bloodua/iStock via Getty Images

Distressed companies are often entertaining corporate soap operas, and the case of New York City REIT (NYSE:NYC) is no exception. This was a previously non-traded REIT that went public during the pandemic in 2020. It is a “pure play” on New York City commercial real estate. The firm considers its peers to be Empire State Realty Trust (ESRT), SL Green Realty Corp (SLG), Vornado Realty Trust (VNO), and Paramount Group, Inc. (PGRE).

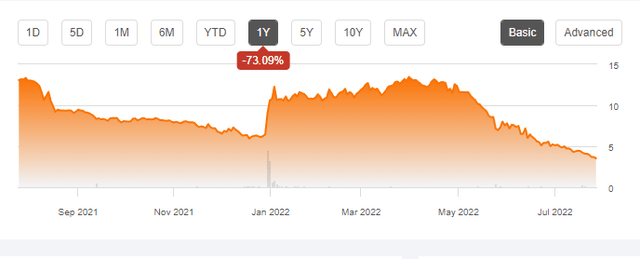

When NYC went public in 2020, it quoted an estimated net asset value of $49.83 per share. The stock opened around $15 and quickly sank. The firm has since suspended its dividends in order to “help fund future leasing activity.” The stock is now selling for under $4 per share.

Stock price chart for NYC REIT (Seeking Alpha)

At first glance, NYC appears to be severely undervalued. With an enterprise value (market capitalization plus debt) of $493 million, a rough back-of-the-envelope calculation shows that the stock market is valuing its 1.163 million square feet of New York City real estate at $424 per square foot. That is less than half the average value of $943 for New York City for the first quarter of 2022. The price/book ratio is also an amazingly low .17. By these estimates, it appears as if the stock could be a very cheap value play.

One might think that such apparent undervaluation would make this a good takeover candidate. Think again.

NYC is well protected against takeovers

NYC has some serious anti-takeover defenses. These include a staggered board, a poison pill, limitations on share ownership, and Maryland incorporation. The poison pill will be triggered if anyone controls more than 4.9% of the shares. The charter prohibits anyone from owning for than 7% of the shares. The REIT is incorporated in Maryland, which has various supermajority rules for takeovers. NYC has a staggered board with only four directors, three of whom are classified as independent. Only one independent director is elected each year.

Nevertheless, there was a proxy fight

With a slumping share price and a suspended dividend, one can see why the shareholders are not happy. Comrit Investments 1, holder of approximately 2% of the stock, engaged in a proxy fight to elect its own candidate for the one open seat on the board of directors. Both of the two main proxy advisory firms, ISS and Glass Lewis, backed the dissident, Sharon Stern, over the incumbent, Elizabeth Tuppeny.

To learn more, I decided to attend the annual shareholder meeting.

Shareholder meetings are a good way to learn more about companies

One of the rights of shareholders is the right to attend the annual meeting of the shareholders. One can learn a lot about a company and its business from how it conducts the meetings. The business items are generally routine non-controversial items such as approving the auditor and electing directors. Companies often present information about their operations and future plans, and answer questions from the shareholders present. Sometimes there are votes on shareholder propositions on social issues.

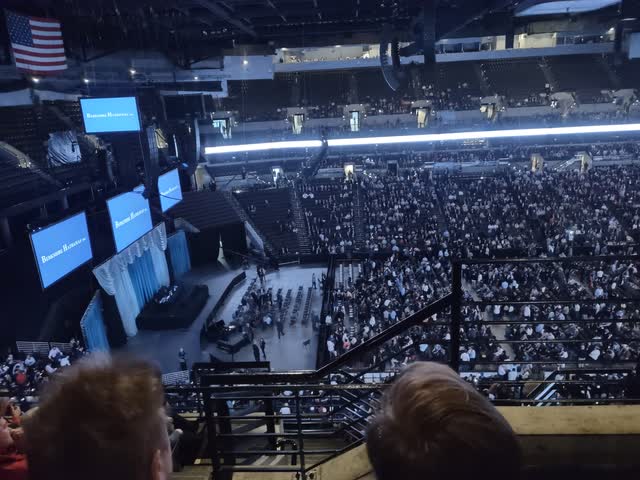

Most shareholder meetings are short, perfunctory affairs. Management zips through the legally required steps to elect directors in a few minutes and then turns to questions and answers from the audience. Some companies, however, use them as a vehicle to reach out to their stakeholders. Before the pandemic, Walmart (WMT) ran a massive live-streamed pep rally for its associates with Super Bowl quality entertainment (a quick web search will find it for you).

