orbit Holdings, Inc. (NASDAQ:VORB) is grossly undervalued. My thoughts are that there are strong tailwinds to support VORB’s expected growth over the coming decade. It is true that there are risks associated with VORB today given they are not generating meaningful revenue or profits, but their strong execution history gives comfort that they will be able to meet guidance.

Business description

VORB is a vertically integrated company engaged in providing small satellite launch capabilities. VORB has three key offerings:

- Commercial & Civil: catering to both the U.S. and international markets, offers dedicated and rideshare launch services. This includes the civil spaceport concept, where a foreign nation can buy or lease VORB mobile launch system ground equipment as well as the company’s aircraft, allowing the convenience of in-county launch capability. This way, any country can become spacefaring using its existing airport facilities.

- National Security & Defense: For U.S. and allied government customers, national security launch and mission services are offered. This includes agencies under the defense department, the intelligence community, the space force, and the Air force. Also in the pipeline is the government squadron service, where the entire air-launch system is sold to the government to be operated directly, allowing enhanced responsiveness and flexibility. VORB also offers missile defense target applications and hypersonic research and development activities due to the availability of distinct features of the LauncherOne hypersonic system.

- Space solutions: end-to-end value-added services for the “internet of things” and ” earth observation” applications through the integration of satellite constellations owned by the company and agreements with satellite operators. Under the satellite-as-a-service model, VORB plans to use its own satellites to serve government and business clients in the US and around the world by 2023.

Investments thesis

Space is the ceiling for the TAM

By 2030, the total addressable market [TAM] of VORB is expected to be worth USD75 billion! The space industry is vast and growing rapidly due to many factors. Because of recent technological advances, the costs of satellite manufacturing and launch have been reduced, allowing space solutions to reach multiple end-markets such as communications, maritime, logistics, and national security and defense. The advancement of space technology in the areas of satellite bandwidth and throughput, allowing for higher rates of data transfer and the miniaturizing of satellite components during the last decade, has been driven mainly by the private sector.

Euroconsult Research shows that 2020 marked a milestone in the journey of commercial satellite launches, with small satellites comprising 95% of the market. VORB management estimates (as per their S-1 filing) that the small satellite industry will become a USD 29 billion business by 2029. The U.S. and its allies need to keep and improve their space capabilities because they depend more and more on space technology for national security and defense (communications, navigation, precise location information, and global monitoring are key areas of focus).

Euroconsult’s Government Space Programs 2020 report predicts world governments to spend approximately USD 80 billion by 2024, investing heavily in research and development on military technologies as well as maintaining existing systems. National Defense Magazine also says that the hypersonic segment is also the part of the DoD budget that is growing the fastest, with a compound annual growth rate of 21% from 2021 to 2025. This shows how much more the sector is focusing on technological innovation.

Proprietary launch technology

The company appears to have shattered the paradigm of ground-based launch, which has remained virtually unaltered for 60 years, by launching rockets from a modified Boeing 747-400 airplane flying at approximately Mach 1 speeds. VORB estimates that this technology provides a platform that is 30% more effective than ground-based technologies because it is more adaptable and responsive. Among tiny rocket launchers, the company offers the lowest launch cost per kilogram. These rockets can reach any desired orbit thanks to the system’s mobility, which enables it to launch from any government-licensed horizontal spaceport that can accommodate a Boeing 747-400 aircraft. The secretiveness, responsiveness, and durability of the VORB system also make it stand out and make it a better deal for their military industry clients.

The fact that ESG investors favor VORB’s technology is another advantage. Normally, it was necessary to locate launch facilities far from locations with a dense population of people. The majority of conventional ground launch stations were chosen on wildlife reserves. Because of the smoke and soot that are emitted, as well as the loudness of the actual blast that occurs at ground level upon rocket ignition, ground-based launch systems are often a considerable contributor to air, ground, and noise pollution. All of these elements have a substantial negative influence on the pristine natural settings that our rivals employ for launch operations. On the other hand, VORB air-launch technology gives ground-based systems a benefit by having less of an influence on the surrounding environment. Their air-launch technology only makes noise and harms the environment at a height of about 35,000 feet. This makes a big difference in the amount of noise and carbon emissions in the area and how they affect local species.

