koto_feja

Investment summary

We remain constructive on Avantor, Inc (NYSE:AVTR) and reiterate a buy rating on the stock despite recent chart performance and Q2 FY22 earnings. AVTR has a consumables-led business model that produces more than 85% recurring revenue and offers investors a low-gamma, defensible play as a long-term cash compounder. We’ve covered the strengths in AVTR’s business model at lengths here, here and here. With the top-line only exposed to a 3-5% margin from each customer, circa, 8% 5-year return on capital and substantial growth plans, AVTR remains insulated from peers in the current market.

The market looks to have priced in foreseeable headwinds for AVTR next year, and further downsides could already be well priced in, we estimate. Whilst shares are richly valued at ~4.7 times book value, there’s still a dislocation to fair value in our estimate. We rate it a buy with a price target of $33.

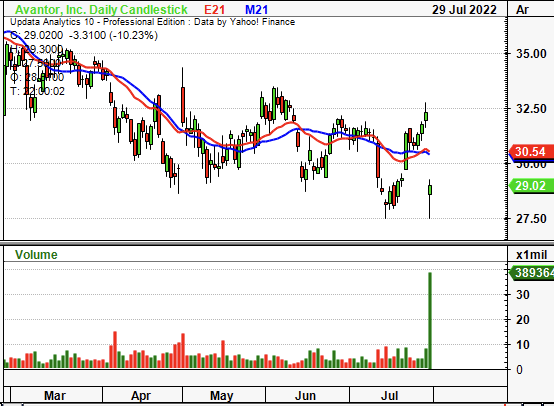

Exhibit 1. AVTR 6-month price action

Data: Updata

Q2 earnings momentum on pace

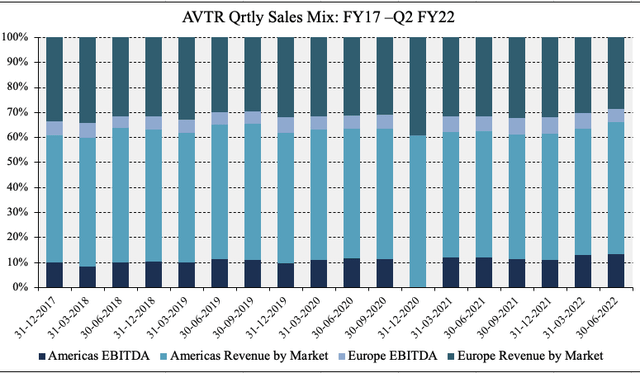

Second quarter revenues were a steady 280bps reported growth at ~$1.9 billion, below consensus. Core growth (ex-Covid) came in 640bps ahead of Q2 FY21’s high comps. In terms of seasonality, it was an above-average quarter from AVTR, as the 3-year top-line growth rate for the second quarter normalizes to 5.8%. Geographically, Europe sales contributed 35% at the top and grew ~470bps YoY, whereas Americas turnover saw ~810bps of upside YoY and contributed 80% of revenue volume. Europe sales were underlined by bioproduction which saw a 25% expansion for the period. Meanwhile, EMEA revenues were flat. As seen in Exhibit 2, the revenue mix has been tilting towards Americas since Q3 FY21. Despite this, AVTR has held a steady EBITDA from its European operations in the same time, as seen below.

Exhibit 2. Geographically, revenue has been steady from all geographies. Sales contribution has tilted towards Americas since 2021.

Data: HB Insights, AVTR SEC Filings and Prospectus

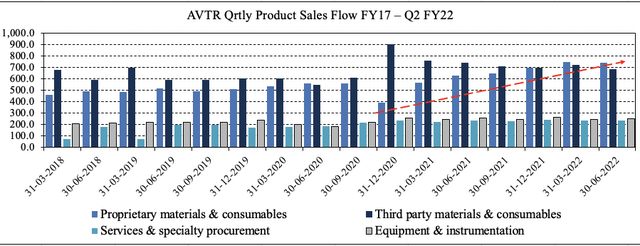

Segmentally, the biopharma division also saw a ~20% organic growth in bioproduction. In fact, management noted the order book for its proprietary offerings segment within bioproduction is reflective of a healthy pipeline across its mAbs and mRNA exposure. Healthcare saw a single-digits decline YoY, despite growing 30% in the 12 months to Q2 FY21. Notably, healthcare contributes ~10 percentage points in segment revenue. AVTR’s portfolio is incredibly diversified with roughly ~3–5% of sales exposed to each customer. This also provides a greater number of revenue streams/sources of value to grow from. As noted in Exhibit 3, all product segments have realized growth into the last quarter even with the slight pullback in performance. Hence, long-term trends are favorable in this name.