Berkshire Hathaway (BRK.A) (BRK.B) runs the “Woodstock of Capitalism” where the Oracle of Omaha holds court for many hours while shareholders buy literally tons of See’s Candies and other products sold by Berkshire Hathaway. One of the cool things about this year’s Berkshire gathering was that the live attendees got to see a funny movie with Warren Buffett and famous stars doing cameos. Of course, the movie pushed Berkshire’s products to the faithful in attendance. The movie was just for the live attendees and was not live streamed like the rest of the meeting. If you want the experience, you will just have to go in person next year.

Here are a few scenes from the BRK meeting:

NYC’s annual meeting was very different

The NYC shareholder meeting was held underground in the offices of the law firm of Paul Weiss Rifkind Wharton & Garrison LLP, just up the street from one of NYC’s troubled properties at 1140 Avenue of the Americas. The meeting was held at the bright and cheerful hour of 8:00 a.m. ET the day after the Memorial Day holiday. There were many empty seats in the nice conference room. A pleasant layout of fresh fruit, coffee, and snacks was put out for the attendees, nicer than at most annual meetings. Most of the attendees did not partake of the food. As the rules prohibited cameras, I do not have any photos for you.

There were a dozen or so suits at the meeting, mostly representing the company and the dissidents. As far as I could tell, I was the only shareholder at the meeting who wasn’t affiliated with either the company or the dissidents. It is not unusual for there to be very few shareholders at an in-person shareholder meeting. Most shareholders vote their shares in proxy form and do not need to show up at the meeting to vote. This actually makes it much easier for a retail investor to meet with senior management and get questions answered at the meeting. Some companies put on separate investor days, but those are generally targeted at institutional investors.

One of the surprising aspects of the NYC meeting was the extensive two-and-a-quarter pages of lawyerly rules for the meeting. Shareholder meetings usually have rules, but they are generally only about a page and are mostly simple “Don’t be a jerk” rules. The rules for this meeting were very detailed and described how much access Comrit would get and more. For example, one rule had a lengthy description of how many representatives Comrit would have, their need for photo identification, and the specific time when Comrit would have to submit their names to NYC.

I suspect that we the shareholders paid big bucks to NYC’s lawyers to haggle with Comrit’s lawyers over the wording of these rules.

The company earned an F in shareholder relations

The entire meeting lasted about nine minutes. When the Q&A came, I went up to the microphone to ask the two questions I was allowed. My first question was why management thought the market was pricing NYC so far below its net asset value. I really wanted to hear management’s insights on this.

The second was why NYC has no policy prohibiting its employees and directors from hedging their stock awards. Most public corporations have rules in place to prevent employees from hedging or transferring their stock awards, and for good reason – the awards are meant to align the interests of shareholders with employees. Both will prosper if the value of the firm increases. This alignment is lost if the employees hedge or transfer their stock awards.

The company refused to answer either question, even though neither question was on the forbidden list of questions. I was directed to call investor relations with my questions. I was shocked at this blatant refusal. No one else attempted to ask a question and the meeting ended. Why even have a Q&A on the agenda if the company was unwilling to answer any questions at all?

After the meeting, I called the IR number. That number is an answering machine that directs one to the AR Global website. If you go through the phone tree to ask questions about NYC, you’re transferred to Computershare. Computershare handles shareholder accounts and can answer questions about how to change the address or locate the dividend, but their representatives are generally not knowledgeable about company affairs.

On that website, the link to get to the NYC REIT was mysteriously gray and made it hard to find the link to the NYC REIT:

Fortunately, the link worked and takes one to New York City REIT.

I asked my questions on the website and have not received any response in over a month, which is a bad sign. I give this company an “F” on shareholder relations.

NYC management prevailed in the proxy fight

The incumbent director won reelection, 50.0% to 43.0%. I wasn’t too surprised at the defeat of the dissident, given the lack of a visible “get out the vote” effort from Comrit. I received several communications via both email and hard copy from NYC REIT management urging me to vote their gold proxy card, but nothing at all from Comrit. This was quite surprising because I usually get bombarded with communications from both sides in a proxy fight. I don’t know whether the fault was with Comrit, their proxy solicitor Saratoga Consulting, my broker, or my broker’s vendor, Mediant Communications.