Vertically integrated model improves scalability

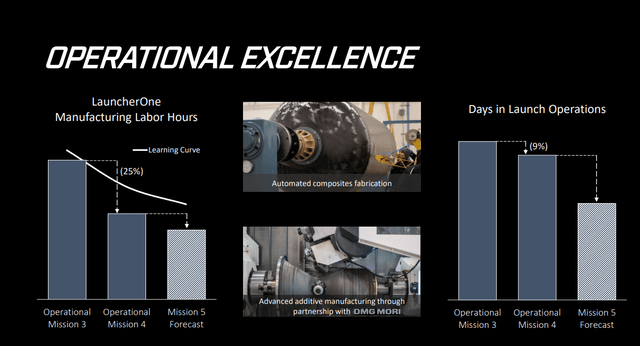

VORB can construct rocket tanks in days as opposed to months thanks to their automated composite manufacturing method. Additionally, because of their partnership with DMG MORI (OTC:GDMOF), VORB benefits from their sophisticated manufacturing technology, which has contributed to a cycle time reduction of more than ten times. Over 90% of every rocket is made within their highly integrated processes. The VORB plant is now producing four rockets, with a yearly manufacturing capacity of about 20 rockets. The factory is scalable, so expanding production capacity can be done by adding new work cell.

Strong ties with the government lend creditability to expand internationally

With contracts from the Space Force, Air Force, and other organizations, as well as being chosen for the “Orbital Services Program-4” IDIQ and taking part in the “Advanced Battle Management System” exercise with USSPACECOM in September 2020, VORB has a proven record of accomplishment with government and national security contracts. VORB’s management intends to continue to broaden VORB’s participation abroad by utilizing the U.S. Government’s enormous reach and alignment with allies.

Regarding performance abroad, VORB has already launched satellites for a variety of international customers. They have additional launches scheduled for a variety of other international customers. VORB has stated ambitions to launch from foreign civil spaceports, including the United Kingdom, Japan, and Brazil, illustrates their unique capacity to also serve worldwide clients from their territory.

The Virgin brand

The Virgin brand has a track record of innovation, dependability, and providing excellent customer experiences, in addition to a track record of safe flights. The reach of Virgin has been crucial in creating important client ties in the civic, commercial, national security, and defense sectors. The family of companies under Virgin Group has also provided significant potential anchor partners for VORB’s targeted applications in the space solutions business. For instance, they might be able to connect ship management for Virgin Voyages and aircraft management for Virgin Atlantic

Forecast

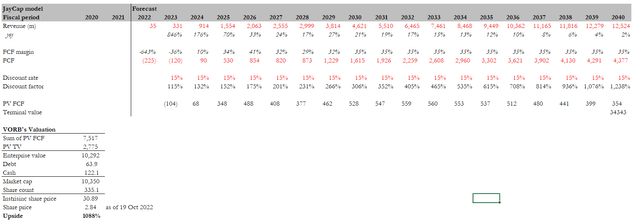

My model’s primary goal is to demonstrate the significant upside if VORB can hit management’s long-term guidance. First of all, the model is extremely sensitive to growth rates and margins as this is an 18-year DCF model. There are 2 stages to my model. The first stage (FY23 to FY30) is based on management guidance, and the second stage is a declining growth model (to 2% in FY40) to indicate VORB maturing. A key part of my model is a very high discount rate of 15%, as the VORB business model is still in its nascent stage, and as an investor, I would need a higher rate of return to justify investing in it

Using these assumptions, VORB could be worth 10x more than its current share price of 2.84.

Red flags

High possibility for additional capital needs

The company started commercial-scale launch operations only in 2021, generating limited cash flows. Currently, it is uncertain when the company will be in a position to generate sufficient revenue or cash flows to sustain its operations and growth.

Small LEO satellites adoption is still an unknown today

Launch services for low-earth orbit satellites are still a new market that may not reach its full potential in the time frame that was planned.

Conclusion

VORB has the potential to 10x from its current share price (2.84). However, investors must believe that VORB can increase revenue from USD35 million in FY22 to more than USD2 billion over the next five years. Underlying this is the hope that low-earth orbit satellites will be a big market, and there are enough strong industry tailwinds to believe it will be.

Be the first to comment