PonyWang

For several reasons, we believe this is a good time for investors to take a look at Tokyo Electron (OTCPK:TOELY). Starting with the Japanese Yen, which is currently very weak, making shares of Japanese companies more affordable, and making companies that export equipment like Tokyo Electron more competitive. There is also significant fear regarding the semiconductor market, with some companies that have recently reported earnings being a little more cautious, which is resulting in lower valuations. Finally, Tokyo Electron’s own valuation has come down significantly and is now trading at what we view as a very reasonable valuation. We, therefore, believe investors should at least start paying some attention to Tokyo Electron, it is a remarkable company, and one worth a place at least on the watch list.

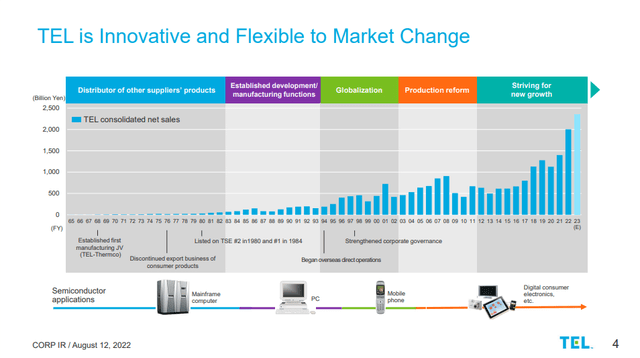

Tokyo Electron has a history of significant growth, starting as a distributor of other companies’ products, then becoming a manufacturer itself, and developing more advanced technology and products until it became one of the most important companies in the global semiconductor production equipment market.

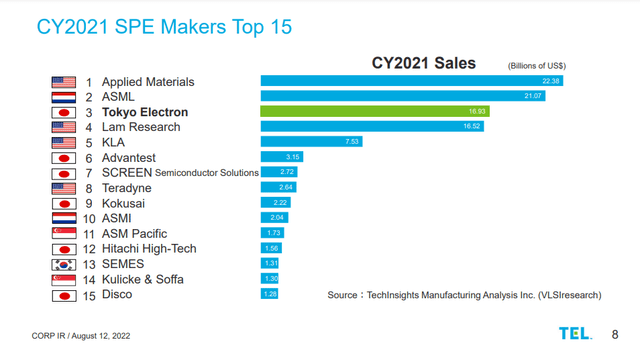

Tokyo Electron Investor Presentation

The company today competes with the likes of Applied Materials (AMAT) and Lam Research (LRCX) in the global semiconductor production equipment market, but not as much with ASML (ASML), which specializes in Lithography. Tokyo Electron’s strength lies in its broad equipment portfolio covering four sequential processes that are critical for semiconductor manufacturing: deposition, Coater/Developer, etch, and cleaning. Its products in these areas rank either first or second in global market share. In fact, Tokyo Electron’s Coater/Developer for EUV lithography has a 100% share of the worldwide market. To summarize the company and its strength, virtually every semiconductor in the world passes through one of its systems.

Tokyo Electron Q1 2023 Results

Tokyo Electron’s Q1 2023 revenue was up 5% year over year, less than expected and mostly due to supply chain challenges. Despite this setback, Tokyo Electron maintained its growth outlook for the year at ~17%. As other companies in its industry have done, management lowered calendar 2022 wafer fab equipment growth expectations from 20% to a range of 5%-15%. It is likely that many of the orders not fulfilled this year due to supply chain issues will move to calendar 2023.

