jetcityimage

Less than a month after resolving the Twitter takeover saga, Elon Musk is once again appearing in the Delaware Court of Chancery, this time to defend his 2018 CEO performance award which is currently valued at close to $50 billion. Musk and members of the board (with Tesla (NASDAQ:TSLA) as Nominal Defendant) are being sued by plaintiff Richard J. Tornetta, who says that the company was wrong in awarding Musk his compensation package in 2018.

Elon Musk’s 2018 CEO performance award

The CEO performance award, granted in 2018 and expiring in 2028, is divided into 12 tranches, each of which awards 25,330,050 stock options that expire in 2028 and have a strike price of $23.34 (post splits), that’s a total of 304 million stock options, which will add almost 10% to the company share count when exercised.

Vesting of the twelve tranches requires that the company achieves a set of specified milestones based on market cap, revenue, and “adjusted EBITDA”.

As of the end of Q3, all the performance and market cap conditions for vesting of eleven of the twelve tranches had been met and the twelfth will almost certainly vest at the end of Q4 when Tesla’s annual revenue will likely exceed $75 billion.

Tesla has recognized all but $4 million of the share-based compensation expense related to the CEO performance award, the remaining $4 million will be recognized in Q4,2022.

The options can be exercised by Elon Musk at any time between now and their 2028 expiry date. However, there is a 5-year hold period on the shares (post-exercise), except that Musk is allowed to sell enough shares to pay the exercise price and any associated taxes. When he does exercise the options, Musk will almost certainly sell enough shares to render the exercise cash neutral.

For tax purposes, stock options are valued at the time they are exercised and are taxable as ordinary earned income, not capital gains.

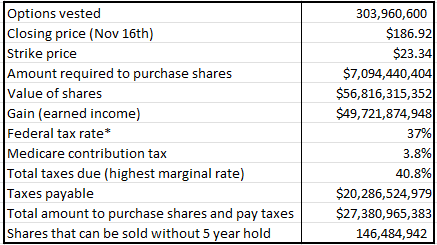

This is what the numbers look like, based on the share closing price as of November 16th:

Tesla 2018 performance award implications (Calculated from 10-K data)

Musk is now a resident of Texas, but he may also have to pay California state taxes on some of his earnings as he was a resident, and Tesla was based in California for part of the period when the bonus was earned, so the tax burden may be higher than I have presented in the above table.

The possible effect of Musk’s share sales on Tesla’s share price

Last year Elon Musk exercised 66 million (split adjusted) stock options from his 2012 performance bonus award and sold about 30 million shares to pay the strike price and associated taxes. The sales took place in the final quarter of the year and were a contributing factor in the fall of Tesla’s share price from its all-time high of $414.50 in November to its year-end closing price of $352.

Elon Musk’s Tesla share sales this year also correlate with drops in Tesla’s share price. The major impacts include a 12% drop from sales of 29 million shares in April, a 6% drop after sales of 23 million shares in August, and a 14% drop after sales of 19 million shares in November. All those transactions took place in a period when the Nasdaq index was flat, market moves were not a factor.

It appears that Tesla’s share price is not as liquid as the daily trading volumes might suggest. Much of the volume is probably speculative day trading and option hedging by market makers and major sales by Elon Musk do have a significant impact on the stock price.

If Tesla wins the case

If Tesla wins the Delaware Chancery case, he will at some time between now and 2028, be exercising 304 million stock options, and he will most likely be selling about 150 million shares to pay the strike price and associated taxes.

The shares sold must be cash neutral (i.e. used only to pay the strike price and taxes), and the remaining shares have to be held for at least five years. If he waits until the options are close to expiry (2028) he will not be able to generate any cash from the bonus award until the hold period ends in 2033.

Appearing as a witness for the defense in the Delaware Chancery Court, Tesla Board Chair Robin Denholm implied that Musk’s bonus had been set at a high enough figure to ensure that he would stay with Tesla while potentially earning enough to pursue his long-term goal of colonizing Mars.

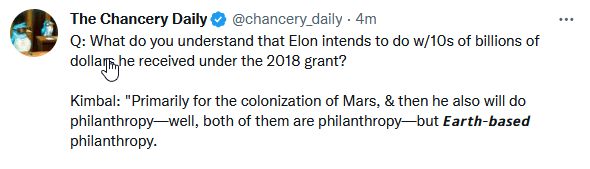

Kimbal Musk also mentioned in his testimony that Elon would be using his performance award to fund the Mars mission, as reported here by Chancery Daily on Twitter:

Kimbal Musk testimony (Twitter)

There was no explanation as to why Tesla shareholders should be asked to fund Musk’s crazy Mars fantasies, I am simply repeating what was said at the trial.

If he does intend to fund his Mars mission from the proceeds of his Tesla bonus award, then he needs to start exercising the options soon because he can’t generate any cash from the award for another five years. And to minimize the impact on Tesla’s share price he should probably spread the load over the five-year period between now and 2028.

So, if Tesla and Elon Musk win the case in Chancery Court, he could be exercising options and selling shares roughly equal to the sales he made at the end of 2021, every year for the next five years. Beyond 2028, he will presumably continue to sell shares to fund the Mars mission.

Shareholders should consider the possible impact of those sales on Tesla’s share price going forward.

If Tesla loses the case

If the case is decided for the plaintiff and the performance award is annulled, the associated share sales will not happen, shareholders will not be diluted, and Tesla will be able to book a one-time gain as the accrued share-based compensation expenses are eliminated.

For accounting purposes, employee stock options are valued when granted. Tesla’s share price at the time was $321.35, equivalent to a post-split price of $21.42. Tesla valued the options at $2.28 billion of which all except $4 million had been expensed to share-based compensation as of the end of Q3, 2022.

If Musk loses the case, Tesla will have a one-time increase in GAAP earnings of about $2.28 billion. It will be a non-cash accounting adjustment, so the impact may be relatively minor.

Cheering for the right side

If you are interested in following the trial, you cannot do better than to follow @chancery_daily on Twitter. If you are a Tesla perma-bull and hold Tesla shares you should be hoping for Musk to lose the case. If you are a short seller, you should be on Elon Musk’s side in this one.

What a strange situation – if Tesla wins the case, shareholders will lose and if Tesla loses, shareholders win. Judging by comments I see on social media; I think many investors are cheering for the wrong side.

Be the first to comment