Gwengoat/iStock via Getty Images

Introduction

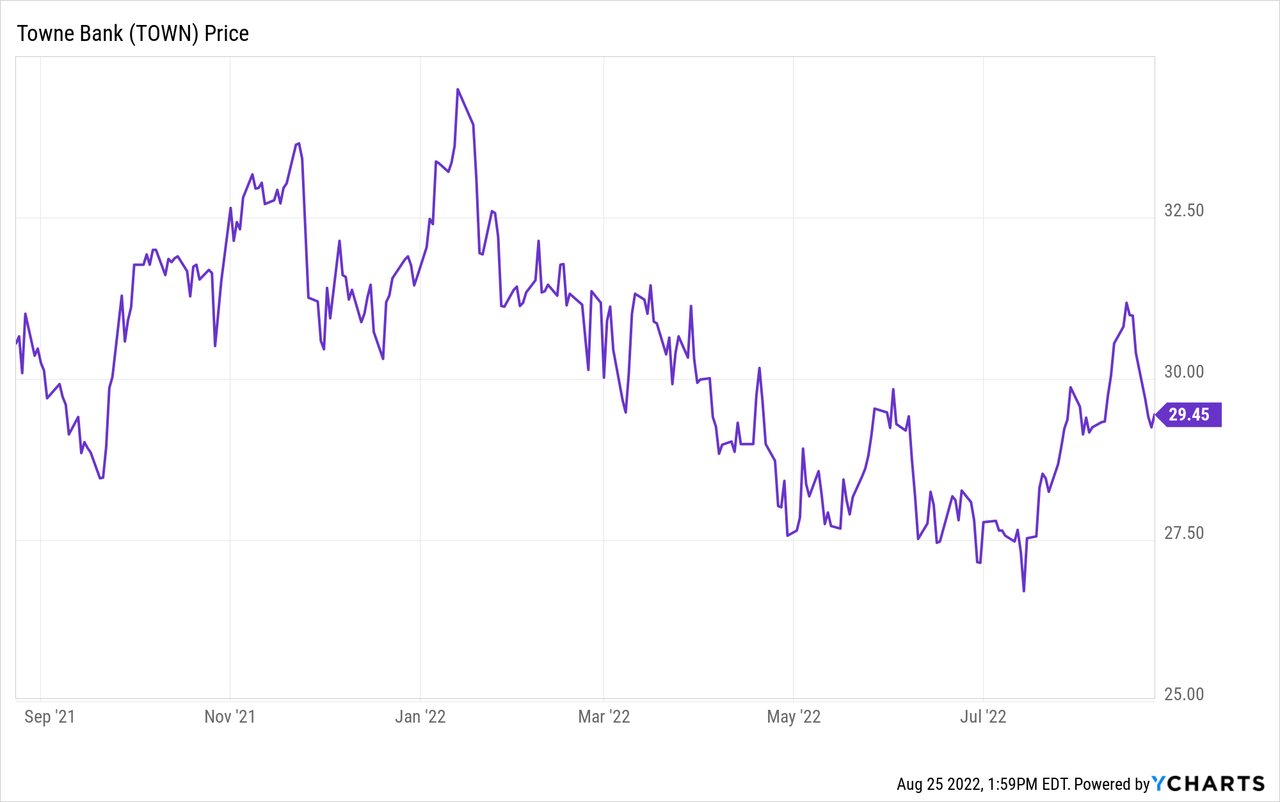

TowneBank (NASDAQ:TOWN) is a Virginia-based bank with a relatively high exposure to commercial real estate loans. Fortunately, the total amount of loans past due was quite low when I last discussed this company in a December 2020 article. A lot has changed since as the COVID pandemic is pretty much over, interest rates are increasing and TowneBank has recently announced a bolt-on acquisition. Plenty of reasons to have another look at this regional bank to see if I should pull the buy trigger.