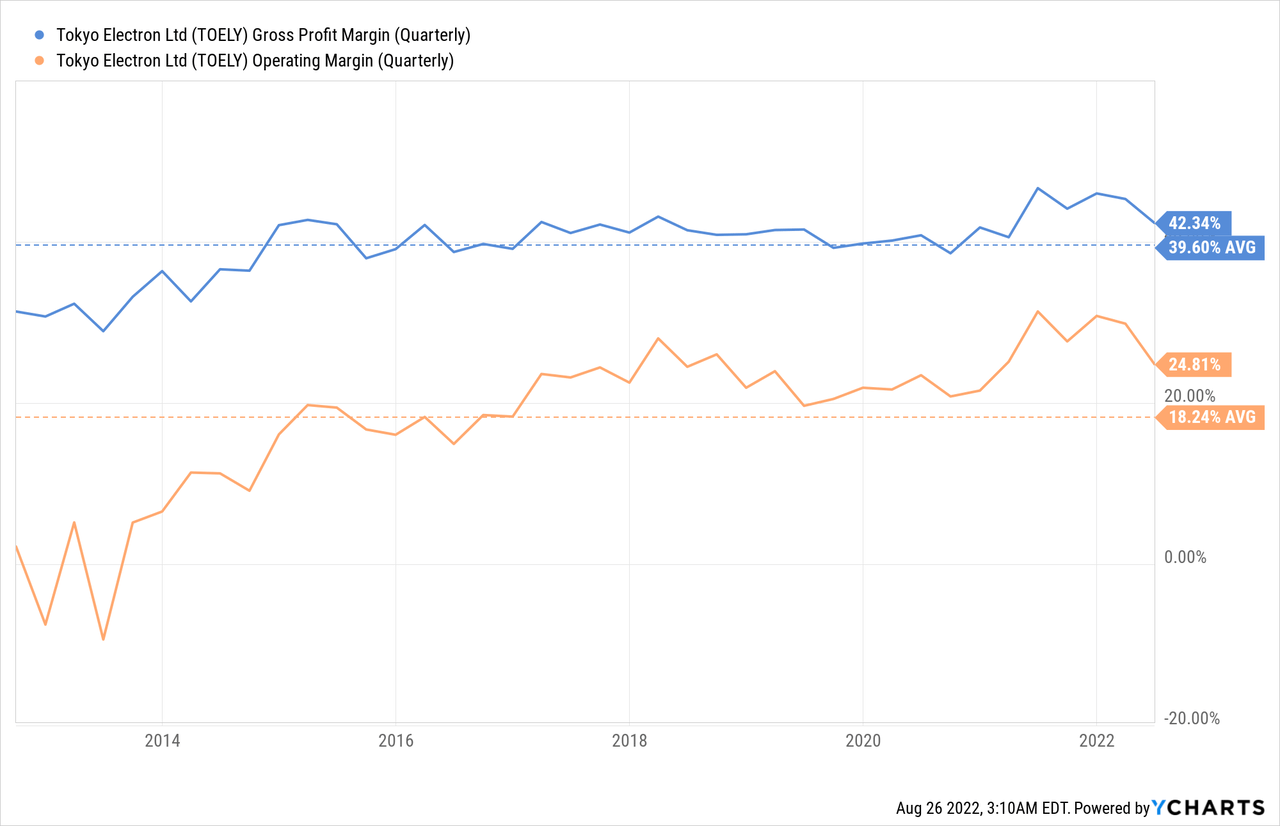

Financials

The quality of the business is reflected in its terrific profit margins and returns on capital. With operating profit margins that are getting close to 30%, this is a particularly attractive business. As expected in the semiconductor industry, there has been some historical volatility, but the company tends to remain profitable even during downturns. At least that has been the case since 2014, and as semiconductors go into more types of devices, the cyclicality appears to be moderating.

