zoranm

One of the more niche companies I have come across recently has been Avery Dennison (NYSE:AVY). This producer of pressure-sensitive materials, such as papers, plastic films, metal foils, and fabrics, that are then sold to label printers and converters for the purpose of label production and other related products, also offers the benefit of quality fundamentals and attractive growth. Of course, the picture has not always been this way. Prior to the pandemic, some of the company’s fundamental figures were volatile and it was only in 2021 that we began seeing some really nice growth for the enterprise. But fast forward to today, and that growth continues while shares are trading at levels that are not unrealistic. I would argue, of course, that much of the easy money in the company has already been made. But so long as its fundamental health remains robust, I do think there might be some additional upside on the table for investors to benefit from. This is despite the fact that similar companies are trading at levels that are much cheaper by comparison.

Strength persists

Back in March of this year, I wrote an article about Avery Dennison that took a bullish stance on the firm. I called the company a unique player that was slightly underpriced. I based this assessment not just on the company’s share price from a valuation perspective but also on the fact that the company had been exhibiting attractive growth since the pandemic came to an end. At the end of the day, I rated the business a ‘buy’, indicating my belief that it did offer some upside potential for investors relative to the broader market. Since then, the company has performed quite well. At a time when the S&P 500 is down by 3.5%, investors in Avery Dennison would have generated a return of 15.2%.

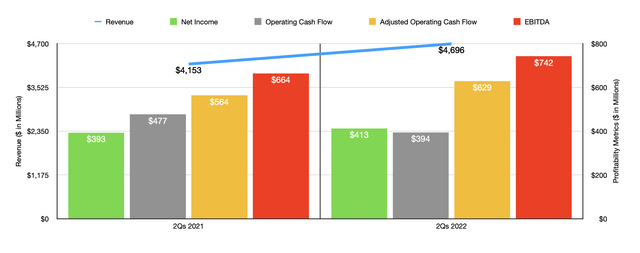

This increase in price was not because of random market fluctuations alone. I would argue that it was largely driven by continued strength demonstrated by the company. When I last wrote about the firm, we only had data covering through the 2021 fiscal year for the business. Today, we now have data covering the first half of 2022. So far, those numbers are quite robust. For the first half of the year as a whole, revenue came in at just under $4.70 billion. This represents an increase of 13.1% over the $4.15 billion the company generated the same time one year earlier.

This growth in sales was driven by strength across the board. However, the greatest upside on a percentage basis came from its Retail Branding and Information Solutions operations. Revenue here jumped by 32.1% from $1.01 billion to $1.34 billion. It is worth noting, however, that actual organic growth from this set of operations was a more modest but still respectable 12%. The company benefited from its acquisition of Vestcom as well. Given current market conditions, it is fair to put particular scrutiny on the most recent quarter since said uncertainty could result in the picture changing rather rapidly. But what data we do have in this regard is also encouraging. During the second quarter alone, sales came in at $2.35 billion. That’s 11.7% above the $2.10 billion generated the second quarter of 2021.

With this increase in sales, we have also seen a nice increase in profitability. Consider, as an example, net income. For the first half of the year, net income came in at $412.7 million. That’s 4.9% higher than the $393.3 million generated in the first half of 2021. A fair argument is that profitability is not climbing at the same rate that revenue is, therefore implying margin contraction. However, this picture is a little more complicated than that. Yes, for the first half of the year as a whole, margins did decrease, with the company’s cost of products sold climbing from 71.8% of revenue to 72.6%. This may not seem like much of a change, but the impact when applied to last year’s revenue translates to $67.3 million in additional pre-tax cash flow missing from the business. Management attributed this pain to the net impact of pricing, freight, and raw material costs, as well as to higher employee-related expenses. It was, of course, offset to some degree by greater volume and favorable product mix. Despite this pain, the picture did improve in the second quarter itself, as evidenced by the fact that the cost of products sold, relative to revenue, remained flat in that quarter compared to the same quarter last year. Strong volume and product mix in the second quarter perfectly offset higher pricing, freight, and raw material costs, as well as the aforementioned employee-related expenses.