TowneBank on a standalone basis performed quite decently

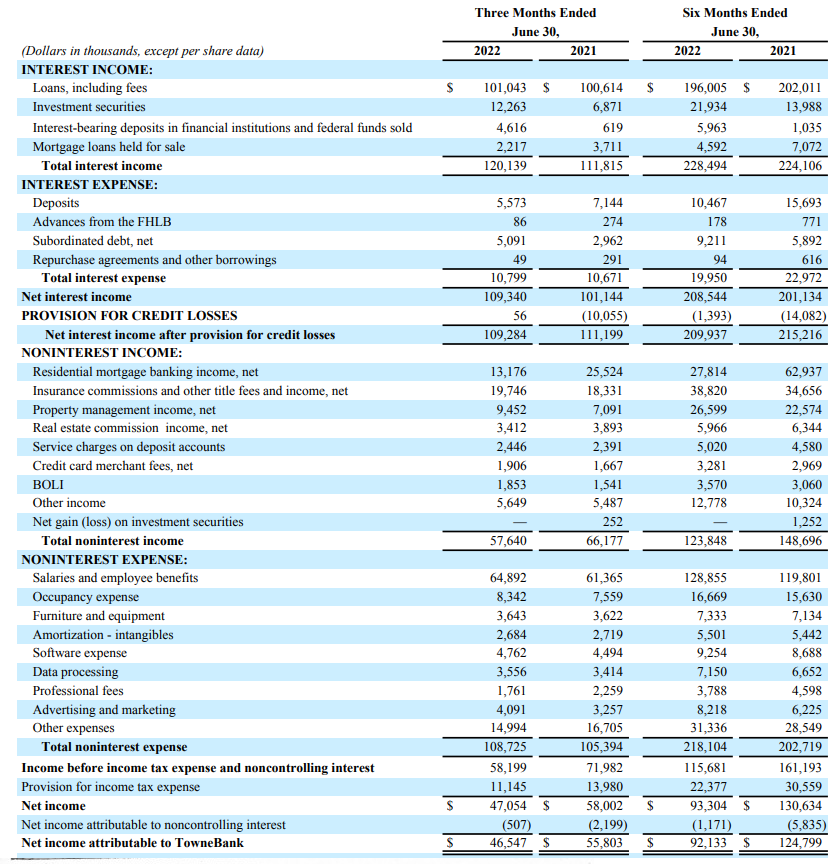

The bank’s net interest income started to increase thanks to a higher interest income in combination with just a marginal increase in the interest expenses. As you can see below, the total interest income increased by about 8% to $120M while the interest expenses increased by just 1% to $10.8M. This resulted in an 8% increase of the net interest income which jumped from $101M to $109M for the second quarter.

TowneBank Investor Relations

Unfortunately, the bank also had to deal with lower non-interest income (mainly due to lower residential mortgage banking income) in combination with higher expenses (an increased salary burden) which resulted in a pre-tax income of $58.2M. After deducting the relevant taxes, the net income was $47M of which $46.5M was attributable to non-controlling interests. This resulted in an EPS of $0.64 for the quarter and $1.27 for the first semester. Keep in mind TowneBank barely recorded any loan loss provisions: While there was a $56,000 provision in Q2 of this year, the total reversal of loan loss provisions in the first quarter came in at in excess of $1.4M.

The portfolio is still geared toward liquid assets. Of the almost $17B in assets, almost $2.5B was held in cash with an additional $2.5B invested in securities available for sale and securities held to maturity. This means that about 30% of the total balance sheet was held in cash and securities. Unfortunately, this also means TowneBank’s book value per share was impacted by the higher interest rates as the value of the securities available for sale decreased. In the first six months of the year, this had a negative impact of about $138M (on a pre-tax level). This explains why the shareholder equity level on the balance sheet decreased from $1.9B to $1.85B. As of the end of June, the book value of TowneBank was just under $25.5/share while the tangible book value came in at less than $19 which means the stock is currently trading at just over 1.5 times the tangible book value.

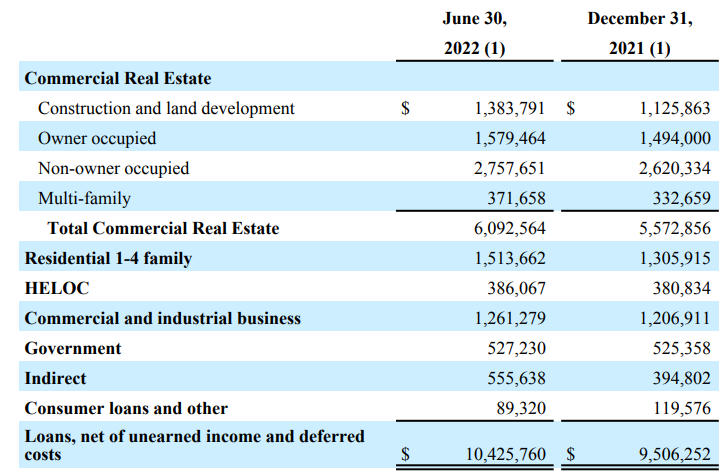

The loan book is still very CRE-heavy and as you can see below, commercial real estate made up in excess of 60% of the total loan book size.

TowneBank Investor Relations

Fortunately, the total amount of defaults, loans past due and non-accrual loans remains low. As of the end of June, the bank had about $5.5M in non-accrual loans and $7.3M in loans past due for a total of $12.8M. And with a total loan loss provision of in excess of $104M already recorded, it’s perfectly understandable TowneBank doesn’t see a need to further increase the loan loss provisions at this point.