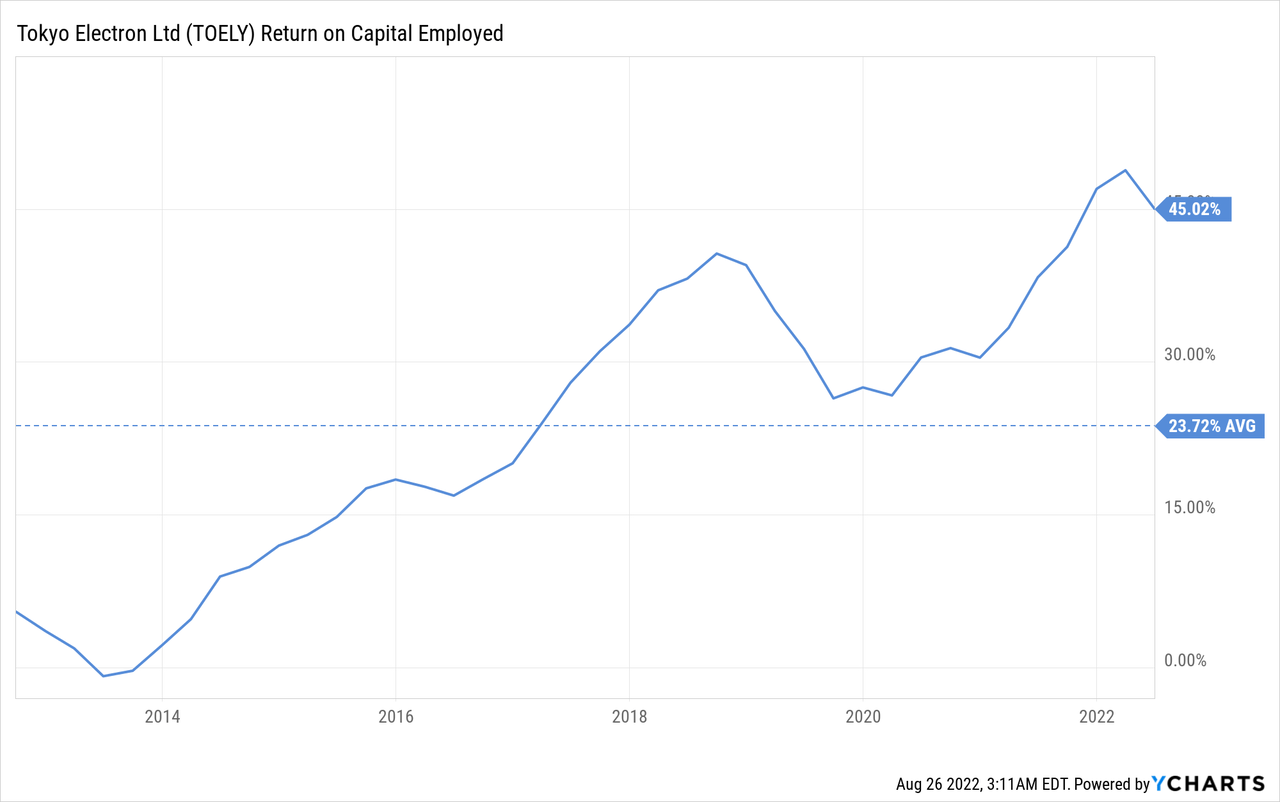

Looking at the Return on Capital Employed, we can see why Tokyo Electron is a powerful investment compounding machine, as its ROCE is extremely high. So any retained earnings can be quickly compounded by the business.

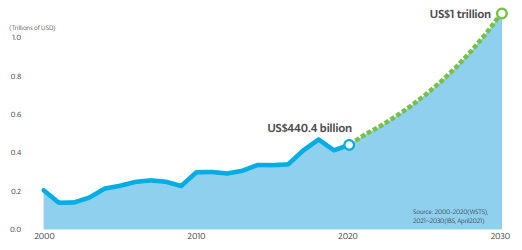

Market

The semiconductor market size is expected to exceed about $1 trillion by 2030, more than doubling the level in 2020, which was around $440 billion. This is a huge tailwind for semiconductor production equipment manufacturers, and Tokyo Electron’s role in the industry is becoming more critical than ever.

Tokyo Electron Investor Presentation

Based on calendar year 2021 sales, Tokyo Electron is a top 15 semiconductor production equipment manufacturer, in position #3 just behind ASML.

