NoDerog

AvePoint (NASDAQ:AVPT) is a software-as-a-service (SaaS) company whose products are designed for migrating, protecting, and managing data in Microsoft (MSFT) Office 365. The company went public last summer following a merger with the Apex Technology Acquisition SPAC.

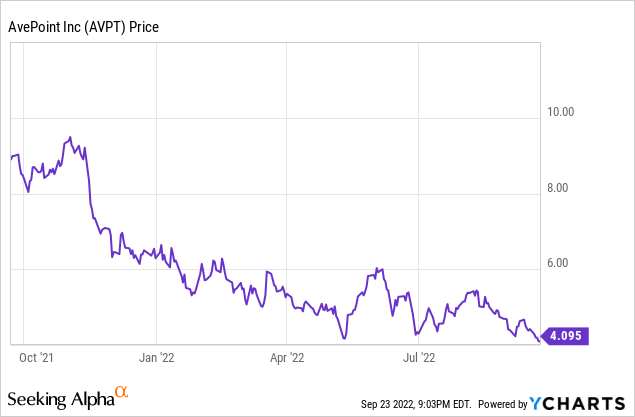

AvePoint originally held up better than many, but has now succumbed to the same weakness that has overtaken most other SPACs and SaaS companies in 2022:

With the stock down by a third since June, AVPT stock is now slipping to new 52-week lows.

Unlike so many other 2021 vintage SPACs, however, there’s actually quite a bit to like about AvePoint. While we can quibble about the right valuation — particularly in these dismal market conditions for this sort of company — AvePoint has a decent business with reasonable economics and should be a survivor out of this current winter for the tech industry.

Am I rushing out to buy AVPT stock tomorrow? Me personally, no I’m not. But I’m hardly buying any tech aside from large-cap blue chip dividend-paying names. After the speculative excesses of the technology market over the past few years, I suspect it will take a while before things bottom out and a new sector bull market can emerge.

That said, I like AvePoint a lot better than most of the other hyped-up SPACs and speculative stocks we saw over the last year. If you’re in the market for a beaten-down small-cap growth stock, here’s why AvePoint is worth your consideration.

Microsoft: Both The Opportunity And A Risk

A unique part of AvePoint’s story is that it exists primarily to facilitate ease of usage for Microsoft products, namely 365.

AvePoint offers a variety of services to improve the user experience across Office, Teams, and Azure. Three main product offerings from AvePoint are for governance, data backup, and analytics/analysis. Oftentimes, a client will come on board for one of these, such as moving data from a legacy platform into the Microsoft cloud relying on AvePoint to handle that. Once there, the client may later use AvePoint for governance needs, or to protect systems from ransomware and cyberattacks or whatnot. There’s a lot of cross-selling opportunity.

In theory, these are all things that Microsoft could itself sell to clients. However, it may make more sense to have partners handle these sorts of nuts and bolts service roles leaving Microsoft to focus on bigger picture opportunities and problem sets. AvePoint is a trusted partner for Microsoft and can give clients a much more hands-on level of service than Microsoft itself would.

My understanding is that AvePoint generates more revenues for Microsoft than Microsoft does for AvePoint. That is to say, the amount of revenues created from making it easy to use Office within an Azure cloud host is likely more substantial than the amount of money Microsoft sends AvePoint’s way by promoting AvePoint within its own sales and marketing materials. In this way, Microsoft is likely to see AvePoint as a helpful partner that expands its overall addressable market rather than just a leech that is drawing off of Microsoft’s success.

Obviously, these things can change over time. And since AvePoint’s business has existential risk tied to Microsoft’s fortunes, AVPT stock owners should monitor developments closely. However, my belief is that the relationship is on a solid footing. To the extent that investors had assigned AvePoint a far lower multiple than rivals due to this concentration risk, I see that as a mistaken or overly cautious assessment.

Valuation: At A Discount To Peers

The main argument for AvePoint is its relatively cheap valuation for a software business. It is currently generating about $220 million per year in revenues. Meanwhile, the market cap is just $750 million, putting the stock at less than 4x sales.

Furthermore, the company has $250 million of cash and short-term investments and no debt, putting its enterprise value at just $500 million. This works out to an EV/Sales ratio of just 2.4x. That’s getting pretty cheap, not just for software, but for a variety of higher gross margin businesses.

The issue, like with so many software companies, is profitability, or the lack thereof. However, AvePoint is not particularly bloated as far as expenses go, it is only losing about $40 million per year. That gives it at least a six year burn rate as things stand today.

And, looking at the income statement, there’s a lot to like. Gross margins are already in the 70s and trending higher. And with 80% of revenues being recurring, there shouldn’t be much volatility in results either. There’s not much on the expense side to worry about aside from SG&A. Trimming SG&A by 25% would get the company to profitability tomorrow. Similarly, growing revenues 30% from here while maintaining flat SG&A spend from today’s levels would also achieve a breakeven profitability result.

I believe AvePoint has an easier path to cutting SG&A spend than many rivals due to its preferred relationship with Microsoft. So much of the work is just getting customers to sign up for Office and Azure in the first place. Just about every potential Teams and Microsoft Cloud customer is also a potential customer for AvePoint. And once a client is in the ecosystem, there’s generally not much motivation to leave, either Microsoft broadly or AvePoint’s specific systems for managing, storing, and safeguarding data therein.

The asterisk with the valuation argument is that AvePoint has always traded cheaply compared to peers since going public. Here’s a William Blair analyst note from September 2021 that pointed out that, at the time, AvePoint was selling at just 6.9x EV/sales versus a comp of 22.7 for software peers that were growing revenues 30% or more annually. Since then, multiples have crashed across the sector, but AvePoint’s relative cheapness in 2021 did little to protect its share price from additional declines.

AVPT Stock’s Bottom Line

If AvePoint can keep growing revenues in the 25-30% range, the stock should be a winner from its current price. There’s not a whole lot that needs to go right when you buy a stock for less than 3x EV/Sales with 70% gross margins and rapid top-line growth. Any modicum of improvement in SG&A spend and profitability should be achieved quickly.

The risk, of course, is that revenue growth slows significantly as the slump in the tech sector worsens. Presumably, as potential customers cut back their own investments in IT spend, it will slow things down for AvePoint. There’s also a concern that much of historical growth has come thanks to migration services, that is, people bringing their data into Microsoft Cloud for the first time. Over time, AvePoint may have to shift more of its business focus to areas like cloud governance where competition is more challenging. That said, Microsoft Cloud is still a burgeoning platform and thus AvePoint’s opportunity set remains broad.

I’d add one more point in favor of AvePoint. We’ve seen some insider buying in the stock since after the deal closed. That includes the CEO, Tianyi Jiang, who picked up another 39,000 shares of AVPT stock in December at $6.43. It’s a reassuring sign to see a CEO buy more stock in their company in the open market, as opposed to so many other SPACs where this has not been the case.

Jiang has also been at the company since 2001, when he co-founded it, and many AvePoint leaders have been with the company for ages. There is a tight corporate culture, and my sense is that it’s unlikely the company would suddenly shock the market with a huge acquisition or pivot in business strategy.

Given that, the company’s $250 million cash pile should last for many years as things stand. And it shouldn’t take too much growth or cost discipline for the firm to reach profitability. I also wouldn’t be surprised to see someone take a look at AvePoint as a potential acquisition given the valuation.

Software stocks are out of favor and former SPACs doubly so. This is a terrible no-good market for speculative unprofitable growth ventures. But if you want to take a swing at a beaten-down name out of this group, AvePoint is a rather interesting choice.

Be the first to comment