Shareholders narrowly approved the nonbinding vote on executive compensation

Also interesting was the nonbinding vote on executive compensation. NYC claims that it has no employees, as all of the people running the business are technically employees of the management company and not the REIT. Nevertheless, there was the usual nonbinding vote on executive compensation.

At the meeting, and in the May 31 8-K, the company announced that a majority had voted against the proposal. However, in the final tally, the proposal received a majority of the shares: 50.7% yes, 44.8% no, and 4.4% abstaining. This is curious indeed, as the final tally was not very close. No shares were visibly voted at the meeting. I wonder whether any last-minute voting or “hanging chads” complicated the tally, which was tabulated by a firm I had never heard of before, First Coast Results. Often the vote tabulator is a large firm like Broadridge (BR).

Thoughts on value

The disconnect between the putative market value of the real estate and the market value of the common stock is indeed a mystery. Is Mr. Market having one of his depressive episodes, providing a great opportunity for a value investor? Or is Mr. Market just being brutally honest?

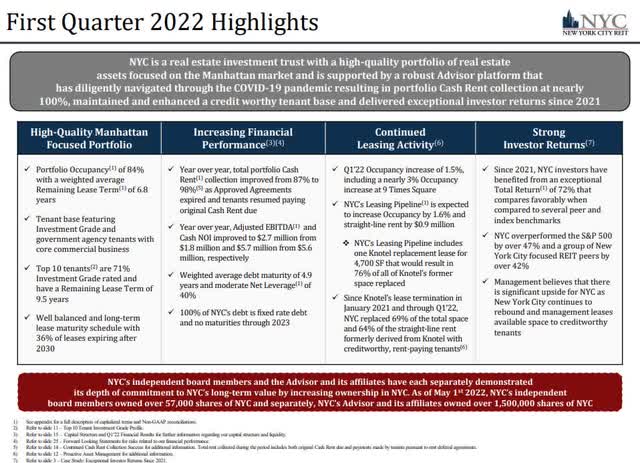

The company has presented promising results in its investor presentations:

Screen shot from NYC First Quarter 2022 Presentation

The properties are 84% rented, and the firm is collecting 98% of its cash rent with a promising leasing pipeline. NYC’s advisor and its affiliates claim to own over 1.5 million shares, showing that management has skin in the game.

So why is NYC so seemingly undervalued? I can imagine some possible scenarios, not necessarily exclusive:

- Mr. Market is crazy and just doesn’t see the value. The market is looking at the low earnings and lack of dividends.

- The buildings might not be worth that much. (Perhaps they’re all sitting on radioactive waste dumps harboring New York’s famous mutant rats and a few “Mutant Ninja Turtles.”) Or, perhaps, when the current leases are up, rental revenues will plummet since nobody wants to show up in person to work in NY offices anymore.

- The market might be scared off by what appears to be management’s refusal to provide information to shareholders.

- The market might suspect that NYC’s long-term contracts with its affiliated management company could be dissipating value.

- The market might expect the REIT to sell more shares to the public at low prices. The REIT could sell shares under its $250 million at-the-money share sale program. This would alleviate financial distress, but further dilute share value.

I don’t know which, if any, of these conjectures explains what is going on. I suspect it could be a combination of all of them. Daniel Jones has some insightful Seeking Alpha articles analyzing the mediocre earnings and cashflows from NYC that are well worth reading.

I’m a bit pessimistic on income-related stocks right now as they will suffer when interest rates rise. Nevertheless, I’m holding on to my shares as a long-term value play, hoping that the value will eventually be unlocked. There is, of course, the danger that an entrenched management will find ways of unlocking that value for themselves and not the shareholders. One possibility is to take more actions to lower the value of the stock (like prolonging the dividend suspension), while the insiders arrange to buy the company on the cheap. Even though the company has strong takeover protections, they can be easily waived by the board when the time comes.

Alas, I suspect it will be long time before shareholders enjoy the true value of the assets held by this REIT. The lack of a dividend and management’s apparent refusal to answer shareholder questions are likely to continue to hold the stock price down. In the meantime, it will be quite an entertaining soap opera. The massive disconnect between potential value and market price could attract more activist shareholders who will attempt to unlock the value. Pull up a chair and get out the popcorn. Next year’s shareholder meeting should be fun.

Be the first to comment