Tokyo Electron Investor Presentation

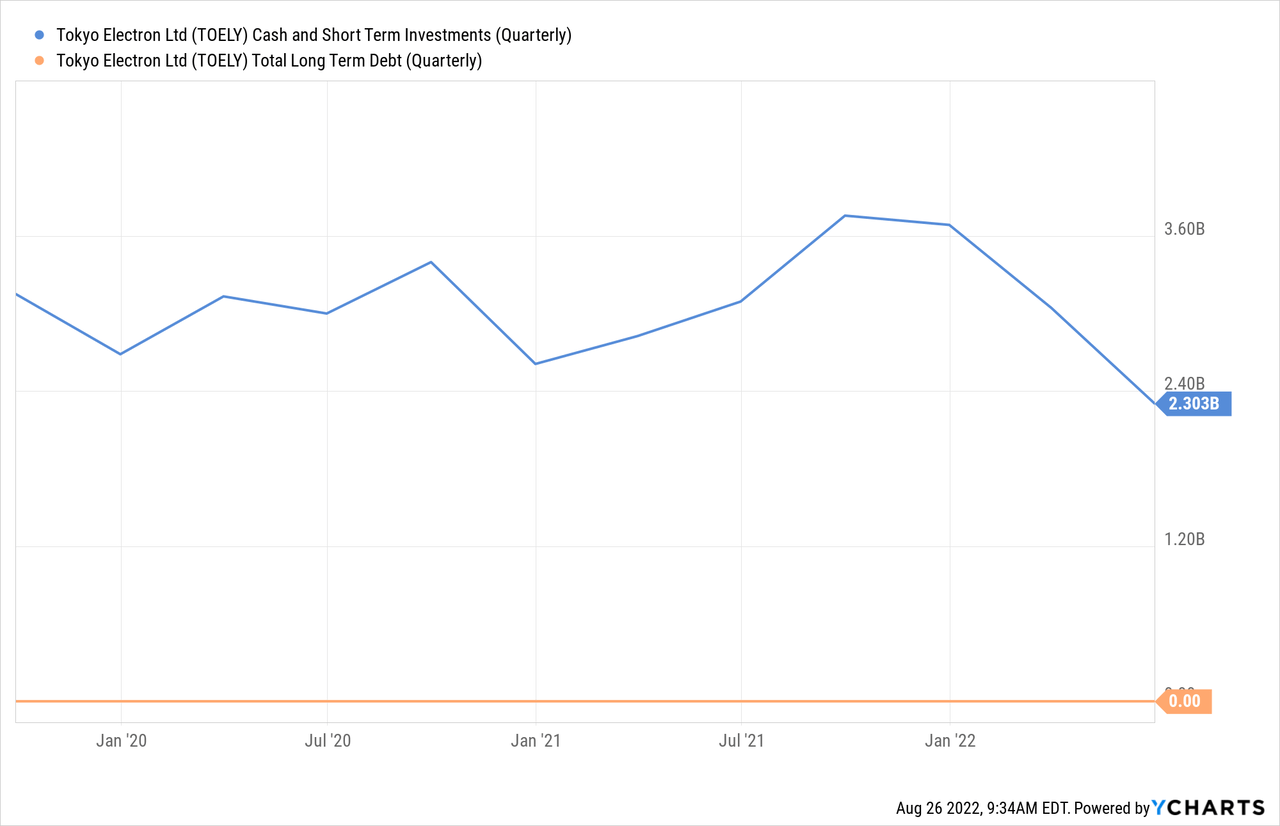

Balance Sheet

As is the case with many Japanese companies, it is operated in a very conservative manner, with no long-term debt and significant cash and short-term investments. We are therefore not worried at all about the liquidity available to the company.