We should also pay attention, of course, to other profitability metrics. Operating cash flow is interesting because, unlike earnings, it actually worsened year over year, following from $476.8 million in the first half of 2021 to $394.4 million the same time this year. If we adjust for changes in working capital, however, it would have risen nicely from $563.7 million to $629.3 million. And over that same window of time, EBITDA for the company also improved, rising from $663.6 million to $742.3 million. Just as was the case with earnings, which shot up by 16.7% from $183.8 million in the second quarter of last year to $214.5 million the same time this year, the real improvement and the other profitability metrics also occurred in the second quarter. Operating cash flow inched up from $267.5 million to $268.2 million. On an adjusted basis, this figure rose from $276.4 million to $323.5 million. Meanwhile, EBITDA for the company shot up from $213.8 million to $384 million.

Thanks to the improvements in the second quarter of the year, management now has a more favorable outlook regarding profitability for 2022 as a whole. Previously, the company anticipated earnings per share of between $9.35 and $9.75. This has now been revised up to between $9.60 and $9.90. It’s also worth noting that these estimates include a $0.10 per share restructuring charge that should prove to be one-time in nature. Adding that restructuring charge back into the equation, the company should generate net income of $808.7 million for the year. That should translate to a 9.3% increase over the $740.1 million generated in 2021. No guidance was given when it came to other profitability metrics. But if we assume that they will increase at the same rate that earnings should, then we should anticipate adjusted operating cash flow of nearly $1.20 billion and EBITDA of $1.46 billion.

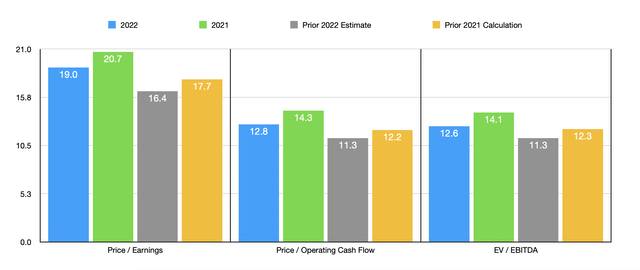

Using these figures, I calculated that the company is trading at a forward price to earnings multiple of 19. Although this is higher than the 16.4 reading that I got when I last wrote about the firm, it is lower than the 20.7 reading that we get using last year’s results. The forward price to adjusted operating cash flow multiple should be 12.8. That’s down from the 14.3 figure that we get using 2021’s data. But it’s higher than the 11.3 reading that I got in my last article about the business. A similar trend can be seen when looking at the EV to EBITDA multiple. My current estimate for that is 12.6. That’s down from the 14.1 using last year’s results, but it’s up slightly from the 11.3 reading from my prior article. As part of my analysis, I also compared the company to five similar firms. On a price-to-earnings basis, these companies ranged from a low of 11.3 to a high of 14.5. Using the price to operating cash flow approach, the range was from 4.9 to 10.5. And using the EV to EBITDA approach, the range was from 5.4 to 9.2. In all three scenarios, Avery Dennison was the most expensive of the group.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Avery Dennison | 19.0 | 12.8 | 12.6 |

| Sonoco Products Company (SON) | 12.9 | 9.1 | 8.3 |

| Packaging Corporation of America (PKG) | 12.2 | 9.4 | 7.6 |

| Graphic Packaging Holding (GPK) | 14.3 | 6.2 | 8.2 |

| Sealed Air Corporation (SEE) | 14.5 | 10.5 | 9.2 |

| WestRock Company (WRK) | 11.3 | 4.9 | 5.4 |

Takeaway

There is no doubt in my mind that recent upside achieved by Avery Dennison was warranted. Management increased guidance expectations for 2022 based on favorable results from the second quarter of the year. Overall fundamental performance is promising and it’s likely that the long-term outlook will be favorable for shareholders. Having said that, shares are not as affordable as they were. But I would make the argument that, from an operating cash flow perspective and an EV to EBITDA perspective, they are still attractively priced. The stock is pricey relative to similar firms, leading me to believe that there might be better opportunities for investors out there right now. But on the whole, I do think that the company likely does offer some additional upside for the foreseeable future. I don’t think this upside is a tremendous amount, leading me to consider the firm only a soft ‘buy’ prospect today. But for those who really like the enterprise and believe in its potential, that upside might well be worth it.

Be the first to comment