Exhibit 3. Sales on each segment stretching up since FY20 despite slowdown in growth

Data: HB Insights, AVTR SEC Filings and Prospectus

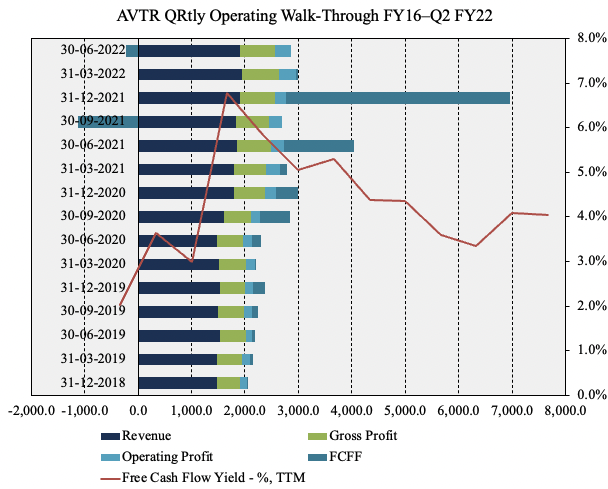

One key standout for AVTR was ~170bps operating margin decompression YoY seeing it print quarterly operating income of $295 million. It brought this down to FCF of $175 million and investors realize a 4% yield on this, in line with 3-year normalized FCF yield of 4.3%. Impressively, acquisitions completed in FY21 increased top-line growth by ~490bps YoY (discussed later) although this was balanced by forex headwinds of ~440bps to the top and ~$0.02 in earnings per share. AVTR reported adjusted EPS of $0.75 after ~13% gain in net income YoY. On a fully-diluted basis, this came in at $0.26, the same as last period. Nevertheless operating leverage continued this period in line with longer growth trends, as seen in Exhibit 4. With that mind, despite missing the Street’s estimates at the top and bottom, AVTR continues to see turnover in line with longer-term growth trends.

Exhibit 5.

Data: HB Insights, AVTR SEC Filings

Despite notable challenges on the horizon, management noted that its guidance of 4-6% in organic revenue growth remains on track. However, it now expects EPS of ~$1.43-$1.49, behind prior estimates of $1.48–$1.54, and below consensus estimates as well. Part of this reflects a ~300bps Covid-related headwind, and it also sees Covid-related revenues moderating faster than previously expected. AVTR also noted it has ~$450 million and ~$155 million in EBITDA from its opportunity pipeline having folded these into FY22 expectations.

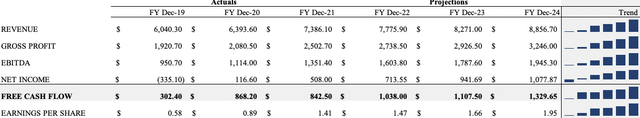

We forecast AVTR to print $1.04 billion in FCF this year and see this stretching up to $1.1 billion for FY23 and $1.33 billion for FY24. We project this on FY22 revenues of ~$7.77 billion and then $8.2 billon the following year. As Exhibit 6 shows, we are slightly ahead of consensus in these estimates, and forecast the stock to outpace the consensus price target of $36 per share.

Additional fundamental factors for consideration

Exhibit 6. AVTR 3-year projections and trend forecast

Management noted that acquisitions made in FY21 have started to come through to earnings. It deployed ~$4 billion of capital for M&A purposes last year. The bolus of this was laid out on the Ritter and Masterflex transactions. At the time, we were cautiously optimistic on each, due to the recurring revenue on offer from both transactions. Most of the upside to date has been recognized with additional revenue to the proprietary offerings, biopharma and healthcare segments.

Management noted that Masterflex integrations have started to come through to the P&L, citing “recent ERP cutovers in Europe and EMEA and excellent traction on cost synergies,” on the earnings call, and that the order book is currently strong amid equally strong demand for the pump systems. However, supply-chain shortages for circuit boards were marginally felt throughout the period, AVTR says. There didn’t appear to be a meaningful impact, and there was no talk of the company replacing circuitboards with other components as other companies have done in response. Meanwhile, it noted the Ritter business is fully integrated into its portfolio.

AVTR also started collaborations with GeminiBio and Cytovance throughout the period as well. It is set to provide plasmid DNA to the former, and will provide hydrated solutions and cell culture media to the latter’s biopharma customers. Look to upsides at the bioproduction revenue level as a potential indicator of success here. The company continues to build this segment out and now has its nodes plugged along the entire development cycle – from clinical stage, scale up stages and full-commercialization.

Equally as important to consider is interest expense in the forward looking regime. AVTR notes it has maintained a FY22 interest cost in-line with expectations, despite hikes to its rates exposure. It has $3.42 billion in both US dollar and Euro denominated notes outstanding, distributed across three instruments, with maturity in FY25/28/29 respectively. These pay a fixed rate at current YTM of 3.3–5% with a modified duration of 3.0–5. AVTR continues to de-lever and this results in management forecasting a interest cost reduction in FY23. Interest expense is covered 4.6x whereas the capital structure is now ~48.5% debt weighted, down from 50.5% a year ago, whilst debt to total capital has come down to 59.4% from 65.4% YoY.