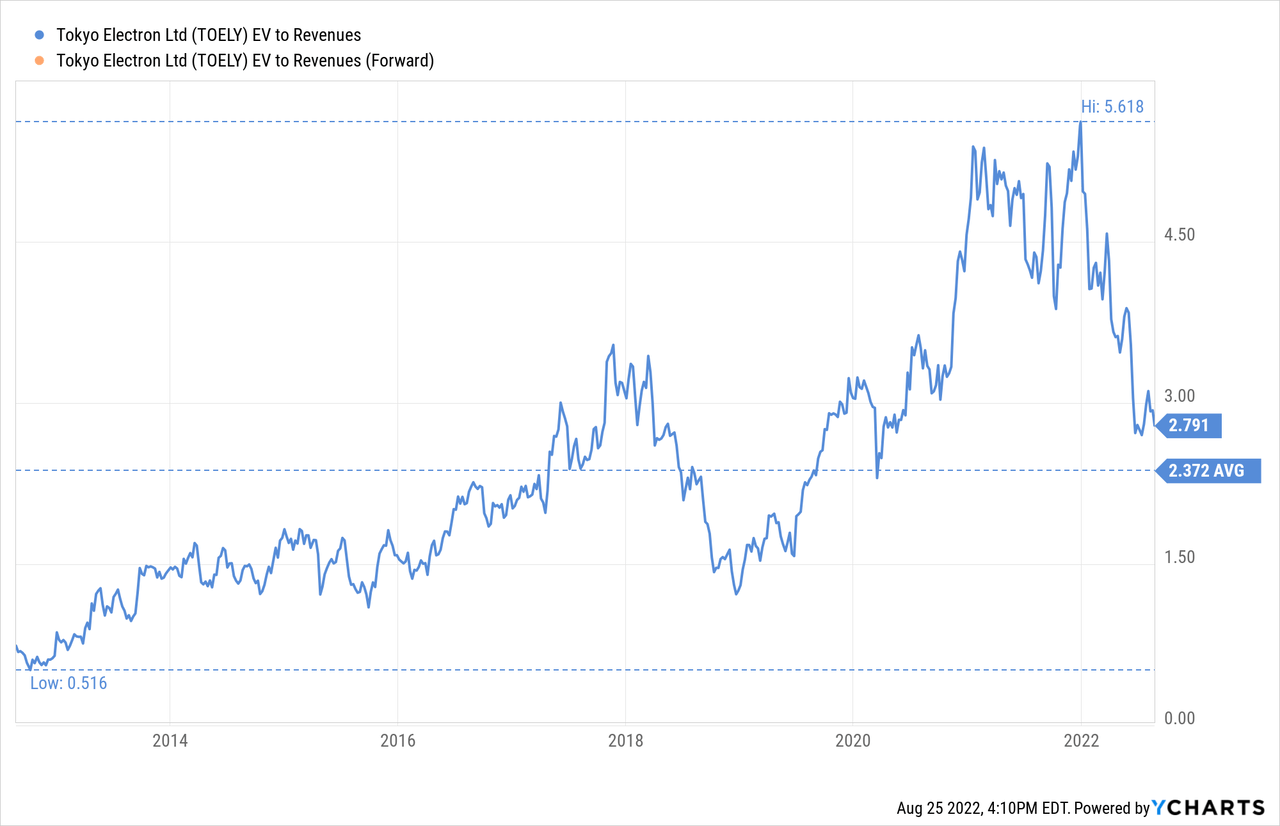

Valuation

Shares became expensive after the Covid pandemic, reaching an extremely high 5.6x EV/Revenues multiple. Since then, shares have come back down to more reasonable levels, and right now are trading close to the ten-year average for this indicator.