The announced acquisition of Farmers Bank: Not cheap but likely accretive

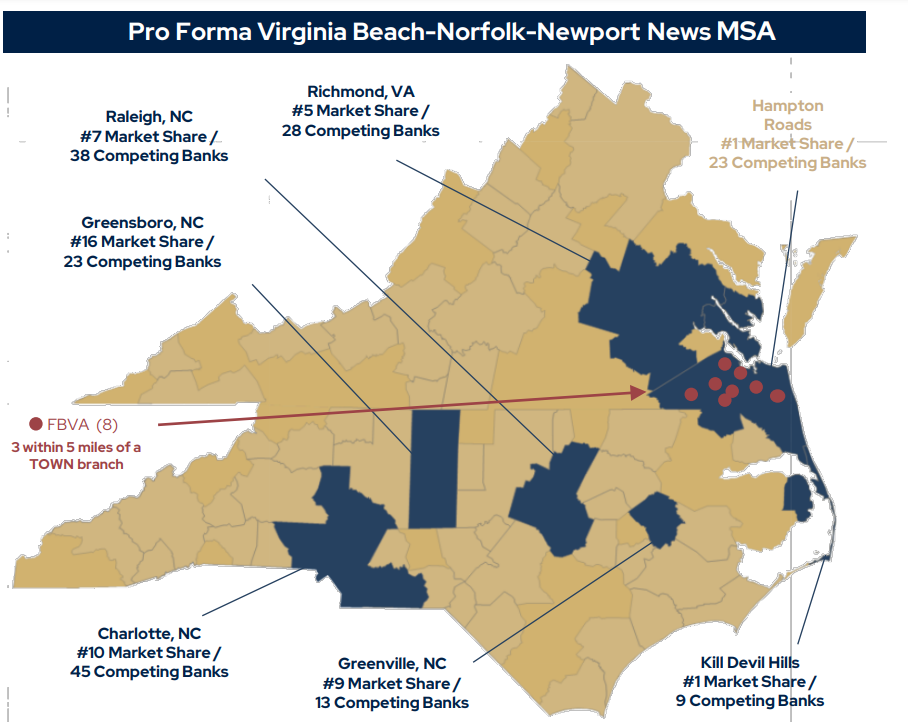

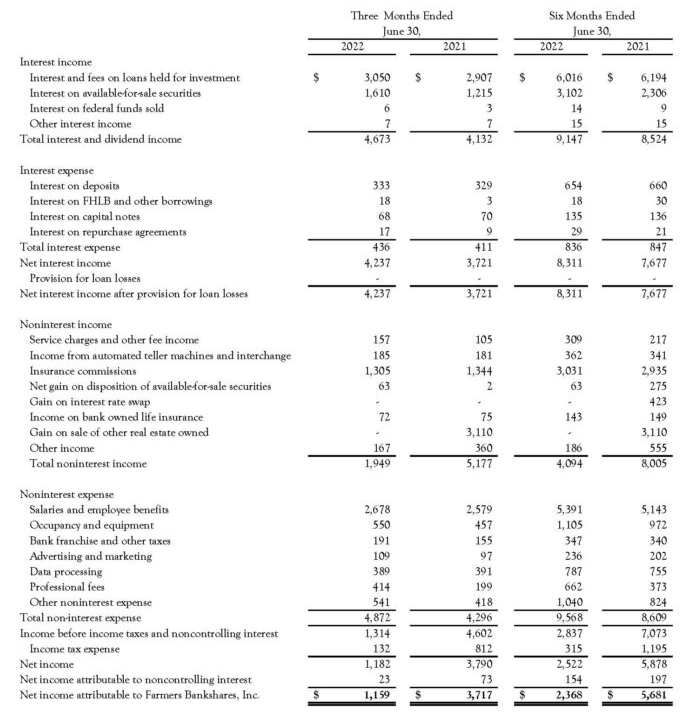

TowneBank is ambitious and earlier this month it announced it entered into an agreement with Farmers Bankshares (OTCPK:FBVA) in Virginia to combine both banks. Towne is offering 0.605 of its own shares per share of Farmers Bankshares and the latter is trading pretty close to the offered price. The total deal value is just $56M which still represents a premium of almost 100% to Farmers Bankshares tangible book value as of the end of June.

TowneBank Investor Relations

So why is this a good deal? Because TowneBank expects it will be able to reduce FBVA’s non-interest expenses by 35% due to synergy benefits and economies of scale. And that could be huge. As you can see below, cutting the non-interest expenses by 35% in the first half of 2022 would have resulted in an increase of in excess of 100% to Farmers Bankshares’ pre-tax income: The EBT would have jumped to $6.2M in the first half of the year.

FBVA Investor Relations

That’s the main reason why TowneBank expects this deal to be immediately accretive to its EPS despite making an all-share offer. Although the synergy benefits are relatively low in absolute amounts, if TowneBank is indeed able to cut the operating expenses by in excess of $6M per year, then a $56M price tag is very reasonable. According to TowneBank, it’s paying just six times earnings for FBVA if one would take the anticipated synergy benefits into account.

Investment thesis

While I’m generally not a big fan of paying twice the tangible book value in an acquisition, the FBVA acquisition by TowneBank makes a lot of sense. If Towne is right about the anticipated synergy benefits, the proposed transaction is a steal from an earnings perspective. Additionally, the FBVA loan book also appears to be pretty strong with just 0.40% of non-performing loans versus the total amount of loans with a coverage ratio of almost five times the non-performing loans.

Would I buy TowneBank right now? Probably not. But I do think this is a very well-lead local bank with a history of successful acquisitions. And while the FBVA acquisition is rather small in dollar amounts, it will add more “body” to TowneBank as a whole which has a history of successfully acquiring smaller competitors.

Be the first to comment