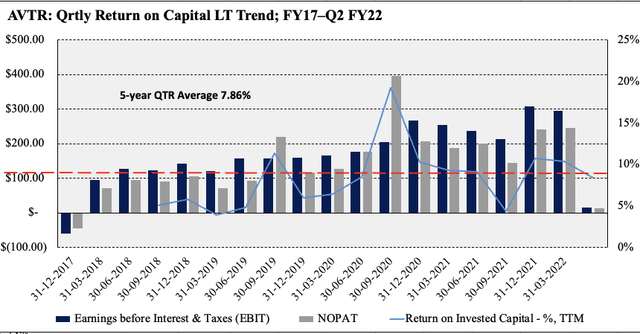

Adding to this ROIC has been steady and built on the back of ongoing growth in NOPAT from FY18-date. As seen below, 5-year ROIC normalizes to ~7.9% and Q2 FY22 printed return on investment of 8.3%. Meanwhile, the company saw a 17.7% ROE for the period, resulting in a T12M ROE from FCF of 17%. To us this suggests AVTR continues to bring a great deal of fundamental momentum to the investment debate and remains attractive on this basis on a forward looking basis.

Exhibit 7. 5-year ROIC steady and compounding capital at ~7.9% geometrically since listing

Data: HB Insights, AVTR SEC Filings

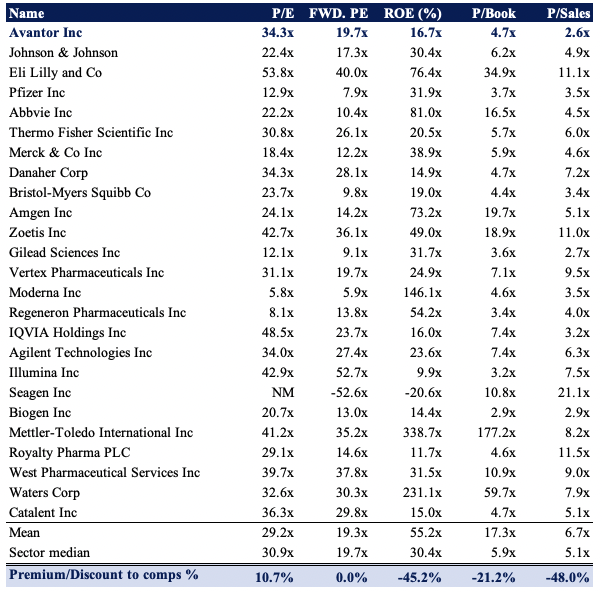

AVTR Valuation

Shares are trading at ~34x P/E and are in-line with the GICS Industry median’s ~20x forward P/E. Shares are also priced at a discount to peers at 4.7x book whilst offering a reasonable ~17% ROE. In fact, shares are trading at an average ~21% discount to peers across key multiples used in this report. The question really is if the discount is warranted. Based on profitability and bottom-line growth data for AVTR to date, we’d say yes, but let’s dig a little deeper.

Exhibit 8. Multiples and Comps

Data: HB Insights

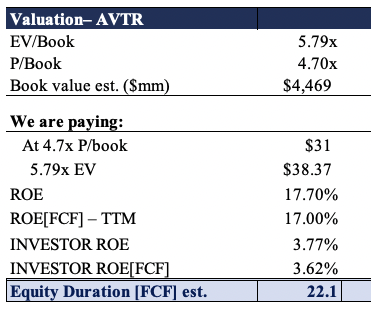

AVTR isn’t trading at a deep discount, as seen below. At 4.7x book value (equal to 5.8x EV/book value) we would theoretically be paying $31–$38 for the share, suggesting it could be overvalued by ~7%–31%. We’ll take the lower bound, and therefore look to price AVTR at $27 at the low end.

Exhibit 9.

Data: HB Insights Estimates

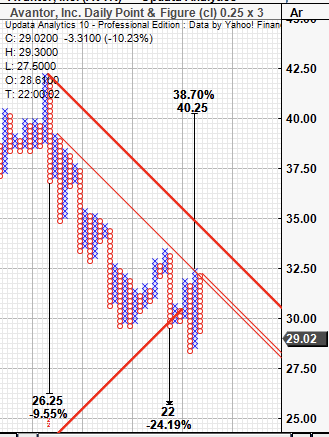

Point and figure charting is excellent at removing the noise of time for unambiguous price targets. On the daily chart we see upside targets to $40 and this must be factored into the investment debate. Taking the arithmetic mean of both price objectives sees us price AVTR at $33, and hence will retain the long-term position of buy.

Exhibit 10. Price action indicating potential upside targets to $40

Data: Updata

In short

We remain long on AVTR shares and project the stock to revert back to its long-term growth schedule. Despite a difficult year on the chart in FY22, AVTR’s defensible top-line and ongoing ROIC illustrates fundamental momentum we are seeking exposure to in FY22. These are both idiosyncratic risk factors that the market is paying a premium for in FY22.

Valuations have softened following this most recent earnings and guidance however this still sees AVTR trade at a ~21% discount to peers and below our fair value estimates of $33. On the culmination of these factors, plus our long-term thesis on the stock, we rate it a buy.

Be the first to comment