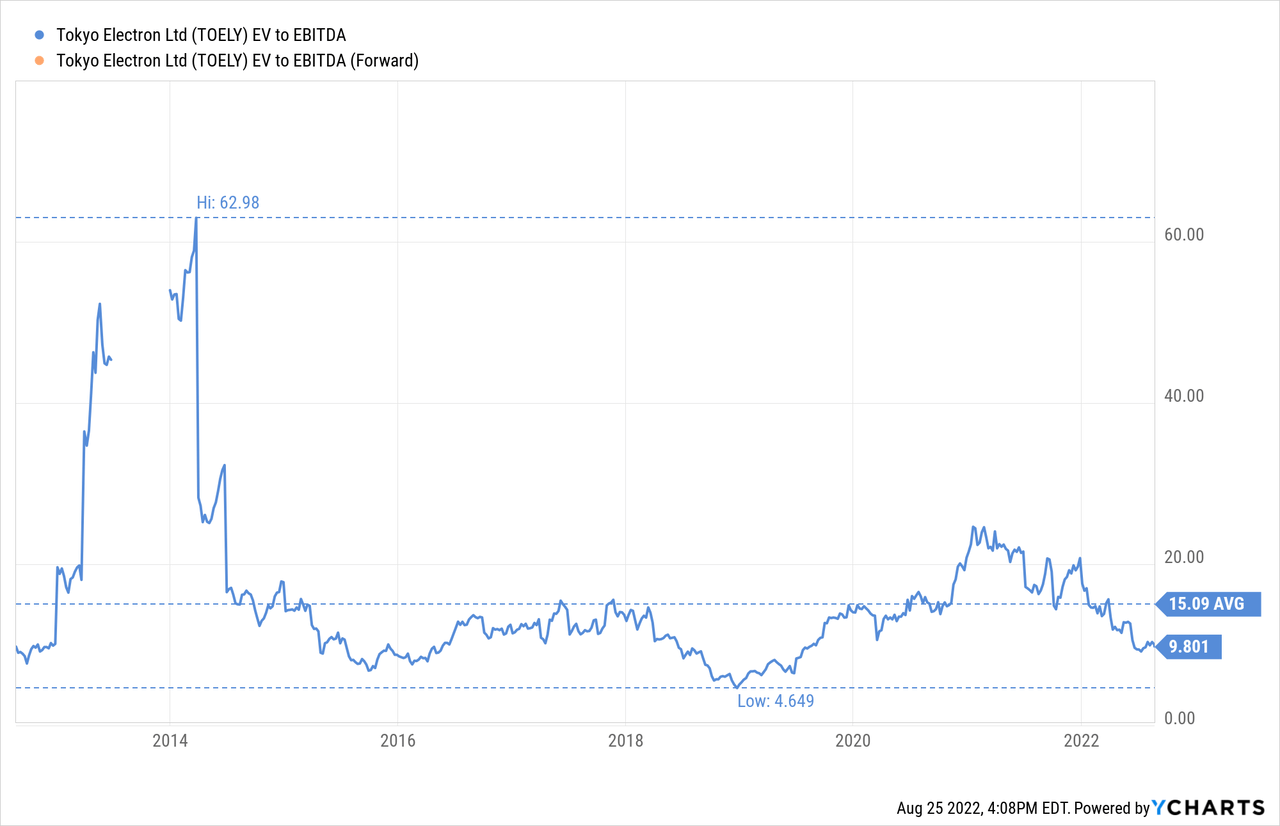

The EV/EBITDA is also quite reasonable, currently at less than 10x, and at a wide discount to the ten-year average of 15x.

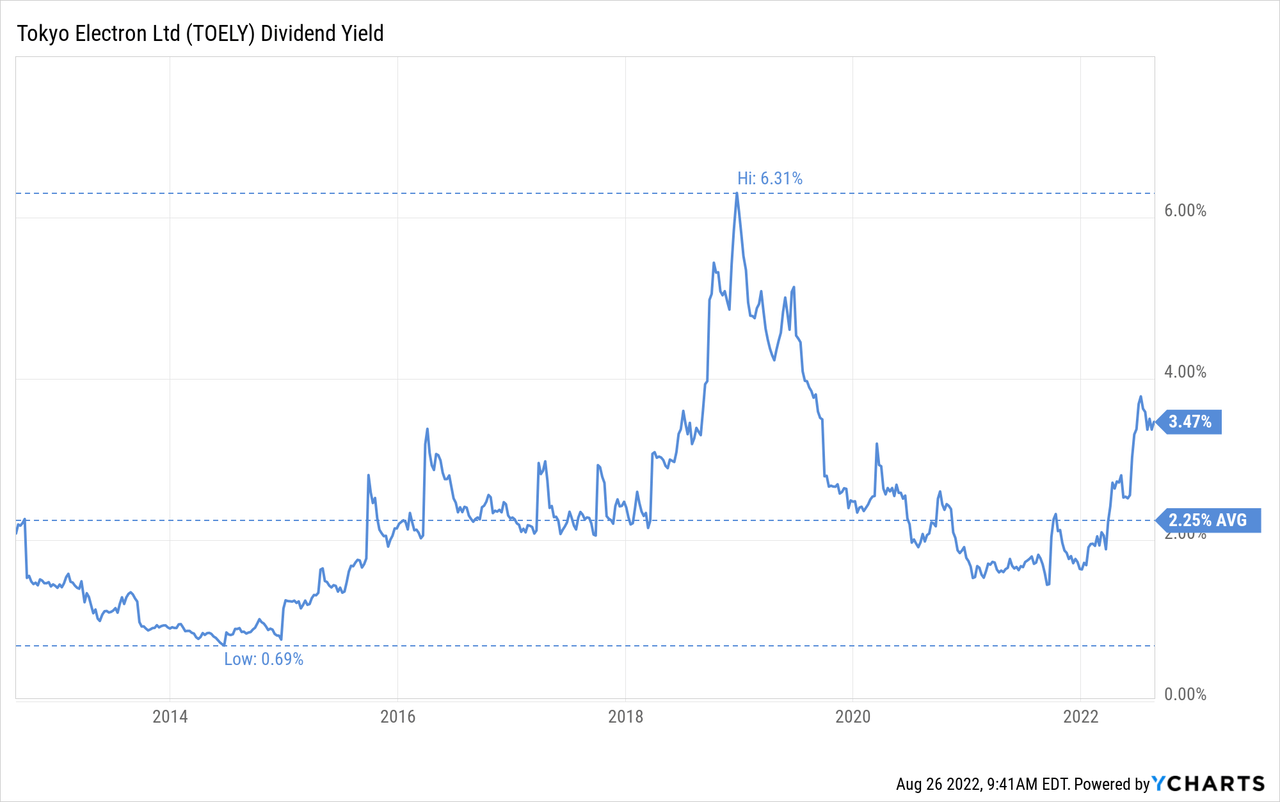

The dividend yield is currently about 3.5%, higher than the ten-year average by a significant margin. The company has a policy to pay ~50% of its earnings as dividends, so there can be some variability in the dividend from one year to the next.

Guidance

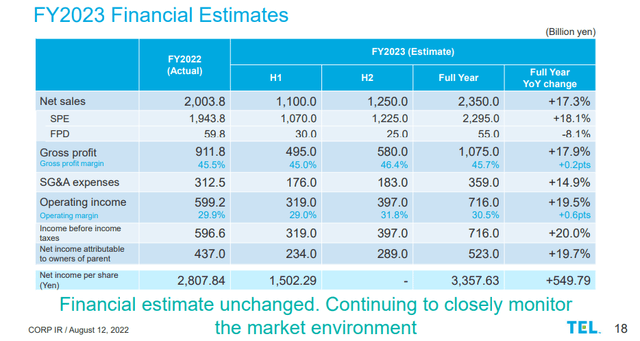

The company is guiding for strong growth for fiscal 2023, expecting net sales to increase +17.3%, and operating income +19.5%. These are impressive growth rates and one of the things that make Tokyo Electron so attractive right now. The question, of course, is how long can they sustain this impressive growth, and what impact will a deep recession have? While we do not have the answers to these questions, we do believe the current industry dynamics are very favorable and could help drive growth for a few more years.

Tokyo Electron Investor Presentation

Risks

As Tokyo Electron operates in a very profitable segment of the market, there are many companies trying to outmaneuver them technologically, or with better business execution. So far, Tokyo Electron has proven itself very capable of keeping competitors at bay, but there is no guarantee this will continue indefinitely into the future. If competitors outperform Tokyo Electron’s technology, the company’s attractive financial profile could quickly deteriorate, including its impressive growth and profitability.

Conclusion

We believe Tokyo Electron does not get the attention it deserves, despite being one of the most important semiconductor production equipment manufacturers in the world, with cutting-edge technology that touches almost every chip produced around the world. After reaching excessive levels its valuation has come down considerably, and we now see shares as somewhat undervalued and presenting a decent entry point. We believe that at the very minimum, investors should add the company to their watch list and familiarize themselves more with it.

Be the first to comment